As i was producing some extra slides for my macro course, I generated this graph:

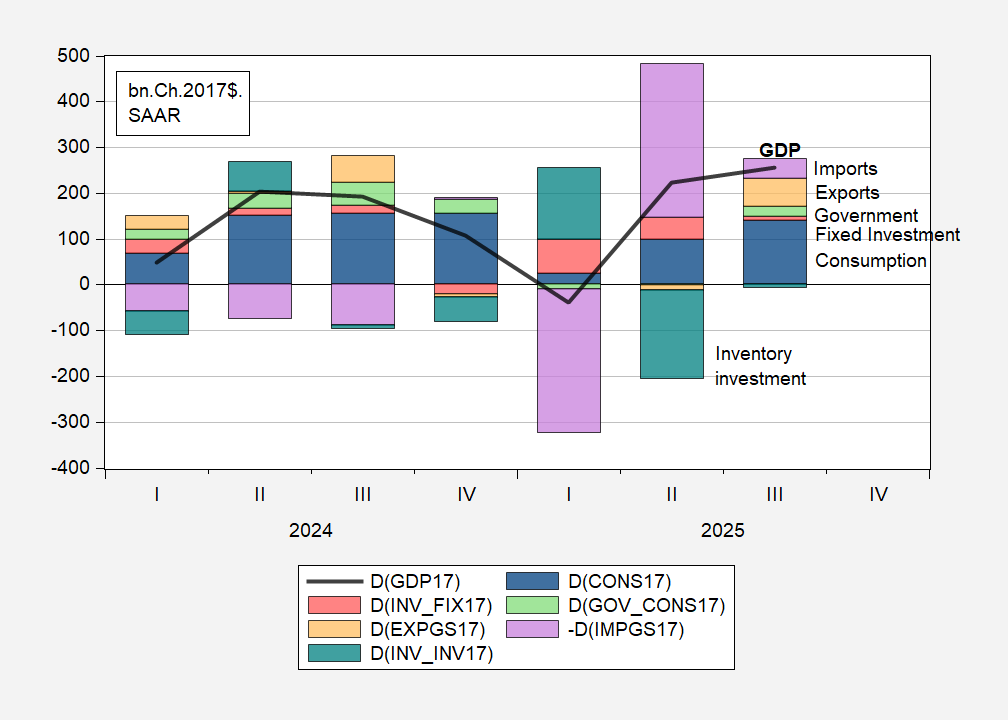

Figure 1: Change in GDP (bold black line), change accounted for by Consumption (dark blue bar), Fixed investment (red bar), Inventory investment (teal bar), government consumption and investment (light green bar), exports of goods and services (orange bar) and imports (lilac bar), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q3 updated release, and author’s calculations.

Note that this is the real dollar contribution instead of percentage point contributions that are typically generated reported in the BEA report, and that Jim plots in his posts on the GDP release. If I did this on a long span of data, I’d be queasy about treating chain-weighted quantity variables this way, but I hope that over this short of a period, the approximation errors are fairly small.

The interesting point is that taking into account the changes in imports and inventory ac/decumulations in Q1 and Q2, these are pretty equal and opposite in value. This allows one to make a kind of guess of what imports of goods and services would’ve been in the absence of tariff-front-running, and hence better visualize the trend in imports.

This in turn potentially yields insights into the effects of tariffs, especially in light of the large deterioration in the trade balance in November. I must confess, I was never one to believe that even the enormous and record-breaking tariff rates imposed would alter the trade balance (or more accurately, the current account balance) on the basis of expenditure-switching effects. Moreover, imports might be decreasing because of the depressing effects of policy uncertainty on economic activity.

Little impact is also to be expected since I view the current account as basically driven by the national saving identity (this is sometimes called the Macroeconomic Balances approach). As it turns out the NIPA current account to GDP ratio is about the same (well, actually about half a percentage points more negative) in 2025 than in 2024.

That being said, I think it’s interesting to see what imports alone are doing.

