That’s what Kalshi estimates the shutdown duration, as of today. What do we miss from BLS if that transpires? BEA? EIA, Census?

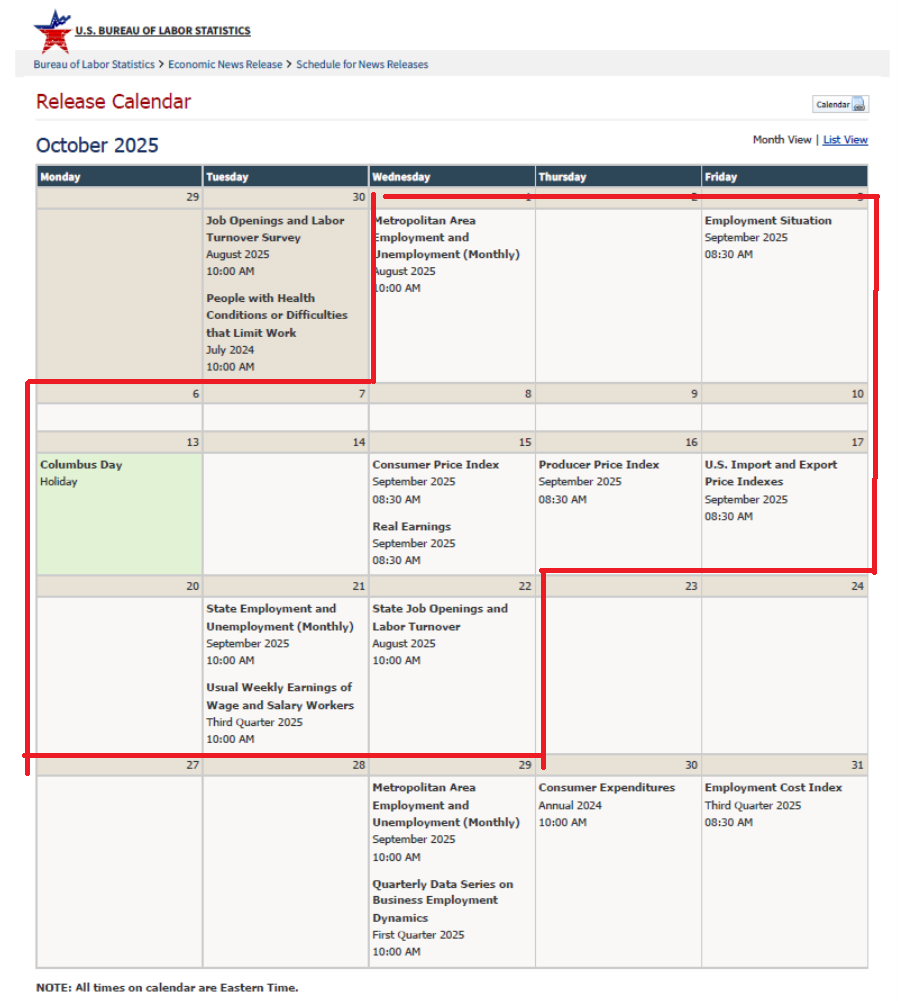

We have already missed the employment situation release. In addition, we’ll miss CPI, PPI, import and export price indices, state employment/unemployment, state JOLTS for August.

Now, as I understand it, data collection has ceased with the shutdown. That means that when next week rolls around (technically calendar week of the 12) if the government is still closed, we won’t be getting as timely and accurate head count/job count was would otherwise, for the October release.

From BEA, we lose international trade.

We’ll also miss construction spending, EIA short term energy outlook plus a lot of EIA petroleum related releases, wholesale trade, retail sales, building permits, housing starts, etc.

