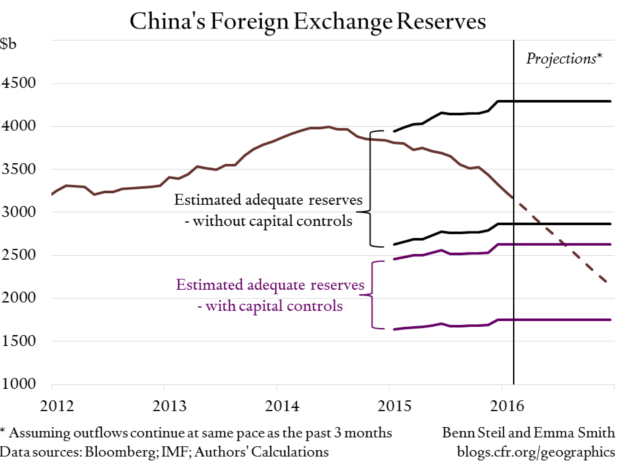

Benn Steil and Emma Smith at the Council on Foreign Relations present an interesting picture of Chinese reserves.

They write:

The People’s Bank of China has been selling off foreign currency reserves at a prodigious rate to keep the RMB stable. At $3.2 trillion, China’s reserves still seem enormous. But they are down $760 billion from their 2014 peak, and $300 billion in just the past three months. As shown in the figure above, at the current pace of decline China’s reserves will, according to the IMF’s framework for reserve adequacy, actually fall to a dangerously low level in the spring. This means that China would be at risk of a balance-of-payments crisis, unable to pay for essential imports or service its dollar debt payments.

China has for years been pursuing what has been called the “Impossible Trinity”: controlling interest and exchange rates while leaving the capital account significantly open. Chinese residents are permitted to send up to $50,000 overseas annually – this is enough to allow trillions in outflows. So what can China do to staunch the rapid decline in reserves?

In an interview with Allison Nathan in Goldman Sachs Global Macro Research‘s must-read Top of Mind publication (the issue entitled “China Ripple Effects”) released the day before yesterday, I made the following observations regarding the choices facing Chinese policymakers:

Allison Nathan: What options does the PBOC have for managing the RMB in the face of ongoing capital outflows?

Menzie Chinn: The standard rules of international finance apply: they have the options of further devaluation, FX intervention, or interest rate defense. For now, I’m going to eliminate one other option—substantial and persistent tightening of capital controls—because that would run counter to their longer-term program of capital account liberalization. Of the three more likely choices, an interest rate defense is least likely because it would conflict with their goal of stimulating growth, which I believe trumps all else. Even if the PBOC tried to raise interest rates, the fact that such a move would likely depress the economy means it would be difficult to persuade the markets that higher rates would remain in place for an extended period. In the end, outflows would not be staunched, and policymakers would be forced to relent, thereby damaging policy credibility. That means the authorities are almost certain to pursue a combination of further intervention in the currency markets and some exchange rate depreciation if need be. They have plenty of ammunition to continue to do the former given their still-massive holdings of foreign exchange.

Allison Nathan: What lessons can we draw from past currency attacks and defenses—successful or not—in other countries when thinking about the PBOC’s policy choices?

Menzie Chinn: Let me first say that I am reluctant to call China’s current situation an attack on the RMB; the currency has weakened because of capital outflows and the deteriorating economic outlook, not because of fear of an impending large and discrete devaluation. It is unfortunately

difficult to draw lessons from other countries that have experienced attacks on their currencies because China’s circumstances differ in many respects from these historical precedents. First, China has a current account surplus, which is not typical for a country facing a run on its currency. This means that even if China has capital outflows, there will still be

some offsetting inflow of foreign currency just by virtue of the fact that they export more than they import. This is a critical difference from countries that rely on capital inflows to offset the deficit in their current account balance. For these countries, if capital inflows cease or reverse and access to borrowing disappears, policymakers end up in a bind—they have no choice but to curtail imports until they match exports.Second, China has an incredibly large stockpile of foreign exchange reserves, which means that even if the current account-related foreign currency inflows are not sufficient to offset outflows, they can use their reserves to offset depreciation pressures.

