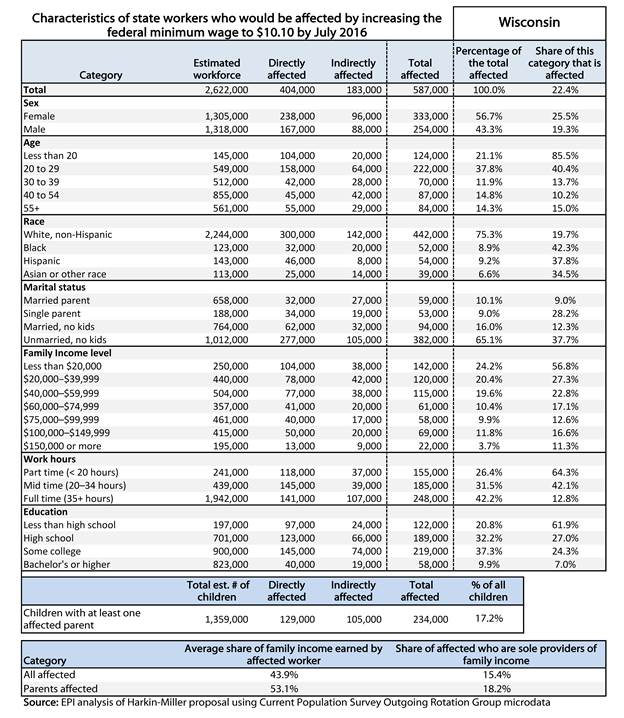

In Wisconsin, the main beneficiaries of a minimum wage increase to $10.10 would be individuals aged 20-29 years, females, and (proportionately), blacks and hispanics. Hence, opposition to a minimum wage increase implies a worse outcome for those groups in the aggregate relative to an elevated-minimum-wage scenario.

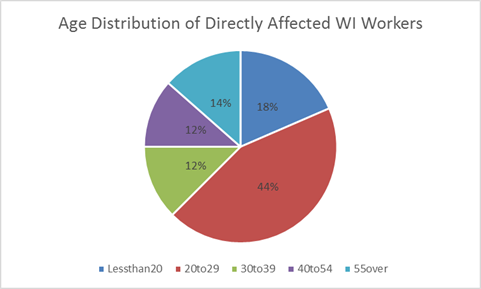

First, contrary to Governor Walker’s assertion, most of the people affected are not teenagers going into the 20’s [1]. Rather, the largest single group is 20-29.

Figure 1: Age distribution of directly affected Wisconsin workers. Source: David Cooper, Economic Policy Institute Briefing Paper #371, December 19, 2013

The 14% in the 55 and over category explains why my impression gleaned from my last visit to McD’s did not match with the Governor’s.

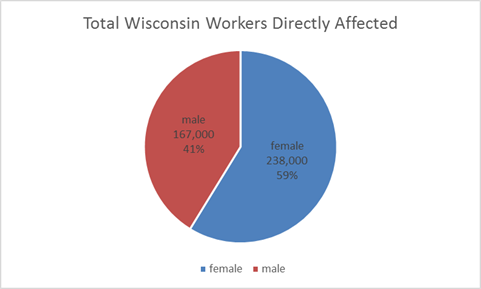

The other interesting fact is the gender distribution of those who would be affected by a minimum wage increase. The majority of those benefiting would be women.

Figure 2: Gender distribution of directly affected Wisconsin workers. Source: David Cooper, Economic Policy Institute Briefing Paper #371, December 19, 2013

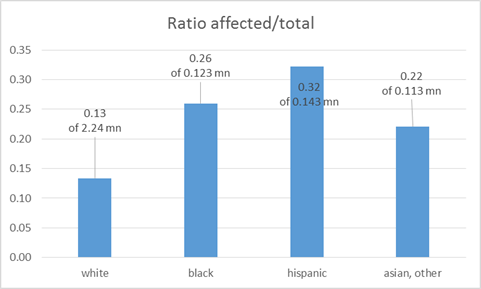

Finally, a minimum wage increase would have disproportionate impact on minorities. While the majority of individuals that would benefit are non-hispanic whites, hispanics and blacks are over-represented in the group that would experience a wage increase as a consequence of a minimum wage boost.

