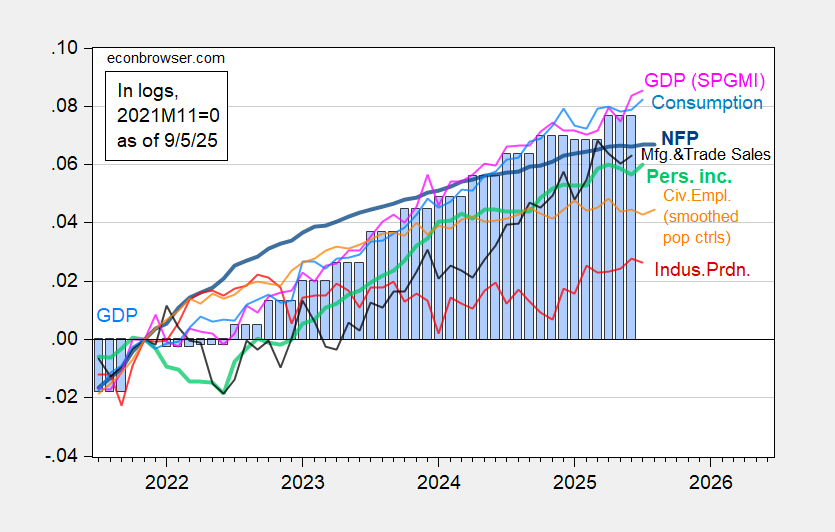

With NFP at +22K < +75K Bloomberg consensus (hinted at by Trump signaling “pay no heed to the numbers behind the curtain”), we have the following picture of key indicators of the NBER’s BCDC (including the 48K downward revision in previous two months):

Figure 1: Nonfarm Payroll from CES (bold blue), civilian employment with smoothed population controls (orange), industrial production (red), Bloomberg consensus industrial production of 8/14, (red square), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2025Q2 second release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

Notice that the Mean Absolute Revision going from first to third release in 2022-24 period is about 40K, so the approximate 95% confidence interval is -62K to +102K.

While smoothed civilian employment rose slightly (orange line), given the variability in this series, should be taken as essentially zero growth. Overall, civilian employment is below recent peak. All in all, these numbers are consistent with a cooling labor market, as discussed in yesterday’s post.

Monthly GDP released on Tuesday by S&P Global, rose at a decelerated rate — 2.4% m/m AR in July vs. 11% in June.

Does rhis mean Wiatrowski has to go?

The index of aggregate weekly hours is down slightly so far in Q3 relative to Q2, suggesting the labor input to GDP is about flat. Average hourly earnings up 0.3%, same as the average for Q2.