That’s the title of a new book by Ayhan Kose and Marco Terrones, just released.

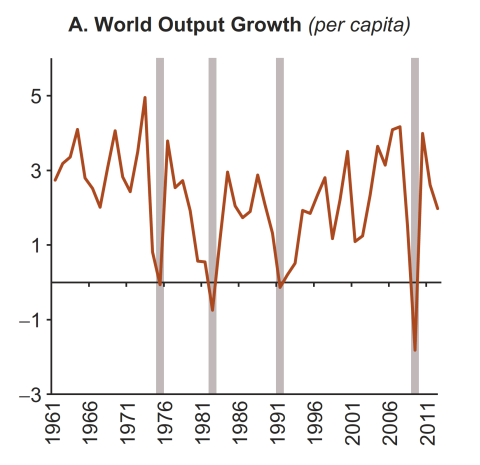

Figure 4.3.A from Kose and Terrones (2015).

Here’s a brief description of the book’s topic.

The world is still recovering from the most recent global recession associated with the 2008-2009 financial crisis, and the possibility of another downturn persists as the global economy struggles to regain lost ground. But what is a global recession? What does it mean to have a global recovery? What really happens during these episodes? As the debates about the recent global recession and the subsequent recovery have clearly shown, our understanding of these questions has been very limited.

This impressive work culminates a research program of central importance—the investigation of the definition and nature of global recessions and recoveries. The authors deploy a comprehensive statistical documentation of global business cycles in an accessible—yet empirically rigorous—fashion, weaving in the most recent thinking on the linkages between financial crises, recessions and recoveries. In my view, this volume is sure to become the standard reference on this important subject. IMF Chief Economist Maury Obstfeld, as well as Ken Rogoff, Mark Watson, Eswar Prasad and Michael Bordo make similar assessments.

“our understanding of these questions has been very limited.”

Amen, say again, brother! 😀

The Long Wave so far remains entrained, although the vast majority of Establishment eCONomists have been trained for half a century or more that it doesn’t exist (or not to know that it ever existed so as to refute that it does not exist, i.e., they don’t know that they don’t know), therefore, it is taboo to examine, which in turn means that not understanding the Long Wave would have resulted in one not having anticipated the crash and the onset of secular stagnation and liquidity trap of the Schumperian depression of the debt-deflationary regime of the Long Wave.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2a7S

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2cql

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2cuW

Now we are experiencing the onset of the next cyclical decline of the Juglar cycle of the longer Kuznets cycle rhythm, which will coincide with another equity bear market and housing (high-end, buy-up housing being hit much harder this time) recession with a global deflationary recession; further contracting acceleration of money velocity; nominal GDP per capita trending well below 2%; wages decelerating form 2%; the 10-year Treasury yield falling to 1% or lower; CPI persisting at periodic deflation; and the Fed being compelled to resort to additional QEternity and perhaps NIRP.

The foregoing is suggested by the fact that real private final sales (FS) per capita have stalled and the deficit/FS is set to increase.

Prepare for a “stimulating” 2016-17 (to 2018-20) during which the Fed will resume QEternity in earnest to fund primary dealers to fund the fiscal deficit to prevent nominal GDP from contracting.

The implication is for deficit/FS eventually to reach 15-16% of FS (SAAR) and the Fed’s balance sheet to reach ~40% of FS and nearly 100% of bank loans less inter-bank loans, charge-offs, and delinquencies, i.e., effectively the de facto end of fractional reserve banking.

Moreover, US oil production is poised to crash to 5-6Mbd; oil consumption will fall 2-3Mbd; the 3- and 5-year prices of WTI will decline from $95-$100 to the $30s in the years ahead; WTI eventually will decline the $20s; the energy and energy-related transport sectors are heading for a bust that will be worse than the 1980s because debt/GDP is much higher, the trend rates of real GDP per capita and wages are less than half the rate of the 1980s energy bust, and fiscal constraints will persist from peak Boomers drawing down on social transfers and food stamps and unemployment payments increasing, resulting in no GDP multiplier from “stimulus”.

The US is approximately where Japan was in the early 2000s and the US in the late 1930s, 1890s, and 1830s-40s. The Long Wave debt-deflationary regime and its structural effects were predictable long ago based on debt, demographics, interest rates, the change rate of prices, yield spreads, and the Schumpeterian techno-economic S-curve progression.

