Some people would have you believe the impact of a minimum wage hike on employment is known to be large and negative. A cursory acquaintance with the literature helps in immunizing one (if one believes in vaccines and the like) against falling for such assertions.

The meta-analysis of Doucouliagos, Hristos, and Tom D. Stanley. “Publication Selection Bias in Minimum-Wage Research? A Meta-Regression Analysis.” British Journal of Industrial Relations 47.2 (2009): 406-428. [ungated working paper version] is useful in this regard.

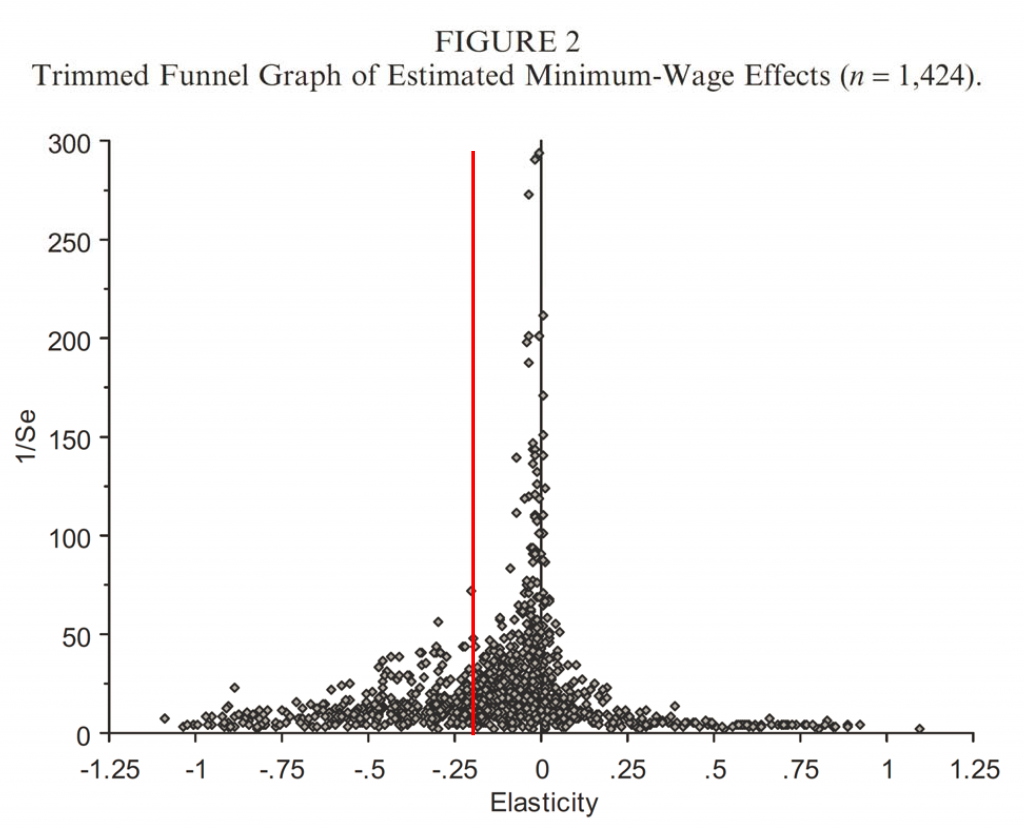

Figure 2 from Doucouliagos, Hristos, and Tom D. Stanley. “Publication Selection Bias in Minimum-Wage Research? A Meta-Regression Analysis.” British Journal of Industrial Relations 47.2 (2009): 406-428. [ungated working paper version], with red line drawn in at elasticity = -0.2.

I have drawn the mid-point of the estimate range cited by Professor Neumark (a respected researcher on minimum wages). It is useful to observe that the range he cites (-0.1 to -0.3) is substantially to the left of where the most precisely estimated locate elasticities are located. This suggests caution in attributing too much weight to one single estimate or set of estimates drawn from a single researchers. That researcher might have indeed obtained “the holy grail” of elasticity estimates; but it is useful to recognize the variation in findings nonetheless, if one is to be a social scientist.