Figure 3: Race distribution of directly affected Wisconsin workers. Source: David Cooper, Economic Policy Institute Briefing Paper #371, December 19, 2013

Table from David Cooper, Economic Policy Institute Briefing Paper #371, December 19, 2013

For a dissection of the criticisms of a minimum wage hike leveled by Scott Manley of the Wisconsin Manufacturers Association, see this post. The Governor has also pronounced his opposition [2].

There is no economist that I know who does not agree that increasing the minimum wage increases unemployment. The debate is about the benefit of a higher minimum wage being better overall than allowing a market wage. Using Menzie’s logic this means that blacks and women will be unemployed in greater numbers than other workers. We see this trend now in unemployment numbers with black unemployment so much greater than for other groups. So, if Menzie promotes a minimum wage isn’t he promoting increased wages for the more privileged at the expense of blacks and women? Does Menzie have some underlying racial and sexist attitudes?

Ricardo: Well, I daresay you likely have a “special” set of economists you know. Also, I think you have not been reading previous posts regarding the debate whether employment increases or decreases in response to a minimum wage increase. I know from your previous posts you don’t believe in statistical inference, so I’m not surprised you stick to your priors in the face of empirical evidence to the contrary.

I am an economists that does not agree that increasing the minimum wage increases unemployment.

I do not have a link, but there was a recent survey where over 50% of economist did not agree.

Actually, minimum wage employment is a function of many thing — just like total employment –and unless you can state that the negative impact of a higher minimum wage is greater than the impact of all the other factors you can not say that a higher minimum wage leads higher unemployment.

The most rigorous empirical models show an increase in the minimum wage up to some level has little or no effect on employment.

Here’s another theory in Wikipedia:

“An alternate view of the labor market has low-wage labor markets characterized as monopsonistic competition wherein buyers (employers) have significantly more market power than do sellers (workers)…Such a case is a type of market failure and results in workers being paid less than their marginal value.

Under the monopsonistic assumption, an appropriately set minimum wage could increase both wages and employment, with the optimal level being equal to the marginal productivity of labor.”

Every economist I know believes the moon is made of cheese.

“a minimum wage increase would have disproportionate impact on minorities.”

Hippocrates would wonder how sure you are about the sign on that impact. How far from certain are you willing to venture before you look to other policy alternatives?

With friends like this, the poor don’t need enemies.

Kevin Erdmann: Well, after a literature review and my own econometric assessments (going beyond bivariate aggregate data), I’ve done my own benefit-cost assessment. Your prescription would be, from my experience in government, a prescription for policy paralysis. Which is perhaps exactly what you would prefer. (Remember, even in Ricardian or HOS models, free trade relative to autarky is Pareto improving when transfers are made…).

‘…from my experience in government….’

That’s what your problem is. Why don’t you put your own money where your mouth is and start a business. You might learn some things about labor economics. Some things that are actually useful.

patrick,

if the private sector is sooooo smart, why do we have soooooo many bankruptcies, both personal and business? you may want to reconsider your ideology that the private sector is so brilliant. they make plenty of stupid decisions every day.

baffling, it’s a feature, not a bug. You are correct that stupid decisions tend to lead to defunding. That’s the beauty of it. We’re all stupid on a daily basis. If you think you need to tell Mr. Sullivan that, then you probably don’t get what he’s saying.

kevin, i understand what patrick is saying. he believes that all government is inept and they should step aside so that the smart business people can run things. it is a foolish perspective, since the public and private sector are both made up of PEOPLE.

The matter at stake is neither intelligence nor goodwill. It is rather two related issues:

First, any blanket rule means that there is a loss due to a lack of flexibility. Thus, a minimum wage prevents a contract–an employment arrangement–from coming into being even when there is a willing buyer and seller, if the agreed prices is below the minimum wage. This implies a loss of welfare.

The reason such a law may come into being is that government is set up to prevent Type 1 errors, errors of commission. It is relatively unresponsive to Type 2 errors, errors of omission. Thus, government meddling may result in much lower levels of activity than would exist under pure private sector rules. For example, fracking occurs primarily on private land, where production has soared. Oil and gas on government land has declined. Production on government land would be much higher if private sector rules pertained. And yet they don’t, because no one in the government is paid more if government land produces more oil.

An extreme case of this is gas fracking in PA vs NY. In PA, where it’s allowed, it’s big business and a significant contributor to the state’s prosperity. In next door NY, fracking is prohibited, even though there are some 5,000 well in the state and people have been drilling for gas there since the 1880s.

