A one standard deviation drop is no small thing. Actual at 85.4 vs. 90.5 Bloomberg consensus, down from upwardly revised 94.2.

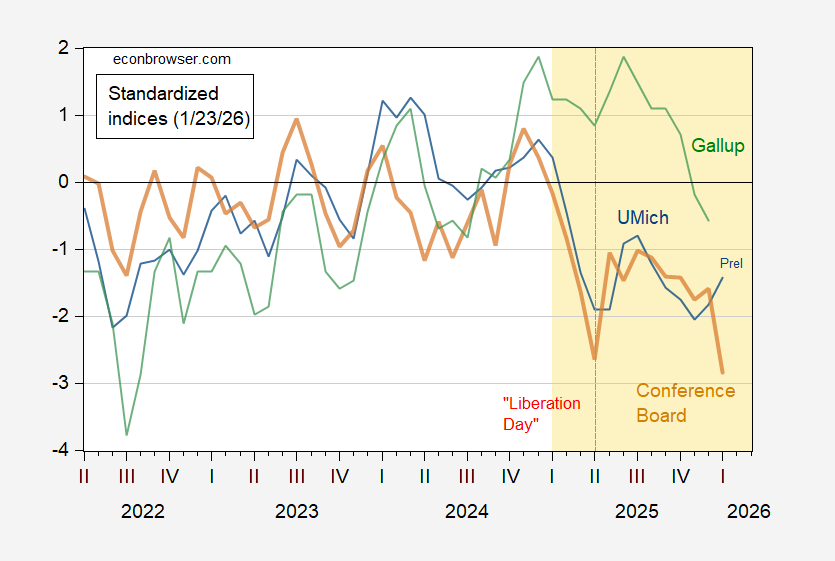

Figure 1: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (brown), Gallup Confidence (green), all demeaned and divided by standard deviation 2021M01-2025m02. Red dashed line at “Liberation Day” Source: UMichigan, Gallup, Conference Board, and author’s calculations.

From the Conference Board today:

“Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened,” said Dana M Peterson, Chief Economist, The Conference Board. “All five components of the Index deteriorated, driving the overall Index to its lowest level since May 2014 (82.2)—surpassing its COVID-19 pandemic depths.”

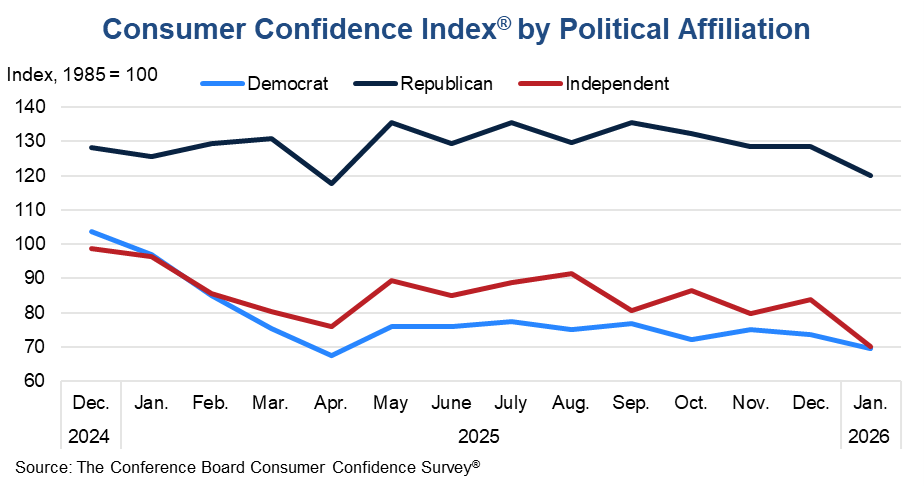

I find it interesting that Democratic and Independent perceptions have converged (at a really low level), while Republican continue to hold up optimistically (with slight deterioration).

Source: Conference Board.

