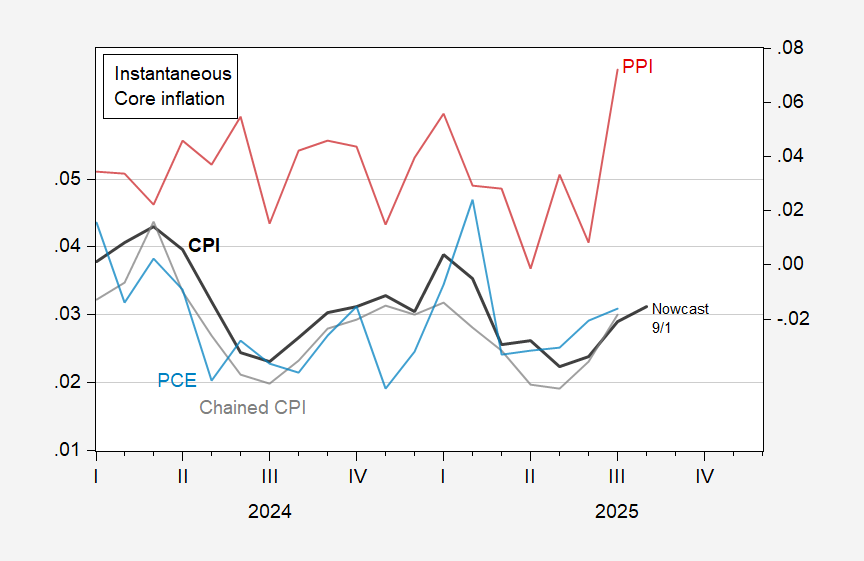

And CPI nowcasted to rise in August, too:

Figure 1: Instantaneous inflation for core CPI (black, left scale), chained core CPI (gray, left scale), core PCE deflator (light blue, left scale), core PPI (red, right scale). Core PCE inflation for August is Cleveland Fed y/y nowcast as of 9/1. All per Eeckhout (2023), T=12, a=4. Source: BLS, BEA, via FRED, and author’s calculations.

Note that 3.1%, core PCE instantaneous inflation is now over a percentage point above the 2% target (y/y inflation is 2.9%).

Fully predicted by anybody with basic understanding of inflation. Trumps desperate attempt to get rates lowered right away suggest that he also have somme understanding that the Fed would be facing higher inflation as part of its decision at future meetings.

Trump does seem so desperate that I wonder how many of his underwater real estate projects are facing a reset in rates.

trump is anxious to get the fed to lower rates immediately because he does understand, over the longer time horizon, his actions have been and will be inflationary. if he gets lower rates now, he can blame the fed for the recession that occurs when the fed has to raise rates again to tame the inflation.

Allowing private equity investment for 401K’s, IRA’s and other retirement accounts, gives me pause to wonder how many of those investment instruments are also underwater and require an influx of ready cash. Long term rates are rising and the cost of borrowing for sovereign nations is becoming steep. The prices of commodities and precious metals continue to rise. The world’s economic situation leaves less hope for lower inflation.

I would not touch those investment in a 401k or ira. if you have spare cash in an investment account, perhaps. but not a retirement account. I already have my financial advisor trying to access my retirement funds for investment, claiming he can do better. but actually my own retirement accounts have outperformed my accounts with jpm, so I will keep doing what I am doing. i very likely will eventually pull those “professionally managed” accounts, although they have been a little better at hedging losses than the standard robo accounts you access in the 401k. my experience is that professionally managed accounts can reduce some losses, but over the long run they are not as profitable because they are more conservative and the manager takes a cut, even if it is small.

I’m sure that several of his real estate projects are about to reset. Trump being a huge real estate person and admittedly being leveraged heavily, obviously needs the lowest rates possible. No matter who you are, a real estate investor should have no input with rate decisions IMO.

For him to have any control over the Fed, would be a huge mistake! Without a doubt, the Fed is in a difficult position.

Inflation from the tariffs, haven’t even come close to fruition yet!