From WSJ July survey out today:

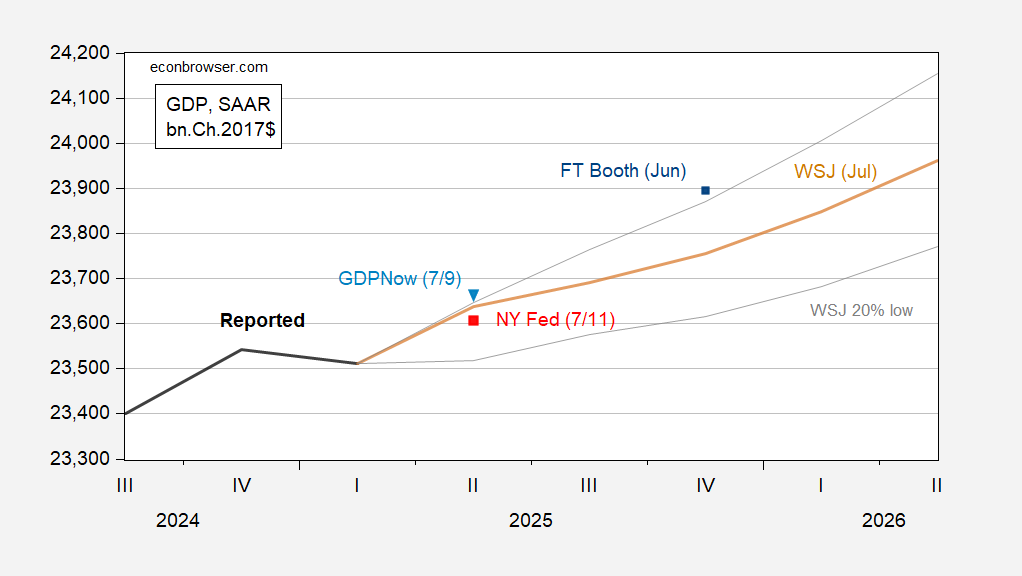

Figure 1: GDP (bold black), WSJ July survey mean (tan), lowest/highest 10% based on 2025 q4/q4 growth (gray lines), GDPNow of 7/9 (inverted light blue triangle), NY Fed nowcast of 7/11 (red square), all in bn.Ch.2017$, SAAR. Source: BEA, WSJ, Atlanta Fed, NY Fed, and author’s calculations.

Only one forecast is for two consecutive negative quarters of GDP growth (AC Cutts, five consecutive quarters), while there are many forecasts of an individual quarter of negative growth.

The WSJ survey mean trajectory is close to the May SPF median. Not surprisingly, the WSJ growth rate for Q2 is just between the Atlanta and NY Fed nowcasts (see here).

A cautionary note from the WSJ:

Diane Swonk, chief economist at KPMG US, cautioned that official economic indicators, which combine actual data from surveys with estimates, often struggle to capture inflection points.

“As good as our stats are, they just weren’t made for these kinds of very large moves in policy that cause a knee-jerk reaction,” Swonk said. “It makes it even harder to read the tea leaves.”

Trump’s policies—which besides tariffs include a clampdown on illegal immigration, stepped-up deportations and a just-signed megabill cutting taxes and some spending—may also take time to filter into the real economy.

Last week Scott Bessent made a strong move in his audition for the next Federal Reserve chair with this statement:

“The president is the most economically sophisticated president, certainly for 100 years, perhaps in history.”

Today Kevin Hassett makes his counter move with: “The thing about President Trump is he became one of the most successful if not the most successful businessman in the 20th century.” You know, the guy who had six bankruptcies. Can he do the same for the US government?

Scott Bessent and Kevin Hassett are now running neck and neck in the sycophancy race to the Fed. They are practically anagrams of each other. It’s hard to keep them straight.

Just to repeat, stall speed for the U.S. economy is around 1.5%. These forecasts suggest we’re slowing to stall speed.

If the felon-in-chief continues to inject uncertainty into economic decision-making, on top of the harm that is being done be the actual imposition of his policies, odds of recession increase.

The felon’s pattern of behavior suggests that many of his announcements are aimed at drawing attention away from news he doesn’t like. The more news he doesn’t like, the more he tries to distract.

