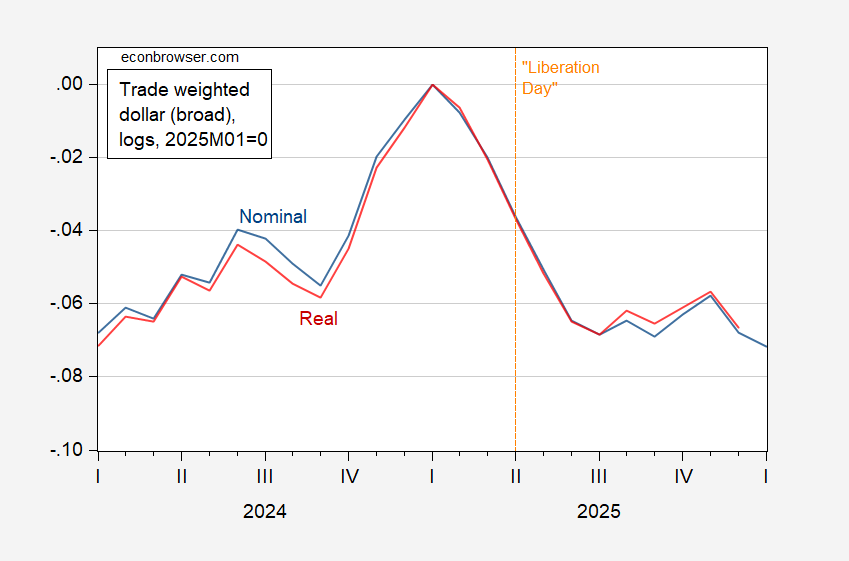

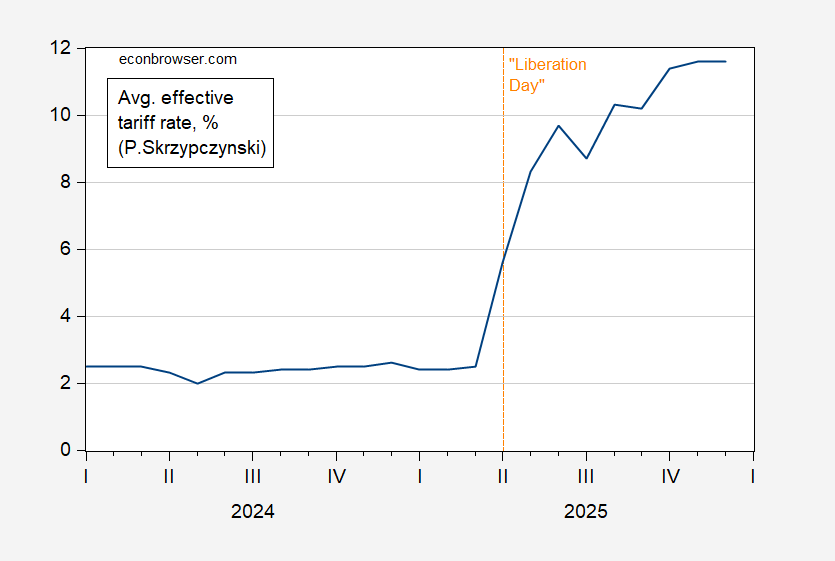

A random thought on Trump’s moves to depreciate the dollar and to implement broad and high tariffs. The dollar has depreciated on a real trade weighted basis by about 6.6% in December (in log terms). Average effective tariff rates have risen from about 2% to 12%. What’s the impact on import prices, based on earlier estimates?

Figure 1: Nominal trade weighted value of US dollar against broad basket of currencies (blue), real (red), both in logs 2025M01=0. January 2026 observation for January through 1/23. Source: Federal Reserve Board via FRED.

Well, exchange rate pass-through has been thoroughly examined, and recent estimates are in the range of about 1/3. This suggests (back-of-the-envelope) a 2.2% increase in import prices ceteris paribus.

Tariff rates have also risen.

Figure 2: Average effective tariff rate (de facto), in % (blue). Source: P. Skrzypczyński.

That’s a near 9 percentage point increase in the effective tariff rate over 2025.

Most empirical work on the previous trade war, and the ongoing, suggests tariff pass through for the United States is near 100%.

A simple-minded calculation then takes import prices rising 9% + 2.2% = 11.2%, while the ex-food/fuel import index has risen about 0.7% through November. One caveat – foreign firms might not have viewed the January 2025 peak in the dollar as durable, so looking at where exchange rates are now relative to say October of 2024 might be more reasonable.

However, more significantly, tariff rates only started rising about April-May, reaching near current rates in October; hence one can expect prices to continue to rise due to the tariffs and domestic firms passing on the price increases.

If the dollar continues to decline, that will add yet more inflationary pressure to import prices, and hence consumer prices. DB forecasts a 6% decline in 2026.

The big rise in PPI seevice prices in December was due in considerable measure to tariffs on goods. PPI is generally not a good short-term predictor of consumer price inflation, but certainly wholesale markups to recoup tariff increases is a step along the way in passthrough.

Thr felon-in-chief’s rrcent threats to both Canada (over trade with China) and Mexico (trade with Cuba) aren’t based in law, so it’s tough to say what effect those tantrums might have on actual tariffs, but the direction is clear.

paulkrugman.substack.com/p/a-wonkish-note-on-tariffs-and-inflation

Krugman offers his insights