More on this in Faith and Econometrics: Minimum Wage Edition. The true believers continue to hold strong.

But you have to go beyond a cursory acquaintance with the literature if you want to appreciate what it’s saying.

Suppose I have 2 variables x and y and they are both random walks with drift, i.e.,

y(t) = a + y(t-1) + ey(t)

x(t) = b + x(t-1) + ex(t)

The error terms are not correlated with each other so that x and y are completely unrelated. However, most people don’t know that and many economists do studies in which they regress y on x using the following regression model:

y(t) = alpha + beta x(t) + epsilon(t)

Those studies typically get non-zero estimates for beta with very low standard errors because that’s what happens when you regress unrelated random walks with drift against each other. However, one economist determines by statistical tests that y(t) and x(t) are random walks with drift and through other tests asserts that there is no relationship between the variables. Now, who should we believe–the lone economist or the consensus?

One way to proceed is to do a funnel plot of the various estimates. If you did that, you’d see that the estimates cluster very strongly away from zero. Looking at the funnel plot, you might even be tempted to say “some people would have you believe that there is no relation between y and x but a cursory acquaintance with the literature will immunize one from falling for such assertions.” But we know that there is no relationship!

Why did the funnel plot mislead? The problem came about because we put the results of the studies into a funnel plot without stopping to assess whether they are in fact valid studies in the first place. You can’t regress random walks that have no relationship on each other and expect to find no relationship. The one lone economist was right all along to assert no relationship. And that’s the problem with the funnel plot of research on the disemployment effects of the minimum wage. Doucouliagos et al put studies into the plot under the assumption that they are all of equal quality and value. But in reality studies are not of equal quality and value. We have to exercise judgment about which studies are more credible and which aren’t. A critical review of the evidence is far better than an uncritical funnel plot.

A good example of a critical review of the evidence on the minimum wage can be found in the NBER paper Minimum Wages and Employment: A Review of Evidence From the New Minimum Wage Research. Here’s a quote from the abstract.

“Our review indicates that there is a wide range of existing estimates and, accordingly,

a lack of consensus about the overall effects on low-wage employment of an increase in the minimum

wage. However, the oft-stated assertion that recent research fails to support the traditional view that

the minimum wage reduces the employment of low-wage workers is clearly incorrect. A sizable majority

of the studies surveyed in this monograph give a relatively consistent (although not always statistically

significant) indication of negative employment effects of minimum wages. In addition, among the

papers we view as providing the most credible evidence, almost all point to negative employment

effects, both for the United States as well as for many other countries.”

Rick Stryker: There is no such thing as a completely correctly specified regression — unless you’re working with simulated data where you’ve got the DGP because…you set it up yourself. Now, who do I trust more? A selective review of the literature by some one who is known to be critical or a formal meta-analysis by someone who well versed in the methodology, and does some formal weighting of the estimates. Reasonable people can disagree.

But…I’m pretty sure the CPI adjusted minimum wage is I(0). (Try it yourself…)

Menzie,

This meta-analysis may be convincing to you, but it does not seem to have convinced people working on the effects of the minimum wage, who are focusing on other explanations to explain the significant national disemployment results.

In contrast to Dube et al, who argue that failure to account for differential geographic trends and other problems has biased the elasticities to the negative side and has overestimated their statistical significance, Doucougliagos et al are trying to account for the disemployment results by claiming that they are the result of publication bias. That’s just inherently not very believable. If true, it implies that researchers, journal referees, or editors censored positive elasticity estimates for some reason. Why would they have done that? People working in this field are aware that estimates could be positive if the market is monopsonistic and many people have created models of the labor market that have monopsonistic features. Card and Krueger created a sensation when they reported positive results.

Publication bias is not a very credible explanation for the disemployment effects found and it seems to me that Dube et al is a much more serious line of attack. There is a bit of an econometric war going on between Neumark and Dube. I mentioned the “bathwater” paper in a previous comment but Neumark and friends have a new salvo out against Dube and friends–More on Recent Evidence on the Effects of Minimum Wages in the United States in which they conclude that the standard disemployment estimates are just fine.

