There are at least two ways of proceeding. One could repeat the following mantra endlessly:

[T]he government taxes or borrows the resources used to build infrastructure projects. Government spending crowds resources out from the rest of the economy. More federal spending comes at the expense of a smaller private sector.

These factors explain why the 2009 stimulus failed. So did Japan’s decade-long attempt to stimulate its economy through infrastructure projects. The Japanese wound up with massive debt, superhighways in underpopulated rural districts—and an anemic economy.

As far as I know, this 2014 statement from the Heritage Foundation is not based on a given econometric study, but is an article of faith, much like the assertion of “The Treasury View” discussed in this post.

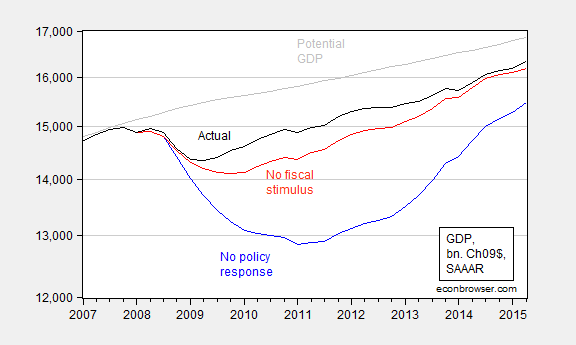

Or, one can appeal to extant estimates of multipliers to estimate how the economy would have performed in the absence of fiscal and monetary stimulus and financial system rescuses. That is exactly what is done in a Blinder-Zandi CBPP study, with the results shown in Figure 1.

Figure 1: Actual GDP (black), counterfactual GDP under no economic response (blue), counterfactual GDP under no fiscal response (red), potential GDP (gray bold), all in billions Ch.2009$, SAAR; log scale. Source: Blinder and Zandi (2015), appendix tables B1, B2; and CBO, Budget and Economic Outlook (August 2015), via FRED.

The fiscal policies include not just the ARRA (discussed here and here) but also the Economic Stimulus Act of 2008, implemented under G.W. Bush, extended unemployment insurance benefits, and payroll tax relief. Of the total 1,484 billion outlays, slightly under half took the form of tax cuts ($701 billion) and slightly over half in spending ($783 billion).

I think you are going down a rathole of correlations (which are usuaully based on limited data sets and subject to cherry picking [an extreme would be your citing little snippets about the Republican administration in Wisconsin being there for a decrease in population, not considering Texas for instance as a counterpoint], when more intuitive insights from markets [like the mantra] would serve you better. I prescribe reading Free to Choose by Milton Friedman and watching the TV series.

Nony: On “Free to Choose”, been there, done that. I don’t think I was any the wiser…

Nor do I believe I ever stated the population of Wisconsin had declined. Labor force, yes (at least according to the BLS, which is the provider of all the other data regarding the labor market cited in the posts).

Countries and leaders alike need to encourage the masses to invest there money instead of spending on trending consumer behavior patterns ( ex holiday spending). No doubt spending is good for the economy, however regular people through proper investing could form what you call a contingency reserve where they can have some cash to pad a crisis, thus spending normally through financial meltdowns. Sort of like the squirrel that instead of stashing a ton of nuts, planted them all around the nest so there will never be another shortage again.

“[T]he government taxes or borrows the resources used to build infrastructure projects.

Government spending crowds resources out from the rest of the economy.”

How does crowding out work when the Fed is adding trillions of dollars to its balance sheet and doing ZIRP for 7 straight years?

There is obviously plenty of money available to borrow if anyone wants to increase investment in new business facilities or staff, so where exactly is the “crowding out?” Who is actually complaining about being crowded out of opportunities? Has anyone heard such complaints?

OTOH, when demand is deficient, there is obviously no reason to increase investment in business facilities or staff and government spending can provide that demand because it is unconstrained by any need for profit making. So what am I missing here?

Does Heritage just repeat its crowding out mantra whenever a recession occurs just to be consistent? Why do they repeat absurdities?

Paul,

You make a typical monetarist mistake. Money and goods are not the same thing. You can have all the money in the world but if you have no goods any production you wish to do has been “crowded out.” Money is a tool not a factor of production.

ricardo, you are dodging paul’s question. over the past 5 years, exactly what has been crowded out? in a lack of demand environment, these crowded out arguments are not valid.

Ricardo

How does this make sense: “[I]f you have no goods any production you wish to do has been “crowded out.”

Are you saying that if the government starts building highways there will be a shortage of concrete so that private enterprise cannot build shopping malls or office buildings? Is there any evidence of such shortages that are constraining private enterprise? Take a look at this chart and please explain why private business investment FELL under the last two GOP presidents but rose sharply under the last two Dem presidents.

https://research.stlouisfed.org/fred2/series/W790RC1Q027SBEA

Paul,

We must be looking at different charts.

Private investment increased sharply under Reagan until the Democrats raised taxes in 1986. Private investment fell significantly under GHW Bush due to his tax increases and austerity.

Then in the 1990s private investment increased significantly under the Republican congress even with the decrease in deficit spending. We should give Clinton his due since he was one of the strongest supply-side presidents since Reagan. He lowered capital gains taxes and reduced welfare. This was a significant supply-side incentive to private investment. At the end of Clinton’s second term private investment crashed.

The first Bush tax cut, his Keynesian cut, private investment stagnated. After his second tax cut private investment recovered significantly. After the Democrats took the congress in 2006 private investment once again crashed.

