We won’t have the BLS series for private NFP as of Friday. Can we use the ADP-Stanford Digital Laboratory series (which missed consensus by 84K on the downside)

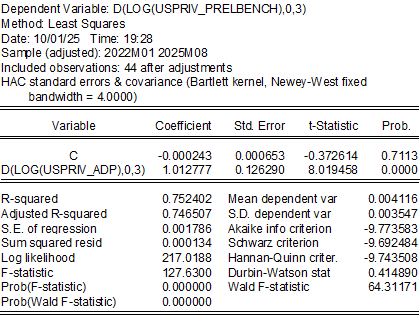

I think the answer is yes…and no. As noted by other observers, the month-on-month correlation of ADP and BLS series is low. However, the quarter-on-quarter is fairly high. A regression of BLS series on ADP series (3 month log differences) yields:

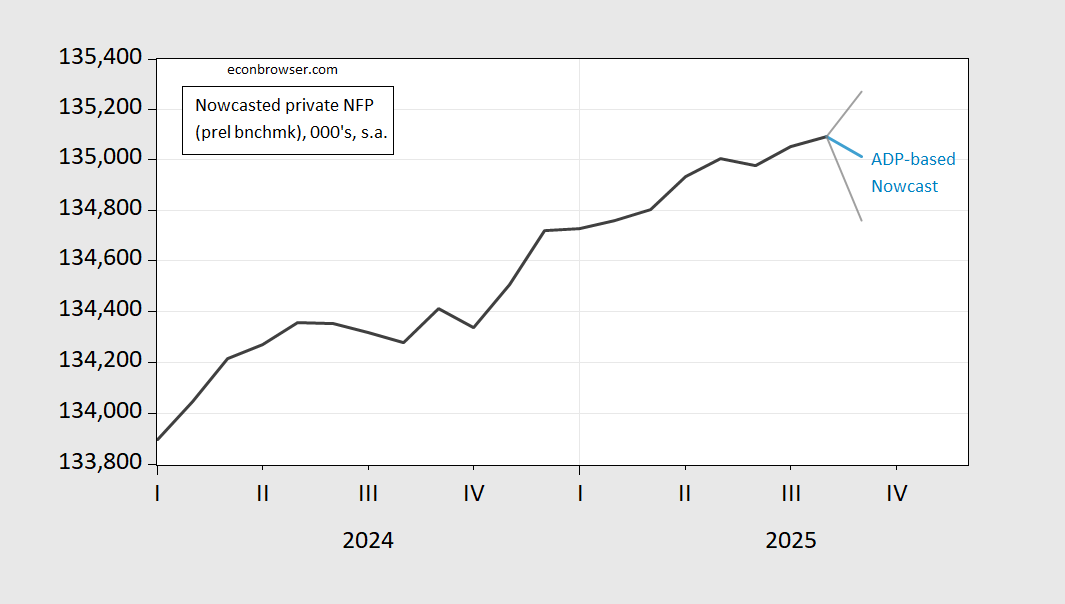

Over this period, the q/q growth rates are highly correlated, and have roughly unit elasticity. Using these estimates, I generate the following nowcast.

Figure 1: Private nonfarm payroll employment, implied preliminary benchmark (black), nowcast (light blue), +/- 1 standard error interval. Source: BLS, author’s calculations.

While the point estimate suggests a decrease in employment, when the report comes out, the wide standard error interval suggests that a positive reading is as possible as negative.

Here’s the Chicago Fed’s preliminary best-guess of the September jobless rate, as of mid-month:

https://www.chicagofed.org/research/data/chicago-fed-labor-market-indicators/latest-release

For now, the estimate is 4.32%, same as for August. The final estimate is due for release tomorrow at 8.30 ET. As a happy coincidence, this is the first month for the Chicago Fed’s jobless rate estimate.

4.34% final