Or take the Bundy ranch in Clark Country, Nevada. There used to be, I think, nearly 50 ranchers in Clark Country. Now there are three. In time there will be none. And how big is Clark County? It’s the size of New Jersey. Thus, BLM rules can comfortably contemplate decommissioning an area the size of an eastern state.

So, let us allow similar intelligence and goodwill for private and public sectors. The sobering truth, however, is that the public sector does not care about prosperity. It’s not their remit, because they are not rewarded to provide it.

Patrick R. Sullivan: If you want to hear the echo chamber of business owners bewailing their labor woes, why not just go to the AmCham blog? You’ve clearly made up your mind about where wisdom resides, so why come here? Is it just so you can disparage academics?

In any case, according to the tax authorities, I am a business…so I would appreciate it if you stop making presumptions about people when your ignorance about so many things is so profound (by the way, have you wrapped your mind around the concept of a fixed effect yet?)

‘I am a business…’

How many employees do you have. What do you pay them?

I believe that Kevin has actually written some of the more interesting analysis of minimum wage impacts. Here’s my personal favorite:

http://idiosyncraticwhisk.blogspot.com/2014/05/minimum-wage-labor-force-and-expected.html

If you have done all these analyses, I would be more than pleased if you would tell us, Menzie, what the optimal minimum wage actually is. If $10 is good, surely $12 is better.

Steven Kopits: I’ve read that post. That’s why I mentioned bivariate aggregate analyses, but I expect you missed that nuance. The issue is what information one can extract from possibly co-trending data (i.e., cointegrated data) particularly when other likely important covariates are omitted.

In point of fact, I assigned a project on this subject to my econometrics class; here is my take on the data, using entirely conventional econometric techniques. Take a look here (assignment here). You can download the Meer-West dataset yourself (the link is provided in the first document), and replicate what I did, since all the data are available.

I would have liked to use the data Joseph Sabia used in the Employment Policies Institute paper; unfortunately, Professor Sabia has to date not responded to my request a month ago for the data.

Menzie,

The link Steven Kopits referenced compared the minimum wage relative to average wages to the number of minimum wage workers as a proportion of the labor force over a period of 33 years and 3 series of federal MW hikes, where the two measures tracked a linear relationship with very little error. While I was surprised by the tight correlation, the relationship itself seemed simple and intuitive. I don’t know of anyone who doubts the relationship, which, by itself, wouldn’t provide any information about employment effects. Do you have a suggestion for what these variables would be cointegrated with, or what significant covariates would need to be tested?

Regarding your first link, it looks like your regression is using levels. Is that correct? Or is it using differences?

Thanks.

Kevin, it seems, there should’ve been an employment boom, since productivity more than doubled, while real hourly compensation was generally flat, compared to the 1970s, when the relation between productivity and real hourly compensation broke down. Yet, the unemployment rate has generally been flat, since the 1970s, and has trended higher, since WWII.

Kevin Erdmann: Apply unit root tests (ADF and KPSS) to the two ratios you have; then apply a cointegration test with constant, no trend (which is consistent with the linear relation you plot). The results I obtain are for (i) both series are integrated; (ii) the two series alone are not cointegrated.

In the regressions I ran using a panel of state level data, I use log-levels, as indicated in the memo. I’ve tested some, not all, of the states; the variables I use in those regressions are cointegrated.

The MW level isn’t a stochastic series. I don’t see how these tests would be relevant. The causation clearly runs from the wage level to the employment ratio. Again, this relationship itself doesn’t say what the employment effects are.

Do you think event type studies are a better way to tease out employment effects from a series like MW levels or regressions of time series of MW levels?

Kevin Erdmann: I don’t know how you can say that — the minimum wage is set in a political process, so it must be stochastic. Moreover, the minimum wage is a difference stationary series according to standard ADF tests. In any case, one of the variables you use in calculating the ratio is compensation, which is (also) difference stationary, so the ratio too would difference stationary.

In your post, by the way, I think there an issue. You use the EPI estimate of the affected workers to total workers, not to labor force. Normalizing by labor force leads to a substantially smaller share.

Thanks for the input.

I just used the number of workers reported by epi and independently compared that to the bls labor force number (around 155 mill). I believe they said 21 million workers would be directly affected. My MW worker ratio is smaller than the ratio reported in the bls annual reports because they are based on hourly workers, I think. In both cases I compared the raw numbers to the cps labor force number.

