The CBO has revised downward the estimate of potential GDP, implying a relatively small output gap. I wonder about the downward revision (although I have the highest regard for the estimates CBO has generated.)

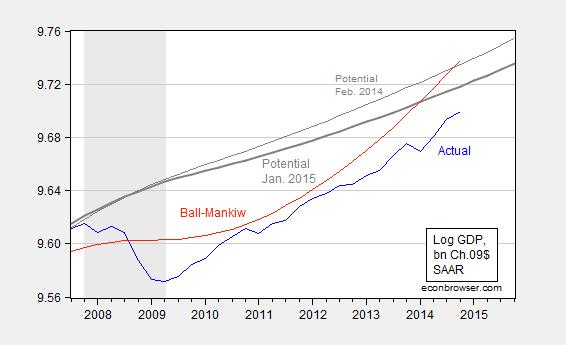

Figure 1: Log GDP (blue), potential GDP from Jan. 2015 (bold gray), potential GDP from Feb. 2014 (gray), and potential GDP as estimated using a modified Ball-Mankiw (2002) approach (red). NBER defined recession dates shaded gray. Source: BEA, 2014Q4 advance release, CBO, Budget and Economic Outlook, Jan. 2015, and Feb. 2014, NBER, and author’s calculations.

The output gap using the estimated potential from the CBO is about -1.9% (in log terms); using the estimated potential from last year’s Outlook would’ve implied a -3.5% gap. While I know the developing consensus is that the economy is approach potential, I do wonder why inflation is so low, and dropping, if we are near capacity. After all, Milton Friedman’s accelerationist hypothesis, as described in AER (1968), would suggest that the gap is widening, not shrinking.

Arguments that negative input price effects explain the decrease in inflation are fine with me. These random shocks are incorporated in the Ball-Mankiw (JEP, 2002) procedure, implemented in this post. I’ve updated an implementation of this approach, setting expected inflation equal to lagged q/q PCE inflation. This yields the red line in Figure 1. The implied output gap is then -3.8%.

The qualitative aspect of the estimate is intuitive, given the trend in inflation.

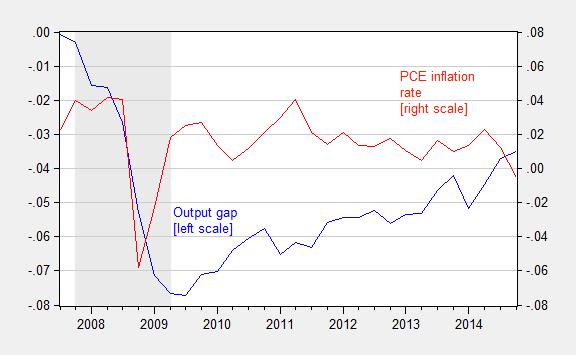

Figure 2: Log output gap as measured using the modified Ball-Mankiw procedure (blue, left scale), and q/q annualized PCE inflation (red, right scale). Source: BEA, NBER, and author’s calculations.

Now, one could take issue with the assumption of adaptive expectations, viz., πet = πt-1. If one argues expectations of PCE inflation have been anchored at 2%, one obtains an output gap of -11.4%. That outcome is driven by the plunge in PCE inflation relative to 2% shown in Figure 2.

The bottom line: The output gap can credibly be interpreted as still substantial; and given output growth in 2014Q4 seems closer to 2.1% rather than 2.6% q/q SAAR (MacroAdvisers today), perhaps the gap is not closing as fast as typically thought.

The output gap may be greater, because older workers are working longer.

“In 1975, nearly 35 percent of the labor force was 55 and older, but that figure had fallen to about 29 percent by 1993.

Since then, labor force participation for this group has risen steadily, peaking at 40.5 percent in 2012.

In 2013, it barely declined, with 40.3 percent of older workers still in the labor force.

Workers 55 and older have among the lowest unemployment rates, and those under 35 among the highest.”

http://www.cleveland.com/business/index.ssf/2014/06/older_workers_stay_on_job_past.html

or they need to upwardly revise gdp to match output. with the globe slowing down in 2012, that makes inflation tough unless you are above average output. 97-00 says high. where is the gdp surge showing the 2014 employment surge?

The Rage says: “where is the gdp surge showing the 2014 employment surge?”

Maybe, it went to reduce the budget deficit.