Third, they have a vast arsenal of capital controls that they could quickly tighten if need be. These three factors suggest that the market should not be particularly anxious about the potential for a sudden devaluation.

The entire interview is here. For a recent post on capital flight, see here, and on financial reforms in pursuit of RMB internationalization here, and the Trilemma generally here.

A few points:

– The yuan does indeed appear under attack by hedge funds. See here: http://financetrendnews.com/2016/hedge-funds-are-preparing-to-attack-cny-and-hkd.html

– If I read the graph above correctly, China will run out of sufficient reserves without capital controls within a couple of months.

– I believe capital controls are likely to put China into outright recession. How many countries have put on capital controls when faced with devaluation pressure and not experienced an explicit recession? Off the top of my head, I associate capital controls with financial crisis and recession. Are there counter-examples?

Steven Kopits: China has capital controls already in place, so the relevant criterion is with capital controls. Re-implementing and/or tightening controls is not the same as implementing capital controls.

I re-iterate: China runs a current account surplus, has big reserves, has extant controls, and a highly regulated banking system. These are not the typical ingredients for a currency crisis.

Menzie, any country blowing through $100 bn in reserves per month has no meaningful capital controls. Or are you suggesting they would be burning through even more cash but for these controls? In any event, even if I take the with-controls view, China burns through its reserves sometime during H2 2016. That’s pretty bad.

Now, given that hedge funds are lining up against China, why would they be doing that?

Possible reasons:

1. They’re wrong. Capital outflows will cease and the yuan will stabilize at current levels. This could happen if the dollar weakens, which is not impossible given that our oil terms of trade have pretty much capped out. Also, those yuan fleeing China are bidding up the yen and won, and that should help, too.

2. The current account surplus is misleading in the sense that it is measuring both weak imports and exports, with imports weak in dollar terms due to the collapse of commodity prices and Chinese exports weak due to a yuan that has revalued against pretty much every other currency other than the dollar. In such a case, the yuan still needs to come down, and that’s what the hedge funds are keying on.

3. We are seeing Russian-style capital flight. The issue is not economic, but rather political, and moneyed Chinese themselves have lost confidence in the Xi government. They are spiriting their funds out of the country for reasons entirely unrelated to trade issues. If that’s the case, the social compact in China is broken and the country has become politically unstable. In such an event, capital flight will continue, and sooner or later the Chinese government will be forced into a material devaluation (15% per Chris Balding, for example) or binding capital controls. If it’s the former, the hedge funds are right. If it’s the latter, the Chinese economy will go into full blown recession, most likely.

That’s the way I see it.

Steven Kopits: Maybe. But I appeal to empirical analyses. From Claessens and Kose,”Financial Crises: Explanations, Types, and Implications,” IMF WP, 2013:

Thanks for posting this exerpt of recent research Menzie, it is a very interesting summation! Doesn’t it contradict your claim about this not being a currency crisis though?

From your quote: “Rather, crises were more likely preceded by rapid real exchange rate appreciation, current account deficits, domestic credit expansion, and increases in stock prices.”

China has two (and a half) of those. A sizable real exchange rate appreciation has occurred but it wasn’t all that rapid.

Moreover, “Crises are typically preceded by somewhat larger current account deficits relative to historical averages, although credit trends more than external imbalances appear to be the best predictor”. As we all know, Chinese credit trends are looking rather alarming. More hypothetically the “somewhat larger current account deficits” could be seen as analogous with the greatly reduced current account surplus seen in China over the last few years.

