trillions of dollars that appear to be economic growth are just borrowing from the future — a debt that will eventually have to be repaid with taxes or inflation. Both will kill growth.

Consumers are in the same boat. Families have depleted their savings and gone deeply into debt to meet today’s stratospheric cost of living. Credit card debt alone is a record $1.14 trillion. Total household debt has ballooned to an eye-watering $17.8 trillion.

However, the debt charade is ending, and the façade of economic growth will come down soon after that. The latest consumer credit data shows that growth for things like credit cards has begun collapsing at the fastest rate since the COVID recession.

It’s unclear whether this is due primarily to people being unwilling to go deeper into debt or because lenders are leery about lending more, but the implication is clear: consumer spending — about two-thirds to three-quarters of the economy — is about to hit a wall.

This is EJ Antoni, August 21, 2024, in the the Boston Herald. Reprinted at Heritage Foundation, August 22.

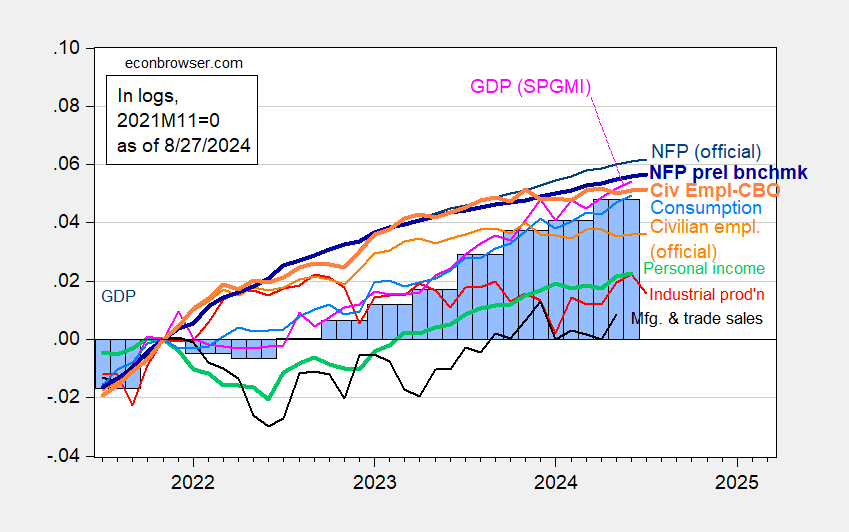

For reference, here are the NBER’s Business Cycle Dating Committee key indicators as of 8/27/2024 (NFP and personal income being central):

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP implied preliminary benchmark revision (bold blue), civilian employment (orange), implied civilian employment using CBO estimates of immigration (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

I find it amazing that Dr. Antoni thought we were in recession conditions in August 2024, and not so in August 2025.

I see the Trump admin committing the six classic mistakes leading to economic failure – 1. lack of public investment; penalizing productivity via weakened services and innovation; 2. stifling competition; penalizing productivity through underinvestment in R&D, 3. erosion of rule of law / corruption; political instability, 4. Deportation of workers, productivity penalties, political instability, 5. Closed markets, Stifling competition, 6. Rule of law erosion, Closed global governance –

Outlined here – The Economic Consequences of The Second Trump Administration: A Preliminary Assessment – https://cepr.org/publications/books-and-reports/economic-consequences-second-trump-administration-preliminary

Trump keeps saying the economy is “hot” – I say the U.S. economy is slowing and let’s hope it doesn’t freeze. Also besides FT – this report got zero media coverage.

For a right wing hack the definition of recession changes depending on who is in power.

“..trillions of dollars that appear to be economic growth are just borrowing from the future.”

This sentence displays a basic misunderstanding of the relationship between the economy and finance. Credit, used wisely, enables growth. No apparent growth – the real thing. The simple S=I statement provides a hint, if little Antoni would just think about it.

Is it possible to borrow too much? Heck, ask the felon-in-chief. He does it all the time, and is at it again with the Big Bloated Budget Bill. Oddly, little Antoni doesn’t seem to think $3.4 trillion in additional federal borrowing amounts to “apparent” growth.