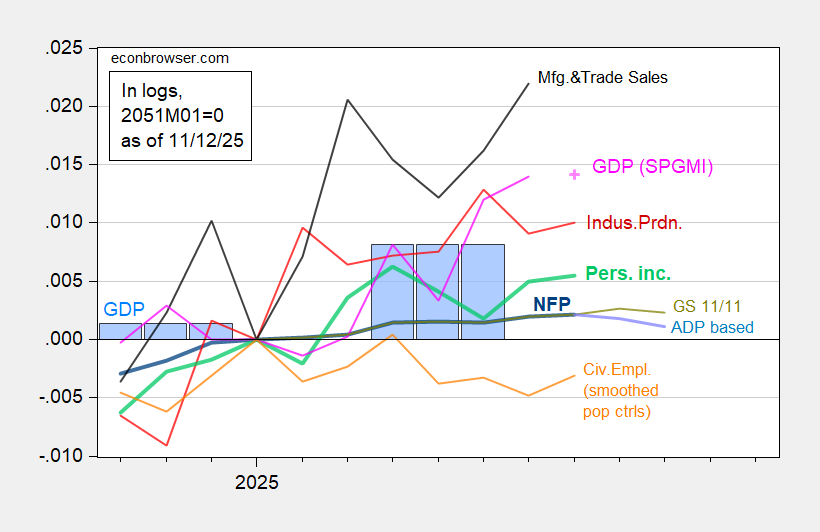

Key indicators, and my guesses:

Figure 1: Implied NFP preliminary benchmark revision (bold dark blue), ADP implied NFP (light blue), Goldman Sachs implied (chartreuse), civilian employment with smoothed population controls, (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), extrapolated monthly GDP using Philadelphia Fed Coincident Index (pink +), GDP (blue bars), all log normalized to 2025M01=0. Source: BLS via FRED, Federal Reserve, BEA 2025Q2 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

I explain my method for nowcasting employment here. SPGMI’s monthly GDP is extrapolated one period using a regression of monthly GDP on coincident index 2022-2025, with a AR(1).

The last FOMC decision of 2025 is in 26 days. As of today, markets are pricing in bearly 50/50 odds of another 25 basis point cut on that day:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

A week ago, odds of a 25 bp cut were priced at 70%. A month ago, 95%. With no government data available to drive this reassessment, why the change in explanations? Fed chatter has leaned toward slowing the pace of rate cuts until there is more data available. In addition, Chicago Fed President Goolsbee (who is more respected by other Fed officials than, for instance, Governor Miran) has said there is “a lot of stability in the job market”. Atlanta Fed President Bostic says he favors holding rates steady, though it’s a close call. And Kansas City Fed President Schmid dissented in favor of holding rates steady at the October meeting. Gotta wonder if Miran’s campaign to cut rates to please the felon-in-chief isn’t backfiring just a bit.

In other news, NY Fed President Williams said the Fed will resume buying bonds soon. To maintain ample reserves.