Here’s a couple of charts:

http://taxfoundation.org/blog/cbo-budget-deficit-will-shrink-it-continues-climb

Since Menzie has such respect for CBO;

http://www.cbo.gov/sites/default/files/43934-Means-TestedPrograms_one-column.pdf

which documents something like a quadrupling (in inflation adjusted terms) of means-tested benefits for things like, EITC, food stamps, housing assistance, medical care etc, in the last four decades. Talk about unsustainable trends.

Next time you hear someone whining about the stagnation of the middle class….

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Patrick R. Sullivan: Well, if one looks at Figure 1, you’ll note that as a ratio of GDP, expenditures are coming down. Before the deepest recession since the Great Depression was bequeathed to us under the G.W. Bush Administration, expenditures to GDP were about 3% from mid-1990’s to ’07. It would be natural to expect an uptick under the extraordinary conditions that obtained during massive recession that started in 2007Q4, so I don’t think you should extrapolate a trend including the recent years.

Sullivan, the things you point out go to the poor, not the middle class.

It is line with a lot of data that shows the poor are being helped, but it does not contradict the analysis that the middle class is being squeezed.

try harder.

Given that we added almost 750 k jobs in Nov and Dec., I am inclined to think GDP may be revised up for Q4, as it was in Q3.

My personal sense, without anything more than gut feeling, is that the gap is on the order of 4%, maybe $700 bn, maybe more if the economy finds its legs.

I think the employment numbers are interesting: 1 million new jobs and an increasing unemployment rate. This suggests there are still substantial reserves of latent labor and that changes will now come principally from the employment-pop ratio and labor force participation, not the unemployment rate. I think looking at these dynamics in a separate post would be worthwhile.

Also, did you notice the wage inflation? You’ll recall I forecast that perhaps two months ago.

steven, calculated risk has an interesting note on employment, which I assume you already saw. interesting to note how much private sector employment was created under obama. and look at the terrible government jobs data under obama-that is our austerity. imagine the growth if we had not lost all of those government jobs. why did we grow government employment under reagan and bush, but needed so desperately to cut government jobs under obama? we would have had a nice strong recovery had we not sabotaged growth for the sake of austerity cranks!

http://www.calculatedriskblog.com/2015/02/best-private-sector-job-creation-ever.html

I take recent wage, employment and credit numbers in the US to be materially supportive of supply-constrained oil markets theory. Given the collapse in oil prices, I expected big numbers, and we’re seeing big numbers. When oil is a binding constraint, it holds back GDP. When there is ample oil, then GDP behaves more normally. And we’re seeing that now.

This week’s articles:

In Platt’s:

http://blogs.platts.com/2015/02/06/lesson-from-oil-history/

My weekly article in the UAE’s National. This is actually an important policy piece disguised as a op-ed

http://www.thenational.ae/business/energy/what-saudi-arabia-should-say-about-its-oil#full

Quotes from me this week in the press:

In The Guardian: http://www.theguardian.com/business/2015/feb/07/shale-industry-hibernation-us-economy-fears

In Bloomberg: http://www.bloomberg.com/news/articles/2015-02-05/andy-hall-sees-oil-rebound-to-65-beneffiting-shale

Well, there is an easy experiment to determine the actual potential GDP but that will never happen because the Federal Reserve’s job is to put their boot on the neck of workers before that ever happens in order to prevent workers from getting any leverage at all over the 0.1% who employ them. According to the Fed, the greatest threat to America today is the possibility of 2.1% inflation.

Economists habitually say that we must have an independent Federal Reserve, when in practice that independence simply means an unchecked power to serve the banker class.

@Joseph: “Economists habitually say that we must have an independent Federal Reserve, when in practice that independence simply means an unchecked power to serve the banker class.”

Precisely. One of the primary roles of the Fed is to run political cover to ensure “independence” for the TBTE/TBTJ private bankers’ (owners of the Fed) license to steal labor product, profits, and gov’t receipts in perpetuity, i.e., G-d’s work.

Effectively, the oligarchic banker caste serve and benefit at the pleasure of the Power Elite top 0.001-0.01% (Anglo-American, German, Dutch, Swiss, and Milanese), who are essentially untouchable and who confer the neo-feudal-like power on the bankers to plunder the masses and the planet with no challenge to their values, motives, and actions, or accountability for the consequences of same.