Hugo Andre: As far as I know, it’s countries that have CA deficits that have currency crises, so I don’t think a CA surplus decline is the same as a CA deficit increase. Two key institutional features not usually included work in favor of China — state ownership of the banks and capital controls. Finally, as you mentioned, the RMB has been on a slow ascent. Even during the recent period of dollar appreciation, the RMB appreciated on a real trade weighted basis by only 8.5% from 2014M02 to 2015M11.

So what do you think the PBoC should do, Menzie? Devalue or hold?

Thanks for the quick reply. As you say, the special circumstances do make China a special case. However even if the politburo can prevent a full out currency crisis it is useful to speculate about what kind of market pressure is on the renminbi since this is only partly offset by capital controls (there is leakage).

In “This time is different”, Reinhart and Rogoff repeatedly emphasize that the run-up to a currency crisis does not usually elicit all of the traits associated with such events. With that in mind I note that China over the last year has shown three maybe four of the six traits that the authors believe are the best predictors of currency crises: A sharp fall in exports, a stock market crash, a large fall in the M2/International Reserves ratio, and more arguably, a banking crisis. Several China watchers have noted that there has been a significant build-up in bad debt over the last few years which will almost certainly cause problems for the banking sector, especially in conjunction with recent troubles. At the very least it will be an additional drain on the resources of the Chinese state.

The two things that China has not seen are a divergence from trend in the real exchange rate and a sizable current account deficit but as your quote from Claessens and Kose points out, credit trends are probably better predictors than external imbalances.

OT: Since I don’t usually comment here I should mention that I am a big fan of your blog! I especially enjoy the posts related to international trade.

Per the C&K quote :

“Rather, crises were more likely preceded by ….domestic credit expansion….”

“The growth rate of credit…… are the most frequent significant indicators in the 83 papers reviewed.”

“……credit trends more than external imbalances appear to be the best predictor….”

Since the onset of the GFC , China has generated truly stupendous rates and levels of credit for a country at their stage of development. I doubt there exists an example that tops them outside of periods of world wars. And this with a “highly regulated banking system”. ( We know all about that , don’t we ? )

If the economy collapses into a debt deflationary spiral , they’ll pull out all the stops , fiscal and monetary , and including exchange rate management. They’ll have to.

Properly formatted:

Let’s consider this sentence and its applicability to China:

Rather, crises were more likely preceded by rapid real exchange rate appreciation (true), current account deficits (false), domestic credit expansion (true), and increases in stock prices (true).

This sentence essentially describes ‘hot money’ crises, where a country becomes fashionable with foreign investors pouring into the domestic stock market and other assets. It ends with a sharp reversal, usually accompanied by a balance of payments crisis and a combination of capital controls, aggressive devaluation and IMF support. The 1998 Asian financial crisis fits that mold.

China is different. It’s a domestic, not international, crisis primarily. We are seeing massive capital flight, but primarily of capital held by the Chinese themselves. In addition, we seem to be seeing a simple policy mistake of following the dollar up–which should have been easily remedied. And we are seeing, or think we are seeing, some slowdown of the Chinese economy, with estimates ranging from 6.4% GDP growth all the way down to 2% GDP growth. And this can matter because China has a very high degree of indebtedness and potentially a massive scale of mal-investment. That suggests a potentially nasty balance sheet recession, really a domestic downturn, rather than one driven by global capital.

Still, we are left with a quandary. If there’s a current account surplus, why the aggressive capital flight? Maybe we’re measuring a political crisis, not an economic one.

Did you remove my comment?

Steven Kopits: I removed the comment that was improperly formatted, and retained the version that you indicated was “properly formatted”, in order to eliminate repetition. Do you want it returned? As far as I can tell, the version deleted is a version of the one still online, but with too much text in “blockquote”.

That’s fine, Menzie.

I have been researching Hong Kong booksellers, and I’m feeling a little paranoid.

Do you know what two of the booksellers’ titles were? “The Collapse of [President] Xi Jinping in 2017” and “Xi Jinping and the Elders: War at the Top”

And that’s what I think we are seeing, an attempt by Xi to install one man autocracy in China, one impervious to five year elections and independent of the power of the Communist Party. That would be classical Chinese palace intrigue and entirely within the Russian model of behavior. Very Putin.

