On November 5th, we’ll get the ADP numbers for private NFP. Bloomberg consensus is for +28K, while betting on Kalshi is for +43K. We won’t have October numbers from the BLS for some time, if ever (so EJ Antoni may get his wish, although quarterly employment numbers given no data collection might not be more accurate in this case). If the ADP release hits the consensus number, here’s the picture of the labor market.

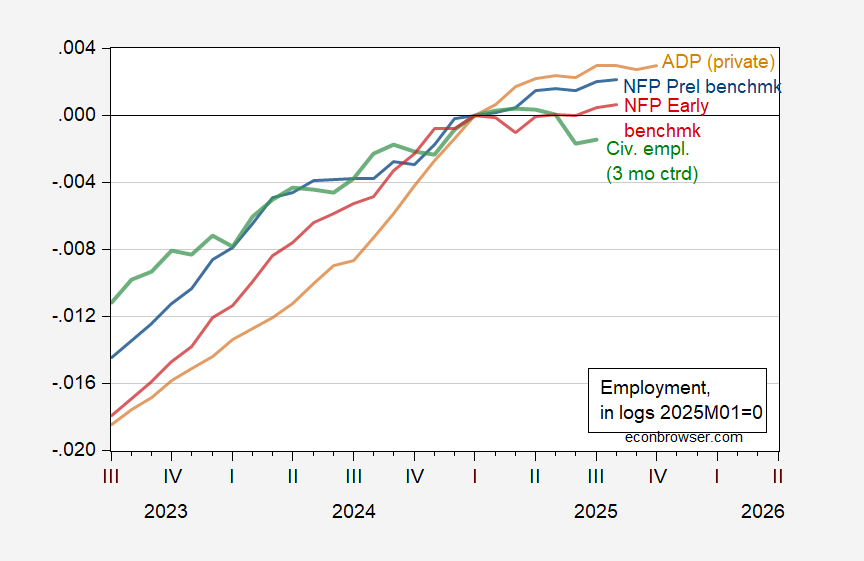

Figure 1: Implied NFP preliminary benchmark (blue), NFP early benchmark, using latest changes for extended forecast period (red), civilian employment – experimental series using smoothed population controls, 3 month centered moving average (green), and ADP private NFP (tan), all in logs, 2025M01=0. October ADP figure is Bloomberg Consensus. Source: BLS, ADP via FRED, BLS, Philadelphia Fed, and author’s calculations.

If it’s true the the civilian employment series — based on the household survey — peaks either contemporaneously of before the BLS NFP series as is sometimes asserted (see discussion here), then we should worry (note the civilian employment series is not revised month by month, so the trajectory of this series will not change over time).

Since the current betting is on about 46.5 days shutdown (taking us to mid-November), I suspect we will have to wait quite a while for the government’s latest reading on the labor market.

Trump has a droopy eye. Looks like nerve damage. Maybe stroke? What are they hiding at white house? MRI for brain damage? Very Unsteady deplaning in europe. Dude seems sick, but those around him are covering up. Why? To protect their recent power grabs?

Fed repo facility is seeing record usage right now. Any thoughts on why? Simply end of month demand, or something else?

Just guessing here, but I think the timing of Fed’s rate cut delayed arbitrage trades. Wednesday’s rate cut went into effect Thursday. Month end was Friday. Ansent arbitrage trades on Thursday, the rate spread between the Special Reserve Facility and overnight reverse repos widened. The SFR and ON RRP amounts on Friday were nearly offsetting, suggesting arbitrage to take advantage of that spread. I’m speculating that some mechanical issue having to do withthe Fed’s rate cut prevented an aebitrage trade on Thursday.

Fed Governor Logan had just given her “what the heck is wrong with you guys?” lecture to dealers for letting market rates get out of whack with Fed rates, essentially for leaving arbitrage money on the table. That’s why I think the timing of the Fed meeting had something to do with it, but I’m not sure of the mechanism. Because the funds rate hadn’t come down, dealers were not engaging in enough arbitrage. Reluctance to do so as month-end liquidity tightness hit widened spreads. Then, whatever timing issue kept them at bay resolved and they ddid $50 billion in arbitrage trades. That’s my guess.

thanks, that is the best explanation I have heard yet. makes sense once you lay it out.

By the way, the month-end liquidity squeeze that drove the whole situation is the reason the Fed is ending quantitative tightening. Reserves are no longer sufficienty abundant to prevent month-end rate wobbles. This episode was a special case because an FOMC rate change came so near month end, but that serves to confirm that the Fed’s portfolio is right at the lower limit of “abundance”. The Special Reserve Facility is supposed to take up the slack, but for one day it didn’t.