From X today:

Nov retail sales came in hot at +0.6% M/M and +3.3% Y/Y, beating expectations and above inflation, also a strong rebound from the lackluster numbers in Sep and Oct, while preliminary Dec data points to yet another month of strong consumer spending…

That’s from EJ Antoni, Chief Economist for the Heritage Foundation. Here’s some perspective:

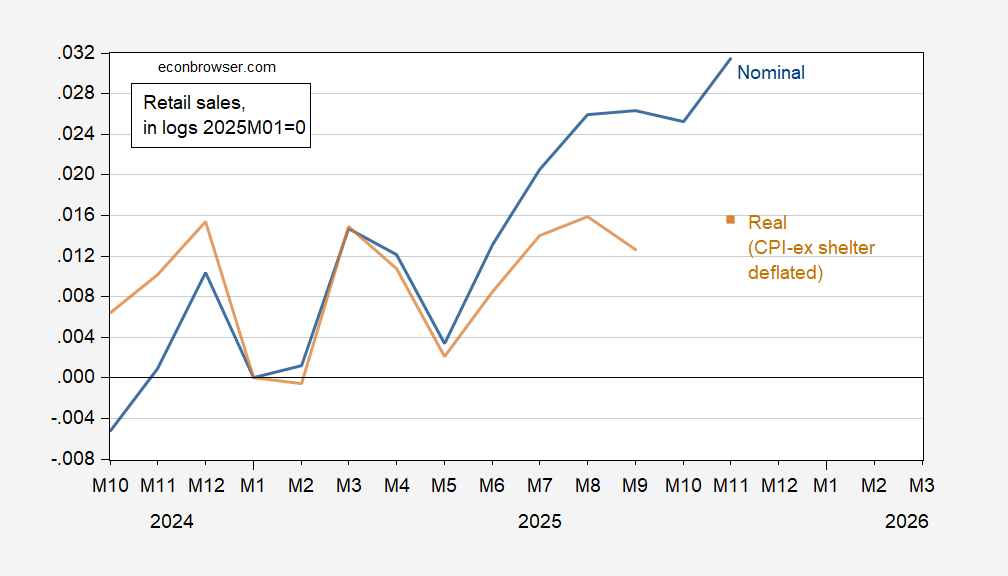

Figure 1: Nominal retail sales (blue), and real retail sales (tan), both s.a., in logs 2025M01=0. Real calculation uses CPI-ex shelter for deflation. Source: Census, BLS and author’s calculations.

While retail sales growth exceed consensus, same-store sales matched expectations, as reported by Bloomberg.

Moreover, while November retail sales grew faster than expected, there being no reported November inflation rate, it’s hard to figure out if it’s true that it outpaced inflation, as asserted (November growth did exceed December CPI-all inflation, m/m).

Using the CPI-ex shelter deflated CPI, retail sales are, despite the recovery, only at August levels.

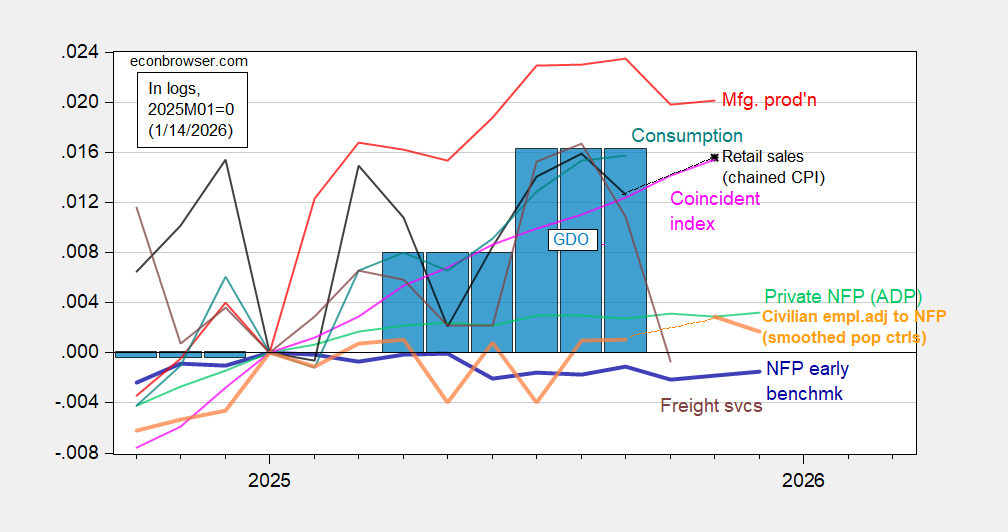

Using CPI-ex shelter deflated retail sales, here’s a picture of the business cycle alternative indicators (NBER BCDC indicators here).