Japan is 10-14 years ahead of the US demographically and structurally, and we are following Japan’s debt-deflationary regime’s progression closely, implying that we will eventually experience the same public debt/GDP constraints and acute effects of secular stagnation and a liquidity trap.

So, prepare for the Fed/TBTE banks to pull a 180-degree reversal in the months ahead, shifting from “forward giddiness” about a rate hike, higher inflation, and “escape velocity” to a full-frontal admission of error and another cyclical panicked reserve-printing party.

The question is begged, however, as to whether the TBTE banksters will pull the plug on the bubble machine to precipitate a crisis to justify more QE, as they did when they pulled the plug on the Dotcom bubble (after shorting Dotcom stocks) and when they shorted unreal estate CDOs and then pricked the bubble that imploded AIG and took down Bear Stearns and Lehman. This time, GS, JPM, and MS have their sights on C, BAC, DB, RBS, BCS, and HSBC as take-down targets during the next debt-deflationary wipeout. Eventually we might have one gov’t-sponsored hedge fund as the primary dealer for US debt, known as Goldman-Morgan-Stanley (GMS), i.e., the corporate-state’s sole remaining TBTE bank with 80% of all assets, loans/deposits reserved at 100%, and the sole dealer of US debt issuance.

Ready?

BC: Following up on your always interesting remarks, I estimate 90% of the economics profession, blinded by belief in a wrong paradigm, is not ready. The 5% who are ready are Austrian. As are perhaps an additional 5 ppts of those who subscribe to the dominant Keynesian paradigm. As the 90% hold total sway over opinion-makers, media, and politicians, the public is far from ready. Debt>deflationary pressure>slowing growth path heading toward recession and next financial crisis> long-term interest rates falling to new historic lows. No Fed tightening in 2016. Stock market in extreme jeopardy. No locomotive to pull this thing out. In fact, the primary locomotive since the crisis – EM economies – is hooked at the caboose end pulling in reverse. Otherwise known as reversal of the US carry trade. The flash point arises in emerging markets. Transmission channels from the EMs are multiple. The one running EMs>eurozone>US will be where the real leak is sprung (in the euro banking system) to trigger the full-blown stage of the next financial crisis. Probability that next crisis far worse than 2008 crisis=67%. Federal Reserve ignorant, propagator of perverse policy from Greenspan to present, now helpless to effectuate anything good, and ought to be nationalized immediately.

JBH, I fully concur.

It’s a U.S.-centric world.

The U.S. offshored entire industries, while creating new industries, and consumed up to $800 billion a year more than produced in the global economy.

After 2007, that cycle of global growth has slowed substantially, with the sharp slowdown of U.S. economic growth.

So, if I look at the shaded bars on the graph:

1: First Oil Shock in the mid 1970s

2. Second Oil Shock (we’re missing the 1980 recession on the graph, by the way)

3. Gulf War oil shock

4. 2008 Oil shock

5. There is a crypto recession, the Arab Spring oil shock, (which ECRI in fact called) from Q2 2011 to Q2 2013. This is an actual recession in Europe, with CEPR now calling the trough at Q1 2013 (I earlier called it for Q2 2013).

All oil shocks.

https://app.box.com/s/ys8ijadj4b57nb95ka0b3ilph38ga7fm

Right, Steven.

From the chart at the link above, the price of oil is still too high in terms of oil consumption to final sales and the differential growth rates. We’re still in a secular, post-Peak Oil regime (“Limits to Growth”) with the associated constraint on output, which is exacerbated by excessive debt to wages and GDP; peak Boomer demographic drag effects; prohibitive health care costs (debt, health care, and demographics were a tailwind during the previous energy bust in 1986); fiscal constraint; extreme inequality; a record low for labor share and resulting decelerating productivity; nominal corporate revenues contractiong YoY (deflationary); and hyper-financialization from unprecedented asset bubbles everywhere further pressuring velocity and its acceleration.

The Fed had to print $3.4 trillion and the US gov’t borrow and spend an additional $8 trillion just to get real final sales per capita back to even in 2007-08. In spite of the printing and deficit spending, US oil production per capita is down 45% since 1970 and back to the level of the late 1940s.