Michael Erdmann: The EPI document lists 16,718,000 directly affected. According the BLS, the civilian labor force is 155,421,000 as of April 2014. I obtain 10.76% doing the division. In your graph, you have nearly 14% indicated for EPI estimate as share of labor force (red diamond). Hence, my confusion on what is being graphed.

Here is the report I linked to:

http://www.epi.org/publication/bp357-federal-minimum-wage-increase/

I don’t see the 16 million number. I used the 21 million number from appendix 1.

Kevin, it’s highly unlikely a $10 minimum wage keeping up with inflation would result in millions of lost jobs. Many other variables would adjust to prevent those job losses. Whether the net effect, on the economy, is positive or negative is uncertain.

However, I may add, the evidence suggests a market failure in low wage income. So, it’s likely an increase in the minimum wage, up to some level, will have a positive effect on the economy.

Kevin Erdmann: I use the data in the detailed supplemental tables (December 2013), here (same document that is referenced throughout this blogpost).

Ah, I see. My original post on the topic used the numbers from their March 2013 article. It looks like the difference may be that the table in the article is based on a $10.10 MW in July 2015, but in the December update, it is based on a $10.10 MW in July 2016.

In my chart, I am using the average wage from 2012. So, I think the adjustment I would need to make is to compare $10.10 to the expected average wage in 2015 or 2016 and to adjust the labor force up slightly. The main effect would be to move the prospective $10.10 data points to the left, as MW will be smaller in proportion to the 2015 or 2016 average wage.

Thanks. You note the Employment Policies Institute. Here’s what their Minimum Wage page says:

Minimum Wage

5 Things You Didn’t Know About the Minimum Wage

1.For every 10 percent increase in the minimum wage, teen employment at small businesses is estimated to decrease by 4.6 to 9.0 percent.1 ◦ According to the U.S. Bureau of Labor Statistics, teen unemployment averaged a record high 24.3 percent in 2009.

2. For every 10 percent increase in the minimum wage, estimates show employment may fall as much as 6.6 percent for young black and Hispanic teens ages 16 to 19.2 ◦ African American teen unemployment averaged 39.5 percent in 2009, which is more than four times the national unemployment average and 26 percent higher than last year.

3. According to recent U.S. Census data, only 16.5 percent of minimum wage recipients are raising a family on the minimum wage. The remaining 83.5 percent are teenagers living with working parents, adults living alone, or dual-earner married couples.3 ◦ Raising the minimum wage is an ineffective tool to fight poverty. Programs like the Earned Income Tax Credit are far better at helping low-income Americans.4

4. The average annual family income of those earning the minimum wage in 2009 is over $48,000.2 ◦ One study found that only 10.5 percent of the beneficiaries of then-candidate Obama’s proposal to raise the minimum wage to $9.50 would come from poor families.4

5. Economists at the University of California-Irvine and the Federal Reserve reviewed the economic evidence and found a majority in support of “the view that minimum wages reduce the employment of low-wage workers.”5 ◦ 27 million Americans lack even the basic skills needed to fill out a job application.6 Minimum wage increases make it more difficult to hire and train less-skilled individuals like this.

Between July 2007 and July 2009, the federal minimum wage increased by 40 percent. A new study from Ball State University found there were 550,000 fewer part-time jobs as a result of this increase.

Federal policy makers allowed the wage hike to go through despite decades of research showing that minimum wage hikes take a sledgehammer to the entry-level job market. As employers are faced with higher labor costs, they hire workers who have more work experience or higher skill levels. This leaves unskilled applicants without a job, and without the invisible curriculum that comes with a first job experience.

http://www.epionline.org/minimum-wage/

Here’s a real example (also, I may add, after the increase in wages, few new workers were hired and existing workers rose to the higher standard):

There was a fast growing firm that was also very disorganized, because it was so busy. One of the recommendations was raising the starting wage from $11 to $13 an hour for all factory workers. However, management decided that was a bad idea. One reason was there were always plenty of applicants for $11 an hour, over the past few years, and of course, there was concern profits would fall, substantially.

However, roughly six months later, management raised the starting wage to $13 an hour and something miraculous happened.

