On Friday I visited the University of Alberta in Edmonton, where falling oil prices have brought a record provincial budget deficit despite aggressive tax increases and spending cuts. Here I pass along some of what I learned about how the plunge in oil prices is affecting Alberta’s oil sands operations.

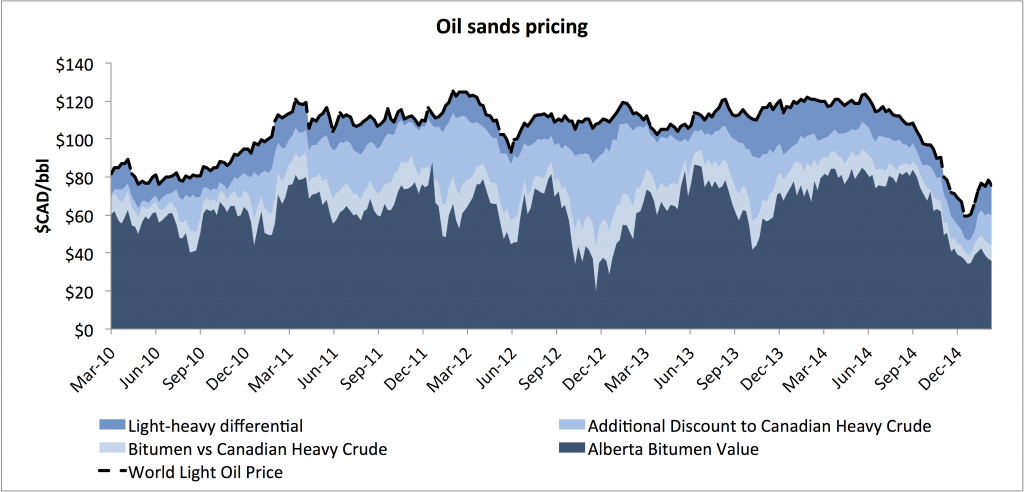

A couple of factors have cushioned Canadian oil producers slightly from the collapse in oil prices in the U.S. First, while the dollar price of West Texas Intermediate has fallen 45% since June, the Canadian dollar depreciated against the U.S. dollar by 18% over the same period, and now stands at CAD $1.26 per U.S. dollar. Since the costs of the oil sands producers are denominated in Canadian dollars, the currency depreciation is an important offset. There has also been some narrowing of the spread between synthetic and other crudes. As a result of these factors, the University of Alberta’s Andrew Leach calculated that when WTI was selling for US $50 a barrel, Canadian producers were receiving CAD $60 per barrel of synthetic crude.

Source: Andrew Leach.

Oil sands and U.S. tight oil production have been the world’s primary marginal oil producers in recent years, by which I mean the key source to which the world could turn in order to get an additional barrel of oil produced. Ultimately in this regime it is the long-run marginal cost of the most costly producing operation that puts a floor under the price of oil. A company with sunk fixed costs will continue to produce even if price is below long-run marginal cost as long as cash flow is greater than current operating expenses. But for anybody considering a new project, the up-front capital costs and required rate of return have to be factored into new decisions. A project won’t be started if price is below the long-run marginal cost.

But oil sands and tight oil are polar opposites in one important respect. Tight oil projects can be up and running with a short lead time and have a short producing life. I expect for this reason that declines in tight oil production could be seen very soon. By contrast, oil sands represent a decades-long investment, meaning that completed projects that cover operating costs, as well as many projects that have already been started but not yet completed, will be producing for a long time. Leach estimates that operating costs are CAD $34.45 barrel for Suncor and CAD $38.31 barrel for the Canadian Natural’s Horizon project. As long as synthetic crude fetches $CAD 60, those operations are not about to shut down. Leach concludes:

So, what does this all mean? Oil sands production will continue to increase in the near term, likely through 2020 if not beyond, unless prices decrease materially relative to today. If they remain as low as they are, there’s certain to be a downward revision in the long-term growth forecasts for oil sands, but don’t expect production to decline in the near term. At today’s prices, industry forecasts of three million barrels per day by 2020 are likely to underestimate production by a bit, but the real kicker will be on the value of that production to all concerned—governments, via taxes and royalties, and shareholders will all suffer much lower returns from this development than they would have expected less than a year ago if prices stay where they are today.

But evidence of retrenchment is nonetheless unmistakable. Last month the Financial Post reported

Producers including Suncor Energy Inc, Cenovus Energy Inc and MEG Energy have slashed 2015 capital expenditures in response to the oil price slump. Wood Mackenzie estimates industry spending will drop by $1.5 billion over the next two years, down 4% from its fourth-quarter 2014 assumptions…. Royal Dutch Shell Plc said it was shelving plans to build the 200,000-bpd Pierre River oilsands mine in northern Alberta, the largest such project to be deferred.