Meanwhile, people are coming up with new research strategies. Baskaya and Rubinstein in Using Federal Minimum Wages to Identify the Impact of Minimum Wages on Employment and Earnings across the U.S. State find even larger disemployment effects of the minimum wage than the range that Neumark thinks the national estimates show.

I don’t think it’s fair to say that people have converged on the idea that disemployment effects of the minimum wage are negligible.

Earth Hour Celebrates Ignorance, Poverty, and Backwardness.

This is from Prof. Mark J. Perry, who is an Economics Professor of considerably higher stature than Menzie Chinn.

http://www.aei.org/publication/who-d-a-thunk-it-minimum-wage-increase-causes-cuts-in-hours-jobs-and-services-in-s-dakota/

what elasticity would you consider problematic?

It makes no sense to suggest that the work will disappear if the wage of the minimum wage employee doing it is increased. But there are legitimate channels for such events – maybe additional automation or (in real small businesses) employers taking on longer hours. These would be rather small effects as documented by the data. However, this negative would be countered by an increased consumption as low wage earners get a little more money in their pocket. Has anybody ever calculated the income of lowest quintile workers before and after minimum wage increases to see how big that effect is?

It seems, top economists, e.g. Robert Solow, are aware of biases, because he stated the effect on employment is small.

It may be negative. However, the positive effects on productivity and income may be greater.

Therefore, government will have more money to pay the people who lost their jobs.

The big thing — and it is a very big thing — that progressive economists (I could understand if it were CATO) perpetually leave out of minimum wage/employment discussions is any acknowledgement of the tradeoff between the proportion of the wage gain and the proportion of the possible job losses. Simply, if we double the min wage and some of the jobs are automated out (in Australia the customer may operate her own order on the key pad) the workers are way (way!) ahead. This should be at the center of every discussion or we are leaving out what could be — literally — the most important factor.

Another huge factor — which I don’t expect individual store owners to grok (they might)– but which should be the alpha and omega of progressive economists’ thinking, is how the income shift of, say, 45% of employees getting an $8,000 average raise ($15 min) will affect the demand at the businesses those employees work in (and don’t forget the businesses/employees whose wages get pushed up as a secondary result).

Toughest case: fast-food? Doubt it. The 25% increase in prices (33% labor costs) may not even be noticed by the 65% of customers coming through Ronald’s drive-thrus if they don’t listen hard before they pop the plastic — what are they going to do, bring peanut butter sandwiches? When Illinois raised its min wage pretty quickly from $5.15 to $8, I and retired teacher who were regulars in the Ronald’s across the street from me noticed a pickup in what we might call the third-world end of the business, mostly Mexican. Now the new owners across the street have just raised prices on many items 20-25% seemly because they think they can get away with it — didn’t seem to worry them.

The 35% coming through the doors will have more money to spend — which wont cost the consumers of businesses they work in very much — SORT OF A “MAKE-BELIEVE” MULTIPLIER. Un-toughest example: Walmart. $15 min wage raises Walmart prices 4% (7% labor costs). Wonder how many jobs lost at Walmart — unless their newly flush low income buyers decide to move upscale — Walmart can always move their merch upscale.

When people argue whether the economics profession knows what it is doing on macro-micro theory — way above my (NY-Chi-SF cab driver) pay grade. But when economists perpetually leave out the most important labor market factors (to people actually in the labor market!) I wish they would plant their feet more solidly on earth.

This is voodoo economics.

Either a minimum wage is binding, or it is not. If it is not, then all of this is pure political theater.

