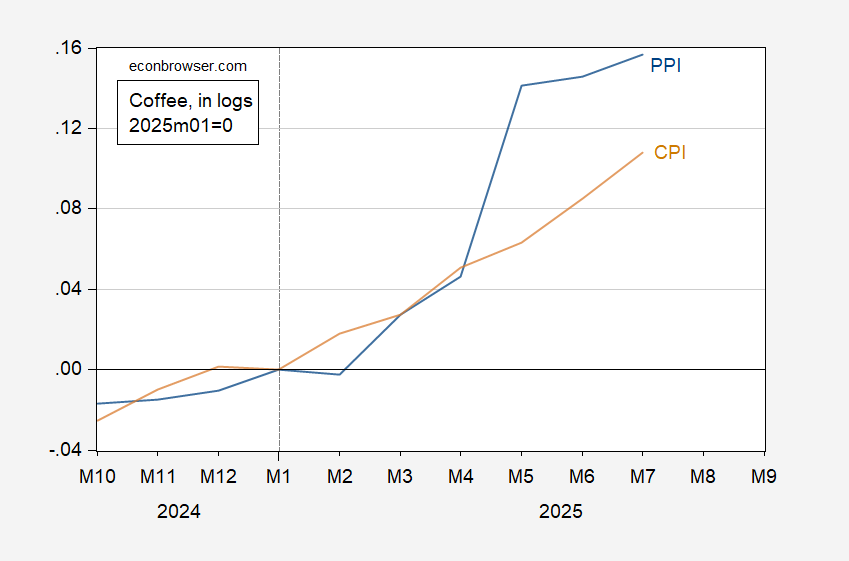

Here’re the July PPI and CPI for coffee.

Figure 1: PPI for roasted coffee, n.s.a. (blue), and CPI for coffee, s.a. (tan), all in logs 2025M01=0. Source: BLS via FRED, and author’s calculations.

Note that near month futures for coffee are roughly the same in July as in January. This suggests that to a first approximation, tariffs are explaining the jump in coffee prices.

In the short run, a one percentage point increase in PPI is associated with a 0.16 ppt increase in CPI. In the long run, the one percentage point increase in PPI is associated with a 0.75 ppt increase in the CPI (pre-pandemic, 2003-2019, using error correction model).

The Trump administration implemented a 10% baseline tariff on nearly all imported coffee in April 2025, with Brazil at 50% tariff as of August 6, 2025 (30% US imports were from Brazil); India at 25% tariff, Indonesia at a 19% tariff, Vietnam: at 20% tariff, and Bolivia, Costa Rica, and Ecuador at 15%.

I can hardly wait for coffee growers to produce in Wisconsin, to show the world we can compete in *all* dimensions!

Coffee-flavored cheese… I can *hardly* wait…

Maybe I’ll buy another couple of pounds of my favorite beans in case he doesn’t TACO on coffee tariffs.

Speaking of inflation, the cost of electricity is rising faster than consumer prices in general:

https://www.eia.gov/todayinenergy/detail.php?id=65284

Electricity accounts for 2.484% of the CPI, so a rise in electricity cost has a smaller impact than would a similar rise in the cost of housing or vehicles, roughly the same as apparel. More than coffee.

Y’all know the story behind the rise in the cost of electricity, when the price of most energy is either falling or rising less rapidly than overall CPI – data centers are sucking in ever more electricity and driving up prices.

Looks like data-center construction is quite strong, while the spike in factory construction driven by Biden-era policies is waning:

https://fred.stlouisfed.org/graph/?g=1LC6f

Note that there is an order-of-magnitude difference between the two, and that the Biden boom is still evident in factory construction, just less so now.

Anyhow, if we take the AI-optimist view that the use of artificial intelligence will push trend growth upward in the long term, that raises some questions about the interaction of electricity consumption and growth.

Energy intensity – btus in for real GDP out – has been on the decline in thd U.S. and around the world for decades:

https://ourworldindata.org/grapher/energy-intensity?time=2018&globe=1&globeRotation=43%2C-94.5&globeZoom=1.5

One effect of that decline is reduced sensitivity to energy price shocks. That’s a good thing for us, even as one of the world’s great energy producing countries, less good for countries for which energy production is a larger share of output – think Saudi Arabia, Canada and Guyana, among others.

While the trend for energy intensity in general is downward, electricity consumption, which had been roughly flat for over a decade, hit a new record last year and is forecast to continue posting gains this year and next:

https://www.eia.gov/todayinenergy/detail.php?id=65264

So in the tech-optimimist’s case, the U.S. economy could become more electricity-intensive and more vulnerable to electricity price shocks. That would be a pretty profound change in direction.

It would not be just AI-driven growth that would face increased sensitivity to electricity. If data-center demand continues to outstrip growth in electricity production, other sectors could face price shocks (relative scarcity) and perhaps actual physical electricity shortages (absolute scarcity).

The record suggests energy price (up) and supply (down) shocks are bad for growth. In general, increased vulnerability to shocks is a bad thing.

electricity is becoming a problem in texas. electric bills have increased dramatically under abbott policies. and he now wants, along with trump, to replace renewable with natural gas going forward. at least with renewables, you now your imput cost (wind and solar) are free going into the future. but our intrepid leaders have decided to replace that with a fuel that costs money, at an increasing level, into the future. so there is no way electric bills will remain stable in texas going forward. great thinking by the numbskulls in austin and the white house. i currently pay about 19 cents per kWh. several years ago, that was less than 10 cents. quite a significant increase. it now costs over $500/month to power my house with electricity and nat gas. that is probably $200 more a month than it should actually be, if we had anybody competent overseeing utility costs. and abbott solution is simply to spend about $10 billion more on nature gas plants, that only operate about 2% of the time. economically we have simpletons running the show in texas.

Coffee can be produced in Puerto Rico (limited because of hurricanes), Hawaii and California (also limited due to high costs of production and other factors). Remember the only reason Trump is targeting Brazil is political — the prosecution of Jair Bolsonaro, his ally, who is accused of plotting a coup. This coffee tax qualifies as taxation without representation.

Well, I guess Puerto Rico and Hawaii will get a bit of a boost, as they both produce coffee, although more on the gourmet side so neither were really competing with Brazilian or Central American coffee.