Is gold supplanting the dollar? Did the use of sanction by the US reduce holdings of dollars by targeted central banks? Did the 2018-19 tariffs reduce holdings of dollars by countries hit with Section 232 tariffs? Jeff Frankel, Hiro Ito and I address these questions in a new paper.

We analyze the determinants of individual central bank holdings of international reserves, as shares of gold, dollar, euro, pound, yen and yuan, over the 1999-2022 period. We augment standard economic determinants of size, exchange rate volatility, currency pegs and bilateral trade with bilateral political/economic variables such as disagreement in UN voting, military alliances, and financial and trade sanctions. These variables augment uncertainty measures such as global Economic Policy Uncertainty, US monetary and trade policy uncertainty, and the VIX. In addition, we investigate whether the US imposition of tariffs in 2018 had any measurable impact on dollar and other holdings. We conclude that financial sanctions and trade policy uncertainty have a statistically and economically significant effect on holdings of the US dollar. US tariffs had an economically – but not statistically – significant impact on shares of foreign exchange reserves: dollar shares fell by 2.1% and other shares rose by 0.8%. These findings can inform the debate regarding some of the benefits and costs of using such geo-economic policies.

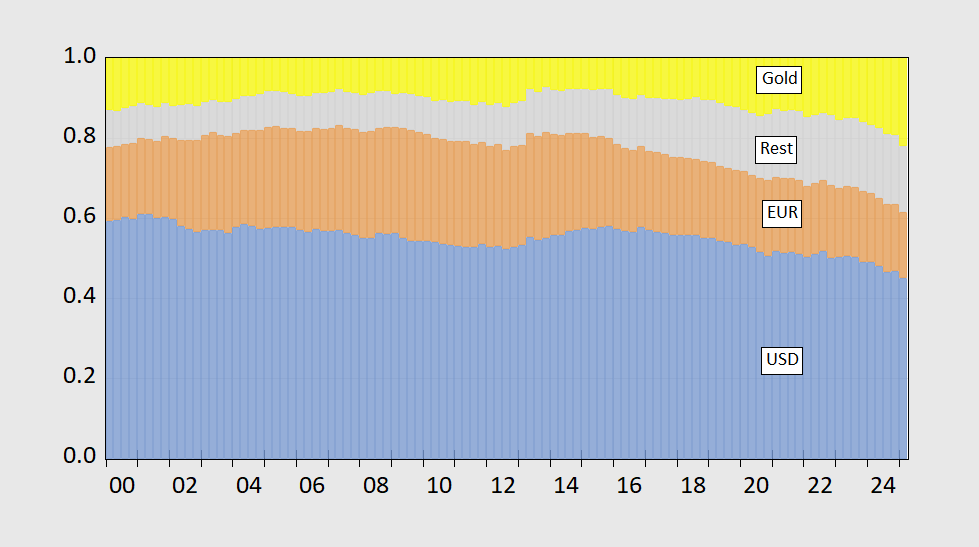

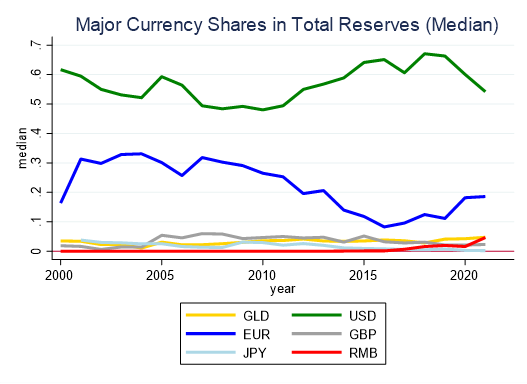

To investigate these questions, we rely in individual central bank data, as used in Chinn, Frankel and Ito (JIMF, 2024). In this way, we can distinguish between what’s happening at the aggregate level (figure 1 below) and at the individual bank level (illustrated by median holdings, figure 2).

Figure 1: USD shares of fx and gold reserves (blue bars), EUR (tan), all other (gray), and gold (yellow). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Assumes quantity of gold holdings stay constant in 2025Q, and observed . Source: IMF COFER, World Gold Council, and author’s calculations.

Figure 2: Median shares of each currency or gold as a share of total reserves, using Ito-McCauley dataset. Source: Figure 3, Chinn, Frankel and Ito (2025).

USD and EUR shares match up ok, but gold is a greater share in average than in median.

While we do not confirm a role for the Section 232 tariffs (on aluminum and steel in 2018-19 in decreasing dollar holdings, it’s important to recall that those tariff revenues barely registered as a blip, compared to the current effective tariff rates of near 10%.

Furthermore, the trade policy uncertainty that attended the Section 232 and Section 301 tariffs had a measurable impact on central bank holdings.

Off topic – Laura Loo.er is making U.S. foreign policy, and that’s bad:

https://www.theguardian.com/us-news/2025/aug/16/gaza-children-visas-medical-care-laura-loomer

She doesn’t want Palestinian chdren, injured in Israel’s ethnic cleansing war, to receive treatment in the U.S. So now, the State Department is “evaluating” its visa program, and has stopped granting wounded Palestinian children visas.

Disgusting.