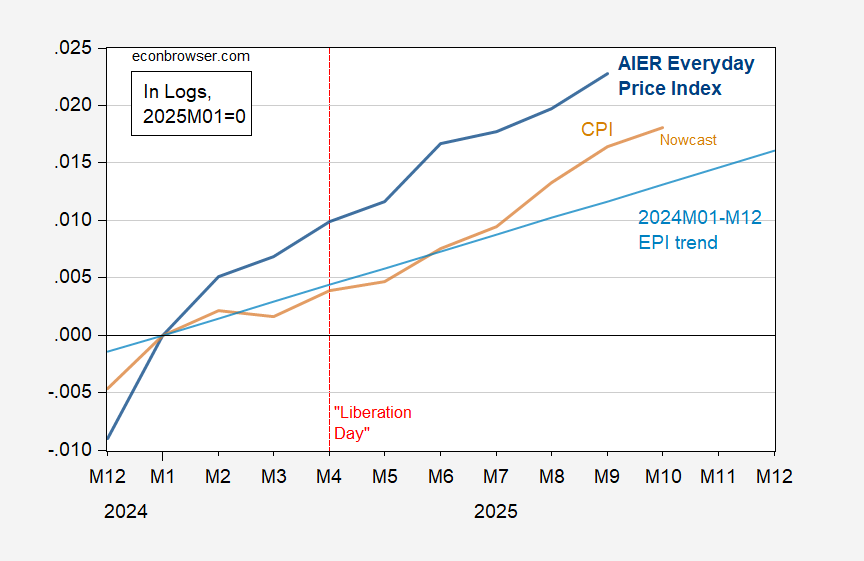

The AIER’s Everyday Price Index vs. 2024 stochastic trend, and CPI:

Figure 1: American Institute for Economic Research (AIER) Everday Price Index (EPI) (bold blue), 2024M01-M12 stochastic trend (light blue), and CPI all urban (tan), all in logs, 2025M01=0. October CPI observation is Cleveland Fed nowcast. Source: AIER, BLS, Cleveland Fed (accessed 11/11) and author’s calculations.

As of September, EPI has risen 0.6 percentage points more than the CPI, and EPI has risen 1.1 percentage points more than the 2024 stochastic trend. On an annualized basis, EPI has risent by 0.9 percentage points faster than CPI, and 1.5 percentage points faster than stochastic trend.

Here’s a description of the AIER’s EPI:

The EPI tracks a subset of prices from the broader Consumer Price Index (CPI) reported by the Bureau of Labor Statistics (BLS). The CPI includes prices of all goods and services purchased by a typical urban consumer. The EPI, in contrast, includes only goods and services purchased on a day-to-day basis that cannot be easily postponed or foregone.

These include everyday items such as food, utilities, fuel, prescription drugs, telephone services, etc. The EPI excludes infrequently purchased items, such as cars, appliances, furniture, or apparel. Purchases of such products can be planned for or postponed, eliminating unexpected shocks to household budgets. The EPI also excludes the cost of housing, which can be contractually fixed for at least several months (in the case of rents) or several decades (in the case of mortgage payments). Even a dramatic change in home prices does not translate into an immediate jump in rents or mortgage payments the way, say, an oil price increase translates into higher gasoline prices.

Who would’a thunk it, raising tariffs and deporting thousands of undocumented (and recently “de-documented) and documented workers would raise prices faced by ordinary Americans?

Sorry, but nope to this post. Deportations are down yry and real tariffs have gone from 3% to 9%. That simp!y isn’t causing “inflation” . its a long winded expansion that imo has lasted too long and we see typical late business cycle formations. We saw it in 2000 and 2007. We saw it in 1989. This is nothing new. Businesses need to shed labor and force vendors to cut prices. Its older than the hills. The damage from the Zionist Trump Organization is long term and varied.

To further my point on immigration, I just toured the Ottawa Ohio freezer plant and guess what they told me.

1. 27 illegal immigrants have joined the plant since summer

2.Trump helped them by “moving” them there

3.ignore all border/ice data. Its a scam.

You nerd to stop talking book. Its gotten old

“Talking one’s book) is a finance bro term, and your argument is finance-bro-level thinking. There is ample evidence of tariffs causing inflation. You simply repeat an average – which is of limited relevance when it comes to prices for individual items – and think that’s the whole story. By the way, what are “real tariffs”?

As to deportations, they have only to do with people out, and ignore people in.

Seriously, you’re out of your league here. Learn before you try to teach.

“That simp!y isn’t causing “inflation”

then why are my weekly costco visits at least 10% higher than last year, stephen? almost everything i purchase in the local grocery store is at least 10% higher than last year (or selling in smaller quantity packages for same price). stop gaslighting. it is very clear inflation is ramping up. this epi result is exactly what i see in my daily purchases. even most fast food combos (i know they are bad for me) are about 10% higher yoy. in texas, you can add in the increase in energy costs. even internet access has increased by about 7% recently.

We read much about how housing is now “unaffordable”, but is that true?

