That’s exactly what EJ Antoni did in “Biden’s Recession” (August 1, 2022):

In terms of how we define it or what marks a recession, the basic understanding is that when the economy shrinks for two consecutive quarters, so three months, and then another three months, that’s a recession. The reason that the White House has been making a lot of hay of, oh, that’s not official definition, blah, blah, blah. Okay. I suppose there is no technical official definition, but I’ve taught plenty of economics courses. That was what we used in every single class. That’s what you’ll see in most, if not all economics textbooks. That’s been the understanding for the last 100 years. So the idea that this is somehow new or not true, I dismiss that out of hand.

I think many people would be surprised to know that the US national accounts went back to 1922. I myself am only able to obtain (quarterly*) BEA data back to 1947, but perhaps Dr Antoni has some special data he’s whipped up.

I daresay I’ve taught more classes in macro than Dr. Antoni has (at UC Berkeley, UC Santa Cruz, UW Madison). I’m pretty certain I never said “2 consecutive quarters of negative GDP growth is the definition of a recession”.

There’s a reason why I don’t. It’s related to why the NBER’s Business Cycle Dating Committee waits a long time after an obvious peak to declare recessions — because the data are revised, sometimes very long periods after the data are first released, thereby altering our understanding of the path of GDP.

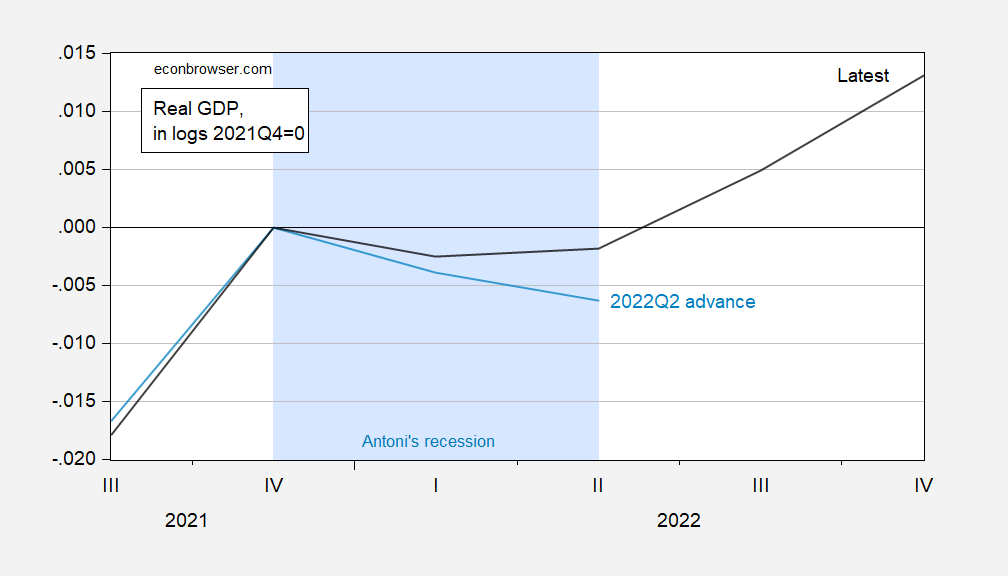

To illustrate this, consider GDP as of the advance release for 2022Q2, and the latest (2025QQ2 2nd release):

Figure 1: Real GDP from 2025Q2 2nd release (black), and 2022Q2 advance release (light blue), both in logs 2021Q4=0. EJ Antoni’s recession shaded light blue. Source: BEA via FRED, ALFRED.

This re-envisioning is not uncommon. The 2001 recession was only briefly (for a few vintages) characterized by two consecutive quarters of negative growth.

Moreover, Dr. Antoni (if he is willing to acknowledge that the (quarterly*) GDP data from BEA starts only in 1947) should be acquainted with the 1947 experience of 2 consecutive quarters of growth, not accompanied by a NBER determination of recession.

Interestingly, Dr. Antoni as recently as a four months ago argued that the 2 quarter criterion should not be used, in the case of 2025H1, should Q2 growth be negative…

Addendum:

* Commenter John Hall correctly points out BEA GDP data at the ANNUAL frequency goes back to 1930.

I’m fairly sure that you mean the official quarterly GDP data only goes back to 1947.

Pretty sure they have supplementary GDP data going back earlier, although it may only be annual. Hard to check on mobile.

John Hall: Yes. You are right! Annual goes back to …. 1930. But you can’t do the 2 quarter thing with annual data, can you? (There are unofficial series, like the Valerie Ramey one; I used that in this post). Correction added, thanks!

it is quite possible that antoni believes recessions did not occur prior to the BEA collecting gdp on a quarterly term. because in the trump world, if we don’t measure it, then it does not exist. there are some quantum physicists who take a similar view of the world, in which reality only exists if and when we measure it.

Antoni says this is what he teaches his students. I pity these students.

His two quarter criteria cannot apply to Trump as Trump is God. It must apply to Biden because Biden is a commie. Right?

“That was what we used in every single class. That’s what you’ll see in most, if not all economics textbooks. That’s been the understanding for the last 100 years.”

Who is “we”. Antoni can’t name a text book from 1922. Now I have a copy of Samuelson 1948 and he is not so stupid to use this metric. Oh wait – Antoni does not know who Paul Samuelson even is.