Turnover rates dropped like a rock, overtime was almost completely eliminated, including six day weeks, injuries fell dramatically, hardly anyone called in sick, damage to equipment and products almost disappeared, including steep declines in reject rates, quality rocketed, morale was lifted, management no longer had to spend enormous time interviewing workers, with related paperwork and training, supervisors no longer had to cover for sick workers, to do their jobs, and had time to actually do their work, and profits increased substantially.

Experienced workers who rejected the job when they learned it was $1 or $2 less than they were willing to work for took the jobs at the higher rate. Management had much more time to manage and supervisors had much more time to supervise. So, operations became much more organized and efficient.

A rise in the minimum wage can increase real economic growth.

The higher wage attracts better and idle workers, with higher reservation wages, to increase productivity.

Minimum wage workers have high marginal propensities to consume. So, a higher minimum wage increases consumption.

Only a portion of the higher minimum wage may be passed along in higher prices, because portions may be absorbed by “excess” wages of other workers (or overpaid workers) and “excess” profits (capital as a share of GDP is at an all-time high, while real wages declined).

Weak or poorly managed firms will lose business or fail. However, stronger or better managed firms will gain their business, and also gain from the increased demand.

Real wages of low income workers will rise more than real real wages of high income workers will fall, through prices. So, income inequality will be reduced.

If the economy was able to absorb a $10 real minimum wage, in 1968 (which coincided with a 3.5% national unemployment rate and a much higher teen labor force participation rate), why can’t it absorb a higher real minimum wage with low-wage productivity 25% higher, and the real minimum wage 25% lower, particularly, since per capita real income doubled, profits are much higher as a percent of GDP, and the proportion of real income of the top 20% became much more concentrated, while real median income was stagnant, and then declined since 2000.

Why raising the minimum wage is a good idea:

1. Stimulate economic growth.

2. Correct a market failure.

3. Lower production costs.

4. Raise productivity.

5. Reverse the collapsed teen labor force participation rate.

6. Expand better managed businesses.

7. Create less income inequality.

8. Reduce the saving glut.

9. Boost weak demand.

10. Create better jobs in capital goods.

11. Reduce government and parental support for low wage workers.

12. Lift morale.

The (positive) income and multiplier effects may be stronger than the (negative) employment effect up to $15 an hour.

Does the data in the source table include unemployed people, or only those currently working?

It appears to be the latter. If so, the data does not speak to the potential harm to the unemployed.

Mike

If politicians really wanted to help the poor, raising the minimum wage isn’t enough. Regressive and excessive regulations should be removed and reduced, along with regressive and excessive taxes, fees, fines, fares, tolls, etc., to lower the cost of living and prices, along with spurring economic growth and allowing higher wages.

Raising the minimum wage, in itself, will likely have a small net effect on jobs. However, higher real wages for low income workers mean, for example, they’ll buy more steaks at the Sizzler and fewer burgers at McDonalds. So, the Sizzler will gain jobs and McDonalds will lose jobs.

Jobs at the Sizzler, including related jobs, will likely be better jobs.

Also, I may add, McDonalds (along with dollar stores), in this depression, seems to be a 21st century version of soup lines in the Great Depression (it doesn’t seem like a depression, because the country is much wealthier compared to the 1930s; and even compared to the 1970s, living, labor, or working conditions, and environmental standards are much higher).

Moreover, I may add, more women work at lower wage jobs, because they’re unwilling to work at some higher wage jobs, e.g. in construction, oil fields, transportation/trucking, etc.. Furthermore, women work fewer hours than men. From Wikipedia:

“Most countries in the developed world have seen average hours worked decrease greatly. For example, in the U.S in the late 19th century it was estimated that the average work week was over 60 hours per week. Today the average hours worked in the U.S is around 33, with the average man employed full-time for 8.4 hours per work day, and the average woman employed full-time for 7.7 hours per work day.”

I suspect, the average workweek of over 60 hours in the 19th century is overstated, because of frequent and severe economic boom/bust cycles, which caused long periods of unemployment for many. However, without today’s kitchen and other household appliances, women worked many unpaid hours in the 19th century.

I say keep up this bluster about $10.10 while the movement for $15.00 gains steam. Seattle and Seatak, the recent protests at McDonalds, lawsuits over wage and hour theft all add up to a serious sea change.

The President is siding with you CofC types here with 10.10, take it stupid.

