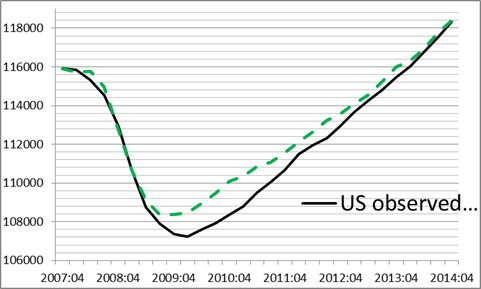

In a previous post, Laurent Ferrara, Valérie Mignon, and I examined the nonlinear relationship between employment and output (based on J.Macro (2014)). Using the most recent data, the level of (establishment) employment now matches the output level. Figure 1 shows the actual level, and the predicted level from a nonlinear error correction model that allows short run dynamics to differ between recession and non-recession regimes.

Figure 1: Actual employment (black) and prediction from nonlinear error correction model.

This does not mean that employment is at full employment levels; rather it means that the long run relationship between employment and output has been restored. To the extent that output remains below potential, then employment is still below the corresponding natural rate.

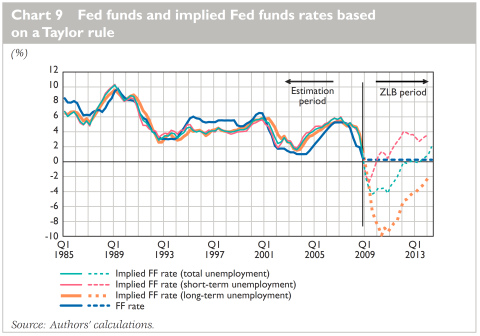

On a related note, Laurent Ferrara and Giulia Sestieri observe (in “US labour market and monetary policy: current debates and challenges”) that the historical relationship between the target Fed funds rate and inflation and long term unemployment indicates a current target rate that remains below zero.

Chart 9 from L. Ferrara and G. Sestieri.

From the article:

This Chart confirms what Janet Yellen has repeated a number of times in her speeches, especially during the period of quantitative forward guidance from December 2012 to December 2013, namely that the unemployment rate is not the only variable to be taken into account by the FOMC in its monetary policy decisions. Indeed, the prescriptions of a standard Taylor rule, based on the total unemployment gap, would have implied a rate increase from the second half of 2013, while a measure of the short-term gap would have implied a rate increase already in 2010. At this point, the specification using the long-term unemployment rate would still prescribe a negative policy rate.

These observations are particularly relevant, in the context of Chair Yellen’s recent speech:

Under normal circumstances, simple monetary policy rules, such as the one proposed by John Taylor, could help us decide when to raise the federal funds rate. Even with core inflation running below the Committee’s 2 percent objective, Taylor’s rule now calls for the federal funds rate to be well above zero if the unemployment rate is currently judged to be close to its normal longer-run level and the “normal” level of the real federal funds rate is currently close to its historical average. But the prescription offered by the Taylor rule changes significantly if one instead assumes, as I do, that appreciable slack still remains in the labor market, and that the economy’s equilibrium real federal funds rate–that is, the real rate consistent with the economy achieving maximum employment and price stability over the medium term–is currently quite low by historical standards. Under assumptions that I consider more realistic under present circumstances, the same rules call for the federal funds rate to be close to zero. Moreover, I would assert that simple rules are, well, too simple, and ignore important complexities of the current situation, about which I will have more to say shortly.

The speech is also discussed at length by Tim Duy. My argument for why monetary policy should not yet be tightened here.

I hope all of the professional economists are busy re-writing the textbooks based on our experience since 2007. Seems like all the various “rules” have been turned into nothing more than guidelines or something worse. The vast majority of economics, excluding Keynes, has proven fallacious.

If you look at the various versions of the Taylor rule they all seem to have two features.

One, is that they give inflation a greater weight than employment. That is what happened under Volcker and most Taylor rules consider that experience to be the norm. But Volcker had a clear mandate to give inflation a greater weight. Historically, Fed policy has tended to give unemployment and inflation roughly equal weight. Maybe we should give inflation a greater weight. But I think it is a question that should be openly debated, rather than trying to sneak that “value” into a rule based policy. I interpret current law or the dual mandate to give the two roughly equal weight.

