Which one of these texts is drawn from a real article?

What a coincidence. Just as momentum was building towards an interest rate hike by the Fed, along comes a dismal jobs report that takes any increase off the table. Contrary to the general perception, this is a lucky break for Democrats. … Given all that is stake, it is surprising that no one has questioned whether the jobs report might have been massaged by the Labor Department

Or.

Friday’s Bureau of Labor Statistics jobs report turned out to be a real doozy, as they say, with the number coming in way, way below expectations. Analysts were looking for 155,000 new non-farm payrolls, but the BLS statistical massaging and manipulation machine only managed to spit out a meager 38,000.

This is a trick question! They are both from actual articles, the first from Fox News, and the second from the Gilmo Report.

I’m not taking issue with the assertion that the estimates of employment growth could be wrong; it’s the assertion that they are deliberately manipulated to go one way or the other which troubles me. Like previous instances — Senator Barraso, Jack Welch, former Rep. Allan West, Zerohedge — it’s easy to dispense with the view that the numbers were massaged to get a certain, wildly distorted, picture.

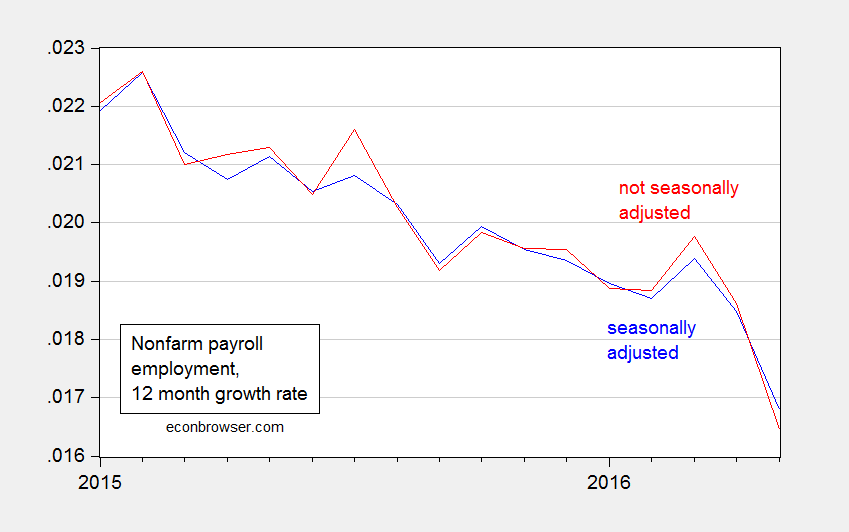

- First, 12 month changes in seasonally adjusted and not seasonally adjusted nonfarm payroll (NFP) employment series look similar.

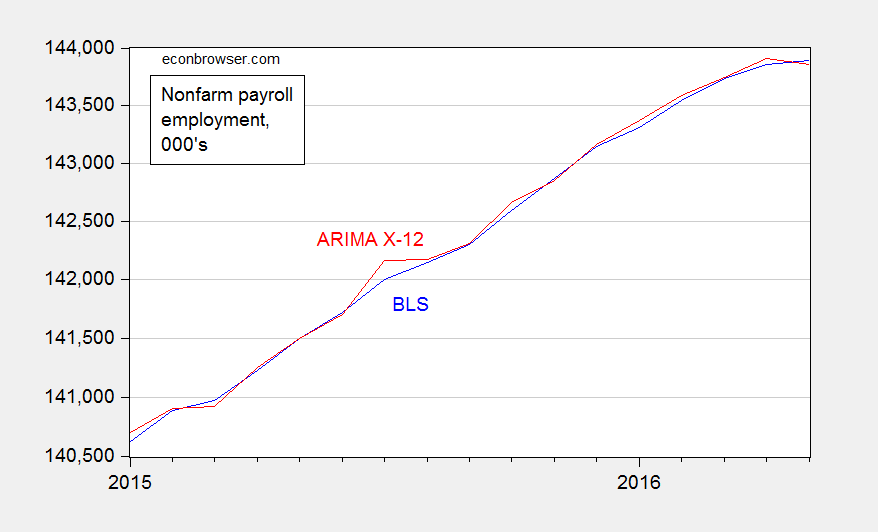

- Second, the BLS NFP seasonally adjusted and a series adjusted using a standard seasonal adjustment series, ARIMA X-12 (over the entire sample post-1986 sample) look quite similar in levels.