If it is, then those whose productivity is less than the minimum wage will be unemployed. That simple. It’s great to talk about minimum wages, but let’s also talk unemployment. California, with all its advantages and perfect weather, has the third highest state unemployment rate in the country, bracketed by such paragons of virtue as Mississippi and Louisiana. (http://www.calculatedriskblog.com/2015/03/bls-twenty-six-states-had-unemployment.html)

And why does California have an unemployment rate which puts on par with the most retrograde parts of the Deep South? Why does California have 34% of the nation’s welfare recipients but only 12% of the population? Does it have to do with the fact that California spends far more than any other state on welfare? That’s what this study suggests: http://www.utsandiego.com/news/2012/jul/28/welfare-capital-of-the-us/?#article-copy

The brutal truth is that California’s employment policies are crippling and absolutely awful. And now we pile a high minimum wage policy on top of this? More barriers to employment? This is progress?

And not only that, minimum wages are a barrier to the employment of those most in need of steady work: inner city young black and Latino men. A binding minimum wage is sexist, racist, and anti-egalitarian. But you know better! A young black man with poor skills should not be offered employment!

This fixation on the minimum wage is terrible public policy and makes a mockery of the very foundations of economics. It is voodoo economics at its very worst.

Steven,

I ask you to reflect that 100,000 out of (I estimate) 200,00 Chicago gang-age males are in street gangs because American workers will not work for three-and-a-half dollars an hour less than LBJ’s 1968 (1968!) fed min — double the per capita income later.

http://www.cbsnews.com/news/gang-wars-at-the-root-of-chicagos-high-murder-rate/

An think that a $15 fed min would shift all of 3.5% of GDP in the direction of the 45% of employees ($15 the 45 percentile wage) who not take about 10% or thereabouts of overall income. That’s how much we grow every couple of years.

$8,000 average raise (half the distance) X 70 mil employees (45% + 5% for those at min now) = $560 bil out of $16 tril.

* * * * * *

yr..per capita…real…nominal…dbl-index…%-of

68…15,473….10.74..(1.60)……10.74……100%

69-70-71-72-73

74…18,284…..9.43…(2.00)……12.61

75…18,313…..9.08…(2.10)……12.61

76…18,945…..9.40…(2.30)……13.04……..72%

77

78…20,422…..9.45…(2.65)……14.11

79…20,696…..9.29…(2.90)……14.32

80…20,236…..8.75…(3.10)……14.00

81…20,112…..8.57…(3.35)……13.89……..62%

82-83-84-85-86-87-88-89

90…24,000…..6.76…(3.80)……16.56

91…23,540…..7.26…(4.25)……16.24……..44%

92-93-94-95

96…25,887…..7.04…(4.75)……17.85

97…26,884…..7.46…(5.15)……19.02……..39%

98-99-00-01-02-03-04-05-06

07…29,075…..6.56…(5.85)……20.09

08…28,166…..7.07…(6.55)……19.45

09…27,819…..7.86…(7.25)……19.42……..40%

10-11-12

13…29,209…..7.25…(7.25)……20.20?……36%?

CORRECTION: make that gang-age “MINORITY” males above — the whole point of my response to Steven.

A high and binding minimum wage will increase the supply of labor and reduce the demand for labor. I don’t doubt that more gang members would work for $15 / hour, and many more at $50 / hour. That’s not the issue. The issue is that there will be reduced demand for their services. With a higher minimum wage, there will be a flight to quality, which implies more educated, more white / Asian, and more female employees in minimum wage jobs. The losers in this competition will be less educated, less well mannered, black and Latino young men–that is, gang members! And yet, these are by far our most at risk population. (Read this, for example: http://www.forbes.com/sites/modeledbehavior/2015/03/18/half-of-fergusons-young-african-american-men-are-missing/)

Had Menzie suggested that we subsidize the employment of young black men, I would have read with interest. If the marginal productivity of young black men is low, let’s lower the cost of employing them. I strongly believe that holding down a job is critical in improving the lot of our at risk populations, for several reasons. First, it takes them off the streets and gives them something productive to do; second, it gives them money, thereby lowering the incentive to commit crime; third, it establishes habits and track records which can lead to better jobs later on.

