From Bloomberg, “Trump Says US Tariffs on Heavy Truck Imports to Start Nov. 1”:

Trump’s announcement is tied to a probe launched in April by the Commerce Department into heavy truck imports. That investigation, conducted under Section 232 of the Trade Expansion Act, allows for the imposition of import taxes on goods deemed critical to national security.

The probe focused on medium- and heavy-duty trucks weighing more than 10,000 pounds as well as parts, with Commerce stating that a “small number” of foreign suppliers made up the bulk of U.S. imports due to “predatory trade practices.”

The duties threaten an industry already feeling impacts from tariffs on steel and aluminum as well as tighter environmental regulations. New levies on imports could raise prices on vehicles used in a variety of sectors, including shipping, construction and municipal services.

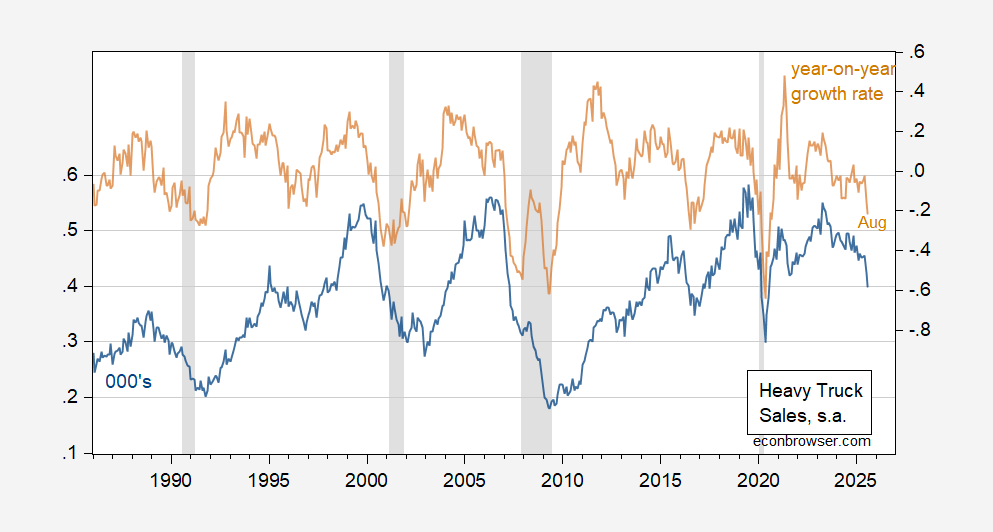

Here’s the recently released August data on heavy truck sales:

Figure 1: Heavy truck sales, SAAR (blue, left scale), 12 month growth rate (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Census via FRED, NBER, and author’s calculatios.

Note that the 12 month growth rate is close to rates usully associated with recessions (save in 2016.

But that’s the game plan: rentier class interests can then scoop up assets at fire sale prices, just like they’ve done with every economic recession and depression.

Maybe not the plan, so much as “heads, I win, tails, you lose”. Cash holdings and access to credit mean richies can afford to buy up undervalued assets, even when their own assets are not performing well. The rest of us lose during downturns, without the ability to prepare for future gains. All the more reason to tax the rich, including really high inheritance taxes. Their ability to do well in good times and bad isn’t a reflection of their contribution to society. It’s just the result of being rich.

I see your point. When I saw that that Warren Buffett was hoarding cash, I knew something was up.

Off topic, but only kind of – home insurance costs:

https://archive.is/20251004121329/https://www.latimes.com/business/story/2025-10-04/californias-home-insurer-of-last-resort-seeks-36-rate-hike-following-january-fires#selection-2349.0-2349.84

California’s state home insurance plan has requested a 35.8% rate increase. LA fires and stuff. Do have to wonder about the interaction of insurance costs and new home construction.

Anyhow, this increase, even if pared back, is a other cost-of-living smack, another thing keeping people from starting families. A climate change thingie. A state budget issue. A rough model for other states which are losing private insurers. So worth a thought.

my old house had doubled insurance cost in the seven years we had it. at one point last year, you could not get insurance from any of the big names like Allstate and farmers in houston. I am receiving solicitations again, so they may be offering policies once again. but the deductibles are huge. insurance has carved out several thousand additional dollars from my yearly budget recently. there must be an economic hit in there somewhere.

The 2016 special case is special for a reason. Oil field activity fell out of bed, while energy costs plunged. Offsetting effects. The slump in oil fields hit demand for heavy equipment, construction and transportation in a narrow but powerful way. Consumers got a boost.

Compare that with our current situation. Higher costs from tariffs hit both business and consumers. OPEC is being helpful, boosting output again, though less than had been priced in. OPEC isn’t our government, though, so any restraint on inflation from OPEC policy isn’t to the credit of the felon administration.

if anybody has looked into buying halloween decorations this year, you will see that inflation is pretty fierce in the new prices. and most fast food places have produced bills that are about 10% higher than last year. inflation is systematically creeping through the economy now.