1. Stimulate economic growth – entirely unproven.

2. Correct a market failure – wrong.

3. Lower production costs – wrong.

4. Raise productivity – right, at the cost of lower employment

5. Reverse the collapsed teen labor force participation rate – Supply of teen labor should expand; demand will decline. The market clearing volume will decline.

6. Expand better managed businesses – Possibly true. The more difficult, low wage employees (let’s say, black and Latino young men, our most at risk population) will be let go; Asians, women and whites will be more retained; overall probably a better controlled, if not managed, workplace

7. Create less income inequality – Wrong. Income inequality is best measured by the declining marginal utility of income (DMUWI). All the action is at the low end of the curve, thus, the increase in utility by those earning more is almost certainly more than offset by those without a job.

8. Reduce the saving glut – You mean the US savings glut? Do we have a savings glut? Or are the Chinese going to visit to eat at McDonalds?

9. Boost weak demand – This measure is oriented towards supply; want more demand, have the government spend some money.

10. Create better jobs in capital goods – Right. Capital goods will displace min wage workers. Are there a lot of min wage workers in the capital goods sector?

11. Reduce government and parental support for low wage workers – Lot of assumptions in this one.

12. Lift morale. True, for those with a job; more than offset by those without. Same logic as union wages.

Steven Kopits, the labor economics literature shows raising the minimum wage has a small effect on employment:

http://www.raisetheminimumwage.com/pages/job-loss.

Without higher productivity, wages couldn’t rise and the economy couldn’t expand. How do you know low wages, in themselves, don’t reduce productivity? There’s massive idle capital. We need a lot more capital spending. That’s the point – to raise wages for low income workers, including minimum wage workers.

Raising the minimum wage reduces other production costs, e.g. turnover. So, there’s less waste in production. Overall production costs may fall from a higher minimum wage, resulting in higher income and lower costs to raise output = GDP = income; consumption + saving = income rises; and profits rise.

If teens are unwilling to work for low wages now, why would they be willing to work if wages remain low? And what about older and experienced workers? Should they stay out of the labor force just because there’s an oversupply of labor depressing wages? If you’re 25% more productive, should you be paid 25% less?

When the real minimum wage was above $8 an hour, roughly between 1960 and 1980, the teen labor force participation rate rose from below 60% to above 70%, and when the real minimum wage was at its highest level, in 1968, the unemployment rate for the country was 3.5%.

Chart – Teen Labor Force Participation Rate

http://research.stlouisfed.org/fred2/series/LNS11300012?cid=32449

You don’t know if there’s a saving glut in the U.S.? Affluent Americans more than doubled in the U.S. over the past few decades. They have high marginal propensities to save (see “paradox of thrift”). And, U.S. corporations are hoarding $2 trillion in cash. Moreover, there’s $2.5 trillion held in excessive reserves (collecting interest) in the commercial banking system.

You don’t believe there’s an earned income tax credit or government support for low wage workers? Do you believe they can be independent on $8 or $9 an hour? How can a 20 year old pay for all of his expenses on $8 an hour, unless he lives at home or receives some support?

And setting a labor standard, e.g. a minimum wage, is not the same as unions.

Also, I may add, the decline in the real minimum wage isn’t the only factor that caused the teen labor force participation rate to collapse. The proportion of affluent households more than doubled, since the 1970s. Why would teens work for less than $8 an hour, when they can stay at home, live off their parents (in a nice house, thanks, in part, to the homebuilding boom from 1995-06), and play with electronic gadgets, which became increasingly cheaper over the past 30 years. And, they can go to college, collect free money, e.g. grants and scholarships, or run-up debt in easy to get student loans. The opportunity cost of giving all that up for a low-paying job isn’t worth it to many teens.

not sure if declining teen employment is such a bad thing. teens would be better off focusing on their education than a part time job that realistically will not lead anywhere in three years. plenty of time to work after graduation.

Baffling, yes, people are living longer. So, they can start working later. A college degree today is equal to a high school diploma 50 years ago.

Lee, I hope Seattle gets it’s maximum/minimum wage.

It will be interesting to see the effects of this mandate.

I am sure that this man will be very pleased by this state

fiat.

http://fremont.com/about/lenin/

The demographics table tells me that most people who might be adversely affected by a hike in the minimum wage are likely to be those in the 16-19 age cohort (actually 14-19 because many states allow restricted employment for those under 16). If that’s the case, then this is a no brainer. I will trade higher wages for young (and not so young) adults over teen employment any day of the week. On balance teen employment probably generates negative externalities. And if you’re worried about high school kids trying to save for college, then a better approach might be higher taxes on the rich to fund a greater share of public university education.