As a result, economists serve largely in the role of ministerial sophists to the Power Elite and banker oligarch castes, providing all manner of specious intellectual rationalizations for economics as politics as war by other means for the business of empire: war, expansionism, resource expropriation, co-opting of foreign elites, profit, and exacting various forms of tribute from client-states.

http://ineteconomics.org/new-economic-thinking/michael-greenberger-setting-stage-next-financial-crisis

https://www.bis.org/statistics/gli/glibox_feb15.htm

http://ineteconomics.org/institute-blog/alan-taylor-surprising-new-findings-point-perfect-storm-brewing-your-financial-future

http://michael-hudson.com/2015/01/inequality-privatisation-of-the-earth/

http://www.voxeu.org/article/rich-and-great-recession

https://www.youtube.com/watch?v=pLtwWsLgaz8

https://www.youtube.com/watch?v=cvpQMkYY5mY

http://www.voxeu.org/article/illusion-monetary-policy-independence-under-flexible-exchange-rates

Prof. Chinn,

In this post and the last, I believe you underlined just how tricky estimating the output gap is.

In the Furman/CEA analysis you shared in the last post ( http://www.whitehouse.gov/blog/2015/02/06/employment-situation-january ), almost a third of the drop in the labor force participation rate since 2009 in unexplained by their estimate of the output gap and by the effects demographic change. If we replaced their output gap estimate by yours/Ball-Mankiw, this “Residual” component would be much smaller.

In my opinion, this suggests that the Fed should not be discussing raising rates, but rather how much more bond-buying they still need to do to help close the output gap.

Over the very long run, real GDP tracks population/labor force growth and its replacement along with labor’s capitalization and returns to labor as a share of GDP. Consequently, US potential real GDP is no faster than 1-1.5% (0.3-0.8% per capita), and probably slower given that high levels of debt to wages and GDP and demographics will reduce investment/employee, growth of domestic production, labor’s share of GDP, and thus constrain real productivity to below 1%.

Deindustrialization since the 1970s-80s, offshoring, labor arbitrage, “globalization”, an order of exponential increase in debt to wages and GDP, and regressive taxes on earned income have driven labor’s share of GDP to a record low, which in turn is a factor causing real labor productivity to decelerate, as labor’s share of output after regressive taxes on labor and production, debt service (“rentier taxes”), and now soaring “dis-ease care” and “education” costs is at debilitating costs to the bottom 90% of workers, reducing or eliminating growth of real disposable income for the lower- and middle-income working class.

In the meantime, hyper-financialization of the economy has resulted in total annual net flows to the financial sector equaling, or periodically exceeding, total annual GDP growth, with the overwhelming majority of the growth of net flows going to the top 0.001-1% of households via unearned rentier income or indirect flows from fees for service from the increasingly financialized sectors of the economy, such as “dis-ease care”, “education”, high tech (via stock options and associated income flows), etc.

Thus, the top 0.001-1% have a perpetual net direct and indirect rentier claim on any and all growth of real wages, profits, and gov’t receipts, precluding any real growth per capita hereafter.

My guess would be that Friedman would advocate a more expansionary $policy for the USandA.

rtd

Read the paper Menzie made reference to, as I read it, Friedman would not. I suspect he would see the current situation as the common overreaction the Fed has a history of. Once the banking crisis was over, he would have advocated a small, transparent and publicly announced increase in the money supply. Friedman thought the Fed had no capable means of targeting unemployment, and would not have supported the QE’s. IMHO.

Thank-you, Menzie for the link, I would much like to read a posting by you dedicated to this 1968 publication. Your take on what you agree with, disagree with, and what you see as advancement in the last 4 decades in economic science which answer some of the questions Milton wrote. i would particularly be interested in the the relative change between the nominal and real quantity of money, if that discourse would be interest to you.

Ed

Ed Hanson: Most of what Friedman wrote in his AEA address has been incorporated into mainstream (read textbook) macroeconomics, so most I agree with. I also like the nuance (that is often lost upon readers) at the top of page 14, which follows logically from his work of economic history of the Great Depression with Anna Schwartz.

I am also skeptical of a literal reading of the accelerationist hypothesis at low inflation rates (which is why I only used the Ball-Mankiw method as a cautionary note). At low inflation rates, consider this 1996 paper by Akerlof, Dickens and Perry.

The slowing of productivity growth is something that usually happens in a late cycle context and probably supports the thesis that there is less slack in the economy than traditional measures show.