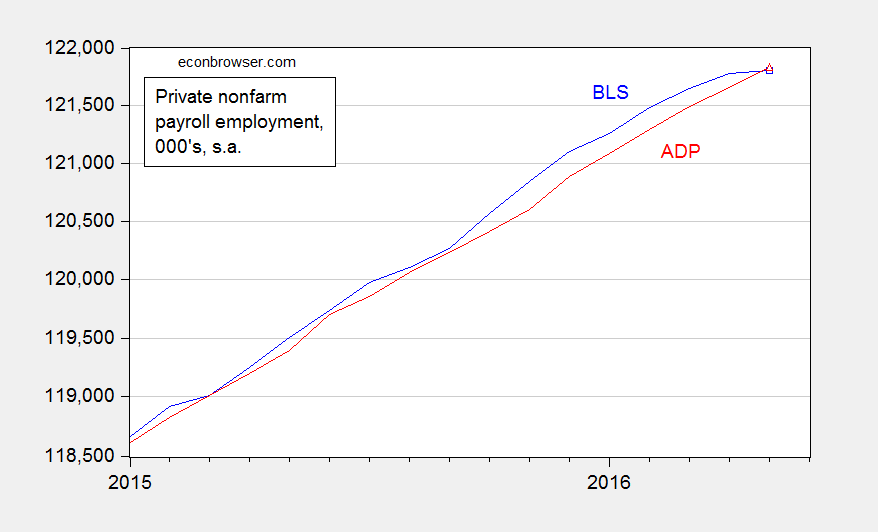

- Third, the level of the BLS private nonfarm payroll series and the corresponding ADP series match almost exactly.

These points are illustrated in Figures 1-3.

Figure 1: 12 month growth rates in seasonally adjusted nonfarm payroll employment (blue), and in not seasonally adjusted nonfarm payroll employment (red). Source: BLS via FRED, and author’s calculations.

Figure 2: Seasonally adjusted nonfarm payroll employment as reported by BLS (blue), and not seasonally adjusted nonfarm payroll employment, seasonally adjusted using ARIMA X-12 over entire 1986-2016 period (red). ARIMA X-12 uses EViews default settings, including multiplicative seasonals. Log scale. Source: BLS via FRED, and author’s calculations.

Figure 3: Seasonally adjusted private nonfarm payroll employment as reported by BLS (blue), and as reported by ADP (red). Log scale. Source: BLS and ADP via FRED.

If the BLS were really trying to manipulate the employment series to be lower than actual, then it did a poor job. If it were trying to manipulate it to be higher, it did a poor job — since it hit the mark on private NFP. (This is not to say there isn’t a bias; Owyang et al. (2014) notes a downward bias in preliminary vs. revised of about 18,000, since January 1980.)

It’s a slightly different story on m/m changes (rather than levels). Then BLS was too low relative to my (conventional) adjustment for NFP, and too high relative to ADP for private NFP.

On the other hand, if one wants to argue that adjustment for seasonals might possibly be improved, then we’re in agreement; see Jonathan Wright (his estimate is that the BLS series is 40,000 too high). Moreover, it’s always important to keep in mind that the margin of error for m/m changes is about plus/minus 100,000…[1]

Of course, these claims pale into insignificance when compared against Donald Trump’s assertion that the “real unemployment rate” is 42%. [2] In that respect, at least, he has the greatest (conspiracy) theories.