Menzie’s view is that we should increase the wages of those who are working. It is my view that we should increase the number of people working and let the market set the wage–and that’s particularly in a high unemployment state like California.

I stand by my earlier statement. A binding minimum wage law is terrible public policy.

It’s the little tin god of “marginal productivity” (do you mean utility?).

Question is, of course, “marginal” to whom? If the effort is made to extract the max the customer will pay — indirectly through collective bargaining with the employer or via a mandated minimum wage — then, the answer is the marginal utility to the consumer. Will the consumer pay for a $15 min wage? That’s not been tried. Min wage history listed above suggests no problemo.

Never fear; if the consumer is pressured for the max they will pay in all retail transactions, then, the physical output of the economy will be geared to consumer wants and tastes — not to whoever has the upper hand in what amounts (if with no intention) to extortionate squeezing in the labor market.

I mean that, if an employee costs $16 / hour (including FICA) and probably $17 / hour including vacation, sick days, etc., then either that employee can produce $17 / hour of value, or they can’t. If they can’t, then they won’t be employed. Very simple. In Menzie’s SF proposal, either an employee is worth $33,000 per year, or they are worth zero.

I would guess a lot of young black men from Oakland are not worth $33,000 per year. Therefore, they are worth zero across the Bay Bridge (newly re-built, and it is spectacular, by the way). A high minimum wage will have the effect of keeping the blacks in Oakland. It’s San Francisco’s Apartheid Law.

What percentage are direct labor costs in the product cost of which you discuss? Far less than 33%. You are conflating the issue with other components of cost.

Hi Steven.

I’ll start by saying I don’t live in CA.

If you examine the BLS’s Calufornia labor force statistics you’ll find that California’s labor force grows strongly year after year. From what I can tell Californians, like Virginians and North Dakotans, never stop looking for work. People seem to like to move there and work there.

Also, California’s largest population centers have very mild climates and lots of free stuff to do. One can make it with virtually no budget for utilities or entertainment. From what I can tell California’s unemployment rate tends to run 0.5 to 1.0% above the national average in most years.

As for “welfare”, this may be a problem for CA’s residents and voters. However, CA taxpayers get far less back in federal benefits than they pay in federal taxes. As long as that’s the case I don’t think I have any place to question their welfare system.

Again for the UW students who pay tuition supposedly to learn from scholars, this opening line of Menzie’s is a crude logical fallacy;

‘Some people would have you believe the impact of a minimum wage hike on employment is known to be large and negative.’

Only someone with no scruples whatsoever would resort to such.

Patrick R. Sullivan: This is a choice assertion from somebody who is constantly making crude, unverifiable statements (unverifiable because they are false). Consider the case in point, your error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Adam Smith warned against people who ‘think’ like Menzie, over 2-1/4 centuries ago;

‘The man of system, on the contrary, is apt to be very wise in his own conceit; and is often so enamoured with the supposed beauty of his own ideal plan of government, that he cannot suffer the smallest deviation from any part of it. He goes on to establish it completely and in all its parts, without any regard either to the great interests, or to the strong prejudices which may oppose it.

‘He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess-board. He does not consider that the pieces upon the chess-board have no other principle of motion besides that which the hand impresses upon them; but that, in the great chess-board of human society, every single piece has a principle of motion of its own, altogether different from that which the legislature might chuse to impress upon it.’

That some chosen statistical technique can’t isolate just what those chessmen can do on their own, doesn’t mean it isn’t there.

Patrick R. Sullivan: Well, that’s true — failure to prove is not proof against. Hence, for some people, faith trumps econometrics. I’ll count you in that group, and I’m sure you won’t object.

Regarding facts, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

https://research.stlouisfed.org/publications/es/article/10343/

Wages and salaries to GDP: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OO

Wages and salaries to gov’t spending: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OP

Private wages and salaries to GDP: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OR

Private wages and salaries to gov’t spending: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OQ

Real per capita profits after tax, inventories, and depreciation: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OT

Real per capita profits plus disposable income: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15OU

Real profits to wages with investment: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15P2

With payrolls: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15P3

It’s very late in the cycle.