Seems like the Epstein list accounts for his decision to blow up trade talks with Europe and Canada:

https://www.nbcnews.com/politics/trump-administration/trump-faces-revolt-maga-base-epstein-files-rcna218385

Shudder to think what happens at BEA when GDP reports are persistently bad. Wonder what bad decisions he’ll make to distract from recession.

Johathan Karl interview professional liar and pretend economist Kevin Hassett on various aspects of the Trump tariff nonsense. Hassett made a fool out of himself on the Brazilian issue and then turned to copper:

KARL: Okay. I’m still confused, but let me move on. Let me ask you about the 50 percent tariff that the president has imposed on copper imports. Copper, of course, is widely used in construction, industrial manufacturing, cars, mobile phones, and the like. This is what “The Wall Street Journal” had to say about these tariffs: “Mr. Trump is going to make U.S. firms pay 50 percent more for a vital metal while they wait five or more years for U.S. sourcing. How does making it more expensive to build aircraft, ships, and ammunition promote national security? This is national insecurity.” What’s your response to “The Wall Street Journal”?

HASSETT: Right. The bottom line is that if there is a time of war, then we need to have the metals that we need to produce American weapons, and copper is a key component in many American weapon sets. And so, as we look forward to the threats that America faces, the president decided that we have plenty of copper in the U.S., but not enough copper production. And that’s why he’s taken this strong step.

KARL: But are you concerned about the effect of higher copper prices before American manufacturing can get up to speed?

HASSETT: The fact is that that effect that you’re just discussing is something that you mentioned that economists said were going to be coming all year, these effects, and inflation is way, way down. In fact, inflation in the U.S. is right about the same level as it is in Europe. And so, the tariffs have worked the way that we said. And so, I guess the expectation would be that the countries and the people that are dumping into the U.S. would bear most of this tariff.’

There are two major problems with Hassett’s babbling here. First of all if the foreign copper producers were bearing the cost of the tariffs (they are not) that would undermine the entire purpose of encouraging domestic copper mining. But this point has been made many times by smart economics who have belittled the ever changing justifications for Trump’s tariff nonsense. I guess Kevin isn’t that bright.

But he is flat out lying about copper prices in the U.S. not being affected by the tariffs. Global copper prices were $4.35 per pound, which is quite high. But after Trump announced his copper tariffs, the New York based copper future price jumped to around $5.60 a pound. Only someone who wrote DOW 36000 could see a 30% jump as a decline in copper prices.

Kevin Warsh has been on faux news, campaigning to replace Jay Powell as Fed Chair. Warsh has had a fire lit under him by a recent WSJ report that Kevin Hassett has also expressed interest in Powell’s job. Here’s what Warsh had to say:

https://www.foxbusiness.com/economy/former-fed-governor-says-trump-right-frustrated-powells-restrictive-policies

It isn’t pretty. Warsh made overt political statements, something Fed officials and aspirants to the Fed don’t do. Well, didn’t do until now. The felon-in-chief has made clear that Fed policy should be political and Warsh is happy to oblige. So is Hassett, by the way; he has now turned from defending Fed independence to harsh criticism of Jay Powell, aping the felon’s own behavior.

Warsh said both that rates should come down and that he would “Run the printing press a little bit less”. What? That’s just babble, though babble probably won’t hurt his chances. Actual technical expertise is beside the point these days. Warsh also said he wants to reduce the Fed’s asset holdings AND bring down yields across the curve. More babble. He was talking to Kudlow, who has a history of similarly innane statements about how interest rates, the economy, foreign exchange, equities and all of human society work, so no harm done, I guess.

For now, we have the rest of the Open Market Committee to rein in whatever the coming chairman-with-no-clothes has in mind. Let’s see how long that lasts.

Macroduck: “Warsh said both that rates should come down and that he would “Run the printing press a little bit less”. What? That’s just babble, though babble probably won’t hurt his chances. Actual technical expertise is beside the point these days. Warsh also said he wants to reduce the Fed’s asset holdings AND bring down yields across the curve.”

Does Warsh even have the vaguest idea that what he is saying is absolutely contradictory. The Fed selling bonds increases supply and reduces prices, which increases yields. Likewise, running the printing press a little bit less means the Fed buys fewer bonds, increases supply and reduces prices, which increases yields.

