In Trump 2.0, most tariffs were imposed under IEEPA. With the Supreme Court perceived to be on the verge of ruling the tariffs unconstitutional, it’s of interest to see what the implications would be.

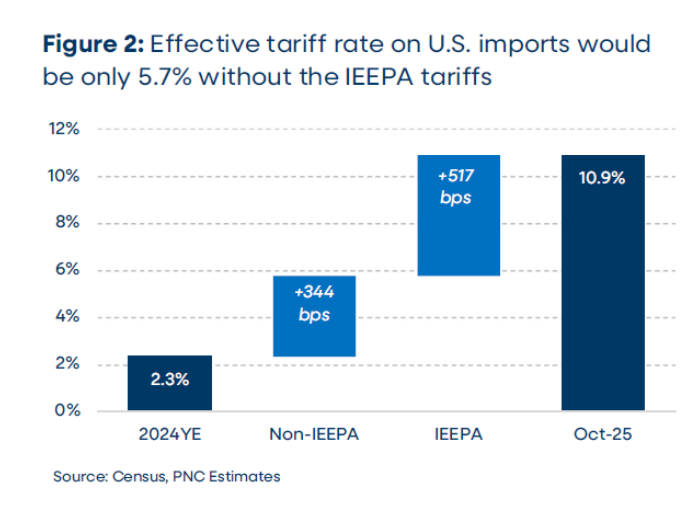

According to PNC Financial Services Economic Research, eliminating the IEEPA tariffs would at least in the short term reduce the realized effective tariff rate:

Source: PNC Financial Services.

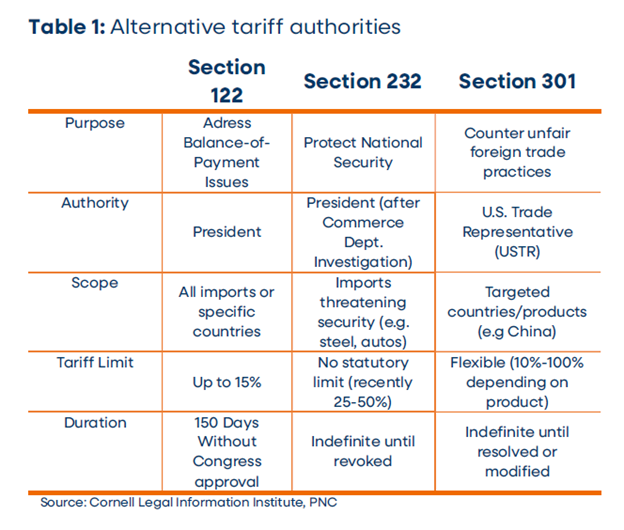

Certain commentators (e.g. Heritage Foundation) have argued that a Supreme Court strikedown would not change overall tariff levels, as Trump could implement tariffs under different authorities. Here is a tabulation of the other trade authorities.

Source: PNC Financial Services.

I think what’s clear is that, given there’s no ongoing US balance of payments crisis, removal of IEEPA tariffs, and the possibility of imposing new ones, would have a short term impact.

Elimination of IEEPA tariff authority would have heightened impact in the context of Trump’s impulsive threat to tariff European countries rejecting Trump’s claim on Greenland. No longer could he threaten country-specific tariffs on a whim.

I have no expertise in judicial matters. So here goes.

The common view is that the Court will overturn IEEPA tariffs. The burden created by the tariffs is considerable, as are the fiscal consequences, so the responsible thing for the Court to do is to rule as quickly as possible, and yet we wait. Why?

Wild guess on my part is that there are two likely causes of delay. One is that some secondary issue has not been resolved. During the public hearing, dealing with tariffs already paid to the government was raised as a problematic issue, so maybe that issur is delaying the ruling. The other likely cause for delay is the writing of opinions and dissents – getting the Constitutional logic right looks easy to me, but I’m on the outside; sticky issues may have been recognized that needs thought to sort out.

If that’s right, that one or both of these is the cause for delay, then the opinion when it comes is going to be more than telling the presidential brat to behave. It’s going to involve big money, unanticipated legal rulings, or both.

or the court may agree the trump tariffs are unconstitutional, but various factions may disagree vehemently on how they are made unconstitutional. multiple opinions will be tacked on to the verdict. some may even contradict one another, which will make the court look bad. need to sort this out.

talking heads are saying the delay means trump will win. not sure I agree, but a lawyer I am not.

White House Deputy Chief of Staff Stephen Miller: ” “Denmark is a tiny country with a tiny economy and a tiny military. They cannot defend Greenland… Under every understanding of law that has existed about territorial control for 500 years, to control a territory you have to be able to defend a territory…”

Danish MP: “I hope he is kept away from women because that is the mentality of a rapist. If you cannot defend yourself, I’m going to take you.”

That’s the 500 year old law that Miller is espousing. They aren’t even trying to hide it anymore. That’s the way they think.

barbarism is ok today, because that is how we behaved 500 years ago. what a loser.

Apparently Stephen Miller never took a class on English common law. I did: https://en.wikipedia.org/wiki/Assize_of_novel_disseisin

Secretary Bessent: ‘Sit back, take a deep breath, The worst thing countries can do is to escalate against the United States”.