The most interesting growth of private investment came after the Great Recession. Why would we have the greatest increases in private investment for the period indicated and yet have the most sluggish economy. Based on supply theory the investment was obviously due to crony socialism, especially health care and unproven energy schemes.

But to your point, yes, when the government uses cement to build a highway to nowhere, that cement is not available for private investment to use for production. This is easier to see during the Great Depression when government under both Hoover and Roosevelt entered into a massive building program on government offices. Though it is not usually called crowding out the same principle applies to the government destruction of hogs and crops during the 1930s starving people while attempting to artificially drive up agriculture prices.

Paul,

Sorry, I did not make it clear. Crony socialism does stimulate private investment. The problem is that it is in segments of the economy where there is lower demand. This causes over-supply of the subsidized sectors and leading to shortages in the “crowded out” sectors.

Ricardo: Please document that there was oversupply of dams and roads during the Great Depression. I would be very much appreciative of specific sources and links.

Yes, the Hoover Dam used a lot of concrete and the Interstate Highway System used even more. They were the biggest construction projects in history at the time. So are you saying that these two GOP presidents “crowded out” private sector construction projects at the time? If so, why wasn’t inflation much higher in the construction industry? In fact there was severe deflation from 1931-36 when the Hoover Dam was built.

Ricardo: Data check time. Nonresidential fixed investment was 14.1% of GDP in 1981Q1 when Reagan was inaugurated; it was 13.9% in 1985Q4. By my reckoning, investment to GDP had declined (or charitably, was flat).

You neglected to mention who was President when the Tax Reform Act of 1986 was signed into law. I believe it was Ronald Reagan. Please correct me if I am wrong.

Menzie and Paul,

Hire people to dig holes then cover them up – great plan.

Kill hogs and plow under potatoes while people starve – great plan.

Build bridges and roads to nowhere in West Virginia – great plan.

Thanks for the tips guys!

Menzie wrote:

“…this 2014 statement from the Heritage Foundation is not based on a given econometric study, but is an article of faith, much like the assertion of “The Treasury View” discussed in this post.

“Or, one can appeal to extant estimates of multipliers to estimate how the economy would have performed in the absence of fiscal and monetary stimulus and financial system rescuses.”

Classical scientific economics tested over more than a century of real world experience “is an article of faith” because it is not “based on a given econometric study,” but multipliers that have 1) only econometric studies to prove them, 2) have never been proven in the real world, 3) cannot be quantified with any concensus by even the most ardent supporters, and 4) have even been questioned by studies that show them as fantasy are not “articles of faith? Then even these multipliers are estimates based on best guess? Keep that propaganda flowing.

Menzie wrote:

“Of the total 1,484 billion outlays, slightly under half took the form of tax cuts ($701 billion) and slightly over half in spending ($783 billion).”

I assume this is an attempt to appeal to supply-side theory but it is based on the pop fantasy of supply theory. It is the myth that all tax cuts are good (is Menzie applying for membership in the Grover Norquist economic club). Anyone who understands the Laffer curve knows that all tax cuts do not lead to prosperity. Even when the tax rates are in the prohibitive range of the Laffer curve, Crony Socialist tax cuts only lead to prosperity of the political class not the economy as a whole. The legacy of the massive spending in 2008, whether from the pen of GW Bush or Barak Obama is the economic stagnation we are still slogging through.

Doesn’t Blinder-Zandi’s “no fiscal response” scenario ignore the possibility of the central bank expanding their efforts? I’m thinking monetary offset.

Also, didn’t Robert Barro argue a zero fiscal multiplier?

rtd: Page 15:

So, you are right that the Fed in the no fiscal stimulus scenario does not undertake even more unconventional monetary policy than actually undertaken. In order to judge what would have been the counterfactual, one would need to know (i) the Fed offset for QE/CE, and (ii) efficacy of that additional policy. As noted in the study, the Moodys model would imply larger gains for the incremental stimulus, while many empirical studies imply smaller.

Re: Barro, yes he did estimate a zero multiplier. See some discussion here. One might reasonably wonder why those findings are not as often reproduced when the sample excludes WWII.

So based on this incredible policy response, is debt/GDP now decreasing since we’ve had a 7 year expansion?

What I believe is the fatal flaw of Menzie/Krugman et all’s economic philosophy is that the policy prescriptions they suggest never result in public debt/gdp decreasing. During recessions debt/gdp dramatically increases, and as the economy recovers it continues to increase, albeit at a slower pace. At the peak of the business cycle, at very best stops increasing, but then during the resulting next recession, it dramatically increases again and we repeat the pattern. Ever increasing debt will not end well, especially coupled with problematic demographic trends.

“What I believe is the fatal flaw of Menzie/Krugman et all’s economic philosophy is that the policy prescriptions they suggest never result in public debt/gdp decreasing.”

Your are quite mistaken. Debt to GDP decreased for 30 years after WWII. Then Ronald Reagan took office and reversed that 30-year trend of decreasing debt and sent debt soaring. It took Bill Clinton’s tax increase in 1994, passed without a single Republican vote, to again decrease the debt. This trend again reversed when George W. Bush took office with his profligate tax cut for the rich.

So your statement that debt never decreases is false. The debt was constantly decreasing until Reagan, and then again Bush took office.

https://research.stlouisfed.org/fred2/series/GFDEGDQ188S