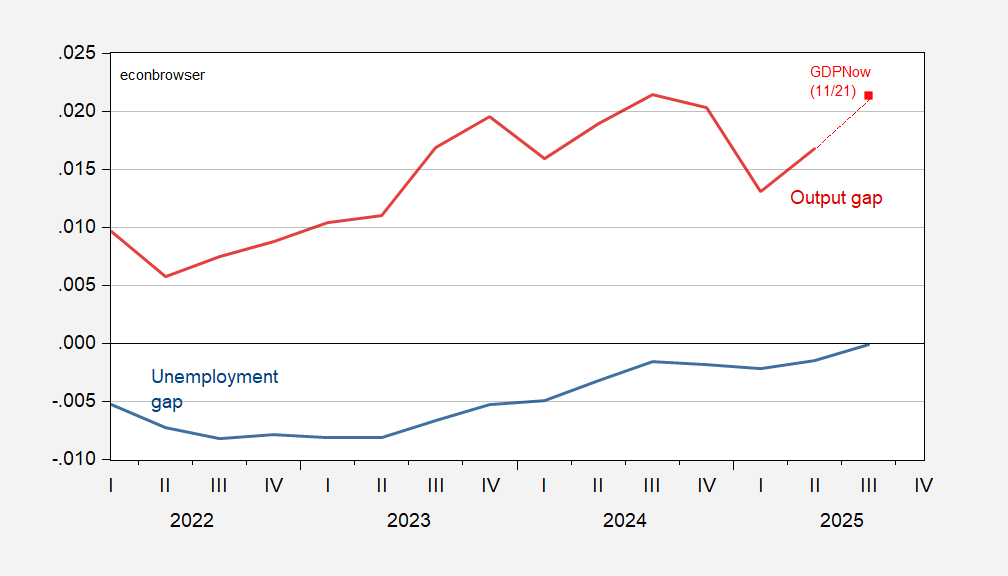

The view using CBO measures:

Figure 1: Unemployment gap (blue), and output gap (dark red), implied output gap using GDPNow (red square). Source: CBO (March), BEA, BLS via FRED, Atlanta Fed, and author’s calculations.

On the basis of this picture, a simple-minded interpretation of the Taylor rule would suggest a decrease in the policy rate is not warranted, using the output gap, and perhaps not warranted using the unemployment gap.

I see that Trump is pushing Hassett as Fed Chair. I think we can expect the following from this know-nothing – Hassett’s policies to produce the worst-case combination: aggressive rate cuts, political interference, loss of Fed independence, rising inflation risk, enormous Treasury issuance, reduced foreign buying, and weak dollar, The result = Long-term rates surge; Mortgage rates remain elevated; corporate borrowing costs spike; State/municipal debt refinancing becomes painful and the market doubts Fed’s ability to control inflation leading to a vicious loop. Just getting my call in early on the Trump/Hassett recession for 2026.

Also remember Fed Governors can dissent, but the Chair controls the agenda.

Priced-in expectations for the December FOMC rate decision are now roughly 84% for a 25 basis point cut in the funds rate. That’s up from 50/50 odds on no cut a week ago. John Williams’s comment about the likelihood of more cuts in the near term seems to have caused the rebound in rate-cut expectations.

I’ve seen speculation that some policy makers (Williams?) are leaning dovish because of next year’s political jeopardy for Fed policy makers. The review of Presidents is in February, two FOMC meetings from now. Staying in good graces with the felon-in-chief would require cuts at both meetings. Fifty basis points seems like a pretty big price to pay for job security, especially given the Taylor rule implications of Menzie’s post.