From Atlanta Fed today:

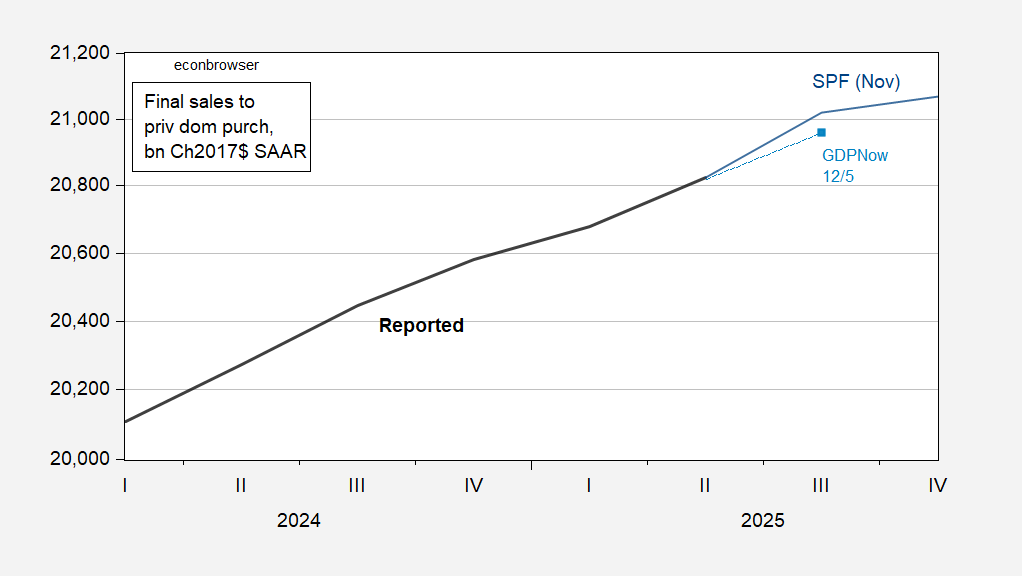

Figure 1: Final sales to private domestic purchasers (bold black), Nov SPF (blue), GDPNow of 12/5 (light blue square), in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, and author’s calculations.

Nowcasted Quarter-on-Quarter annualized growth is down from 2.9% to 2.6%, below the SPF trajectory. For determining the amount of momentum, “core GDP” is more useful than GDP. GDP growth is nowcasted to slow to 3.5%, from 3.8% in Q2.

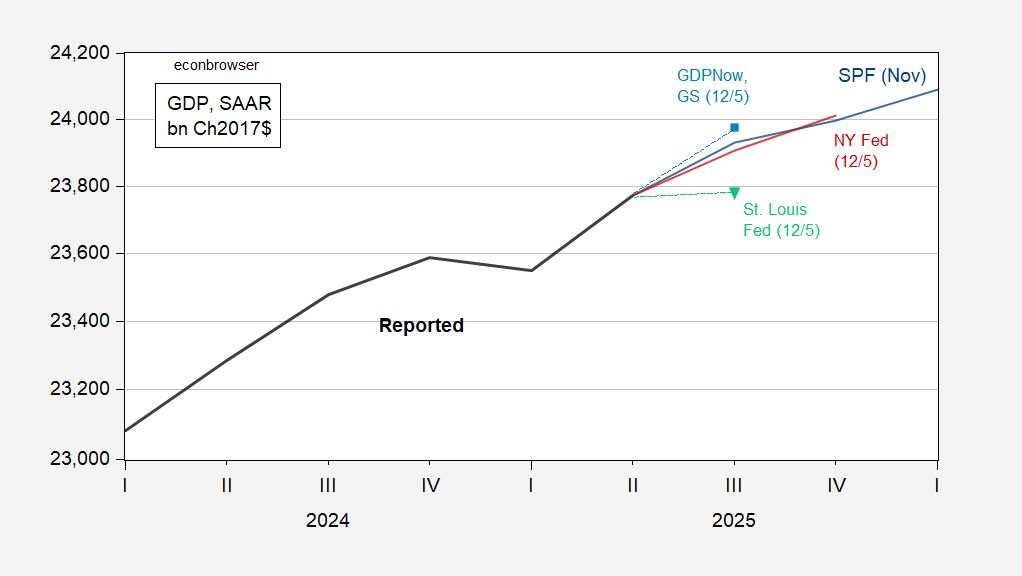

Figure 2 [updated]: GDP (bold black), Nov SPF (blue), GDPNow of 12/5; Goldman Sachs tracking of 12/5 (light blue square), NY Fed nowcast of 12/5 (red line), St. Louis Fed of 12/5 (light green inverted triangle), in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, St. Louis Fed, Goldman Sachs, and author’s calculations.

NY Fed nowcast is a top-down nowcast, compared to Atlanta Fed bottom-up (Jim H. discussion here), and the St. Louis Fed nowcast is based on revisions to releases.

Nearly on topic – Today should have brought BLS jobs data for November, but didn’t because BLA is still catching up from the shutdown. It could also be that our political bosses are in no hurry delivery the ugly facts.

Mennzie suggested combining the average monthly change in public-sector employment (+22k) with ADP’s private-sector estimate for November (-32k) which yields a 10k loss of jobs:

https://econbrowser.com/archives/2025/12/business-cycle-indicators-industrial-production-implied-employment-alternatives

It’s always useful to compare alternative estimates as a check on reliability. Turns out, Revelio Labs employment estimate for November shows a 9k loss of jobs – public and private:

https://www.reveliolabs.com/public-labor-statistics/employment/

Seems reasonable to assume there was a small loss of jobs in November.

The two estimates differ in some details. Revelio reports a loss of 19k across trade, transport and utilities vs ADP’s 1k rise. ADP reports the loss of 18k factory jobs, Revelio the loss of 7k. As for leisure and hospitality, ADP shows a 13k gain, Revelio an 11k loss. ADP has construction down 9k, Revelio up 3k.

By the way, Revelio reports an 8.5k loss of retail jobs in November. BLS shows an average 6k monthly gain in retail jobs in the year ending in September. That puts November 13.5k off the average pace. Could be worse, considering retail-sector hiring plans for the holiday season are for 59k to 159k fewer workers this year than last:

https://www.cnn.com/2025/12/02/business/holiday-hiring-seasonal-temporary-workers-retail

Sure would be nice to have BLS data about now.

Today’s personal income and spending report (which wins the award for “least stale,” being only 5 weeks late) adds to the causes for concern.

Typically real spending on services sails right through all but the most prolonged recessions. It is real spending on goods that provides the leading signal. Well, the three month moving average (which cuts down on noise) of real spending on durable goods probably peaked last spring, while real spending on goods in total may be peaking right now.

Since it is real spending that has been holding the economy aloft, if that turns down it is hard to see how any of the other measures will save us from recession.

And BTW, following up on Macroduck’s note above, all of the regional Fed indices, as well as both ISM reports, showed jobs contraction in November. And withholding taxes paid for the month were only 0.3% higher than November last year. And California’s tax department, which updates withholding tax payment information monthly, put in a blog post today that they have slowed substantially since mid-October.