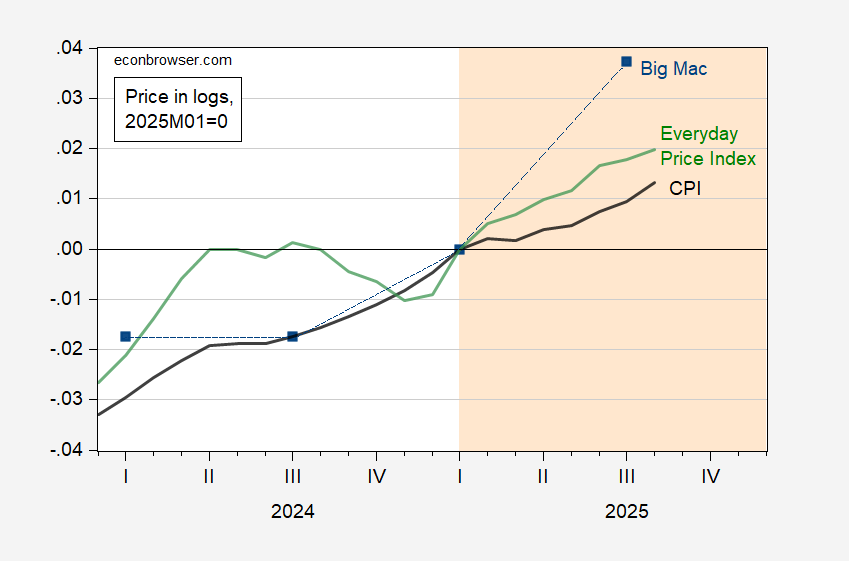

Data suggests that Big Mac prices are far outpacing the CPI, and AIER’s Everyday Price Index. Oh, the humanity!

Figure 1: CPI (black), AIER Everyday Price index (green), Big Mac price (blue square), all in logs 2025M01=0. source: BLS, AIER, Economist, and author’s calculations.

Off topic – Powell told market participants yesterday the Fed will soon end its balance-sheet runoff:

https://www.federalreserve.gov/newsevents/speech/powell20251014a.htm

Here’s the good part:

“Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision. Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates. The Committee’s plans lay out a deliberately cautious approach to avoid the kind of money market strains experienced in September 2019. Moreover, the tools of our implementation framework, including the standing repo facility and the discount window, will help contain funding pressures and keep the federal funds rate within our target range through this transition to lower reserve levels.”

In the latter weeks of any year, starting around the end of October, there is a reduction in liquidity. Powell’s description of the timing for ending the run off of Fed assets, “in coming months”, might overlap with this year-end liquidity shortage, but might not. The Fed may rely on the standing repo facility and discount window through year end, if they see a need to shrink the balance sheet a bit more. My money would be on ending the run off before year end, based on “signs have begun to emerge that liquidity conditions are gradually tightening”. By the Fed’s own definition, reserves aren’t ample if fluctuations in reserves influence maeket yields, so “signs have begun to emerge” means you’re within spitting distance of ending the runoff.

Also, “…our portfolio is currently overweight longer-term securities and underweight shorter-term securities.”

So adjustments to the Fed’s balance sheet over time are likely to steepen the curve, all else equal.

Treasury yields were pretty calm yesterday and today; Powell’s speech doesn’t seem to have surprised anybody much.