Two, is that Taylor seems to keep restating and changing his rule every six to twelve months. If we are to have a rule it should be much more stable than the Taylor rule has been over the years.

@Paul Mathis:

“The vast majority of economics, excluding Keynes, has proven fallacious.”

So… the vast majority of economics that is being taught right now from MIT Econ Dept and down the list of the best econ departments in the world is fallacious? The vast majority of economics being published in the elite journals like AER, JPE, QJE, etc is fallacious? This is rough, man…. never knew this…. they must have lied to me all these years and decades….

Well, let’s see. Krugman, Stiglitz, Yellen, Evans and Bernanke are all Keynesian and they have the best records of the past 7 years, while guys like Taylor, Barro, Cochrane, Meltzer, et al., have been complete failures. So yes, the Anti-Keynesian nonsense we’ve been indoctrinated with over the past 30 years has been proven to be bunk. Interestingly, Keynes himself experienced the same thing in the aftermath of the Great Depression.

Paul Mathis: You do not know what you are talking about. Though they may have made contributions to the discipline, none of these academics have good track records. Not one. One could almost posit a law about this. None mentioned have regularly published forecasts. So an occasional correct call proves nothing. From a broad perspective, those at the fringe of the mainstream have done by far the best. Roubini, Steve Keen, Stockman, Mark Skousen, the deceased Hyman Minksy, these got it right about the crisis. That was an important thing to do. Hedge fund managers are far more correct than academics in knowing what is going on and putting down bets accordingly. They have skin in the game. Academics do not. For readers who want to be better equipped, here is a short list of 5-star forecasters: Kyle Bass on Japan, Michael Pettis on China, Finance Minister Varoufakis on Greece, Lacy Hunt at Hoisington on interest rates, and a select group of forecasters you may never have heard of – like Julia Coronado at BNP Paribas, John Silvia at Wells Fargo, and Paul Ashworth at Capital Economics on real growth. Rain or shine, people like this are the lodestar. Ships guided by the wandering stars of academic mainstream naturally enough came to grief on the shoals. None more so than those relying on the utterly inept guidance of Bernanke and Yellen.

“the utterly inept guidance of Bernanke and Yellen”

LOL. Bernanke and Yellen have been consistently right for the past 6.5 years which is why we have had over 6 years of economic growth and 12 million new private sector jobs since the job market hit bottom in January 2010. They have also been right on inflation and interest rates despite all their naysayers who have been utterly discredited.

You are right about Minsky, however.

jbh,

“Hedge fund managers are far more correct than academics in knowing what is going on and putting down bets accordingly. They have skin in the game. Academics do not.”

if you look at how much money the hedge funds lost during the financial crisis, you cannot possibly believe they know more than others. other than a couple hedge managers who placed big bets (gambles) on housing, there was a ton of money lost during the depression and years since. you need to rethink your criteria for success.

You know, this is an interesting post. Nothing in the comments. Tough writing wholesale, sometimes.

So let’s see if I understand this correctly, Menzie. During a recession, productivity rises per employee as the least productive employees are let go, and therefore output does not fall as much as employment. That makes sense.

In a recovery, however, lower value-added employees are re-hired and the employment to output relationship is restored. Does that then mean that GDP growth and employment growth will be more closely linked from here on out?

Steven K said: “…During a recession, productivity rises per employee as the least productive employees are let go,…”

Having been through a bunch of recessions, I would like to propose a different mechanism: Productivity increases, not because the least productive employees are let go, but mainly because the least productive companies go out of business, or existing companies close down unprofitable divisions.

It is also worth noting that merely cutting staff, randomly, while maintaining department work load will increase productivity. This is commonly the case, and employees accept it, because they are happy to have a job. You could call this: “The beatings will continue, until productivity improves”. Needless to say, that mode fails when employment opportunities takes a turn for the better, which also might explain why Boom-times tend towards lower productivity.

As for interest rates and the long term unemployed: This is a very tricky call right now. Easy to get wrong. (Much safer to second guess after the fact.) I am inclined to agree with your thesis for the moment, although as I have said before, I think Q2 will be a turning point. By Q3, I would guess that either the thesis will have been proven right, or wrong, as the case may be.

