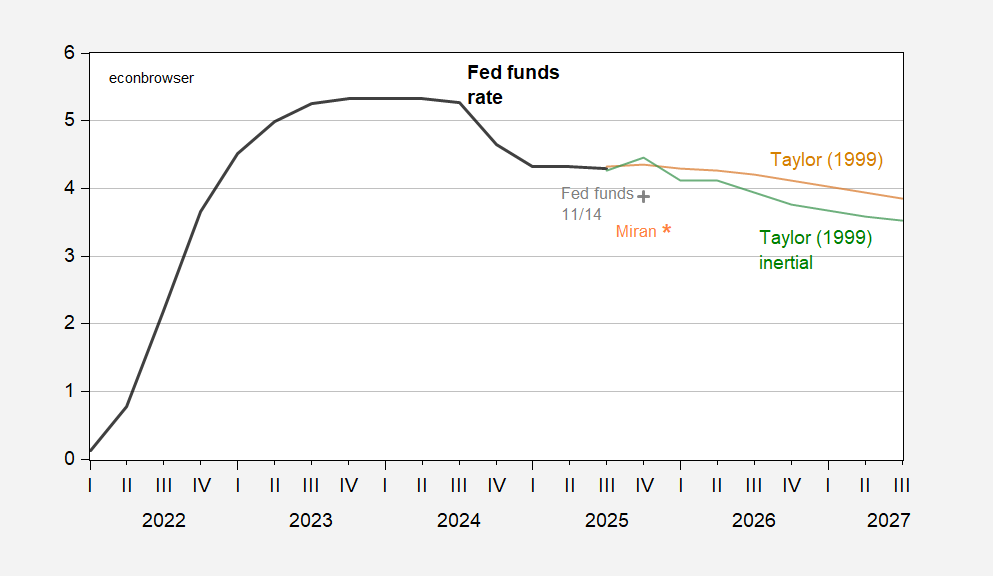

Really, a 50 bps drop in the Fed funds rate in December? What does a Taylor rule say?

Figure 1: Fed funds rate (bold black), Fed funds as of 11/14 (gray +), Taylor (1999) formula (tan), Taylor (1999) formula with inertia (green), Miran’s proposal (orange *), all in %. Uses parameter values and forecasts from Chicago Fed BVAR. Source: Federal Reserve via FRED, Cleveland Fed Taylor rule app.

Using CBO forecasts would result in higher target Fed funds rates.

Now, maybe r* is a lot lower than the 1% assumed in these calculation. Miran has (in my mind unconvingly) argued that r* is low, but has not specified how low.

Walker, Kashkari and Logan all speak today. Let’s see if they sound maybe a little different.

If tariffs lead to increased demand for investment, as the felon-in-chief claims is the case, the r* will rise. If “deals” lead to increased fdi, the r* will fall. It threat (via Miran) to impose a fee on foreign purchased of U.S. assets is imposed, fdi will fall, leading to a riae in r*. If tariffs cause a one-time increase in prices, there may be a negligible effect on r*. If tariffs cause persistent inflation, r* will rise…

If one is honest, one admits to the variety of possible combinations of effects on r*, thus greater uncertainty for policy making. As Fed officials other than Miran have said, greater uncertainty should mean a slower, more cautious decision-making process for monetary policy.

So now we get the sad story of Adriana Kugler’s abrupt resignation from the Fed Board a few months before the end of her term. It seems that unknown to her, her husband was doing some day trading in stocks back in 2024. When discovered, she disclosed this information to ethics auditors and asked for a waiver for the violation given the circumstances. Powell refused, which led to her resignation and the installation of Trump’s dual job toady Miran.

From the sound of it, Kugler’s husband wasn’t motivated by greed as much as he seems to have a gambling addiction. That’s too bad as Kugler has had a distinguished career in economics, having worked under George Akerloff, and produced many academic publications.

if this is the case, it is a shame that we force one good person out over ethical conflict of interest case, only to embed a new member with a clear conflict of interest issue. why is one conflict of interest an ethics failure, while the other ignored?

I agree it seems unfair, but Powell make a big point after the trading scandal of 2021, in which three fed presidents resigned, that there would be no tolerance for insider trading. He stuck to his ethical word in this case, which is more than you can say for the Trump administration.

May be considered off topic, but economists have coddled this guy for much too long.

Harvard and the economics profession have a lot to answer for that they have put up with this disgusting guy as long as they have. He was having difficulties consummating his extra-marital affair with a person he refers to as a “mentee” so he goes to an expert, a well-known convicted child sex offender for advice. He notes the sex offender’s better understanding of “Chinese women” as a qualification for advisor. And he continues this conversation through 2019 up until literally the day before the sex offender’s second arrest.

https://www.thecrimson.com/article/2025/11/17/summers-epstein-wing-man-woman-described-as-mentee/