Let’s hope capex investment in data centers is sustained.

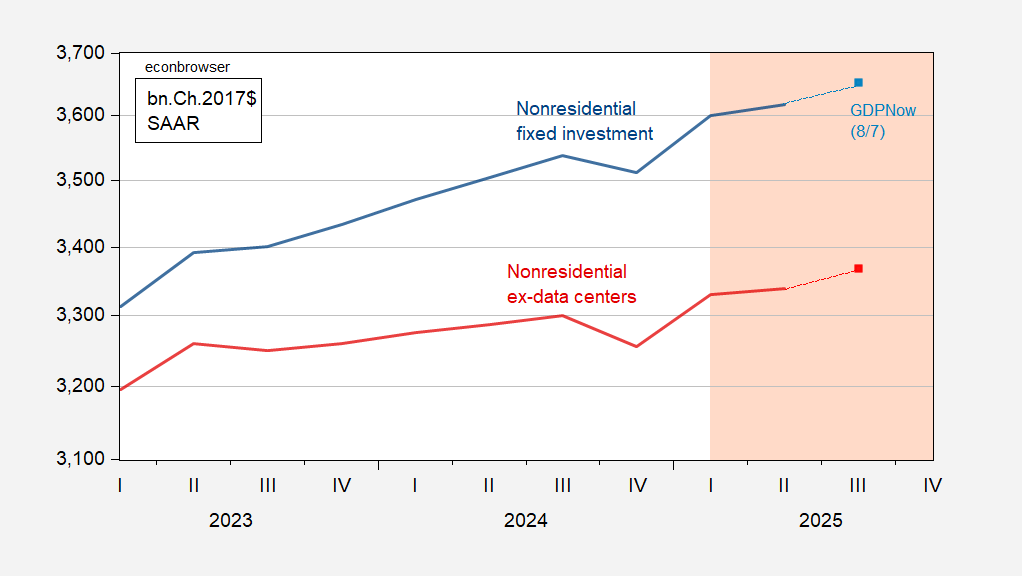

Figure 1: Nonresidential fixed investment (blue) GDPNow of 8/7 (light blue square), nonresidential fixed investment minus data center capex (dark red), GDPNow of 8/7 (red square), all in bn.Ch.2017$ SAAR. Annual data center capex interpolated using cubic spline. Assumes information processing equipment prices rise by 0.9% in Q3. Source: BEA, Atlanta Fed, JPMorgan, and author’s calculations.

The data center investment series is based on JP Morgan projections.

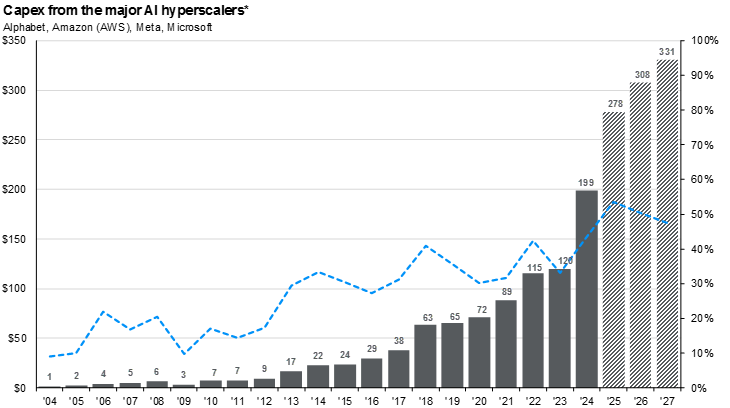

Source: JPMorgan.

Should the Magnificent 7 stocks deflate, capex is likely as well.

“Let’s hope capex investment in data centers is sustained.”

I hope this was tongue in cheek. Sort of like Krugman in 2002 sarcastically saying that Greenspan need to create a housing bubble to replace the NASDAQ bubble.

And data centers are also a disaster for the electric grid and environment.

Check.

Off topic, but Cage’s Longlegs brought it up, so blame him:

With the FOMC blackout period over, we’re getting fresh policy chatter from Committee members. Much of it suggests lower rates soon.

The funds rate is right about where conventional Taylor rule settings say it should be:

https://www.atlantafed.org/cqer/research/taylor-rule

The most recent Summary of Economic Projections, from the June meeting, put the end-of-year funds rate at 3.9% vs the current 4.33%, so a 43 basis point reduction (we’ll round up to 50 bps, in two 25 bp cuts).

Bowman, who is a felon-in-chief appointee and seems a sycophant, is calling for 3 cuts (75 bps). Others are less clear, but if the July jobs report has changed the thinking among policy makers, odds are it’s toward an extra cut this year, so a total of 75 bps.

The June SEP anticipated a 3.1% end-of-year core PCE inflation reading (up 0.3 ppt from June), 4.5% unemployment rate (0.3 ppt higher than July) and 1.4% real GDP growth rate – modest stagflation was the median view. Even with the sad little July jobs report, those are still reasonable estimates.

Looks like the FOMC is shifting toward the “high employment” side of its mandate, away from “stable prices”, which had been the focus since 2022. That would be my preference, as long as efforts to politicize monetary policy stop right now; the 2% inflation target is too low. However, politicizing monetary policy makes the entire concept of a dual mandate ridiculous.

Greenspan often said the best way to support employment in the long run was to contain inflation in the short run. However true that was in Greenspan’s day, once inflation was contained it was no longer true. Politicize monetary policy, though, and we’ll be back to a Greenspan inflationary regime in pretty short order, but not a Greenspan policy regime. Volcker addressed stagflation by killing off inflation, which was the basis of Greenspan’s view. Looks like today’s FOMC may have forgotten that history.

The economy is no longer creating jobs due to the high internal inflation businesses face now. Wage, hiring freezes have become the norm. Everybody and everyone is trying to cull costs.

Well, it’s official. EJ Antoni will be the next BLS commissioner. (Needs Senate approval but that is a foregone conclusion with these clowns.)

This should be fun.

interesting piece as always

PS there are official data on investment in data centres at https://www.census.gov/construction/c30/historical_data.html where the private-sector data are in column J of https://www.census.gov/construction/c30/xlsx/privsatime.xlsx .