Or, why should a bunch of ICE agents running amok in a Hyundai-LG factory have an impact on trade policy uncertainty?

People tend to think of international trade and foreign direct investment as substitutes (one can import widgets into country A from country B, or alternatively a firm in Country B can build a new widget factory in Country A). That kind of makes sense in a world of differing goods, maybe without information asymmetries. However, when there are differentiated productions, supply chains, intellectual capital etc., it is perhaps more useful (especially in trade between advanced economies) to think of trade and FDI as complements (or FDI as technology transfer, as this was a chip manufacturing facility). In any case, see Chapter 6 of Chinn and Irwin (2025).

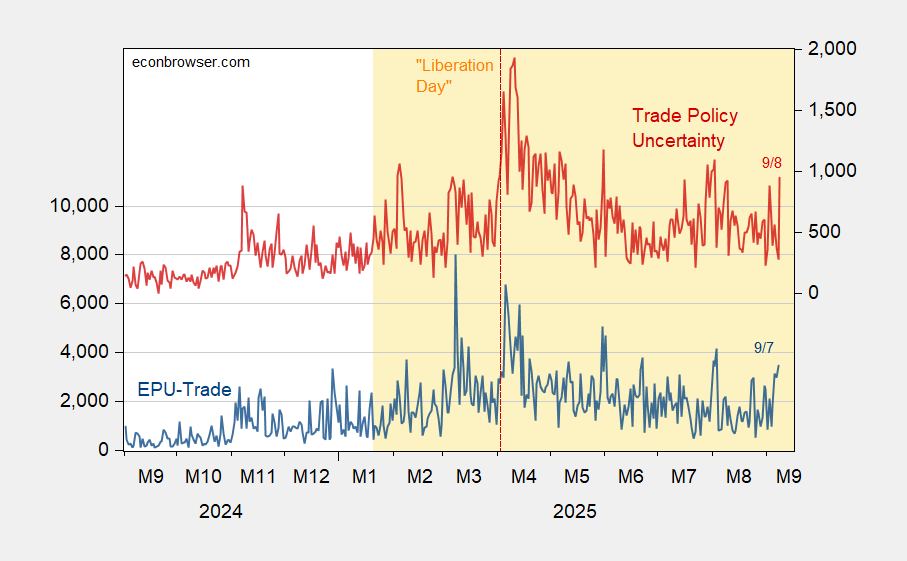

So, here’re two trade policy uncertainty measures:

Figure 1: EPU-Trade (blue, left scale), TPUD Caldara et al. (red, right scale). Source: policyuncertainty.com and Iacoviello.

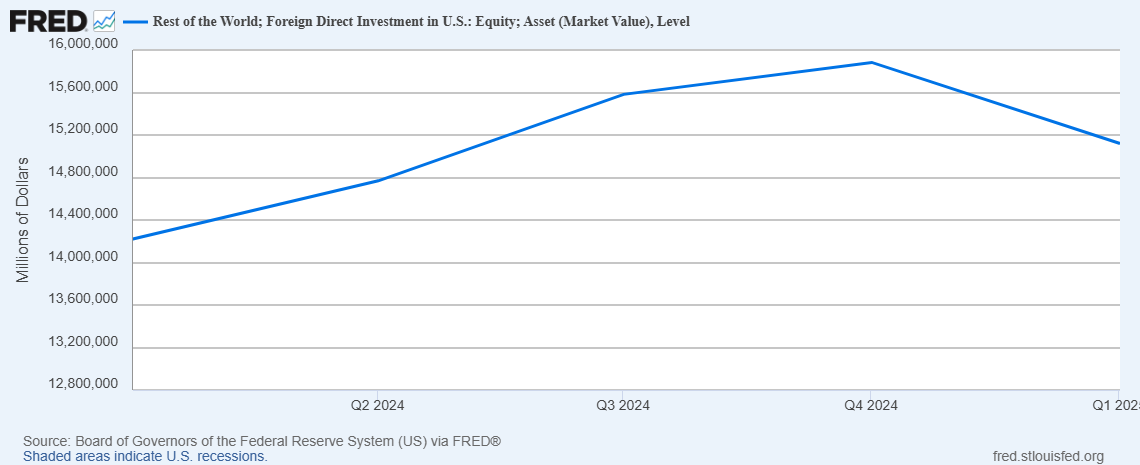

Given the impact of uncertainty on FDI (see e.g. Jardet, Jude, Chinn, 2023), it’s no wonder FDI fell in Q1.

so ppi was reported lower today. many people are using this as an argument that tariffs are not causing inflation, and to justify a rate cut next week. my question is not about he rate cut. but if i recall from a recent post and discussion, does the ppi not include the tariff in its calculation? meaning just because the ppi is not increasing, does not mean that consumers are not facing inflation? the tariffs could still be causing inflation because they are not a part of the ppi? if so, does this mean that ppi is a poor measure of the impact of tariffs on the economy?

Do you know the latest on that import price index. It seems our fake Treas. Sec. took a beating on Meet the Press this Sunday regarding this topic.

That a great point – here is bottom-line when I asked ChatGPT about this: “Today’s low PPI print is not proof that tariffs are benign. PPI excludes tariffs directly, and much of tariff inflation shows up in consumer prices (CPI/PCE) rather than producer prices. That means households can still feel inflation pressure even if PPI looks tame.” The full answer was fascinating to read.

ChatGPT probably cribbed off of Menzie.

https://www.spglobal.com/commodity-insights/en/news-research/latest-news/metals/010625-commodities-2025-china-to-turn-up-heat-in-copper-processing-even-as-global-output-lags

China imports a lot of copper and decided a while back that it would heavily invest in smelting that copper as smelting costs have historically been quite high. It seems they overinvested as smelting cost may actually turn negative.

Under-supply of ore while China aims to over-supply smelted copper. What’s the term for “crack spread” in the copper industry.

Off topic – Rising ocean temperatures threaten to reduce O2 production by ocean bacteria:

https://www.nature.com/articles/s41564-025-02106-4

This not only means lower overall O2, but more particularly lower O2 saturation in sea water, the stuff that fish breath.

In addition, the bacteria in question are part of the microbial ecosystem of the ocean; lower populations of the bacteria in question means big changes for other microbes in the ecosystem – less plankton, the stuff fish at the low end of the food chain eat.

We’ve really screwed ourselves. Good thing U.S. policymakers are working to fix this.

Isn’t the FRED graph the stock of FDI. Which means the net increase in FDI under Trump has been negative.