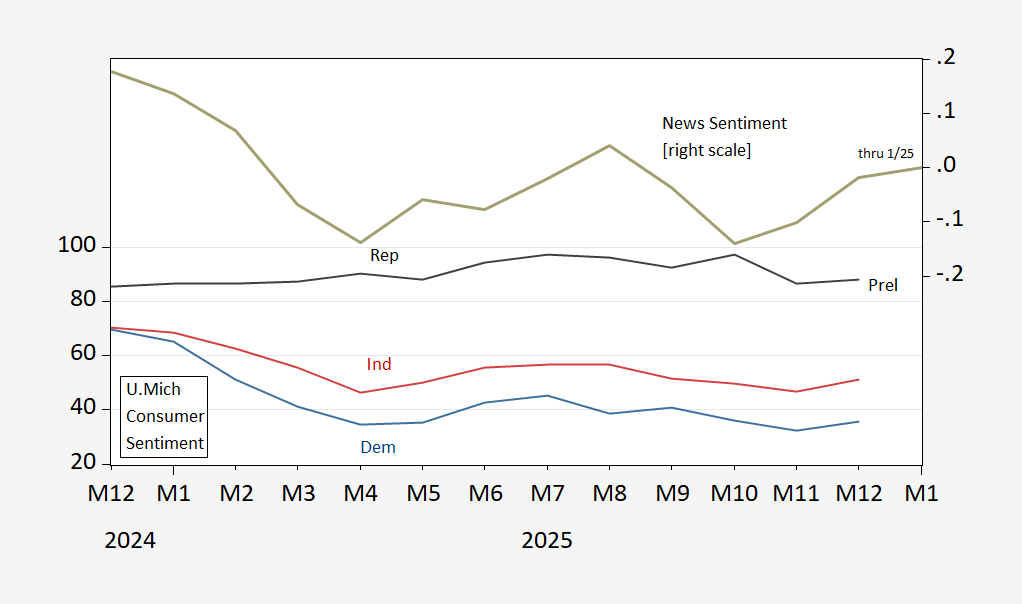

This is a slightly different picture, using U. Michigan data:

Figure 1: U. Michigan sentiment index for Republicans (black, left scale), Independents (red, left scale) and Democrats (blue, left scale), and SF News Sentiment (chartreuse, right scale). January observations for Sentiment are preliminary. January New Sentiment index for data through 1/25. Source: U.Michigan Survey of Consumers, and SF Fed.

Here too, Republican/lean Republican stand apart

The record is fairly clear that growth, employment, the budget and stocks all perform better, on average, when Democrats are in charge. If memory serves, mixed government is also superior to having Republicans in charge.

If we assume that Republican voters are more optimistic when Republicans are in charge, then Republican voter opinion is probably a contrary indicator.

Seems testable.

From today’s FOMC policy statement:

“The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

“We would…if…” does not suggest any particular bias about future policy. The SEP from the December meeting suggested quarter-point rate cuts this year and next, so today’s text is a shift toward less dovishness. Priced-in odds of a March rate cut are now at 13.5% vs 16.7% yesterday, 45.6% a month ago.

The dollar perked up a bit, but who knows why? The felon-in-chief says a four-year low means the dollar is going “just fine”. Bessent says the U.S. has a strong dollar policy after rate checks aimed at weakening the dollar against the yen and also denied the U.S. is planning to intervene in FX.

When ya don’t know what to say, maybe stop talking.

Maybe there’s causation in this coincidence:

https://www.kff.org/quick-take/aca-signups-are-down-but-still-an-incomplete-picture/

January is when Bixen-era Obamacare subsidies ended. KFF reports that over a million people to drop Obamacare health insurance coverage and that premiums for those who stayed on Obamacare are up by an average of 114% in this year’s enrollment period.

No surprise, then, that healthcare costs top the list of U.S. households’ financial concerns:

https://www.kff.org/public-opinion/kff-health-tracking-poll-health-care-costs-expiring-aca-tax-credits-and-the-2026-midterms/