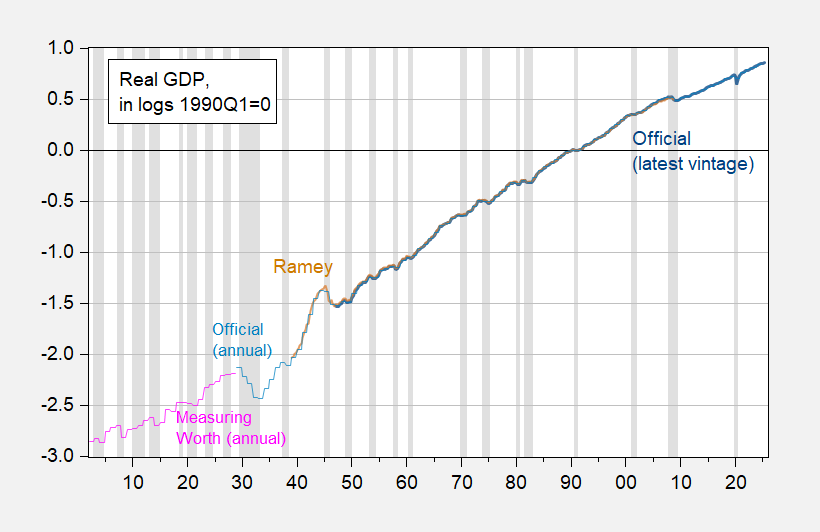

Referring to Dr. Antoni’s definition of recessions using quarterly data, here are the GDP data series for the US I am aware of.

Figure 1: Real GDP according to BEA (blue), Ramey series (tan), BEA annual (light blue), Measuring Worth annual (pink), all in logs 1990Q1=0. NBER defined peak to trough recession dates shaded gray. Source: BEA, Valerie Ramey, Measuring Worth, NBER< and author’s calculations.

As can clearly be seen, quarterly GDP data to make the assertion that the two-quarter equals recession rule only goes back 75 year’s prior to Dr. Antoni’s claim.

(To be fair, Dr. Antoni is being nominated to head BLS, not BEA.)

Off topic – A new article, so new it’s dated eleven days from now, explains the much lower average human life span in the Southeastern U.S. compared to the rest of the country:

“Mortality caused by tropical cyclones in the United States”

https://www.nature.com/articles/s41586-024-07945-5

The gist is that tropical cyclones cause many more deaths indirectly over time than are counted in official statistics. Rather than the average 24 deaths counted in official statistics per cyclone, the authors estimate 7,000-11,000 per cyclone, with excess deaths wxtending over a 15-year period.

The persistent, indirect effects the authors identify are things like reduced budgetary capacity, damage to infrastructure and so on. Resources destroyed by and used to recover from cyclones aren’t available for other beneficial purposes.

This is new stuff, and there has not been time for the scientific world to pile on. Taking the results at face value, a couple of issues come to mind –

There has been a big migration into the states with low life expectancies and high incidents of tropical cyclones. If geography is the problem, does that mean our falling national life expectancy results in part from a population shift to the Southeast? Will improved budgetary and economic capacity in the Southeastern states mitigate the effect of cyclones on average life expectancy?

The other issue is that we may have vastly underestimated the cost of climate change. If we are going to have more and more powerful cyclones, and the death toll from cyclones is a couple of orders of magnitude greater than we had thought, we’re really in the soup.

Little Antoni is routinely dishonest, and this case is no exception. As a matter of rhetorical style, his dishonesty often amounts to declaring some falsehood to be an accepted fact, on the strength of his authority. His declaration regarding the accepted definition of recession is such a case.

I thought I might do a tour of textbooks to find out whether there is a “textbook definition” of recession, but Jeremy Horpedahl saved me the trouble. From professor Horpedahl’s 2023 blog post ‘The “Textbook Definition” of a Recession’ we have these results from his survey of 17 recent principles texts:

“…while some textbooks mention the “two quarters” rule, the majority do not (9 out of 17). And among those that do mention it about three call it a “rule of thumb” rather than it being how we define recessions (some even say it’s not a good rule of thumb!). Just five of the 17 use it as a definition (one of these calls it a “working definition,” another also references NBER definition). Most definitions are much closer to how the NBER defines recessions using multiple other measures to define a recession, with many even referencing the NBER as the agency that defines recessions.”

https://economistwritingeveryday.com/2022/08/10/the-textbook-definition-of-a-recession/

Horpedahl gives lots of context, such as that when the 2-quarter notion is mentioned, it is often separate from the text’s formal definition of recession. He notes one text calling the 2-quarter notion an “informal definition of a recession, often cited by reporters”.

