According to Bloomerg. No doubt the USD is losing in value in nominal terms against a basket of currencies as well gold, since the weekend.

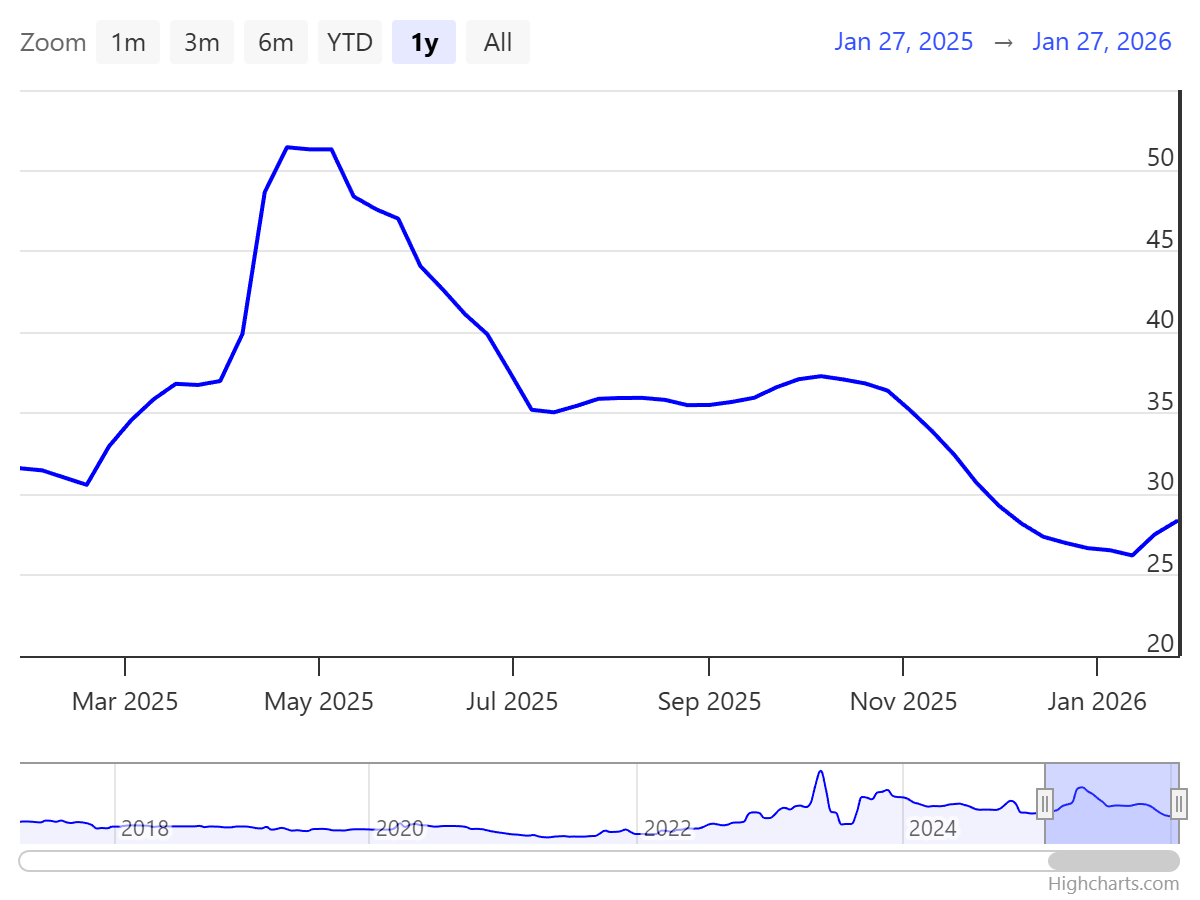

Source: TradingEconomics.com, accessed 1/27/2026.

This correlation suggests a diminished confidence in the value of US dollar assets. Is this due to heighted inflationary concerns, or default related concerns? 5 year CDS values have risen in the past weeks.

Source: Worldgovernmentbonds.com accessed 1/27/2026.