Warsh served on the board of governors a couple decades ago so he can’t really be this dumb, can he? Which means that he is knowingly lying to appease his boss in a play for the Fed chair.

It’s getting to be a crowded race for the Fed chair with Bessent and the two Kevins all debasing themselves to prove their loyalty to the Dear Leader.

Let’s look at this objectively. There are 12 voting members of the FOMC. Since the Supreme Court has made it clear that the King, sorry…President…can fire anyone he wants associated with the Federal Government, the ideal candidates to fill all 12 seats for a golden era of Trumpian monetary policy are as follows:

Kevin Hasset-President

Warsh (even though he wants the top job, this will be a consolation prize)

Ivanka

Kushner

Don Jr.

Peter Thiel

Matt Gaetz

Sam Bankman-Fried (post-pardon)

Elizabeth Holmes (post-pardon and with a MAGA makeover so she looks more like Kristi Noem)

Laura Loomer

Satoshi Nakamoto

Barron–everyone needs a first job

I’m open to criticism and alternatives to these predictions.

@ David S, Wait, isn’t Nakamoto a “foreign devil”?? “White ghost”??? A house fly coming in when you opened the mainland China Windows?? OK, I just called the Gestapo 1-800 hotline. Have you re-hearsed your answers before my MAGA friends deport you for jaywalking 15 years ago?? Think….. before answering

“Warsh served on the board of governors a couple decades ago so he can’t really be this dumb, can he? ”

well, during the great recession warsh was most concerned about inflation getting out of hand. he argued that the fed should have been increasing interest rates even with unemployment over 10% during the great recession. and now, he argues that rates should drop, with inflation rising? i don’t think he has a realistic grasp of how the economy actually works. he married into money, he did not earn it.

Every country besides the U.S. is making trade deals with each other – the Trump admin is making the U.S. poorer and a weaker economy – https://www.bloomberg.com/news/articles/2025-07-13/eu-to-extend-suspension-of-countermeasures-to-allow-for-us-talks

When Trump talks about winning a trade war – ask yourself who are the winners and losers in a trade war? the winners are company owners/capitalists who can either charge more for their products or get inputs at a cheaper price and eliminate their labor force – the losers are either workers who lose their jobs or have to pay more for products they consume.

Hassett says that the White House is “looking into” the possibility of firing Fed Chair Powell “for cause” over Fed building renovations.

That should calm the bond market.

Note that Trump just spent millions of taxpayer money plowing up the White House rose garden so he could install a patio to entertain fawning guests like he has at Mar-a-Lago. Incidentally, the Federal Reserve is self-funding. Taxpayers do not fund the Fed.

not to mention the billions it is costing for the trump White House to build out new air force one planes-with major design flaws introduced by trump’s demands to begin with.

The Fed funds the Treasury. Perhaps Powell should ask for an audit. Seem to recall some bankruptcy problems…

Trump announces new plan to provide arms to Ukraine! Oh, wait, the US isn’t sending arms to Ukraine. Trump is allowing NATO countries to buy arms from the US to send to Ukraine. Always the Art of the Deal. So this isn’t anything new at all. NATO is already sending arms to Ukraine.

And Trump is giving Putin a 50-day deadline, because Trump is always so prompt about deadlines.

Hmmm. I thought Trump wanted to depreciate the currency. So now Europe is going to buy US exports of arms??? Don’t get me wrong, I’m all for arming Ukraine, but this seems like cognitive dissonance.

Seems Trump hasn’t even a framework for sending more U.S. made weapons to Kiev.

Reuters today described a possible plan for proving Patriot air defenses, from several NATO members who operate the systems, speculate 10 to 12 batteries. That is quite a lot of launchers, and radar/control sets. 70 U.S. soldiers per battery.

All this is preliminary from conversations with officials in DC and Europe.

Once the NATO Patriots are in Kiev, could take over a year 800 operator technicians are hard to make, the donors will get US approval to replace them from US vendors.

Other things like artillery shells and guns may be sent and resupplied to the donors. Who pay.

Cheap drones etc and decoy missiles, 100 or so interceptors won’t make much difference.

