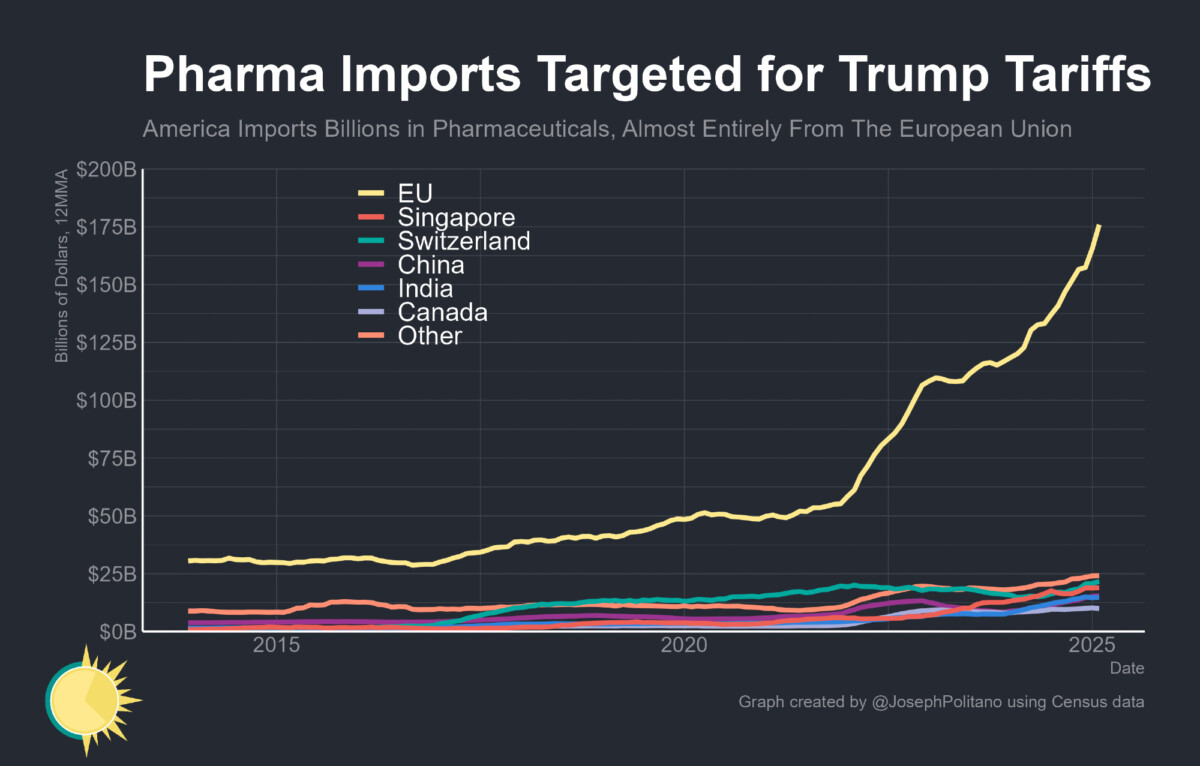

The just-announced trade “deal” (what’s the enforcement mechanism?) apparently covers pharmaceuticals. Where do we get most of our pharma (by value)? From Joey Politano, the answer:

Source: Politano.

I don’t think there’s anything on paper (and even if there were, would it mean much?).

So, not the 50% I pondered back in May, but still 15% is above 10%.

* To be clear, we do not know if Mr. Trump is taking a GLP-1.

** Back of the envelope calculation of tax increase. Effective tariff rate rises from 1.2% to 15%; 2024 imports from EU equals approx 600 bn. Assuming no price response (price elasticity is 0), and US as small country, this is a tax increase of $83bn/year, or $70 bn/year assuming a price elasticity of demand of unity.

This deal is similar to the one for Japan — and just as crazy.

For example finished EU cars can be imported with a 15% tariff. But US manufacturers have to pay 50% tariffs for steel and copper and 25% tariffs for the auto parts they get from Canada and Mexico.