He also looks into older texts, and finds even less evidence for the 2-quarter definition of recession. So much for little Antoni’s claim that 2 quarters of contraction has “been the understanding for the last 100 years”.

Antoni simply lied. I can’t see any way of avoiding that conclusion; ignorance can’t account for the specificity or number of false statements Antoni made. Every assertion, except perhaps about his own classroom malpractice, is wrong.

I like using ChatGPT to do “back of the envelope” economic impacts on Trump admin chaotic policies – where is what it says about the H-1B shock policy announced on X – Innovation drag: Fewer H-1Bs → fewer patents and slower innovation (10% more H-1Bs ≈ 3% higher patent growth at H-1B-reliant firms). Restrictions tend to push jobs offshore and permanently hurt startup performance. A 30–50% drop in new H-1B admissions implies ~9–15% slower patent growth at the most H-1B-dependent firms over the next 1–3 years—most critical for AI, cloud, chip design, med-tech. Inflation/productivity channel: Short-run: wage pressure in scarce skills + project delays → higher costs for software, implementation, and IT services (services CPI-adjacent), while some work is deferred or pushed offshore. Medium-run: lower innovation and slower diffusion of AI tools reduce measured productivity growth, a classic stagflationary tilt (weaker supply side even as some costs rise).

The Trump admin is really loading up the U.S. economy with stagflation headwinds – more and more I’m thinking recession. The Trump admin has taken the best economy in the world and destroyed it in short order.

AI bubble is over. Most of those visas won’t be necessary. Heavy cut backs and layoffs beginning in other sectors. Only thing left is bursting of the valuation bubble.

i would take a look at florida and the last couple of years of hurricanes that hit some of those areas. detailed analysis will probably show those areas are suffering quite a bit, both economically and medically. most of the people hit by storm surge are not what i consider wealthy, and their ability to bounce back is limited. they tend to endure the following years in almost squalid like conditions, with damaged homes that are not fixed up and improved. it is amazing the conditions humans can adapt to after storm damage, that others would consider very abnormal. and those conditions are probably very unhealthy to live in long term.

Yikes!

Secretary Bessent: “Argentina is a systematically important US ally in Latin America and the US Treasury stands ready what is needed within its mandate to support Argentina. All options for stabilization are on the table.”

Wait, I know that Trump’s electoral “mandate” is imaginary, but now we have a mandate for Argentina too?

“These options may include, but are not limited to, swap lines, direct currency purchases, and purchases of US dollar denominated government debt from Treasury’s Exchange Stabilization Fund.

So not only does Treasury bailout out irresponsible US bankers but now we use taxpayer dollars to bailout foreign irresponsible leaders that happen to be political allies of Donald Trump?

“Opportunities for private investment remain expansive, and Argentina will be Great Again.”

Criminy, now we have MAGA Argentina too? President Javier Milei is the guy who handed the chainsaw to Elon Musk that he waved around at the Conservative Political Action Conference in February. Milei is a good friend of convicted Brazil coup organizer Bosonaro, and of course, fellow coup organizer, Donald Trump.

I can see how dollar swaps and the like will help in the short term. The peso is under pressure in part because of elections just around the corner. Once Congress is back in business with new power arrangements, there may be some let-up in the rush for dollars.

In the somewhat longer term Argentina has $34 billion in external debt maturing through 2027, and only about $40 billion in reserves, $20 billion of which is from the IMF. Things are still grim, whatever happens on election day. Not sure the U.S. is going to help with that, and if we don’t, not sure help in the short run is going to matter.

Long term, Argentina is Argentina. Great people. Great natural endowments. Badly governed from the left, right and center.

But make no mistake about it. Javier Milei is a bad person — full stop.

We should not be using US taxpayer dollars to bail out an authoritarian while we simultaneous use tariffs to undermine the democracy in Brazil. Milei has expressed his full support for Bolsonaro, Orban, Donald Trump, Elon Musk and yes, Charlie Kirk. You know someone by the company they keep.

Also note that this is one month before mid-term elections where Milei is projected to take a beating from disappointed voters. This is essentially a massive billion dollar campaign contribution to prop up Milei.

Apparently the company that makes Tylenol failed to buy any Trump crypto.