EIA U.S. Energy Information Administration Excel Data Add-In. Includes FRED data.

http://www.eia.gov/beta/api/excel/?src=home-b1

How cool is that!

Steven, it might even be waaaaay cool, dude! if the link worked. 😀

It does, but here’s what you have to do:

Download the file from the EIA site.

Then go, in Excel, to Files, Options, Add-ins.

At the bottom of the Options page, you will see a drop down menu which says “Manage” and in the box next to it “Excel Add ins”. Click on the “go” button next to it.

In the Add-ins, click on the ‘browse’ button. Find the EIA.xlam file you downloaded and open it.

That should put it into your Add-ins list. Make sure it’s checked, and you’re set to go.

Directions are also here: http://www.eia.gov/beta/api/excel/instructions.cfm

Thanks Steven. This is very nice.

South Dakota recently raised the minimum wage and South Dakota’s public universities responded by cutting hours for workers, most of whom are students. So, student workers will get a higher wage and work fewer hours. Maybe in absolute dollar terms they are no worse off and maybe they are better off in general if they also work fewer hours. We don’t know. However, there is no free lunch. To pay for the minimum wage hike, the universities are cutting services, which also go to students. But the loss of services to those students would not be measured in an econometric study of disemployment effects.

That’s why disemployment effects are not the whole story. Whether the minimum wage is a good policy overall is a more complex question.

A minimum wage law is bad public policy, Rick. Unless you can show a kink in the demand for labor, it is bad policy, period.

Min wage laws are poorly targeted and inefficient. They help many who do not need it, and hurt those who need employment the most. It is not a matter of one-the-one-hand-on-the-other-hand. There is no ambiguity here. Binding minimum wage laws are bad public policy.

Steven,

Yes, I agree it’s very bad policy. I just wanted to make the point again that a small or negligible disemployment effect does not automatically imply that the minimum wage is a good policy, as so many minimum wage advocates seem to think. There is plenty of other evidence out there that this is bad policy.

Yes, for any given policy objective, there is a much better tool than a minimum wage. And it’s such a tired, weak policy.

Now, if Menzie had said, what if we waived FICA costs to employers and employees for black and Latino men in designated blight areas, I would have probably endorsed that. At least it’s worth a try. It reduces the cost of employment, may increase wages, and brings focus on blight areas as places to establish a business. And it costs nothing, if I assume that many of those youth would be otherwise unemployed.

It’s that kind of thinking I would like to see.

Steven,

Yes, I would have endorsed that too. It’s ironic that so-called progressives want to take us back to 1970 instead. Progressives are today’s conservatives, who trying to return the country to the failed policies of the past.

rick, the university is cutting hours and paying more. so is that a wash overall? if they are continuing to cut services, then you cannot directly say it is the fault of minimum wages. it is more likely the result of the state decreasing funding support to the universities overall. that is a policy choice and not the fault of minimum wage hike. if a government chooses to cut back its funding, the obvious result is a cut in services. you will note the problem at most public universities is not out of control spending, even though the press likes to spin it that way, but significant cuts in state support for higher education. again this is simply a policy decision.

Baffles,

The article I linked to attributes the increased costs and cuts in University services to the minimum wage hike.

rick, reading that article one is stretched to blame the rise in minimum wage for cutting services. for one, as they note explicitly, the current budget had no provisions for this minimum wage. since the budget is not flexible, they cannot adjust until next year-which they state will happen. in addition, the shuttering of services is also driven by lack of student use of certain facilities. this just seems to be a poor example if one is trying to point out issues with minimum wage hikes. it does, however, show the problem with inflexible budget policies.

Baffles,

You should tell the universities not to tell the Board of Regents that the minimum wage is responsible then, since that is what they are doing.