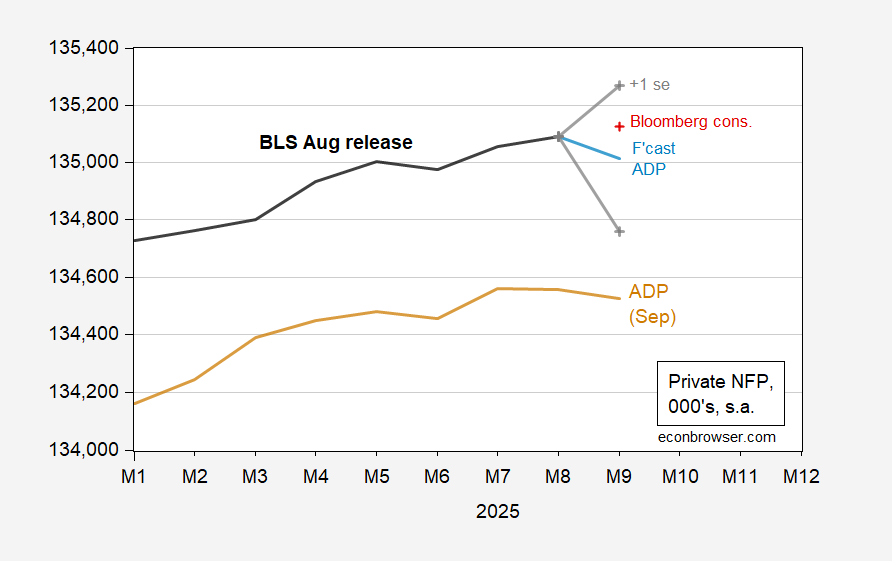

For now, the best snapshot I have is the following, from ADP:

Figure 1: US private nonfarm payroll employment through August, implied preliminary benchmark (bold black), nowcasted private NFP using 3mo changes in ADP (light blue), +/- one se prediction interval (gray+), Bloomberg consensus as of 10/5 (red +), and ADP private NFP September release (tan), all in 000’s, s.a. Source: BLS, ADP via FRED, BLS prel. benchmark, Bloomberg, author’s calculations.

Bloomberg consensus is for +35K private NFP gain. My nowcast suggests a decrease of 78K.

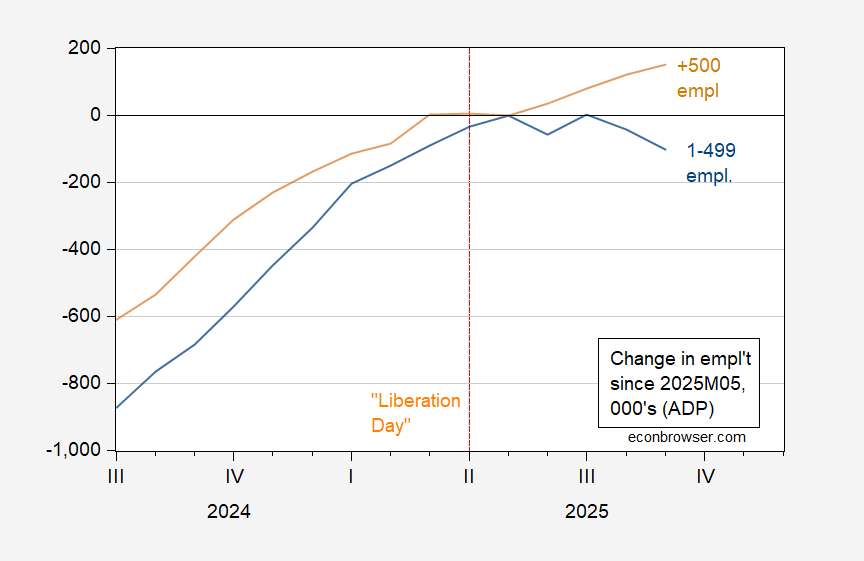

Perhaps more importantly, there’s a divergence in employment growth between large and small firms.

Figure 2: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. Source: ADP via FRED, and author’s calculations.