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, smoothed population controls and 3 month centered moving average (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), freight services index (brown), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve, BTS via FRED, BEA 2025Q3 initial release, and author’s calculations.

Taken overall, there seems to have been an overall flattening of some indicators in the last three months.

A week or two ago I left a comment here that there may have been at least a shallow downturn that started in Q3, exacerbated by the government shutdown.

New data since then has increased the odds that is correct. The below link goes to a graph norming to 100 in July all of the following: payrolls, industrial production, real income less government transfers, and both real and nominal manufacturing and trade sales (the last two because nominal total business sales declined through September, while the other hasn’t been reported yet, but is almost certain to have declined as well):

https://fred.stlouisfed.org/graph/fredgraph.png?g=1QuhH&height=490

Only two of those have been higher, by 0.1%, since – in September. One of those turned back down in October, and the other hasn’t been reported yet.

Additionally, payroll tax withholding continues to look like it has declined in real terms.

It may not be enough of a decline to qualify as a recession, but also remember that we may have government shutdown 2.0 starting in less than 3 weeks.

What the heck??

From Semafor:

US gets first $500 million Venezuelan oil deal, holding some proceeds in Qatar.

Revenue from the oil sales is currently being held in bank accounts controlled by the US government, as indicated in Friday’s order, according to the administration official. The main account, according to a second senior administration official, is located in Qatar.

The US government has bank accounts in Qatar? Why is the money there? A favor to Trump’s business partners? Why aren’t government funds deposited in the Treasury’s bank account at the Federal Reserve?

what makes you think those are government funds? trump can place his cash anywhere he sees fit.

Here is Trump:

This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States! Yeah, trust him!

This is truly bizarre. The president can send his mafia enforcers into a foreign country to extort money out of them and then that money belongs to him as a slush fund to use as he likes, not the US Treasury. If it went to the Treasury, he would need congressional approval to spend it. Instead he stashes it in a foreign bank account that only he controls.

It’s crazy that he runs the US military as a shakedown operation and this provides him with a long term revenue stream completely outside of governmental oversight. This is outright fascism.

Where is Congress in all this? Oh, right, Republicans just voted down a war powers control act.

Ya know how users of economic data have worried that the felon-in-chief and little Antoni at BLS and Miran at the Fed might mean an end to reliable data? And, of course, users of scientific data have the same worry. Well, now there’s cause for anyone who breathes or drinks or eats or bathes to worry:

https://www.nytimes.com/2026/01/12/climate/trump-epa-air-pollution.html

The felon’s EPA plans to stop taking human lives into account when assessing environmental costs. Costs to business will still count, but not human lives.

I can’t think of a better summing up of this administration’s view of things; profits matter, humans don’t.

The Republican party has long had a sizable dose of this in its policies, but now it’s absolute and explicit. I’d love it if Republicans were to pay a high political price for this, but they won’t. Dramatic, videotaped deaths from police shooting innocent (white) people get attention. Rotten kidneys and slow deaths, gasping for breath in hospital beds just don’t.

Only about a decade late, the felon-in-chief has come up witha healthcare plan:

https://thehill.com/policy/healthcare/5691065-trump-health-care-affordability-plan/

Few details, lots of window dressing and ineffective fluff. Oh, and some checks sent directly to voters – politicians love sending checks directly to voters.

A concept of a plan? This is how they passed the 2017 tax cut for rich people.

contrary to what you hear by politicians and the media, getting a comprehensive healthcare plan for the country in not rocket science. it simply requires the public to actually care for one another, and not act in such a selfish way.

if you want to reform healthcare, simply start by making the billing process transparent. healthcare problems are not the result of insuring as many people as possible-that is actually how insurance should operate. healthcare problems are a result of the enormous amount of friction created by nonhealthcare providers, in order to make a profit, within the healthcare system. you think all those vp’s at the insurance company are there for improved healthcare quality, or profit? claims denials and delays are a big part of the problem.

From WaPost: “Trump threatens tariffs on nations that ‘don’t go along’ with Greenland plans”

Wouldn’t that be all of ’em?

Russias oil income is sinking and they have spend the liquid part of the reserves. Now very expensive borrowing is what’s financing the war.

https://understandingwar.org/research/russia-ukraine/russian-offensive-campaign-assessment-january-16-2026/

Yep:

https://www.reuters.com/business/energy/russias-oil-gas-budget-revenue-falls-24-lowest-since-2020-2026-01-15/

And yep:

https://www.businessinsider.com/russia-economy-wealth-fund-reserves-ukraine-war-moscow-inflation-stagflation-2025-1?op=1

However, total reserves are still pretty high:

https://www.ceicdata.com/en/russia/official-reserve-assets

I’m too lazy to check, but I believe “official reserves”, as reported by Russia’s central bank, include assets seized by western powers in response to Russia’s renewed invasion of Ukraine.