And in another report from March 12:

About 1,000 construction workers employed by a contractor at Husky Energy Inc.’s Sunrise oilsands project were laid off unexpectedly on Wednesday, a union official confirmed…. Suncor Energy Inc said in January that it would cut 1,000 employees and contractors, while Royal Dutch Shell Plc is cutting about 300 from its oilsands operation.

And on Friday the Globe and Mail reported that China’s CNOC decided to write down $842 million in its overseas investments, including extensive investments in Canadian oil sands.

Price cannot exceed long-run marginal cost in equilibrium. But at least in the case of oil sands, it could take a long, long time to reach that equilibrium.

i know that tar sands aren’t using rigs, but the canadian rig count from Baker Hughes is off dramatically…Canadian drillers shut down another 20 rigs this past week, leaving them with just 120 rigs active..that’s down from the 300 rigs they were running just 3 weeks ago…this week they idled another 12 oil rigs, leaving them with just 18, while they shut down 8 of the 110 gas rigs they ran last week, leaving 102…the Canadian rig count is now down 178 rigs from a year ago, with oil rigs down 137, and gas rigs down 41…

SAGD uses drilling rigs, which is a major portion of the tar sands. FYI.

Canada’s net oil exports (total petroleum liquids + other liquids, EIA) increased from 0.8 mpbd in 2004 to 1.7 mbpd in 2013 (and EIA production data suggest another increase in 2014).

However, combined net oil exports from the seven major net oil exporters in the Western Hemisphere in 2004* fell from 5.9 mbpd in 2004 to 5.2 mbpd in 2013. In other words, rising net oil exports from Canada were (so far, through 2013) unable to offset declines elsewhere in the Western Hemisphere.

We see a similar pattern on a global scale as the combined net oil exports from the (2005) top 33 net oil exporters (what I call Global Net Exports, GNE) fell from 46 mbpd in 2005 to 43 mbpd in 2013. The volume of GNE available to importers other than China & India fell from 41 mbpd in 2005 to 34 mbpd in 2013.

*Canada, Mexico, Venezuela, Trinidad & Tobago, Argentina, Colombia, Ecuador

Incidentally, despite discussions in 2009 about Brazil “Taking market share away from OPEC,” Brazil in recent years has been a net oil importer, with a recent track record of increasing net imports, even if we count biofuels as production.

In April, 2009, when the following Bloomberg column was published, monthly Brent crude oil prices were then in the process of increasing at 43%/year (from 12/08 to 2/11).

April, 2009: OPEC Cuts Thwarted as Brazil, Russia Grab U.S. Market

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aiSCDyK4CWmI&refer=news

The Alberta government raised a number of taxes except taxes on gasoline and diesel. From a political perspective, interpret that as: no carbon tax increase on consumers.

This means that it is ‘game on’ for the anti-oil sands global environmental movement. As no serious effort is being made to curtail consumption, targeting and sabotaging production and distribution by holding up and blocking new oil pipeline capacity remains the number one strategy.

I call it Albertan exceptionalism. Canada’s taxes on dirty fossil fuels are the second lowest among the rich OECD countries. Alberta’s tax rates on gasoline, etc., are the lowest in Canada.

Others might call it exceptionally myopic and stubborn as the discount Albertan producers received relative to the Brent benchmark amounts to billions and billions of dollars.

On the bright side, anti-oil sand and anti-pipeline campaigns are big fund raisers for the environmental movement. From a perspective of equity and fairness, perhaps that is a good thing and suggests that Albertans are motivated by something more noble than just a crass cheap energy entitlement.

How soon will you do a post on Bernanke’s Brookings blog piece out yesterday morning? It is right down Econbrowser’s alley, and Brookings screens so that only comments of those in agreement with him appear. The world needs full disclosure on the past 30 years of how the Federal Reserve led us into this box canyon which will take decades (if ever) to backtrack out of. This is precisely in line with my longstanding request for Econbrowser do a post on the unintended consequences of QE and ZIRP, a part of the larger overall 30 year picture. Thank you …

JBH, JDH is not the man to speak out loud against the party line. Though you are right, this Bernanke blog is a bad joke, pure propaganda. “low interest rates are not a short-term aberration, but part of a long-term trend” -well, of course, that’s how the intention was. And who the winner is, everyone knows.

Some US refiners cutting back on blends of heavy crude and condensate

It’s possible that last year US refiners hit the limit of what they could take in terms of very light crude and condensate as a percentage of total Crude + Condensate (C+C) inputs, causing them to reject more very light crude and condensate, and resulting in still relatively high net crude oil imports of about 6.8 mbpd, which is 44% of the C+C input into US refineries (four week running average)–contributing to the large build in total US C+C inventories, and I’m not sure how much demand there may be globally for more very light crude and condensate.