It would be cheaper for US manufacturers to build their cars in the EU and ship them back to the US. Otherwise, it is likely that imported EU cars will be cheaper than US built cars.

US auto makers are livid. And US consumers are poorer. The Art of the Deal.

Off topic, but similarly stupid policymaking:

Last month, the Social Security Administration reported that the combined Trust Funds would be depleted in 2034, nine years from now:

https://www.ssa.gov/news/press/releases/2025/#2025-06-18

At that point, benefits will be reduced to 81% of what is promised. Since I expect I’m writing to a fairly well-off bunch, let’s use the maximum 2025 monthly benefit, $5,108, as an example. At 81%, you’d receive $4,137 per month (minus Medicare payments). Not bad, but that’s still a $971 reduction in payments each month. Over the course of a year, a reduction of $11,646, or $49,650 vs the full benefit of $61,296. (Pardon my rounding.)

If you aren’t among those who take in the top benefit, your situation might look more like this: A $3,000 monthly benefit reduces to $2,430 per month, so a reduction of $6,840 over the course of a year, or $29,160 vs $36,000. Keep in mind that for most retirees, Social Security benefits make up the majority of their income.

Now, that 19% reduction isn’t the end of it. At no point in the SSA’s 75-year forecast period does revenue exceed outlays, which means a steady further reduction in paid-out benefits after 2034. And every year that nothing is done to fully fund SS benefits, the problem gets harder to solve.

What’s Congress up to? Well, the House has taken an early recess to avoid talking about whether the felon-in-chief had sex with underage girls. Senate Republicans would like to join them, but the felon wants them to stay in Washington to confirm his judicial appointments. Which is to say, Congress is doing nothing about Social Security finances – again.

Well, that’s not strictly true. Congress has eliminated the double-dipping penalty on government retirement benefits, which worsens the finance of the Social Security Trust Fund. Otherwise, nothing.

Seniors are the most reliable voters in the U.S. They report being highly sensitive to threats to their government benefits, for obvious reasons. Any political party which made restoring Social Security finances an important goal would probably be rewarded at the polls. Typically, political “outs” take up the issues that the “ins” don’t want to deal with and make hay with them. So Congressional Democrats must be campaigning to save Social Security every day. Right?

What’s wrong with elected Democrats? Why aren’t they preaching from the pulpit about saving Social Security? Well, according to a recent news report, one Republican Congressman’s mail is running 500-to-1 Epstein to EVERY OTHER ISSUE, COMBINED! Yep, scandalous, prurient, kid-rapey stuff is what voters care about.

So “What’s wrong with elected Democrats?” is the wrong question. What’s wrong with us?

Anyhow, we ought to be pressing Congress to fix an obvious problem, with obvious solutions. Our economy benefits those at the top a whole lot more than everybody else. Change that just a little bit, and Social Security can pay what we promised. Do nothing, and everybody but those at the top is in for a much worse future.

I should have mentioned, the cut to benefits is off the top-line figure, before the Medicare premium is deducted. The Medicare premium probably won’t be adjusted lower when the Social Security benefit is reduced, so the net benefit, the deposit to recipients’ bank accounts, will be reduced by more than 19% in 2034.

And in subsequent years, by more than 20%, 21%, 22%…

Tom Lehrer, mathematician and melodic cultural commentator, has died at age 97. Lehrer received his PhD in math…wait, sorry no…never finished his dissertation after 16 years of trying, from Harvard University. In addition to teaching math a Harvard, MIT, UC Santa Cruz (where he also taught musical theater) and Wellesley, Lehrer may have worked for the Los Alamos Lab (couldn’t talk about it) and the NSA (couldn’t talk about it).

Among his many contributions to our culture are “Poisoning Pigeons in the Park”, “National Brotherhood Week”, “Werner von Braun”, “New Math” and Jello shots. His work has been banned by the BBC, denounced by Time Magazine, covered up by the U.S. national security apparatus and praised by Isaac Asimov as the best time he ever had at a night club – probably referring in particular to “I Got It from Agnes”.

He was not the first of his kind, but in his time and maybe for all time, he was the best. R.I.P.