The trajectory of liquid reserve use suggests zeroing out sometime in the autumn oft this year.

By the way, the latest update st your link suggests that Russia’s military is exaggerating its successes in Ukraine, probably with Pooty-Poot’s blessing, in order to influence U.S. leaders’ in the current peace talks.

Front line commanders have strong incentives to make “good” reports – they can literally lose their lives for failing to show “progress”. How far up these lies are recognized as such – is anybodies guess.

The main Russian efforts currently seems to be sending a few soldiers in civilian clothes forward to unfold a Russian flag (and take a picture) at a landmark/building – the, run back before being discovered and killed. This is then the proof that an area has been conquered – and the superiors will be pleased and forward that “proof”.

I find the China-Canada trade deal interesting – My take – Canada increases exports to China (energy, agriculture, minerals, forestry products) -China substitutes Canadian supply for U.S. supply, U.S. exporters lose marginal market share, not all at once, but persistently, This is especially painful for: Soybeans, corn, pork, LNG and refined fuels, and Industrial metals and chemicals. In today’s globalized world, I think we will find we need our long term allies and trading partners – more than they need us.

As a Wisconsinite, I believe Wisconsin is unusually exposed because its economy sits at the intersection of agriculture, manufacturing inputs, and cross-border North American trade. For Wisconsin manufacturing – Wisconsin manufacturing is input-intensive and export-exposed, especially to Asia indirectly. Sectors impacted by this – Industrial machinery, Food processing equipment, Metal fabrication, Paper & packaging. Canadian firms gain scale advantages exporting to China and Chinese manufacturers stabilize costs using Canadian inputs. Wisconsin manufacturers face: Higher relative input costs, Weaker export competitiveness, and Less pricing power. Sounds like a continued decline in Wisconsin manufacturing jobs.

Agreed. Canada is our best allie, a neighbor whose security and economic interests are naturally interwoven with our own. Canada has, for decades, sought a way to diversify its trade, but the magnet has simply been too strong – for both of us. Now, the magnet is shielded by idiocy. If Venezuelan sour returns to the U.S. in greater volume, the Canadian sludge that has replaced it will go where Venezielan sour had been going – China. Funny Fynny how that works.

Meanwhile, trade and defense deals are being negotiated all over the world, to patch up the damage thr felon-in-chief’s ridiculous antics have caused. The world is changing, becoming a patchwork of economic and military do-it-on-the-fly tactical arrangements, all because the felon’s ego requires that he put his name on things.

So the felon-in-chief has TACOed on Greenland? Stand up to him and he folds. Love to get this guy in a poker game.

The two main U.S. political parties are now less popular, together, than at any time on record (since 1988) says Gallup:

https://news.gallup.com/poll/700499/new-high-identify-political-independents.aspx

In the latest survey of political affiliation, both Democrat and Republican came in at 27%, indepe dent at 45%. That’s a new all–time low for Democrats, but not for Republucans.

So despite enormous dissatisfaction with the policies of the Republican Party and with the policies of the felon-in-chief, Democrats have lost ground this year. Good job, party leaders.

Gallup also points out that among independents, “lean Democratic” has a 5 ppt advantage over “lean Republican”. Add “lean” to outright party affiliation and Democrats still have a 5 ppt advantage. That’s a switch from the prior two years. Which is to say, the mid-term election is the Democrats’ to lose. If anyone can flub a 5 point lead in a mi3-term, it’s the party bosses who have led Democrats to their lowest party affiliation 38 years.

In regards to Greenland – I agree with Krugman on the other aspects of this madness, but also randomly putting an additional tariff on our allies ” A tariff to promote territorial expansion is clearly illegal, under any sane interpretation of U.S. trade law. This is on the Supreme Court, which is obviously dithering while the world burns”

Look at the U.S. ten-year bond market – these traders are having the classic frozen deer-in-headlights moment – they don’t know if tomorrow the Fed Chair gets fired, another major city gets it’s economic and social activity shut down for weeks, or we go to war with our NATO allies.

Also it should be obvious to everyone that our long term allies have given up on dealing with the U.S. – “Merz, after traveling to India in mid-January, is expected to make his first trip to China as chancellor in late February. ” Noah Barkin

Trump bailing on iran has cost the lives of 15,000 protesters. Dont count on trump to have your back, unless he gets something in return.