By the way, if there is a conspiracy, then the ADP Institute must be in on it since there employment index and numbers show the same trend line as the BLS. http://workforcereport.adp.com/

Gosh, it must be wonderful to invent conspiracy theories whenever the data disproves your ideology.

The FED has been in a tightening cycle for almost 3 years starting with the “Taper Tantrum.” It is an illustration that we all become, no matter how brilliant, often “prisoners of the quiet dogmas of the past,” and unfortunately for Stanley Fisher and Janet Yellen, the inflation of the 1970s is the trauma of their youth that they are constantly fighting. When they see the FED Fund rate this low, they think they are being to accommodative, but the reality of world of “over supply,” low labor share of GDP, and low “investment” due to public sector austerity and lack of private sector demand it indicates no such thing. Velocity of Money continues the secular decline of the last 35 years, and this fact is little noted or explained by the FED or macroeconomists in general. https://research.stlouisfed.org/fred2/series/MZMV and https://research.stlouisfed.org/fred2/series/M2V, a slow down that basically neutralizes the growth of the money supply. https://research.stlouisfed.org/fred2/series/MZM What the Fed has done over the last 3 years, with termination of QEIII and talking incessantly of its plans to raise interest rates as been tightening, most manifested in the dollar’s 25% increase in trade weighted value since 2012. https://research.stlouisfed.org/fred2/series/TWEXB The slowing of growth and employment is the natural result of this foolish tightening, a triumph of emotions and nostalgia over brilliant minds. Kocherlakota and Summers both predicted last fall that the Fed would be rushing back to ZIRP and starting QEIV long before they got the short term rate to 2%.

Anyone who does not understand that this administration is corrupt to the bone, as were the prior two, is pig ignorant. Think Lois Lerner, the bailout of Fannie and Freddie which current court cases are proving was entirely unnecessary, the 9/11 cover-up, etc. etc. Political appointees head every department. Orders come down from on top. You’ll lose your job if you don’t follow them. What earthly reason, therefore, is there to believe that some of the economic numbers are not fudged by some amount in difficult or impossible to discern ways? What other reliable benchmark does one have to compare with, anyway? The employment surveys are a government monopoly. Medical cost inflation in the CPI is splintered into a dozen pieces from which an overall is impossible to construct. What is that all about? Best efforts at reconstruction find that CPI medical inflation falls far short of private sector numbers.

For many years I implicitly trusted the government numbers, even defending the job that Washington’s civil servants do. Not anymore. Anyone who in good faith questions such things today is promptly belittled. Whistleblowers are hounded. Shadow Statistics may not have it right. I for one surely don’t reference or use their numbers. Yet the old saw of where there is smoke there is fire no longer cuts the mustard. Instead now there is billowing >/i> smoke and there is definite fire.

JBH: You write: “Political appointees head every department.” Well, I think that’s been true for a pretty long time. Each post that is subject to Senate confirmation is a “political appointee”. Or are you saying they are “political” now in a way they weren’t in, say, Reagan’s time. If so, please clarify.

Really, you are coming off as hysterical. You ask about government statistics “What other reliable benchmark does one have to compare with, anyway?”. Well, in the post you are commenting on, I noted the comparison between the ADP and BLS series. That’s one. We can do comparisons of CPI’s indices and the Billion Prices Project (see this Econbrowser post). That’s another.

If you want to be taken seriously, come up with some tangible evidence of manipulation, discernable by statistical methods. Until then, feel free to keep on your tinfoil hat.

Menzie: I am saying Congress and the executive branch have become increasingly more corrupt since the Reagan era. Obamacare would never have passed over the wishes of the people, otherwise. As well, the mainstream media is more bought and paid for and deceptive and propagandizing, with the government continuously feeding the media sound bites. And you well know all this.

