Some observers claimed the fungibility of soybeans would mean little impact on US soybean prices. Unless the Bloomberg terminals are being hacked by the Russians…

Continue reading

Category Archives: China

Will Soybean Prices Recover when China Starts Buying American in the Autumn?

Typically, Chinese purchases of American soybeans picks up in the autumn, due to timing of harvests. If this is an important factor in the recovery of US soybean prices, one would expect futures for November delivery of soybeans would reflect that fact. As of today, they don’t.

Continue reading

As a Social Scientist, I Thank Mr. Trump: Trade Policy Edition

One of the key difficulties in measuring effects and attributing causality is the fact that there are typically many confounding factors. That is why social scientists (and financial economists) often resort to event analyses — looking at what happens around a certain event (like an announcement) when little else is happening. Because there is so much going on with the Trump administration, this is not always possible. However, yesterday evening, the White House released a directive to USTR to identify an additional $200 billion worth of taxable Chinese imports. Here is what happened.

Continue reading

Round Two for US-China Trade?

One irrelevant graph and one (possibly) relevant graph, in light of Mr. Trump’s statement on additional trade sanctions.

First, the irrelevant: the US-China trade deficit, which has been deteriorating over the first five quarters of the Trump administration.

Continue reading

What Does This Mean? Trump asks USTR to…”identify $200 billion in Chinese goods for additional tariffs at 10% rate”

That’s part headline from CNBC.

President Donald Trump has requested the United States Trade Representative to identify $200 billion worth of Chinese goods for additional tariffs at a rate of 10 percent.

Continue reading

On the Eve of Disruption

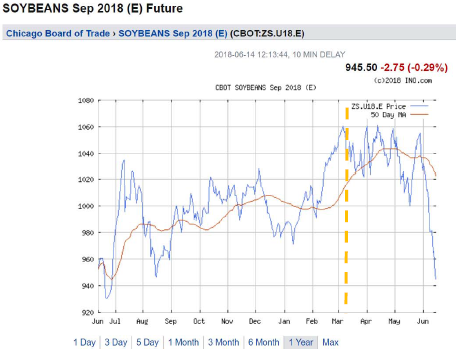

(Apologies to P.F.S./B.McG) Soybean, hog prices and corn prices dove even before the Section 301 import tax hit list was announced. (Orange dashed line denotes Trump announcing imminent Section 232 tariffs). Why?

EconoFact: “What is the National Security Rationale for Steel, Aluminum and Automobile Protection?”

From EconoFact, an update:

The Trump administration has implemented a number of trade related measures purportedly on the basis of national security. First, it invoked the seldom-used provision of the trade law to investigate whether imposing import restrictions for steel and aluminum is justified by national security reasons. The Commerce Department’s investigation concluded that imports of both metals pose a national security risk and subsequently the administration applied tariffs and quotas to both products. In a new investigation, the Commerce Department has started looking into whether imports of cars or automobile parts could impair U.S. national security.

On China: Applying 19th-century remedies to 21st-century problems

My op-ed in today’s The Hill:

Is it a trade dispute with China, or is it a trade war? If the latter, is it on hold, or not? The flip-flops in America’s trade relationship with China are coming in ever more frequently, as President Trump issues and rescinds threats.

Guest Contribution: “Trump’s On-Again Off-Again Trade War with China”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared in The Hill.

“(Trade) Peace For Our Time”

Not the phrase used by the White House, but I think the essence of the statement. From ActionForex:

THE WHITE HOUSE – Office of the Press Secretary

FOR IMMEDIATE RELEASE – May 19, 2018Joint Statement of the United States and China Regarding Trade Consultations