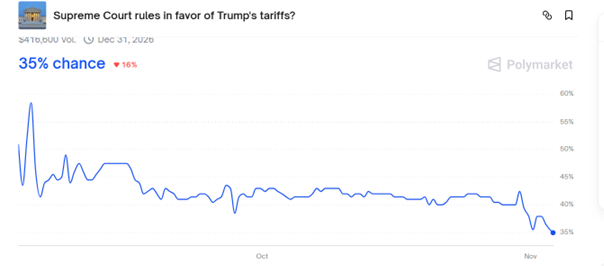

What has driven the betting on the Supreme Court upholding IEEPA tariffs down to 35%? Is it just Trump saying he’s not going to attend? Couldn’t figure out what other “news” there was.

Betting on Kalshi is the same, 35%, as of 2:15 CT.

SCOTUSblog article today.

i am going to ask the question again, since nobody on the trump side had the courage to respond. if you know that funding snap is the right thing to do , and you know that funding the ACA health insurance is the right thing to do, why are we negotiating over these items. simply do the right thing and pay for them. why should democrats give something up so that republican do the right thing? should you negotiate with a toddler so that he takes a breath? really republicans, is your negotiating approach that of a toddler? stop negotiating over doing the right thing. there is nothing to stop you from offering a continuing resolution and simultaneously doing the right thing regarding snap and ACA. you have had a year to negotiate. time to vote and end the republican shutdown.

Off topic – Holy silver linings, Batman!:

https://adamtooze.substack.com/p/chartbook-414-slouching-towards-red

China has an overcapacity problem. Earlier this year, Xi warned against further investment in sectors that already have excess capacity. The solar cell industry is part of the “problem”. Tooze points out that China can produce enough photovoltaic panels to overshoot a hypothetical “optimized” global target by 50%. Tack on rest-of-the-world capacity, and we’re at 200% of that target.

Overcapacity results on downward price pressure. Lower prices result in faster and more installation of solar power. This “problem” is pretty great.

U.S. tariffs on Chinese solar panels result in higher prices, slower and less installation of solar power. The U.S. economy is about the same size as China’s, the growth differential is probably the smallest in a generation, and U.S. demand for electricity is rising very fast due to data centers and cybercurrencies. Vehicle electrification will add to demand, depending on adoption. We need more clean generating capacity.

China’s coal-fired generating plants remain a problem, but China’s adoption of solar power and exports of solar generating capacity are a huge deal. If we want our own photovoltaic panel industry, we should subsidize it, not impose tariffs on China. This case of overcapacity, as Tooze points out, is our friend.

On your OT:

So we can reverse the flow — have the Chinese PV panel factories disassembled to be shipped to and set up in the US.

On-topic:

Commerce Secretary Howard Lutnick’s sons and their clients are betting against Supreme Court approval of tariffs IRL. The betting markets let the little guy place the same bet without connections and big cash. I won’t claim that the ability to duplicate Cantor Fitzgerald’s speculation explains anything happening in the betting market, but it is an interesting case to see a high-finance play duplicated so well by a transparent, low-cost, and accessible alternative.

Perhaps the news is that the Court will begin hearing arguments this week? I notice that Kalshi shows the volume of bets, but I don’t see a way to track the change in volume. If volume has picked up due to the nearness of arguments, that could swing prices.

bessent has conceded that IF trump loses the supreme court case, then there are other avenues the administration can pursue to enact tariffs. this amounts to an admission of defeat by the administration. which makes you wonder exactly what that 35% is thinking, if even the trump administration has acknowledged it will lose the case?