With September personal income and spending, we have new insights into whether we’re close or after the business cycle peak.

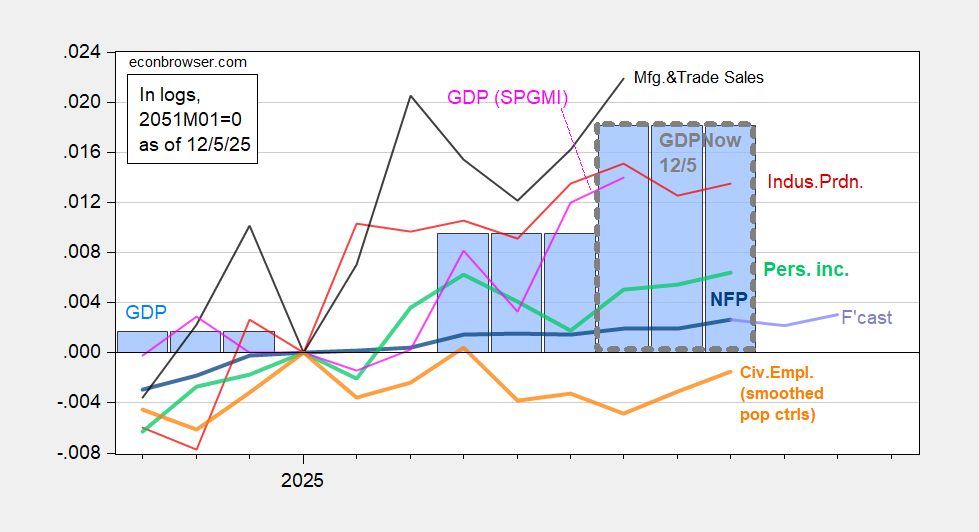

Figure 1: Implied NFP preliminary benchmark revision (bold blue), ADP based author’s estimate (light blue), Bloomberg consensus employment for implied preliminary benchmark, (blue square), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink),GDP (blue bars), GDP from GDPNow of 12/5 (blue bar, gray outline), all log normalized to 2025M04=0. Source: BLS, ADP, via FRED, Federal Reserve, BEA 2025Q2 third release, Atlanta Fed, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

As noted in this post, the GDPNow Q3 nowcast has declined from 3.9% to 3.5% q/q annualized. In contrast, the NY Fed nowcast is for 2.31%, and for Q4, 1.76%.

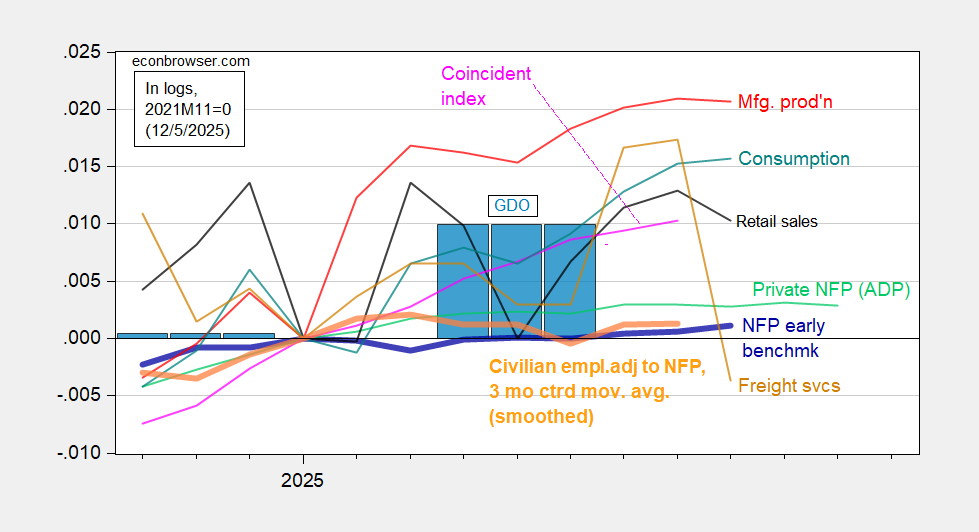

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), ADP private nonfarm payroll employment (green), real retail sales (black), consumption (teal), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: BLS, ADP,via FRED, Philadelphia Fed [1], Philadelphia Fed [2], Bureau of Transportation Statistics, Federal Reserve via FRED, BEA 2025Q2 third release, and author’s calculations.

Series below recent peak: industrial and manufacturing production, civilian employment (3mo ctrd moving average), civilian employment adjusted to NFP concept (3 mo ctrd moving average), real retail sales, freight services index, and private NFP from ADP.

Consumption in September rose 0.5% m/m annualized. When combined with declining inflation adjusted retail sales, one might reasonably think the American consumer is coming close to being tapped out.

Normally, we’d be speculating about Q4 GDP by this time of year. Instead, we are busily marking down the Q3 growth rate. GDPNow still has Q3 growth at 3.5% down from 3.8% as of yesterday.

The Hutchins Center estimates that the government shutdown cut 1.5% from Q4 growth (SAAR), versus just a 0.2% drag in Q3. Mathematically, government should add about 2.8% to Q1 growth, says Hutchins. That could be enough to mask any downturn in the underlying economy until Q2 of next year.