I think war is suggested as Trump gaslights about Epstein files.

So the Supreme Court says that Biden had no authority to order the Department of Education to eliminate student debt.

The same Supreme Court says that Trump has the authority to eliminate the entire Department of Education

Judge Myong Joun wrote in his May 22 ruling that the evidence “reveals that the defendants’ true intention is to effectively dismantle the department without an authorizing statute.”. The Supreme Court says “Go right ahead” — with an emergency ruling, no less, before even hearing arguments.

Yup.

My amateur GDP model is showing +1.5% Q/Q growth.

https://4lights.substack.com/p/gdp-nowcast-q2-2025-15

Sincerest apologies for bringing electoral politics into this discussion, but…does anyone else find the Texas Senate race interesting at this early date?

https://www.270towin.com/2026-senate-polls/texas

Click on the Texas Southern University link to see the result of polling matchups between various Republican and Democratic candidates (some not yet declared). The incumbent, John Cornyn, looks to be in trouble in the primary. Ya know law-breaking Texas attorney general Ken Paxton, whose wife has filed for divorce for “biblical reasons”? He leads Cornyn by 20 ppts among GOP voters. It’s Texas – nuff said.

Beato O’Rourke is running again, and is once again within striking distance against either Cornyn or Paxton, but former Rep Collin Allred (JD – Berkely, Linebacker – Tennessee Titans) is polling even closer. Cornyn and Paxton are gearing up to gut each other in an expensive primary, while support for the felon-in-chief is declining even among Texas Republicans. That should dent support for whichever candidate wins the GOP battle. Meanwhile, all four tentative Democratic candidates just held a powwow, suggesting they intend to lay off negative campaigning in the primary – we’ll see.

Anyhow, I’m getting ready to care about the outcome of this race so that, once again, I can be horribly disappointed by my fellow voters.

i think allred has the best chance. beato gathers media well, but his policies are much too liberal for election in this state. allred probably has the best chance of picking up independent and moderate votes needed for election. he would be a strong representative for both texas needs and the democratic party. but not sure if he can fund raise as needed.

the corynyn vs paxton battle should be interesting, good ol boy cornyn versus immoral mafia boss paxton. i am warning the rest of the country, this guy paxton is even worse than trump. his is a criminal, but used his power in office to avoid prosecution at both state and federal levels. his wife left him because his is an immoral cheat, but still claims to be of traditional family values.. his claim to fame, and pride and joy, is the ability to disenfranchise the black and democratic voter. he is not a believer in democracy, only power. be forewarned.

Speakingof Texas:

https://www.marketplace.org/story/2025/07/15/in-an-eu-trade-war-texas-is-the-state-with-the-most-to-lose

Marketplace does its usual poorjob of handling numbers – Texas has large exports to Europe partly because Texas is large. That said, Texas does have a good deal at stake in the felon-in-chief’satest tariff threat. Good thing Texans know alot about TACOs.

Speaking of policies that are likely to hurt Texas – again keep in mind Texas gets hit hard because Texas is big – as of 2023, Texas was the top state for FEMA spending, in the top four in FEMA Covid spending.

Because governor hotwheels decided to block expansion, Texas has only about 5 million residents on Medicaid. What a relief.

Based on policy, a Democrat should win the Senate race. Odds are, a Republican will win because the attorney general will make it so (remind me – who’s the AG?) but it will be close. Naturallt, the DOJ won’t investigate election tampering.

as I have said several times over the past few years, the election and voting rights issues in texas are a huge issue. and they effect the national outcome, because texas is so large. texas is red because of illegal actions by the Republican Party that disenfranchise democratic voters in the state. if you notice, trump does not do any investigation of election issues in the state of texas. but it is a real problem. voter suppression in texas is real, and growing.

During the texas floods,only 15% of calls to fema were answered because dhs failed to renew call center contracts the day before the storm. Hey bruce, not sure if this is the best policy to support. Reduce fema spending by ignoring the customer. Why do you support such filthy behavior bruce hall?

