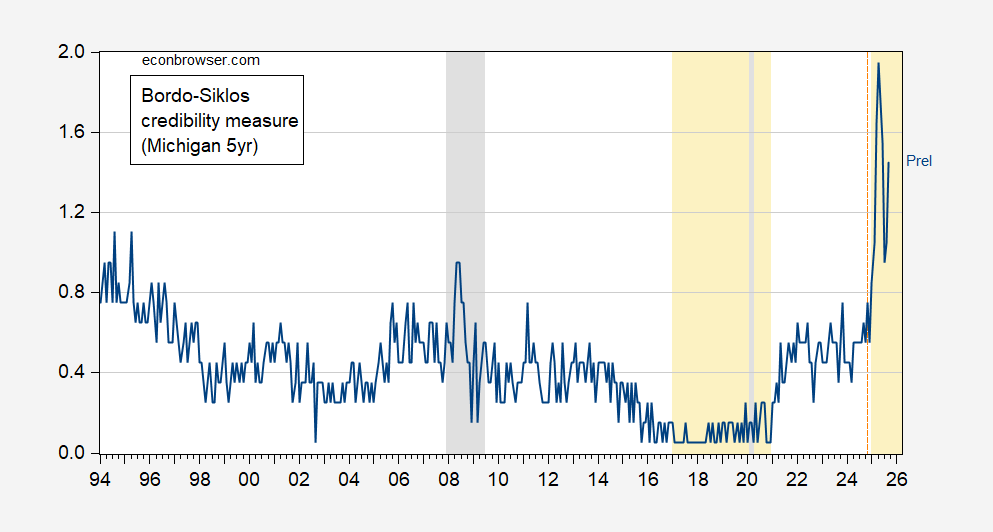

If credibility is degraded, then tariff induced cost-push shocks are less likely to manifest as one-off price level increases, and more likely to spur a bout of inflation.

Figure 1: Bordo-Siklos measure of Fed inflation credibility (blue). Calculation assumes CPI target consistent with PCE target is 2.45%. September observation is preliminary. Light orange shading denotes Trump administrations. Orange dashed line at “Liberation Day”. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, author’s calculations.

From Bloomberg:

“To the extent that the Fed’s decision this week is seen as a capitulation to political pressure, a new layer of risk is being added to US financial markets and the dollar,” [ David Kelly, chief global strategist at JPMorgan Asset Management] said.

See also Griffin-Kashyap in WSJ.

Looks familiar:

https://fred.stlouisfed.org/series/MICH

your inflation rate is over 3% ( trimmed mean which is the best estimate ask our Central Bank). given there is no downward trend then a cut in rates is highly problematic.

Trump wants rates cut by 3 percentage points but he says the economy is booming. This only makes sense in a Trump mind which is quite small

Some of it is, I suspect, “I can blame the Fed if anything goes wrong, because they wouldn’t carry out their part of my Grand Unified Plan to fix the broken Biden economy.”

Off topic – Ricketty-ticketty-toc is all the financial press seems to care about with China. Reuters did, however, manage a few lines on this:

https://www.reuters.com/world/chinas-xi-urges-orderly-exit-outdated-production-capacity-xinhua-says-2025-09-15/

Somewhere between really important and nothingburger, depending on implementation, in one of the world’s two largest economies.

China’s exports recently hit a new high, in part because of domestic overproduction. Same story for the current account:

https://tradingeconomics.com/china/current-account

This export boom exports Chinese disinflation right along with Chinese goods. Shutting down excess production will reduce exports and, if things go according to theory and to Xi’s wishes, will boost Chinese prices. Both factors will add to global inflation. It’s probably the case that there’ll be a boost to U.S. import prices, though the felon-in-chief’s trade policies make that far less certain.

There is also reason to be concerned about Chinese financial stability. Though this new policy of killing off overproduction is meant to provide stability, such transitions always carry financial risks.

Definitely on topic – calls for the BoE to reduce bond sales:

https://www.theguardian.com/business/2025/sep/14/bank-of-england-urged-to-slow-bond-selling-plan-to-help-cut-record-uk-borrowing-costs

Liquidity problem? Monetary policy efficiency? Nope. Borrowing costs are too high, so stop demonetizing the debt!

Can’t wait for tomorrow’s FOMC wrap-up. We also get a new SEP, which will undoubtedly forecast slower growth and maybe higher inflation than the CEA just did.

Will the felon-in-chief insist the outlook is great, the FOMC is an outpost of left-wing radicals and should cut rates by 3%? Tune in tomorrow for the next episode of “The Dumb and the Feckless” brought to you by…Voters! Yes, Voters! The most affordable way for an oligarch to own the government! Voters! V-O-T-E-R-S! One of many fine products from the friendly people at VRWC.

Off topic – holiday sales forecasts:

https://www.reuters.com/business/retail-consumer/us-online-holiday-sales-growth-slow-shoppers-tighten-budgets-salesforce-2025-09-16/

Salesforce expects a 2.1% rise in holiday sales. Links in the article to other recent forecasts show similarly soft expectations.

Note that these forecasts run below the pace of inflation. That implies a drop in real demand. Early days yet. Watch hiring plans. Challenger has already reported that hiring plans for the remainder of the year look soggy, particularly for retailers.

A lot of immigrants will be cutting their holiday spending 100%.