I think the phrase he was looking for was “If it is inevitable, lie back and enjoy it”, a phrase made infamous by Robert “RJ” Regan as advice for his daughters to not fight back against assault.

This a real thing in Greenland now. People are wearing red MAGA hats that say “Make America Go Away”.

The harder Trump pushes, the angrier these peaceful people become.

https://bsky.app/profile/joncooper-us.bsky.social/post/3mcnuiuhank24

Off topic – what “climate change is a fake” looks like in practice:

https://phys.org/news/2026-01-repeal-basis-climate.html

The felon-in-chief is preparing to overturn the entire legal and regulatory foundation for regulating greenhouse gasses. There will be legal action to resist, of course, so the Supreme Court will decide. That seems like a bad idea.

his goal is to provoke them into some offensive action that he can use as an excuse to exercise military actin and takeover as a “defense”. that is exactly what he is doing with ice. provoking and then saying shooting us citizens was self defense. we will now invade Minnesota in response to those aggressions. replace Minnesota with Greenland.

Q: Is Greenland or NATO more vital to national security?

Secretary Bessent: That’s obviously a false choice

Q: Not to European leaders

Bessent: They will come around & understand they need to be under the US security umbrella. What would happen in Ukraine if the US pulled support? The whole thing would collapse.

So that’s what it’s come down to. Give us Greenland or we pull the plug on Ukraine and NATO.

Europe needs to realize that the US is not an ally — it is a declared enemy. Germany should immediately evict all US troops from Germany and keep all the equipment and bases. Germany is a critical staging ground for all of the US operations in the Middle East.

My guess is the Roberts will engineer some split compromise similar to the ruling on the ACA in which he allowed the ACA to proceed but disallowed the state Medicaid expansion mandate.

He may disallow IEEPA tariffs but will green light Section 232 tariffs based on national security. And further they will establish that “national security” is an executive determination non-reviewable by courts. So tariffs on bathroom vanities for nation security reasons — nothing stopping it. Trump will simply switch over every current tariff from IEEPA to Section 232. Easy peasy.

Deutsche Bank ups the ante:

“Europe owns Greenland, it also owns a lot of Treasuries. We spent most of last year arguing that for all it economic and military strength, the US has one key weakness: it relies on others to pay its bills via large external deficits. European countries own $8 trillion of US bonds and equities, almost twice as much as the rest of the world combined, In an environment where the geoeconomic stability of the western alliance is being disrupted existentially, it is not clear why Europeans would be as willing to play this part.”

Things could get real. As they like to say, FAFO.

the financial times had an article on this from Alphaville. European countries do not own those bonds. they are held by European companies for private entities, for the most part. the governments do not control those funds (outside of Norway and its sovereign wealth fund). if they tank the treasuries market, they will take a large loss themselves-the private market that is. its the same reason china has not taken any direct action-although their action could be more coordinated.

It’s my understanding that China has been running slowly for the exits. That dynamic is actually more stable if there are governments than private entities involved. The governments can decide that they will take a hit for the greater good of the world and society (trusting that other governments will live up to promises of doing the same). Private companies look after themselves and their next quarter profits. A lot of US bonds are held by Wall Street now and they are not even in charge of when/whether to sell. You hit the trigger and your collateral is sold. Where and when that trigger is nobody knows.

Following on from Joseph’s “EU owns a lot of Treasuries” comment = Trump is well on his own to dethroning the U.S. dollar as world’s reserve currency – From Bloomberg this morning: “Zambia is the first African country to let Chinese mining companies pay taxes in yuan. It probably won’t be the last, as Beijing seeks to internationalize the currency and dilute its dollar dependence. The move, disclosed last month, is Beijing’s latest success in a bid boost the currency’s use in Africa, where China is the biggest trade partner. Already, Kenya’s converted some of its dollar debt to China into yuan and Ethiopia’s in talks to follow suit. The African Export-Import Bank last year sold its first ever panda bond.” Trump is well on his way to destroying the U.S. led world order –

As to yhe simole conversion of dollardebt to yuan debt, seems like the timing could have been better.

Debtors just keep getting screwed.

So much for lowering mortgage rates 10 years have spiked today.

They have ordered Fannie and Freddie to hold mortgage bonds. Next they will order the Fed to hold more treasuries? Both of those actions will induce more selling by everybody else. Does anybody else get the feeling they have seen this movie before and know how it ends?

I think the fed can buy more treasuries than europe will sell, and at a discount. They did it a couple decades ago in the financial crisis. Not saying that is a good outcome, but i think the idea somebody can tank the treasury market is not likely. Shorting america is a risky bet, imo.

The Fed can certainly buy up all the treasuries and MBS it wants. But what would be the outcome of them owning say 50% of all outstanding US treasuries and MBS?

Its a fair question, and i dont know. My bet is, not much of a difference as long as people continue to want treasuries in a risk on environment. Its not like the fed, as the largest holder, would start a firesale themselves. As i said, i am not in the business of shorting America even if trump is in charge.