Steven Kopits

a minimum wage prevents a contract–an employment arrangement–from coming into being even when there is a willing buyer and seller, if the agreed prices is below the minimum wage. This implies a loss of welfare.

No. You are assuming the labor market is perfectly competitive and the buyers of labor services do not have any monopsony powers over the local labor market. This is unlikely to be true in many cases where the minimum wage is binding. In those cases an increase in the minimum wage would increase welfare. In any event, any adverse welfare effects from a minimum wage could be offset in other ways.

Slugs –

If you assuming a monopsony in minimum wage employment, you’re out of your mind. Go ahead, find me an example. If Princeton, a town of 40,000, we probably have more than 100 min wage employers.

Steven Kopits You’ve obviously never been to a Chamber of Commerce meeting. If you don’t think they talk about ways to shut down businesses that try to hire above minimum wage, then you are one very naïve puppy. And for the record, I have been to Chamber of Commerce meetings where they’ve done just that.

Min wages and unions share many characteristics as regards wage setting. In both cases, market forces are over-ridden by political forces and wages are set above market clearing prices. We know how the union story plays out.

How about minimum wage? Here are some cross country comparisons (can’t verify the source):

Eight nations have no minimum wage, and 8 nations have a minimum wage. Here are the countries by disposable income (after tax) and unemployment rate:

Western European countries with No minimum wage:

Austria – 29,008 4.8%

Denmark – 27,974 6.9%

Finland – 25,747 8.4%

Germany – 24,174 5.2%

Italy – 23,194 12.7%

Norway – 32,620 3.5%

Sweden – 28,301 8.0%

Switzerland – 35,471 3.1%

Western European Countries with a Minimum Wage:

Belgium – 25,642 8.4%

France – 27,452 10.8%

Greece – 21,352 27.4%

Ireland – 41,170 12.4%

Netherlands – 29,269 6.9%

Portugal – 17,170 15.5%

Spain – 26,856 26.7%

United Kingdom – 33,513 7.4%

http://www.aei-ideas.org/2014/01/teen-employment-and-the-minimum-wage-over-60-years/

One reason employers tend to have market power is they have the jobs and many employees are desperate for jobs.

The data you cite explain nothing. Not all European countries are the same and the U.S. is not Europe.

Some European countries have more natural resources, including oil & gas reserves. So, they can afford higher wages or more government subsidies to support low income workers.

It’s possible, countries, and U.S. states, with lower minimum wages also tend to have lower tax rates and less regulation.

The U.S. has a minimum wage and U.S. per capita income is over $10,000 a year more than Germany and other large European countries.

Here’s a poll on the experts (the trend for a higher minimum wage has increased):

“Surveys of labor economists have found a sharp split on the minimum wage. Fuchs et al. (1998) polled labor economists at the top 40 research universities in the United States on a variety of questions in the summer of 1996. Their 65 respondents were nearly evenly divided when asked if the minimum wage should be increased. They argued that the different policy views were not related to views on whether raising the minimum wage would reduce teen employment (the median economist said there would be a reduction of 1%), but on value differences such as income redistribution. Daniel B. Klein and Stewart Dompe conclude, on the basis of previous surveys, “the average level of support for the minimum wage is somewhat higher among labor economists than among AEA members.”

Since the minimum wage was established, U.S. per capita real GDP has grown at a much faster rate (of course, there are other factors that contributed to faster growth).

Average annual per capita real GDP growth:

1863-1937 (75 years): 1.33%

1938-2012 (75 years): 2.44%

Source: Census data and the BEA.

“One reason employers tend to have market power is they have the jobs and many employees are desperate for jobs.”

Peak, is not labor subject to the law of supply and demand…Go to America’s oil shale plays, where labor enjoys

a shortage of worker bees and subsequently much higher wages.

In the Bakken play, burger flippers and Wal-Mart employees are receiving $17.oo per hour…This is the dramatics

of an open market, rather than mandates from governmental units whom do not comprehend the

market place.

Why is there such a limited choice for cable service, along with high prices – the 1984 American Communication

Act…Wherever governmental units meddle, the results are always less choice and higher prices..