We bought a 2300 sf home in 1979 with a 10.5% mortgage interest rate (a step up from our 1200 sf starter home). It was a bit of a strain, but our second child was on the way so we bit the bullet. Now it seems that this generation whines about housing being unaffordable and wants the government to “do something” about it.

Mortgage rates: https://fred.stlouisfed.org/series/MORTGAGE30US

Yeah, up from “free money”, but still in line with much of the last 50 years and far lower than the 1980-85 period that was supposed to be so “affordable” for “boomers”.

A little AI Assist search comes up with this:

Search Assist

“Since 1970, the average size of new single-family homes in the U.S. has increased significantly, nearly doubling in size. For example, the median size of a new home was about 1,595 square feet in 1980 and grew to approximately 2,386 square feet by 2018.”

Search Assist

“Inflation-adjusted home prices per square foot have remained relatively stable since 1973, averaging around $116 per square foot in 2015 dollars.”

So the issue of homes being unaffordable is that young couples are no longer content with a 1,200 sf “starter home” that might be 30-years old. They “need” something twice as large and brand new.

Home unaffordability is a myth.

“Whatabout” everything else. Okay, what about it?

https://fredblog.stlouisfed.org/2025/11/the-harmonized-consumer-price-index/

Again, no “free money”, but besides the period of reckless government spending in 2020-22 and resulting inflation, current price increases are not historically out of line.

https://mitsloan.mit.edu/ideas-made-to-matter/federal-spending-was-responsible-2022-spike-inflation-research-shows

Personal income increases have followed the historical trend.

https://fred.stlouisfed.org/series/PI

Unemployment rate not so bad.

https://fred.stlouisfed.org/series/UNRATE

Maybe it’s time to stop whining so much.

You keep pretending that your particular cicumstance, whether Costco coffee or housing costs, releale something about general conditions. Not so. And oddly always biased toward your political views.

what fraction of your take-home pay went towards that starter home, bruce? and unless you were a fool, that 10.5% interest rate lasted for 2 years, tops. it should have been cut in half within five years of ownership. do you think current owners can get a 5% cut in mortgage rates, like trump promised, and you received?

and i am going to point something else out, bruce. it is not that new home buyers don’t want a 1200 sf home (they don’t, apartments are bigger), it is simply that size home is not much on the market these days. builders will not build starter homes, because they are not profitable. existing housing stock in that size has been purchased by investors and rented out. this is different from a few decades ago, when the demographic of baby boomers facilitated the construction of small starter homes. those demographic forces do not exist today.

bruce, you are nothing but an old and tired troll. you surfed along on a demographic wave that benefited even a fool like yourself. there is a reason you are no longer in the workforce, and it is not because of age. you would not be useful one bit in the world of generations x, y and z.

Regarding immigration, there has definitely been a fall in people arriving Mexico and probably an outflow of people leaving the country to avoid detention and abuse.

https://www.migrationpolicy.org/news/new-era-enforcement-trump-2

As both MPI and Pew point out, changes in policies and restrictions implemented by the Biden Administration were already reducing the number of immigrants in the United States. Not to pointed out by the thoroughly politicized and Hatch Act violating Department of Homeland Security, is that Biden Administration deported about 655,000 people last year and that despite the stated goal of 1 million deportations, the first year of the Trump Administration will likely only match that rate. But, where most of the Biden deportations were the result of border encounters and convicted criminals, Trump-Miller-Noem-Homan are going after the long term immigrant with ties to the community. https://www.pewresearch.org/short-reads/2025/08/21/key-findings-about-us-immigrants/

I am not an economist, but I follow the subject closely and have read Smith, Ricardo, Mills, Keynes, Samuelson, Robert Heilbronner, Krugman, DeJong, and Keen. Just going back to what Smith, Ricardo & Mills wrote, it is pretty obvious that a nation’s GDP is ultimately based on its labor, the total supply of that labor, and the productivity of that labor as skills are maximized and improved every year by increased specialization of the division of labor and improved techniques and technology made available to the worker (e.g. increase in productivity). So real GDP growth from year to year is the growth on number of workers and the growth of productivity of those workers. When you reduce the number of workers, unless there is an off-setting growth in productivity or a pool of replacement workers (child labor? bringing retired workers back into workplace?), it will have a negative effect on GDP growth.

This appears to be a situation where the Trump administration in the short term is setting up a situation of stagflation, where low interest rates cause a spurt inflation, but where most worker’s salaries will lag that rate, particularly as demand for for college and “some college” jobs is suppressed by the spread of AI and the reduction in the Federal workforce, both direct and indirect. There will be lots of resistance by this group of going into the low wage end of the workforce, where job vacancies are being created by immigration enforcement since the current minimum wage of $7.25 an hour has the lowest real buying power level that it has had in 70 years since it was raised to $1.00 in 1956. (The current minimum wage equals $.83 in 1969 dollars, the first year I worked a summer job and I was paid $1.30 per hour.) https://www.bls.gov/data/inflation_calculator.htm

The long term damage to the U.S. Economy from Trump administration policies will have to unfold and will need more sophisticated economic analysis then I can provide.