I think the whole issue merits further exploration. That is, it’s not only the long-term unemployed who matter here, but more broadly the employment to population ratio. To say that we don’t understand the dynamics well is an understatement.

Historically, productivity has displayed a very cyclical patter of being the strongest in the first year of a recovery and weakening as the cycle progressed.

It typically bottomed during recessions. This cyclical pattern clearly plays a rose in the relationship between hours worked and output.

That should be role not rose.

The Fed deserves a lot of credit (pun intended) for its accommodative policies in this slow recovery over the past six years.

It seems, there’s still a lot of slack in the labor market. And, the recent relief in oil prices, along with a stronger dollar, lessens inflation.

If the slow recovery continues, a Fed Funds Rate around 1 percent within two years seems realistic.

Well I can’t believe I’m saying this, but I’ve come to realize climate change is a real problem that we do really need to address. If we don’t change policy soon, it will be too late and we could do irreparable damage to the earth’s environment.

Evidence?

Steven,

It was a BBC news article yesterday, available here, that made me think that we should have taken the scientific evidence more seriously. And then there’s also the seasonal evidence.

Ahhh, you got me!

Initial unemployment claims at 268,000. Very, very strong report.

Oil trade deficit continues to improve, but this will likely peak and deteriorate over the next year or so due to falling domestic production and rising oil prices paid for imports. Oil deficit will begin to improve again from around Q2 2016.

SA auto sales over 17 million, again very strong report.

This economy is really rolling right now.

McDonald’s also announced a 10% wage increase for 90,000 employees. Something’s going on.

You should have waited for Friday’s jobs report before declaring victory. The job market is clearly very weak and declining.

Paul Mathis: If you inspect the scale of the graph, you will see 120 thousand (about the shortfall relative to consensus) is barely detectable. In addition, we hardly declare victory. In fact, what I asserted is that the long run output-employment relationship has been re-attained. Given tracking nowcasts for 2015Q1 are at less than 1% q/q SAAR, it’s hard to say that a preliminary 126K for March is off-track in this statistical sense.

On the other hand, if you say that employment is below full employment levels (and output below potential), I agree — and indeed said exactly that in the post.

So time to raise rates then?

I’m with Charles Evans on this one. Perhaps J.M. Keynes can help out:

“The austere view, which would employ a high rate of interest to check at once any tendency in the level of employment to rise appreciably above the average of, say, the previous decade, is, however, more usually supported by arguments which have no foundation at all apart from confusion of mind.” The General Theory, p. 327.

Paul Mathis: I don’t think you are reading accurately what I am writing. I have been consistently arguing that we should not be eager in raising the policy rate. I believe that is what you are arguing. Are we not agreeing, then?

Yes Menzie, we agree. Now is not the time to raise rates. If anything, another round of QE aimed a lowering mortgage rates would be appropriate, but that is not happening. We need more stimulus. If we don’t get it, we are in uncharted waters and the fog of unknowns.

Initial unemployment claims state the job market is strong–new jobs indicate that it might be declining.

But as you know, I’m a real economy guy. Why would the US founder? I agree with Menzie that we might see some weakness in exportable goods employment due to a strong dollar. Also some weakness in services and manufacturing related to oil. But the latter is the result of a huge burst of production from the oil patch, and the former is also the result of a huge burst of production from the oil patch. They both attest to the success of Drill Baby Drill (which I hate as a phrase, by the way). But if you think we’re seeing a little Dutch Disease, we might.

Do I think it will materially slow down the economy? No. I agree with Menzie that there is still slack in the labor market, although I am not convinced there is much slack in the minimum wage sector (didn’t think I’d ever write that). Ordinarily, we would expect a big surge in illegal population growth during such periods to fill the need, but it’s not clear to me that the border is as open as it once was. Also, I suspect the Mexicans are a bit behind the curve, psychologically speaking. I think the strength of the min wage market has taken a lot of folks by surprise, including the more and less documented Latino community.

Finally, I might add that there may be a change of sentiment brewing in the Latino community. Many of these folks have become established and increasingly successful, and their interests may be gradually swinging towards pulling up the ladder now that they’re on the boat.