Let’s use common sense rather than bathos and pathos….

Hans says: “is not labor subject to the law of supply and demand…”

Yes, up to a point. There’s an imbalance between those with money and those without money.

Prices don’t equal wages, and widgets don’t equal workers.

People respond to incentives. And, the law of supply and demand excludes income and inputs.

I agree with these ideas by economists:

“The argument that minimum wages decrease employment is based on a simple supply and demand model of the labor market. A number of economists (for example Pierangelo Garegnani, Robert L. Vienneau, and Arrigo Opocher & Ian Steedman), building on the work of Piero Sraffa, argue that that model, even given all its assumptions, is logically incoherent.

Michael Anyadike-Danes and Wyne Godley argue, based on simulation results, that little of the empirical work done with the textbook model constitutes a potentially falsifying test, and, consequently, empirical evidence hardly exists for that model.

Graham White argues, partially on the basis of Sraffianism, that the policy of increased labor market flexibility, including the reduction of minimum wages, does not have an “intellectually coherent” argument in economic theory.

Gary Fields…argues that the standard “textbook model” for the minimum wage is “ambiguous”, and that the standard theoretical arguments incorrectly measure only a one-sector market.”

Nice stats, Mr Kopits! One nation with no minimum has double digit

unemployment…Five nations with minimum wages has five with

double digit unemployment.

Compelling? Yes indeed! But then this is Bathos politics and that is

all that matters…Minimum/Maximum wages should be addressed by

social workers and not trained economists.

Look how the Tar Heel state addressed unemployment inequality.

http://blogs.marketwatch.com/capitolreport/2014/05/19/north-carolina-to-cut-jobless-benefits-again-to-lowest-in-nation/?mod=MW_latest_news

Steve Kopits,

Thanks for doing the heavy lifting. I am surprised that Menzie does not see that his logic in his post applies to the unemployed. Those who know that minimum wages reduce employment also know that those who become unemployed are the most vulnerable in society. Steve, that is why your criticisms are so biting. You point out that all the do-gooders who raise the minimum wage hurt the very people they pretend to be helping. As Mises states, the minimum wage is not really economics but politics.

“While traveling overseas, Professor Milton Friedman spotted scores of road builders moving earth with shovels instead of modern machinery. When he asked why powerful equipment wasn’t used instead of so many laborers, his host told him it was to keep employment high. If they used tractors or modern road building equipment, fewer people would have jobs was his host’s logic.

“Then instead of shovels, why don’t you give them spoons and create even more jobs?” Friedman inquired.”

Gov. Mark Dayton and the Minnesota legislature actually did something that will help rather than hurt the state. In what Dayton called an “unsession” they repealed 1,200 foolish and unnecessary laws and actually streamlined some business red tape. Hopefully this will not be a one time event. I imagine there are another 1,200 destructive laws on the books. This is something Gov. Walker from Wisconsin should copy from Minnesota.

Mr. Chinn,

This is my first time posting here, and I do not know all the “correct” protocols, so please do not take what I write as an offense. I can certainly say that you have forgotten more about economics than I will ever know.

That being said…

A statement that there is no negative impact on low-wage employment from an increase in the minimum wage is troubling. What that means (I think) is that low-wage employment is perfectly inelastic to a change in wage. While I will agree that it is somewhat inelastic (example: a room cleaner in a hotel does about 17 rooms per day, that will not increase with a higher wage), I disagree that inelasticity is 1.0.

The CBO agrees with me. They stated recently that the employment loss from a minimum wage increase to $10.10 to be in the vicinity of a half million, with a possibility of the number going as high as one million.

http://www.cbo.gov/publication/44995

Another reason I oppose increasing the minimum wage is admittedly political: I really don’t like our federal government setting a law and walking away without paying for it. Call it an “unfunded mandate” if you will, I just don’t like it.

I would much rather see a serious discussion about increasing the EITC:

1. Expanding the scope to include single wage earners without dependent children.

2. Expanding the benefits.

Expanding the EITC will cost. There is no free ride. But there is no free ride with raising the minimum wage either, it just looks like it.

There are problems with the EITC. It is cumbersome and much easier to fraud than just raising the minimum wage. But it absolutely will not increase unemployment. I posit that it would likely increase employment among single wage earners.

Regards,

Michael Gauss, CFP®