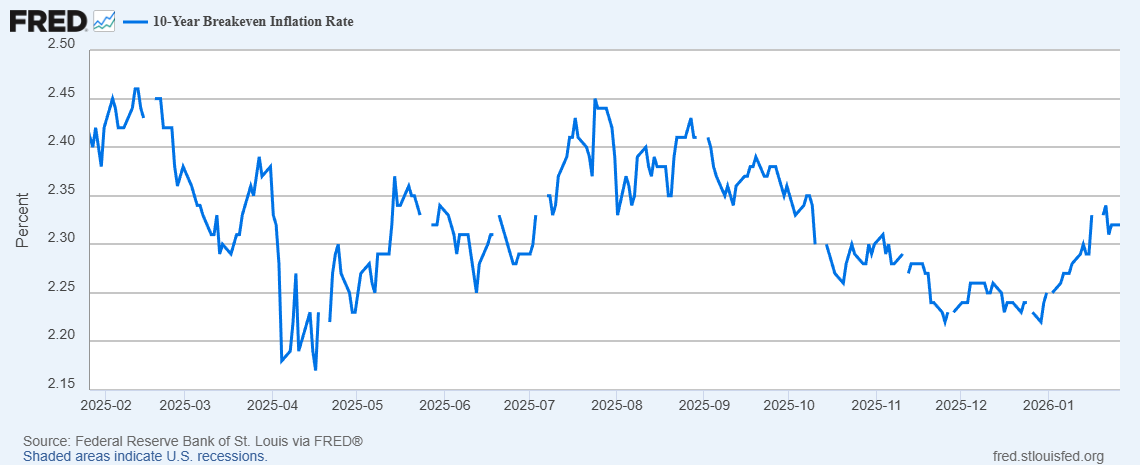

At the same time, the ten year break-even has registered lower:

Source: Treasury via FRED, accessed 1/27/2026.

Breakevens are imperfect measures of inflation expectations, but for a quick and dirty measure, I count a risk premium associated with political uncertainty as a bigger contributor than higher expected inflation.

Oh, and consumer confidence (Conference Board) fell to a 11 year low.

gold is an issue, not sure if it is a problem or not. but it has doubled effectively since trump took office. I just don’t see how that happens if conditions are good and stable. what exactly is driving this fear? it seems to me it is more than simply overheated speculation.

One thing to keep in mind is where gold demand is coming from. For instance, stablecoin hucksters are buying pretty hefty chunks:

https://kelo.com/2026/01/26/tether-says-it-bought-27-tons-of-gold-in-fourth-quarter/

That’s new, and when they’ve reached their target holdings, they’ll only buy what’s needed to match growth in stablecoin demand. There’s a bottleneck that’s only going to matter for a while.

Central banks are also buying big chunks these days; Poland, for instance:

https://www.bloomberg.com/news/articles/2026-01-21/top-gold-buyer-poland-to-ramp-up-purchases-as-geopolitical-hedge

As I understand it, central banks aren’t ditching dollar assets for gold. Rather, they see geopolitical instability – and dollar weakness – as a reason to increase TOTAL reserve holdings. And since geopolitical uncertainty is the problem, no particular region looks like a good hedge. Instead, they’re picking up gold because it isn’t a regional thing. Some central banks are also shipping physical gold home so that they don’t have to depend on the kindness of strangers. Till now, most of them were still OK leaving gold in fore8gn depositories. Like stablecoin hucksters, central banks will cut back on gold demand once the re-ordering of their portfolios is accomplished.

Menzie’s chart gives some impression of the negative correlation between the dollar and gold. The 2014-2023 period is probably clearer:

https://fred.stlouisfed.org/graph/?g=1QXim

This makes gold useful not just for central banks, but for any portfolio exposed to a deterioration in dollar value or reliability.

One last source of gold demand right now is, of course, the public. Apmex, a precious metal broker and smelter, gives a feel for what has happened to demand lately. They have boosted their minimum order size substantially because they can’t handle order volume – turning away business. It’s nuts out there. It won’t last.

So what happens to gold when those characters stop buying? Does it hold stable or fall, and by how much. If you know you are buying an overvalued asset, but do it to round out a portfolio, you may be less likely to sell on a correction. But can that high price be sustained? Gold has me baffled more than most asset classes out there. Not sure i would short it, but certainly dont want to buy it either. I feel differently about the AI bubble, however. It will pop eventually.

“Buy low, sell high” is dandy, as long as you accept that “high” may be far from the top. It’s a “bulls make money, bears make money, pigs get slaughtered” kinda thing. Market timing ain’t a good strategy.

I just sold my gld holdings for a tidy profit. have been holding it for quite a while. it very well could go higher, but best not to be greedy. I sold my Tesla last year as well, for another tidy profit. could have made some more money on it lately, but again, why be greedy? I can still earn 4% while I wait for sp500 to correct, and then plow it back into index.