Noem and Trump say they want to eliminate FEMA — but they don’t want to eliminate FEMA funding. What Trump wants to do bring all of the disaster funding into the White House so that he can personally dole it out to his loyal governors and withhold it from his enemy governors.

yes, he seems to be working that model across the board. he has watched too much of the godfather.

so we have growth slowing down and inflation ramping up, based on the latest data. hey bruce hall and rick stryker, is this what you were promising with your “winning” maga economic programs? i thought we were going to get mortgage rates back down to 2%, affordable housing, amazing economic growth and no inflation. and now, you have even backed off on your promises to release the epstein files. is there a campaign promise you haven’t broken yet?

Scott Bessent makes a pre-emptive move in his campaign to be Fed chairman.

As we discussed last week, the Fed chair has to be selected from a member of the board of governors, so that can put a crimp in Trump’s plan to install one of his Trump loyal toadies as an outsider. But as I pointed out, Powell is both a board member and the chairman so if he retires, then both a board seat and the chair are vacant so Trump can appoint his choice to both the board and the chair simultaneously.

But it turns out that while Powell’s chair appointment expires in 2026, his seat on the board of governors doesn’t expire until 2028. So Powell could remain on the board after his chair term expires, depriving Trump of the seat on the board he needs to make his appoint for chair. It’s rare for a chairman to stay on the board after his term as chair expires but not unknown. The last time it occurred was Marriner Eccles in 1948. So Powell could do it to stymie Trump’s move.

So today, Scott Bessent, realizing the same possibility in his bid for the chairmanship, comes out with a statement that “I can tell you, I think it’d be very confusing for the market for a former Fed chair to stay on.”

The soap opera drama continues — Bessent, Hassett, Warsh — or Don Jr. Who will it be?

Also today we have word that Trump is just going to fire Powell, contrary to law.

This should be no problem. If the Supreme Court can allow Trump to fire the entire Department of Education surely they will have no problem with Trump firing one guy at the Fed.

Federal Reserve is a bank, chained to Treasury. As such all it has to do with the U S government is report 4 times per year.

Trump is only involved bc the bank creates money, taking in T Bills to put new printed money into circulation.

Trump is close to jumping the shark.

David Culter and Ed Glaeser have published a note on the JAMA Online Forum about the likely economic impact of spending cuts for medical research. The losses are large relative to budget savings, as you’d expect:

https://jamanetwork.com/journals/jama-health-forum/fullarticle/2834949

“Over 25 years, the proposed annual savings of $20 billion amounts to $500 billion in budgetary reductions. This pales in comparison to the $8.2 trillion in lost health, which is 16 times greater than the proposed cost savings. Put another way, punishing campuses by cutting health research funding would destroy the equivalent of one-quarter of annual gross domestic product in the US.”

“Estimates suggest that every dollar of NIH spending leads to $2.56 of economic activity, which is in line with a well-cited study that finds that adding an extra job generates 1.6 extra local jobs, and an extra skilled job generates even more employment.”

And so on. When you hear the 3 Fed-wannabe stooges competing to praise the felon-in-chief’s economic smarts, maybe keep Cutler and Glaeser in mind.

the cuts to nih funding is criminal, in my opinion. people do not realize, the kids (and they really are just kids in their 20’s) doing a lot of this research as phd students and post docs, are not ready for a professional research lab yet. the faculty who oversee this kids need to have the patience and temperament (some do not) to transform these book smart kids into productive biomedical researchers. this is not an easy task and costs money (both in time and wasted experiments). in the process, they conduct some very innovative and groundbreaking medical research that society benefits from. and those kids move on as doctors, professional researchers and other productive members of the professional field of biomedicine. when you cut nih funding, not only do you lose the actual research material, but you will lose a generation of “kids” who do not get the training to become good doctors, pharmaceutical researchers, etc. that will create a societal problem for decades. there will be an actual shortage of people who can work in the medical field. all because trump and musk made a few billion dollars in cuts. private sector will not pick up the slack in this situation. we will simply be left wanting. once again, thank you rick stryker and bruce hall, for supporting more policies that only lead to negative consequences to others in our society. not only do you two have blood on your hands from the recent floods, but millions of people will die over the next decades because you stopped the development of treatments for cancer, heart disease, Alzheimers and so on. evil people you are.

Trumps health is failing along with his mind. Now we here he has a weak cardiovascular system. And bruises simply from shaking hands. As i said during the election, a vote for trump is really a vote for vance.