Trump takes military action off the table (for the nonce):

Source: TradingEconomics, accessed 11am CT on 1/21/2026.

The VIX has declined, although currently rebounding. The 10 year bond yield is still way up relative to pre-weekend.

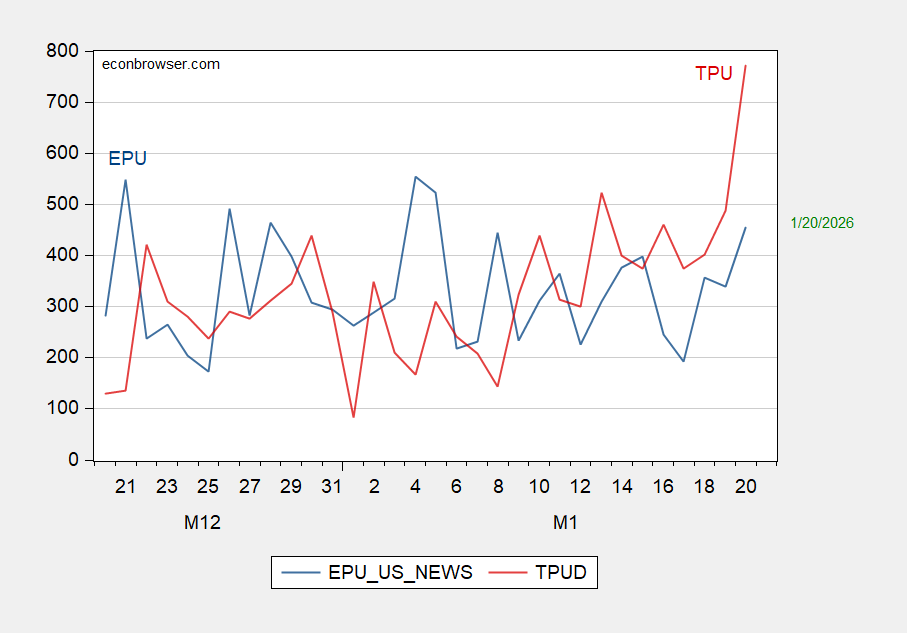

EPU and trade policy uncertainty are up (data through the 20th):

Figure 1: EPU (Baker, Bloom and Davis) (blue, left scale), and Trade Policy Uncertainty (Caldara et al.) (red, right scale). Source: Policyuncertainty.com and Trade Policy Uncertainty, accessed 1/21/2025.

Keep in mind that Trump didn’t really rule out military action.

He effectively said “I have a gun in my pocket. I won’t have to use the gun in my pocket because you are going to give me your wallet.” What happens if you refuse is implied.

So the bond market is betting on whether Europe will give up their wallet or not. If they don’t, expect violence.

I think they called his bluff. Having taco’s for supper.

Speaking of threats of violence:

https://www.straitstimes.com/asia/east-asia/chinese-drill-sparks-talk-of-decapitation-strike-on-taipei?ref=top-stories

The author rightly points out that China’s practice run for a decapitation strike against Taipei is partly a response to the U.S. kidnapping of Maduro. If the rules have changed, then China will gladly play by the new rules.

So the felon-in-chief has TACOed in Greenland, for now. A week or so ago, he TACOed in Iran. Press reports at the time indicated that U.S. military planners had told the felon there were insufficient military resources in the Middle East to do whatever it was that he wanted done to Iran. Turns out, we’ve continued to move resources to the Middle East in preparation to do bad things to Iran:

https://www.wsj.com/world/middle-east/trump-iran-military-options-b49429c4?st=yqnVRs&reflink=desktopwebshare_permalink&

Decapitation is the new fad, but maybe not looking very clever, what with Venezuela not much changed. Is regime change really a likely outcome from doing bad things to Iran? Dunno – outside my scope of expertise. Probably outside everybody’s scope, though neocons love to pretend to see the future.

The carry trade is collapsing:

https://tradingeconomics.com/japan/40-year-bond-yield

The result is another TACO moment, which is good, though as you point out, it may be temporary. It’s going to be a shame if statutory rape leads to the end of the modern worlds most effective defensive alliance and maybe the end of U.S. democracy. We really have to remember not to elect any more rapists.

Speaking of exorbitant privilege:

https://www.aa.com.tr/en/economy/eu-vulnerable-due-to-reliance-on-us-payment-systems-economic-affairs-committee-chair/3807048

Lalucq is stating the obvious, but it’s the worry she attaches to it that matters. Europe has been vulnerable to U.S. payment systems for decades, and never worried about it. The fact that the felon-in-chief has threatened any country which tries to operate oitside that payment system is reason to worry – he wants a weapon.

Europe is sophisticated enough and integrated enough to create an alternative payment system – heck, they kinda have one already. Drtaching from the U.S. paymrnt system won’t change the reserve currency fundamentals – the felon is doing that by himself – but it would reduce the benefits.

Trade transactions denominated in a currency lead directly to financial transactions in that currency. The dollar is not 80% of reserve holdings, but it is one side of 80% of currency transactions – that’s real dominance. Often, short-term debt is part of currency transactions, and collateral is involved. Holding Treasury debt allows one to transact more cheaply because Treasury debt is the most favored collateral; use as collateral creates demand for Treasuries. Transact in Euros and Euros become better collateral, displacing Treasuries; Euro rates fall, Treasury rates rise.

When the felon-in-chief bad-mouthed NATO, it was a problem. When he threatened NATO with violence, the problem came into sharp focus – he means us harm. Anything that European members of NATO can do to take weapons away from the felon should be considered. The payment system is a weapon.

By the way, this business of collecting the vig from a payment system is being hotly cintested right now in Congress. Stablecoin platforms want to be able to pay interest, and banks don’t want them to. All about who gets to handle transactions.

Banks have to report transactions of $5,000 or larger, as a way of preventing criminal payments. Stablecoin exchanges don’t. Banks are under macroprudential regulation. Stablecoin exchanges aren’t. Banks participate in deposot insurance that protects against runs. Stablecoin exchanges don’t. What do you think happens if stablecoin exchanges are allowed to pay interest?

By close trading Friday there will be two aircraft carriers with their air and missile defense screens near where Iran can shoot missiles at U.S. bases and Israel.

CVN aircraft less use than their destroyer screens.

Repeat June 2025 12 day war and get different results

Two felon-in-chief appointees to the Supreme Court seem ready to block the felon’s effort to take over the Fed:

https://talkingpointsmemo.com/news/kavanaugh-trumps-federal-reserve-supreme-court