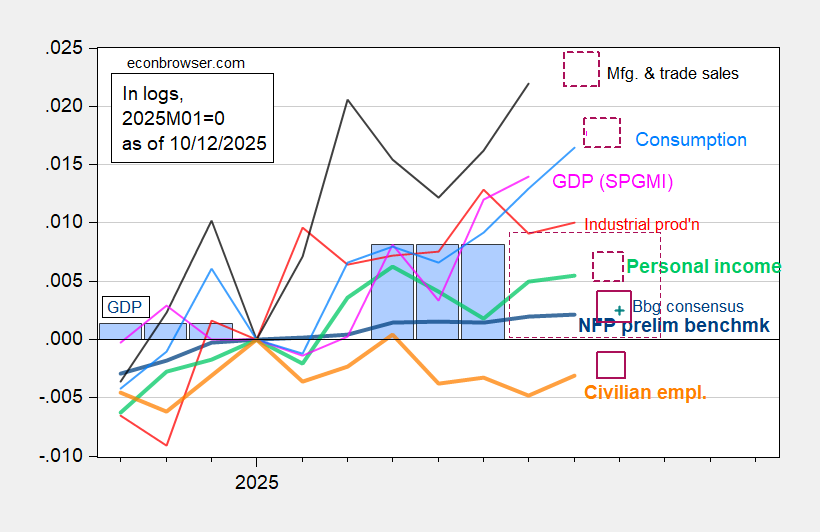

Here’re key indicators followed by the NBER’s Business Cycle Dating Committee, with indications of measures already missed (purple squares) and will be missed in a 34 day shutdown (and likely delayed even if a shorter shutdown occurs) (purple dashed squares).

Figure 1: Implied NFP preliminary benchmark revision (bold blue), civilian employment with smoothed population controls (bold orange), industrial production (red), Bloomberg consensus employment for implied preliminary benchmark, (blue +), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2025M01=0. Purple squares denote releases already missed. Purple dashed squares indicate releases that will be missed and/or delayed with a 31 day shutdown. Source: BLS via FRED, Federal Reserve, BEA 2025Q3 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

Of these, employment and personal income are the most heavily weighted — and we’ve already missed the employment numbers (of which NFP was by estimates growing meagerly, and civilian employment was as of August below prior peak). No advance GDP release on the 30th seems likely to me, as well.