Also, you should realize that these Universities’ problem is the same as Borderlands books. Borderlands couldn’t raise prices. Similarly, with a fixed budget, the universities can’t get additional revenues either. In the future, maybe the universities can get more revenues in their budgets to compensate for the minimum wage hikes. But who pays for that? Do the student’s pay for their own minimum wage hike through higher tuition? Do the tax payers pay by paying higher taxes? Maybe the faculty will take a wage cut? Or maybe they will just cut services to students permanently?

As usual, you missed my larger point–that you have to look at the consequences beyond the disemployment effects before you analyze whether it’s a good policy or not. I suspect if the faculty takes a pay cut they won’t think it’s a good policy.

Does the university system make a profit? Does it care about demand? Can customers go elsewhere?

Firms tend to maximize profit, even with a minimum wage hike.

as many of you may know, a similar statistical issue arises in biomedical research, where one wants to know the effect of some treatment (say a drug vs no drug)

Often, there are many “studies” and the studies are in turn subjected to metanalysis

The Cochrane Review is a journal devoted soley to such meta studies

The operating principle in this journal is that authors clearly state (a) how they looked for studies – what literature they searched, and what tems they used; (b) how many studies were found, and (c) how many studies were discarded for not meeting preset quality criteria (eg, not enough patients, no control arm, etc)

On intuitive grounds, a labor demand elasticity of -0.1 strikes me as implausible.

If we consider a large increase in the minimum wage of (say) 100%, is it really reasonable to expect only a 7% reduction in demand for unskilled labor? This would mean an 86% increase in the total cost of unskilled labor used in production, after we accounted for all companies that go out of business, all substitution towards production processes that are more capital-intensive or skill-intensive, and all reduction in total production. It’s simply very hard to believe that firms wouldn’t substitute away from a more expensive input to a much greater degree than this.

The standard Cobb-Douglas production function is unit elastic in inputs. If you take that as your benchmark, a -0.1 elasticity of demand in one input is very surprising. It implies that unskilled labor is such a critical component in production that it is 10x more difficult to substitute away from than the average input. This is an extraordinary claim, and I think it requires very strong evidence before it can be accepted.

Such solid evidence is lacking. A very reasonable explanation for the available data is that most historical changes in minimum wages have been small, affect only a small part of the workforce, and firms’ responses play out over time, so that they are difficult to detect.

Are you surprised, since the country was at full employment with a much higher teen labor force participation rate, the real minimum wage fell 25 percent, while productivity in the fast food industry, for example, rose 25 percent, real per capita income doubled, and profits as a percentage of GDP almost doubled?

If the minimum wage, since 1968 (when the unemployment rate was under 4 percent and the teen labor force participation rate was much higher), kept up with productivity growth, it would be over $12 an hour today.

The economy has the capacity to easily “absorb” a higher minimum wage.

One mechanism how the economy adjusts to a higher minimum wage is weak firms will lose business or fail and stronger firms will gain their business and gain from the increase in demand.

peak, completely agree. those weak firms were not an efficient use of capital or labor, so for the free market enthusiasts of the invisible hand, this should be applauded.

We’ve finally come to the Twilight of the Progressive Idols. Policies that don’t kill businesses make them stronger!

so a firm that can only survive on cheap child labor is acceptable? no policy needed? the twilight of conservative ideology.

I really wish you folks would drop the vacuous authority arguments.

It smacks of celebrity narcissism. Not well thought out science.

There’s a TV show called “Kitchen Nightmares” that reveals with a little more training, some capital spending, and a little more work, a restaurant can turn from a money losing operation to a highly profitable business.

Low-skilled workers can easily rise to a higher standard and be more productive.

Unfortunately, many businesses shouldn’t be in business, because the quality, and/or quantity, of their goods or services are low. However, well-managed businesses can easily pay a higher minimum wage.

So, how dol the genius econometricians here propose to measure the effects of this new Massachusett law;

http://www.insurancejournal.com/news/east/2015/03/31/362612.htm

‘A new law set to take effect this week aims to increase protections for domestic workers in Massachusetts.

‘The law requires people who hire nannies, caregivers and other domestic workers in Massachusetts to adhere to established labor standards and other worker protections.’

