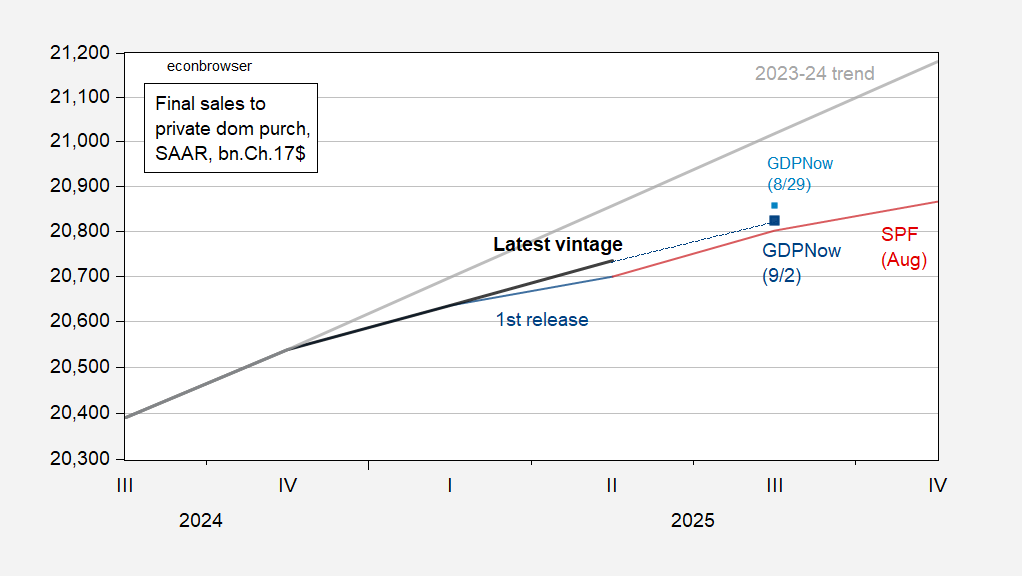

Q2 final sales to private domestic purchasers — arguably a better indicator over time about momentum in the economy in the wake of the tariff-frontrunning — was 1.9% q/q AR. Four days ago, nowcasted final sales for Q3 was 2.4%. Today’s GDPNow release takes that number down to 1.7%, a slowdown from Q2.

Figure 1: Final sales to private domestic purchasers, latest vintage (bold black), advance release (blue), GDPNow of 8/29 (light blue square), GDPNow of 9/2 (dark blue square), Survey of Professional Forecasters August median (dark red), 2023-24 stochastic trend (gray), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, and author’s calculations.

The downward revision was associated with the ISM manufacturing survey and the construction release. (Q3 GDP nowcast was reduced from 3.5% to 3%, q/q AR.). Manufacturing PMI was at 53.0 (vs. 53.3 Bloomberg consensus), while construction m/m was -0.1% (at consensus).

Here’s the picture:

https://fred.stlouisfed.org/graph/?g=1M0PC

With the latest GDPNow estimate, the first 3 quarters of 2025 will be the slowest growth for core GDP since the final three quarters of 2022. Remind me; when were right-wing recession cheerleaders telling us we were in recession? Where they be now?

Better news on GDP from Secretary Bessent:

“Tariffs are delivering historic results for the American people. Even the mainstream media are starting to admit it.

I’ve said total tariff revenue could reach $300 billion this year, but it could be much higher. Every $300 billion adds 1% to GDP. With tariffs alone growth could hit 5%.”

Whoa! Taxes increase GDP! And his 5% growth implies $1.5 trillion in tariffs, which is a rate of about 45% on all goods coming into the country, assuming no domestic substitutions.

There was a time when they said Scott Bessent was the smart one in Trump’s cabinet of fools.

Not only does he claim that taxes increase GDP (contrary to what he said about OBBB when he claimed tax cuts would increase GDP), but he claims they do so dollar for dollar. Every dollar of tariff revenue is a dollar added to GDP.

So GDP = C + I + G + (X-M) + T

Amazing stuff! What a time we live in.

Wow… Just wow. Where’s Mnuchin? Even he never said anything like that. And he at least gave us “Fury Road” before reselling his soul.

And here I thought tax cuts caused growth all this time. I can’t keep up with the latest theories and gyrations. Orwell was just off by a few decades.

Off topic – tariffs and the dollar:

https://cepr.org/voxeu/columns/tariffs-and-us-dollar-depreciations-not-so-surprising-after-all

The authors find note that in theory, a currency’s response to home-country imposition of tariffs depends on whether other countries retaliate, and that history bears out this view- nothing odd about the dollar’s response to the April 2 tariff screw up. The response of Treasuries to the April 2 tariff announcement is, on the other hand, not as simply understood.

So a number of seamen were just killed by the U.S. military, allegedly for running drugs. We know there were U.S. naval vessels in the area which could have intercepted the vessel, thereby avoiding killing those men. Killing them was a choice, obviously, but it was not a choice between killing them and doing nothing. Another option was to do what has been done throughout history when dealing with suspected smugglers, but that’s not what we did.

The felon-in-chief has now demonstrated a preference for killing. Not a surprise, but a new addition to his list of crimes – unless we count the assassination of an Iranian general in the felon’s first term.

Any Cabinet resignations? None that i’ve heard of. This is who we are now.

If you have a fast boat I suggest you stay away from any waters near US naval vessels.

And all those federal executions.

Trump has certainly earned his coveted Nobel Peace Prize for bringing together long time rivals China and India. And Russia and North Korea have joined in. Great job, Donnie. Peace at last.

well, he certainly stopped the war in Ukraine. and the killings in Gaza have come to a halt under trump’s watch as well. peace throughout the world. time to offer up the Nobel prize and send him off into the sunset.

off topic.

this morning’s JOLTS reports had June’s separations revised from 5,060,000 to 5,341,000, while June’s hires were revised from 5,204,000 to 5,267,000…that’s the first time since the pandemic recession that i’ve seen separations exceed hires for any month, and implies there was a loss of 74,000 jobs for the month…

July fared better; hires increased by 41,000 while separations fell by 52,000, implying an increase of 19,000 jobs in July…

at any rate, JOLTS seems to be suggesting there’ll be downward revisions to non-farm payrolls for those two months (not withstanding the +/-110,000 job margin of error in our monthly employment extrapolations…

Someone will lose their job. There is not such thing as revising to anything except “Tump is Great” numbers

Trump is destroying U.S. manufacturing https://www.reuters.com/business/us-manufacturing-contracts-sixth-straight-month-amid-tariff-drag-2025-09-02/

Also demand for housing is slowing because of high home prices, high mortgage rates and declining immigration. I think we are headed to another Trump/GOP recession.

My local measure is cranes around Seattle. The number is dropping precipitously. As projects get completed, the cranes come down and don’t go to a different jobsite. A few years ago, I could count dozens from the freeway through town. Now there are nine. Two will come down soon. There are two large projects in downtown Seattle that have not been started, and the level of development in residential neighborhoods, while still plenty active, has dropped. The spam callers who plague my cell phone are now “contractors” who want to give me a “free estimate” instead of people who want to make an offer on my house. It’s all pointing the same direction.