Until recently, I lacked hard evidence that refiners were not happy with the blend of C+C production that they were getting from US producers, but recently there was a Reuters article which is something of a “Smoking Gun.”

U.S. refiners turn to tanker trucks to avoid ‘dumbbell’ crudes

http://www.reuters.com/article/2015/03/23/us-usa-refiners-trucks-analysis-idUSKBN0MJ09520150323

Excerpt:

As noted in the article, producers are blending low API gravity crude with 50 API range condensate to get an “Imitation WTI” type crude oil with a low 40’s API gravity, but insofar as the refinery is concerned, there is no difference between buying one barrel of low API crude and one barrel condensate versus two barrels of blended crude and condensate. In both cases, the combined input of the two barrels are deficient in distillate content.

So, I suspect that not only are US condensate inventories building, but inventories of “Imitation WTI” type crudes may be building too.

Re: Some US refiners cutting back on blends of heavy crude and condensate

Regarding tight/shale play potential globally, a key question is whether wells like the Bakken Play, i.e., quickly declining wells with an average production rate of a little over 100 bpd and a median production rate of less than 100 bpd, will work in much higher operating cost areas around the world.

Also, one has to consider the quality of the liquids production from tight/shale plays.

What refiners want and need is generally 40 API gravity and lower crude oil (and when we ask for the price of oil, we get the price of crude oil with an API gravity of less than 40). The EIA’s own data and projection show that it took about half the global (oil and gas) rig fleet to increase US 40 and lower API gravity crude oil production by just 0.5 mbpd from 2011 to 2014.

EIA chart showing actual and projected US liquids production by API gravity (light blue and lower on the chart is 40 API and lower):

http://i1095.photobucket.com/albums/i475/westexas/US%20Crude%20Oil%20Production%20by%20Type_zpsso7lpqgq.png

Grades of Global Crude Oils (API gravity scale tops out at 40):

http://i1095.photobucket.com/albums/i475/westexas/APGravityVsSulfurContentforCrudeOils_zpsc28e149c.gif

Refinery Yields by API gravity (note tremendous decline in distillate yield over 39 API):

http://i1095.photobucket.com/albums/i475/westexas/Refineryyields_zps4ad928eb.png

In the US context, some (many?) producers banked on [well, issued bonds on] the assumption of the cash flow generated by higher prices, analogous to Alberta basing expenditures on the revenues that come only from high oil prices. How important is herd behavior in credit markets for oil developers / producers? A priori I would expect there is substantial herd behavior, and that access to credit will dry up ever faster than do the wells drilled into tight formations. Now orderly debt reorganizations should recognize the sunk cost / marginal cost distinction, so in principle a wave of defauts and bankruptcies shouldn’t affect output. Workouts aren’t always orderly. The overreaction of financial markets might also mean that even firms with really good leases that still make economic sense at today’s prices won’t be able to raise the funds to keep drilling, accelerating the pace of output decline as tight formation wells deplete.

Are there any short-term, finance-sensitive operations with oil sands? — perhaps in downstream operations, rather than the mines themselves? Again, the logic of high sunk costs / low marginal costs is straightforward and (to me) compelling, but in the industry I watch most closely (autos incl suppliers and dealers) some of these indirect channels such as finance can be pretty important over a short (2 year or so) time horizon.

JDH wrote:

On Friday I visited the University of Alberta in Edmonton, where falling oil prices have brought a record provincial budget deficit despite aggressive tax increases and spending cuts.

Why is a failure of a Keynesian solution always a surprise? When taxes are increased, especially aggressively, and budgets are cut economies are restricted. This should never be a surprise. During the 2000 recession all the states were encouraged to increase taxes and cut budgets. A number of states did just the opposite. The four states that did not fall into a deficit all were tax cutting states.

What facing an economic problem the most logical solution is to remove wedges to businesses so that they can continue to realize profits, pay employees, and provide goods and services to people. That is what an economy is about. Economy is not about Sudoku!

JDH wrote:

…the dollar price of West Texas Intermediate has fallen 45% since June, the Canadian dollar depreciated against the U.S. dollar by 18% over the same period, and now stands at CAD $1.26 per U.S. dollar. Since the costs of the oil sands producers are denominated in Canadian dollars, the currency depreciation is an important offset.

The US dollar has been soaring and the analysis of the Canadian dollar is that it is depreciating? Surprise, the Canadian dollar has been much more stable than the US dollar for over a decade. The US dollar plummeted and the Canadian dollar was stable. Economists said the Canadian was appreciating. Now the US dollar is soaring and the Canadian dollar is stable. Economists say the Canadian is depreciating. Now just what was that relativity theory again?