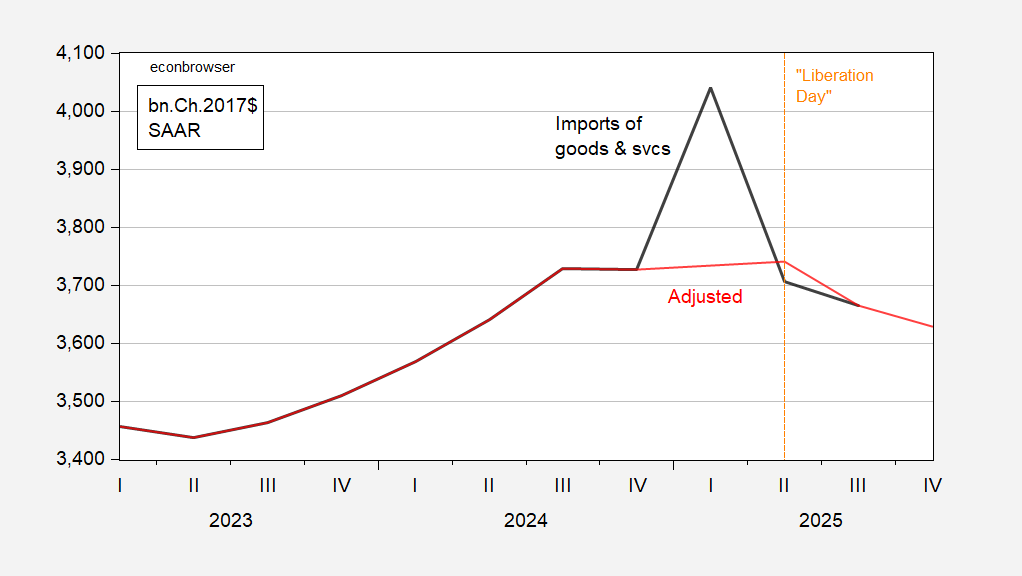

Figure 2: Imports of goods and services (bold black), and counterfactual (red), both in bn.Ch.2017$ SAAR. 2025Q4 final sales is GS estimate of 1/30; 2025Q4 imports is extrapolated using regression of total imports on goods imports 2023Q1-25Q3, where Q4 imports of goods proxied by October and November imports. Source: BEA 2025Q3 updated release, BEA trade release of November, Goldman Sachs, 29 January 2026, and author’s calculations.

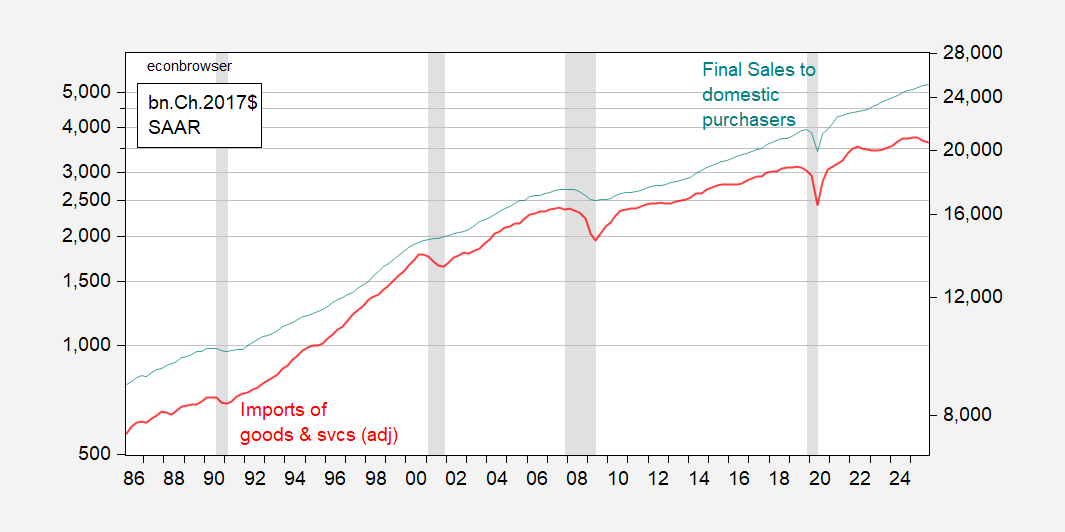

Figure 3: Imports of goods and services, adjusted (red, left log scale), and final sales to domestic purchasers (teal, right log scale), both in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2025Q3 updated releases, BEA November trade release, Goldman Sachs, NBER, and author’s calculations.

It looks like there’s a downward movement in imports, despite the jump in November trade deficit. A quick and dirty estimate over the 2023-2025 period suggests that tariffs account for the majority of the movements.