As I wrote in my related CNBC piece, this kind of autocratic leadership tends to be associated with low growth (with Lee Kew Yuan the exception). http://www.cnbc.com/2016/01/05/why-chinas-growth-could-be-over-commentary.html

So we’re seeing a struggle over which ideology–nationalist and autocratic; or economically liberal and collective–will rule China.

I had earlier thought Xi might simply change policies. From my perspective, I don’t really care who rules China as much as I care about the quality of its governance. Xi could simply adopt a liberal line, and the crisis is over. But Xi is taking hit after hit just now, with one mistake leading to the next. A failure to delink the yuan from the dollar led to poor export performance and capital flight. But trying to fix it has also proven expensive, as it has brought capital markets to their knees. So we see one mistake leading to the next.

And then there are the Hong Kong booksellers, the abduction of which have led to street protests there. Just a few hours ago, Britain denounced this snatching, as one of those taken held a British passport. So an internal struggle has manifested itself as an international crisis of sorts. Xi has overplayed his hand again.

It all paints a picture: the inflexible yuan, the base at Fiery Cross, the suppressed PMIs and the HK abductions. It’s all power-based, with very little understanding of or interest in the linkages and implications. Lots of muscle, less intellect. And it is leading to a string of political and policy mistakes.

I think we have arrived at a turning point for China. If Xi wins, China will be taken onto a side-track of lower growth and less prominence–much as we have seen with Hungary and Russia. If the Elders (or Communist Party, if you’ll have it) win, then China will be on a path to develop like Korea or Taiwan. But whatever happens, it feels like it will happen soon.

Steven Kopits: If you are saying that China is run by an authoritarian, single-party, autocracy, well gee, I don’t disagree. It’s been run by such since 1949; why is growth only slowing now under a single-party autocracy?

My point is not that they’re not in trouble. Rather, with lots of levers at their command, the leaders could maintain growth in the short term, and (here’s my opinion) will do so, even at the expense of medium term growth.

I am saying that the evidence suggests that we have Xi, who is looking for autocratic and permanent one-man rule, versus the Communist Party (the Elders), which is looking for five (or ten) year rotating leadership and collective decision-making. If we put it to England in 1215, its the King versus the Peers.

We have Xi who thinks international confrontation and aggressive base building is a good thing; that the abduction of British and Swedish citizens in Hong Kong is a good thing; and that taking away the flash PMI when the yuan and China’s economy is facing turmoil and uncertainty is a good thing. Under his leadership, the PBoC is unable to issue a one-page communique explaining their exchange rate policy. I could write it for you in an hour.

To me, and I would imagine to a good number of the technocrats and Elders in China, this is pure amateurism. It reflects some sort of retro-Soviet mindset completely out of step with China’s underlying development trends. China is not some sort of rogue nation, it’s a great global power and it needs to be run like one.

This is what’s going on in China.

http://www.nytimes.com/2016/02/05/world/asia/china-president-xi-jinping-core.html

I think the HK import / export data suggest we are seeing real capital flight out of China. It’s not just an exchange rate issue.

http://blogs.wsj.com/chinarealtime/2016/01/26/new-math-china-hong-kong-trade-stats-more-than-meets-the-eye/

Here’s the important news today. This is unvarnished aggression.

http://www.wsj.com/articles/china-deploys-missiles-on-disputed-island-in-south-china-sea-1455684150

How badly do people want to get their money out of China?

http://blogs.wsj.com/chinarealtime/2016/02/16/china-capital-flight-2-0-lose-a-lawsuit-on-purpose/?mod=WSJBlog

http://tv.ifeng.com/2467202/news.shtml

Don’t get it. Lots of talk of war with the US.