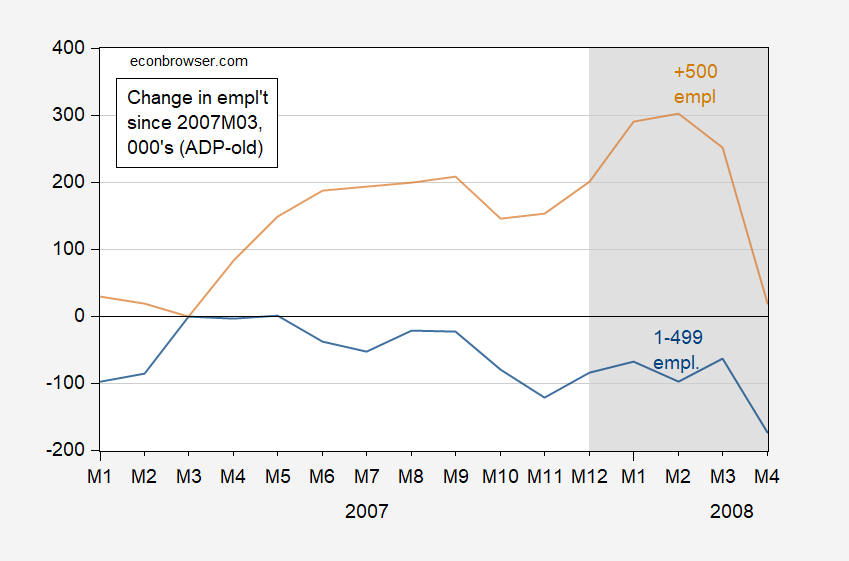

A similar trend occurred in the runup to the 2007-08 recession (using the discontinued series).

Figure 3: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. NBER defined peak-to-trough recession dates shaded gray Source: ADP (discontinued series) via FRED, NBER, and author’s calculations.

In contrast, no similar divergence was exhibited in 2022H1, or in 2024.

Trump today gave a political speech at the Norfolk Naval Base with cheering sailors in uniform behind and said “We have to take care of this little gnat that’s on our shoulder called the Democrats.”

This is genuinely scary f**king s**t. He is enlisting the military in his government takeover. Mark my words, there will be uniformed military with guns on the streets for the next election day. They are just limbering up with their excuse of a domestic insurrection by putting the military in Portland and Chicago and DC. By the time the election rolls around everyone will think this is all normal.

That’s how it worked in Germany in the 1930s.

By the way, it is a violation of military rules to have members in uniform participating in political activities. What this tells you is that military officers of the highest rank okayed this. This should put the lie to the comforting myth that high level officers, sworn to the Constitution, will prevent Trump from executing unlawful orders.

Prof. Chinn,

Please tell us your opinion on George Selgin’s book referenced in George Will’s recent column from which I’ve copied the paragraph.

But economist George Selgin’s latest book refutes progressives’ triumphalist nostalgia for the New Deal. It thereby demonstrates that “national conservatives” are oblivious regarding the cautionary lessons of Franklin Roosevelt’s experience. These kindred spirits on the left and right should read “False Dawn: The New Deal and the Promise of Recovery, 1933-1947.”

New White House talking point: “We expect the economic mess caused by our policies to be fixed by our policies.”

https://archive.is/20251006024801/https://www.wsj.com/politics/policy/trumps-team-hones-a-new-message-pledging-economic-gains-next-year-3e9f8397#selection-537.0-537.59

The WSJ reports that Bessent is telling the felon-in-chief what he wants to hear, that the big bloated budget bill will boost growth, starting in early 2026. Here’s the Hutchin Centers calculation of the effect on GDP of fiscal policy in coming quarters:

https://www.brookings.edu/articles/hutchins-center-fiscal-impact-measure/

There is a very small lift from the bloated-bill tax measures, offset by tariffs and spending cuts across all levels of government. The result is slightly worse than nothing.

Of course, Bessent and the GOP in general will argue that tax cuts are economic magic beans. That’s what they always say, but that’s dogma, not reality.

So we can look forward to a few months of happy talk about the wonderfulness just around the corner. That’s a step back from the felon’s usual insistence that things are great, the best ever, right now, startung from the moment he took charge. I’m interested to see how a narcissist delivers a Chauncey Gardener message.

“Growth will improve, but not yet” is an interesting message, headed into a mid-term election.