I predict that nannies and housekeepers will see a decrease in demand for their services, or an increase in demands upon their services. How about you, Menzie? Monopsonistic competition?

Patrick R. Sullivan: I suspect one will have to do a diffs-in-diffs analysis, comparing MA against a neighboring state. I doubt a monopsonistic model works well, since most people don’t hire more than one nanny, or more than one or two caregivers (although the set of folks you know might differ – perhaps they hire an entire retinue, including butlers and maids). A matching model with information asymmetries would be better.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

‘I doubt a monopsonistic model works well, since most people don’t hire more than one nanny, or more than one or two caregivers….’

You think that’s the definition of monopsony, that it’s how many employees you hire? How about Wal-Mart, they’re not acting like any monopsonist I’ve ever heard of;

http://www.wsj.com/articles/wal-mart-ratchets-up-pressure-on-suppliers-to-cut-prices-1427845404

‘[Wal-Mart is] increasing the pressure on suppliers to cut the cost of their products, in an effort to regain the mantle of low-price leader and turn around its sluggish U.S. sales. ….

‘With the heavy investments related to its promise to raise wages and the development of a vast e-commerce business, Wal-Mart has fewer options for chipping away at costs, putting suppliers in the cross hairs. ‘

Sounds pretty competitive, no?

Patrick R. Sullivan: I believe you mis-apprehend what a perfectly competitive market is, insofar as economists are concerned. Maybe you should consult an introductory economics textbook.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

A question about the literature:

I remember that the original Card-Krueger paper found substantial (~100%) pass-through of the minimum wage increase to prices. Is this common in the minimum wage literature?

I ask because it’s hard to believe that the demand elasticity for fast food is near zero, at least over a longer time horizon. So if this is a common result, I would consider that a strong point against the no-result finding.

Jon P: Not sure if I understand what you mean by 100% pass through. On page 787 of the AER article, they assume 15% increase for half of the workers earning less than the new minimum wage leads to a 2.2% increase in the price of a meal. If you mean the 15% increase for those workers with bound wages is fully manifested in higher prices, and no impact on profits, is 100% pass through, I’m not sure if this is typical or not in the literature. I’d guess it’s just a convenient way to put an upper bound on the price increase.

Right. They did a back-of-the-envelope calculation to estimate how much costs increased following the minimum wage, and then tracked the price of a few central menu items, and found that prices increased by MORE than their estimated cost increase. The implication is ~100% pass-through of the higher production costs from the minimum wage increase to prices.

I think this is very significant. In general, we can think of two sources of elastic labor demand in response to a higher minimum wage: (1) firms substitute away from low-skill workers in the production process, and (2) firms passing on the cost increase to customers, which should lower demand from customers and therefore a reduction in employment.

A low labor demand elasticity in response to a minimum wage increase requires BOTH limited ability of firms to substitute away from low skill workers in production (which I find implausible, as I argued above), and ALSO either limited passthrough, or very low elasticity of demand from customers. Card and Krueger find 100% passthrough, so their finding implies a very low elasticity of demand, which I also find implausible.

A higher minimum wage can raise demand for fast food.

The increase in demand can be greater for low-wage workers than the decrease in demand for high-wage workers.

An increase in demand can cause prices to rise.

I have just returned from a great trip to Australia. I met with an economist friend while there and he asked me if there was anything that surprised me about Australia. I told him I was surprised by the high prices. Without hesitation he said it was the impact of the minimum wage. Australia’s minimum wage in $16.87, more than double the rate in the US. Not surprisingly the percentage difference between the US and Australia minimum wage is almost exactly the difference in prices.

This is striking in Australia because while the exchange rate is about $0.80 to a US dollar today, US purchasing power has soared in recent years. Only 3 years ago it was near parity. Once again we see that government policy in wage controls actually falls on the domestic citizen reducing the quality of life and this is something that was expressed by every Australian I talked with from the housekeeper in my hotel to the bus driver taking us to Chinatown; from my college professor friend to the waitress in our local coffee shop.