Hungary: What happens when the technocrats are sidelined

http://www.bloomberg.com/news/articles/2016-02-18/hungary-central-bank-stockpiles-guns-bullets-citing-terror-risk

Keep your eye on Li Keqiang. Something bad is about to happen to him.

Business Insider presents the same thesis I do:

http://www.businessinsider.com/xi-is-preparing-to-dominate-china-2016-2

NYT Missile Provocation:

http://www.nytimes.com/2016/02/18/opinion/chinas-missile-provocation.html?_r=0

China announces new restrictions on foreign media, notably that any media outlet with any foreign ownership has to submit any articles for government approval prior to publication. Not easy to provide news using that standard. The effect is to prevent domestic Chinese from accessing external information, ie, to facilitate a domestic news blackout.

When does this putsch happen? Feels like this weekend, Saturday into Sunday, on a gut basis.

http://www.cnbc.com/2016/02/18/the-associated-press-china-requires-approval-for-foreign-firms-to-publish-online.html

PBoC has discontinued reporting some of its capital outflow numbers. No surprise here.

http://www.scmp.com/news/china/economy/article/1914007/sensitive-financial-data-missing-central-bank-report-capital?utm_source=edm&utm_medium=edm&utm_content=20160219&utm_campaign=breaking_news

According to FT in 2015:

“China will become one of the world’s biggest cross-border investors by the end of this decade, with global offshore assets tripling from $6.4tn now to nearly $20tn by 2020, according to research.”

In recent years, annual outbound FDI from China exceeded 100b usd. It was reported that pending or approved deals amounts to about 65 b usd so far in 2016. Does this add to position of strength for China?

People are panicking in China, Ben. That’s why the PBoC declined to publish apples-to-apples capital flows numbers.

So let’s see Xi’s accomplishments for the week:

– placed missiles in the Paracels, earning international condemnation

– effectively prohibited foreign entities from publishing in China

– fired head of China’s SEC

– fudged capital outflow numbers

– prompted HK newspaper commentator to write that ‘there will be no Tiananmen event in HK’. Not good if you have to deny it!

And that’s just this week! He just doesn’t understand the linkages, or more likely, doesn’t care. And that’s the perennial weakness of dictators, from Hitler, to Saddam, to Putin, and many others (but excluding Stalin and Mao, by the way). They know how to open positions, but they don’t know how to close them.

So, if Xi succeeds–not a given–then the Chinese will have to choose, just as have we Hungarians. The expatriate community is sharply split between those who back Orban, loyal conservatives, and what I might call classical liberals, who believe in rule of law. They are split today as no time in the past.

You remember that scene in The Sound of Music in the cemetery, and Captain von Trapp says to Rolf, after pulling the gun away from the boy: “You’ll never be one of them.” That’s the decision, Ben.

If you rely on what read in western media, you have about 80% of misses, based on my understanding of western media reporting which seems like the blind leading the blind.

I mean “If you rely on what read in western media(except the likes of econbrowser”, you have about 80% of misses, based on my understanding of western media reporting which seems like the blind leading the blind.

Just out: China’s 2015 trade balance is 293 b usd.

May be PK should continue shouting currency manipulation.

From bbc

China has overtaken the US as the top destination for foreign direct investment (FDI), for the first time since 2003.

Last year, foreign firms invested $128bn (£84,8bn) in China, and $86bn in the US, according to the United Nations Conference of Trade and Development.

The growth in China’s foreign investment benefitted the services sector as manufacturing slowed.

Globally, foreign investment fell by 8% to a total of $1.26tn last year.

From straits times

BEIJING (AFP) – Foreign investment into China accelerated in 2015 as cash poured into the country’s service sector, official data showed Thursday, despite slowing expansion in the world’s second-largest economy.

Foreign direct investment (FDI), which excludes the financial sector, rose 5.6 per cent from the previous year to US$126.3 billion (S$181.1 billion), according to figures from the commerce ministry.

That is more than triple 2014’s growth of 1.7 per cent.

Bbc report dated 30 jan 2015