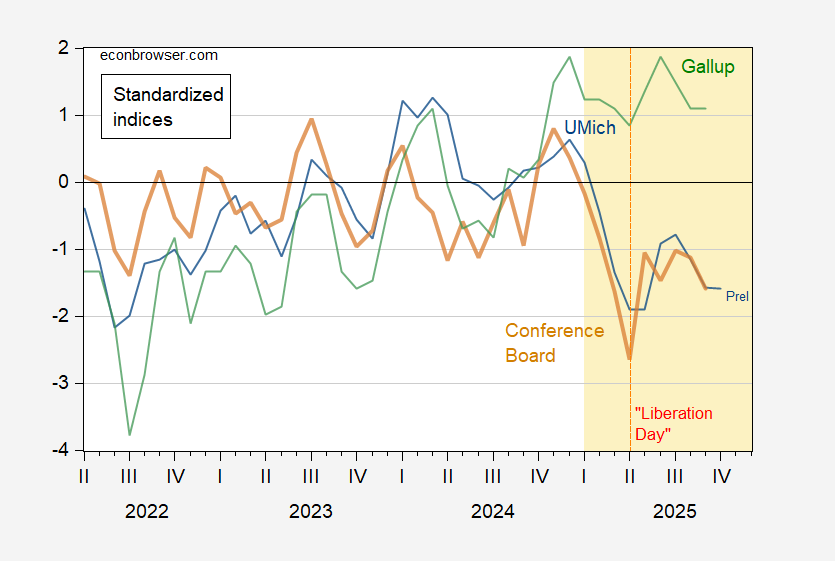

With today’s release of University of Michigan Survey of Consumers (preliminary) data, we have this picture.

Figure 1: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (brown), Gallup Confidence (green), all demeaned and divided by standard deviation 2021M01-2025m02. Red dashed line at “Liberation Day” Source: UMichigan, Gallup, Conference Board, and author’s calculations.

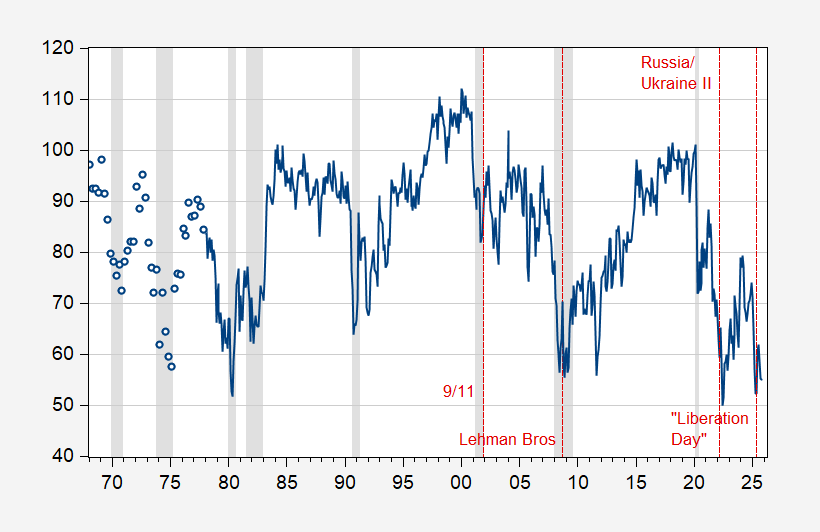

The above graph is normalized on 2021M01-2025M02 period mean and standard deviations. Over a longer horizon, we have the following picture of the (unstandardized) Michigan Sentiment index.

Figure 2: U.Michigan Economic Sentiment (blue). October value is preliminary. Red dashed line at selected critical events. NBER defined peak-to-trough recession dates shaded gray. Source: UMichigan, and NBER.

I can hardly wait to see how sentiment evolves as Trump re-ignites the trade war along the China dimension. We should see something EPU-wise sooner.

We have a taste of the shift in sentiment in today’s market response. Ten-year yield down 9 basis points, WTI down 4.2%, S&P500 down 2%.

A mini-replay of Liberation Day. TACO time?

Here’s an extra wallop to the stock market, on top of the felon-in-chief’s threat of massive new tariffs:

https://m.economictimes.com/news/economy/foreign-trade/china-seeks-indias-assurance-on-no-heavy-rare-earths-diversion-to-us/articleshow/124397178.cms

China is trying to assert authority over its heavy metal exports after they leave China. Specifically, China wants India to refuse to re-export heavy metals to the U.S. That means big problems for advanced chip manufacturing, which in turn means trouble for all things artificially intelligent.

So the S&P is down 2.0%, while the Nasdaq is down 3.2%. Nvidia is down 4.0%.

The very thing that has driven the stock market recovery since its Liberation Day plunge is now falling apart. China is showing, once again, that it’s in the driver’s seat when it comes to trade. Figuring out how to use that power most spectacularly isn’t all that hard. “Nice little stock market you’ve got here. It would be a shame if anything happened to it.”

And, as we know, U.S. economic growth has lately been highly dependent on tech spending:

https://econbrowser.com/archives/2025/09/growth-reliance-on-the-tech-spending-boom

So while high rollers will be the first to get a tummy ache from China’s heavy metals policy, it won’t be long before the wider economy could suffer.

One awaits the “private credit” meltdown; now in its early stages. As the small dominoes lean into the larger ones it’s only a matter of time and it makes for a much messier Rubrik’s cube than say a SVB bailout. First Brands/Jefferies/Mass Mutual/Western Alliance Bank combined with Tricolor/5th3rd/Chase/BlackRock/Pimco represent the first wave and for now the bigger entities can handle it.

Much as with the last go round: It’s all opaque until the liquidity dries up.

Reverse repro the past 4 days in the single digit billions of dollars.

Fed not soaking up “excess reserves?”