Moreover, the value of US oil production adjusted for debt-money and population is at effectively the usable net energy to final sales of the Great Depression. IOW, oil is in insufficient supply and at a price that is too high to sustain growth of the oil-, auto-, debt-, and suburban housing-based economic model; and that’s even more the case for China and India.

If I am correct from the post above in terms of monetary base to the deficit and net savings deficit to investment, the Fed will have to resume QEternity and print another $3 trillion to fund deficits to prevent contraction of nominal GDP under conditions of secular stagnation, liquidity trap, and price and debt/asset deflation, including eventually for service prices.

But the printing and deficit spending will be no more successful in permitting growth of profitable marginal extraction of kerogen and tar. We will soon discover to our dismay and potential despair that all of the QE and debt to fund the energy sector and for firms to buy back stock was utterly uneconomic and added next to nothing to the country’s sustainable productive capacity and capital formation, resulting instead in a Japan-like debt burden that we cannot print, borrow, tax, or grow our way out of ever.

For all of the eCONomists and pundits who are fond of incessantly repeating that we’re not Japan, well, the world is becoming Japan. The system characterized by the post-Bretton Woods fiat digital debt-money reserve currency regime, neo-imperial military Keynesianism, and rentier-socialist corporate-state hyper-financialization is progressing toward its global end game.

Duck and cover.

steven, you present an excellent argument on why we should be searching for alternatives to an oil based society. especially when alternatives can and do exist.

@baffling: “we should be searching for alternatives to an oil based society. especially when alternatives can and do exist.”

We’ve been doing that since the 1970s via deindustrialization, globalization, and financialization, so much so that the sum of total gov’t spending, private “health” care and “education”, and financial services flows now exceed an equivalent of 50% of GDP. Effectively, this is where the EZ is, as their “health” care and a significant share of higher “education” is publicly funded with the result of gov’t spending being ~50% of GDP.

IOW, gov’t, “health” care, “education”, and the hyper-financialized sectors of the western economies now preclude real growth per capita in the rest of the private sector. Moreover, these sectors are the least likely to add to net increases in productivity and productive capital formation/accumulation, i.e., the cumulative net costs to the rest of the economy exceed the net benefit. And now Obummercares is exacerbating the effects of prohibitively costly “health care” and the marginal extractive flows to the financialized sectors by way of mandated revenues to insurers.

Now, try to maintain the level and no less than the ~0% real growth of US private GDP per capita since 2007 if “globalization” retreats, “trade” ceases growing, and the half of global available net oil exports not consumed by the US and China continues to decline inexorably.

The West has all of the techno-scientific advances we need for a a lifetime or more. What is most desperately required today are economic, social, and political innovations that encourage incentives that result in broader distribution of the gains that have accrued from the multi-century increase in productivity and “progress”.

But extreme inequality, detachment from, and indifference among elites to, the experience of the masses, low labor share, decelerating productivity, regional multi-cultural and socioeconomic incompatibilities, mass immigration, and increasing political polarization have historically resulted in destabilization, disintegration, and elite and state reaction, conditions that were hardly conducive to peace and prosperity.

There was already a recession before the Gulf War. There was no shock.

The war was anticipated, and some (for example, Jim, I believe) have argued that expectations of shortage contributed to a short recession in that year. I’ll grant you, however, the timing of the shock is not entirely convincing. I don’t include it in my standard list of oil shocks, although 2011-2013 does, of course, count as one in my books.

I believe recessions are the way to narrow the difference on the score board and let everyone in on the money making party

Japan government debt has been increasingly almost linearly since about 1993 and currently stands at 230%. Assuming this can’t go on forever, and that an economic boom is not in Japan’s future, what is the end-game here. Surely some economists have worked this out. Does Japan have a Jubilee? Issue new currency? Fall into an Argentinian hyper-inflationary period? Seems like a fun project to assign to an upper level economics class. Plus, when is the tipping point when Japanese debt buyers figure out they will not get their money back. The Japanese panic may affect other markets…or maybe not. Maybe we just learn that you get a free ride up to X% and then you have to worry.

There was no recession for the globe. You mean normalization of growth after a lewd period between 2003-7, yet there was no recession when taking out the United States. The amazing mistakes people make on this blog are amazing.

According to the IMF WEO, World GDP growth in 2009 was 0.03% in constant price terms, and -2.0% at constant prices measured at market rates. If we allow that a recession is two quarters of negative GDP growth, it’s all but certain there was a global recession in 2009.