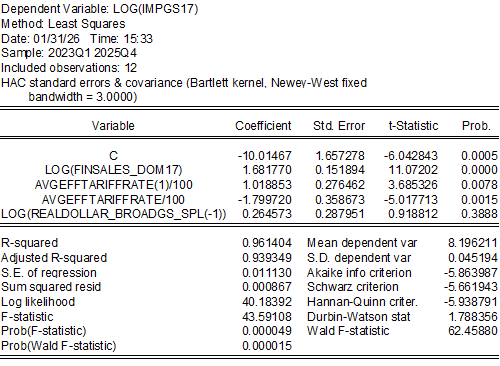

Over the 2023-25 period, imports have a semi-elasticity of 1.8 with respect to the contemporaneous effective tariff rate, while absorption and the value of the dollar have the corrected signs. Note that these estimates are sensitive to sample and specification (as would be expected given the small sample).

The slowing of the economy (as measured by domestic final sales) and the increase in the contemporaneous tariff rate have roughly equal coefficients. To see what is more important empirically, one can examine scaled, or normalized, regression coefficients (dividing by respective standard deviations) indicates that the impact of the former is about 0.93 and 1.35 for the latter.

In sum, tariffs do seem to be reducing imports, even if not necessarily reducing the current account deficit. Trade policy uncertainty doesn’t seem empirically important in the specification tested, but might (likely) have an impact on broader economic activity, and hence depressing imports. Quantifying this effect I leave for a subsequent post.

tracking laden container flows from china to US shows this trend. january flow is flat vs last year. perhaps adjustment period is over.

What I find interesting is that Trump admin can not escape the 10 and 30 yr bond market – Long-term Treasury yields are being pushed up by term-premium fears, although investors still expect the Fed to eventually cut short-term rates. The U.S. bond market is charging a risk surcharge for inflation uncertainty, deficits, policy volatility. Meanwhile, foreign investors diversify away from duration risk.

This translates into increased debt servicing for everyone else. Counties/municipalities debt service is starting to crowd out local services. For example, Milwaukee County projects 2026 debt service of ~$103.7M, up about $11.9M from 2025. That’s the “uncomfortable” bond market turning into budget tradeoffs (less room for operations/capital).

I predict this will all end in tears for everyone except Trump.

Only ever-so-slightly related, here’s what the felon-in-chief’s personnel policies are doing to scientific expertise in U.S. agencies:

https://www.science.org/content/article/u-s-government-has-lost-more-10-000-stem-ph-d-s-trump-took-office

There has beem a 14% decline in the number of science-related PhD holders employed by the federal government since Biden left office. That amounts to the losse of 48,304 years of work experience. Not woke workers. Not DEI od DEI supporting jobs. Science jobs.

Across federal workers in general, the decline over the last year was just 3.2%. Science-related PhD holders have been cut from federal employment at about 4 times the rate of overall employees. The felon-in-chief has a hard time with anything he doesn’t understand.

Making America Great, I guess.

Looks like Cuba is next for a Venezuela-style “win”:

https://www.washingtonexaminer.com/policy/foreign-policy/4442362/trump-cuba-deal-tariffs-oil-trade/

A bogus declaration of an “emergency” to justify tariffs in countries that trade with Cuba. Mexico has partly replaced the oil Venezuela no longer sends to Cuba, and is looking for a way to continue shipping oil to Cuba without triggering U.S. tariffs. Even the Pope is asking us to back off.

Notably, the felon-in-chief is now talking about a humanitarian crisis in Cuba, after predicating Thursday’s “emergency” declaratiin on the threat Cuba represents to the U.S. – the guy will say anything.

Anyhow, a humanitarian crisis in Cuba will lead to a flow of refugees toward whatever coast boats can reach. Florida, Yucatan, the Bahamas, Jamaica and Haiti are all roughly the same distance from Cuba, with Florida closest to Cuba’s biggest population centers. Mexico is big and kind, so may be a big destination of choice. For some, El Norte would be the next stop after Cancun.

Oh, and by the way, regime change is the felon-in-chief’s goal in Cuba, according to the WSJ:

https://www.wsj.com/world/americas/the-u-s-is-actively-seeking-regime-change-in-cuba-by-the-end-of-the-year-1d0f178a

In Venezuela, the felon left the second rank of thugs in place after kidnapping the president; the democratic opposition was left out in the cold. Cuba has no significant internal political opposition, democratic or otherwise, so what would regime change look like? The WSJ says the felon administration doesn’t have a plan for that.