ADP has consistently underestimated private sector employment. On a rolling 12-month average of monthly changes, since this recovery began ADP has never once estimated as many jobs as the government. Last month was the sole exception because of ADP’s gargantuan miss to the up side. That’s egregious bias. And suffices for the kind of proof you are looking for.

And what about the flawed medical component of the CPI?

“Obamacare would never have passed over the wishes of the people, otherwise. ”

i understand it is inconvenient to acknowledge this fact, but obamacare was passed in a democratically elected congress and approved by a democratically elected president. this idea of against the wishes of the people is simply garbage.

That was a real doozy of a “soundbite” that he Administration fed to Fox News then, wasn’t it.

JBH: Now, here we have a conundrum. You write “ADP has consistently underestimated private sector employment.” How do you know ADP consistently underestimated? By referring to the BLS series you assert was consistently massaged? Or do you have “revealed wisdom” that tells you what private sector employment, and if so, do you receive such revealed wisdom on monthly installments?

Menzie: You are quite right. Moments after I hit send on my comment, I realized my mistake. Between the two, we cannot know which is the truer representation of the population universe without bringing in some outside information. As for revealed wisdom, I take it from your reference to monthly that it only comes around infrequently for you.

JBH: Yes, quite infrequently. Precisely never, in fact

This Admin.? Why even make this post? You could say this about any Admin that lived.

Professor,

Thanks for trying, but don’t you know, like the world turtle, it’s data manipulation all the way down.

Sorry, but your still not telling of the “new” “adjustments” made for this year to end the weak first, strong second, weak third and strong 4th. IMO, they had issues when dealing with it. It lead to a slight overestimation of job growth in the 1st quarter which they are trying to unwind. It was a blunder. Talk to any “BLS insider”. They will reverse that now with fat reports in the 3rd quarter and econ-bear nostrils will be flaring.

“Think Lois Lerner, the bailout of Fannie and Freddie which current court cases are proving was entirely unnecessary.”

Lois Lerner? Fannie and Freddie? I mean Fannie and Freddie were leveraged at 100 to 1. A mere 1% default rate meant that they were insolvent. Of course they needed to be bailed out. When you have a liquidity crisis, you can’t just sit by and wait for the chickens to come home to roost five or six years later.

And the passage of Obamacare was also a fake? You can look on line and count the votes in Congress yourself. Are you implying that McConnell and Boehner were in on the fraudulent vote count and are keeping their mouths shut about the real vote count?

That’s some weird conspiracizing going on there.

That there is an elitist global conspiracy going on is the most intelligent remark I ever recall you making, Joseph. The wonderful thing about the internet is that archives open and the public then learns the truth. For the truth on Fannie and Freddie – which you evidently do not have the foggiest clue about – go to the gold standard on the subject, GSElinks.com. The corruption surrounding the Fannie and Freddie scandal is a mile wide, drenched in government corruption, and about to break out in front page headlines. Freddie and Fannie never had a cash problem, and were never close to insolvency. Once you grasp hold of this string – that Fannie and Freddie were never in financial trouble and could have weathered the crisis just fine without any bailout – all the rest of the ball including the government’s cover-up will unravel before your eyes. In knowledgeable legal and financial circles, the 100-1 leverage ratio you spout off would be laughed out of the room. You lack any comprehension of the details of their business, that Fannie and Freddie each operated two businesses, and that each dual business was sound and profitable at all times, even at the peak month of mortgage defaults.

“That there is an elitist global conspiracy going on is the most intelligent remark I ever recall you making.”

I wouldn’t be surprised if you heard such a statement from someone in your conspiracy circles, but you never heard it from me.

Paranoids can never handle the facts… that’s the definition of paranoid. Try convincing a paranoid that the fed’s aren’t listening into their thoughts though hyper-wave transmission mechanisms being carried by the drone’s that look, sound, and behave just like birds. .. or were those the extra-terrestrials from the zymodiam galaxy? I can’t be sure which version the paranoids have decided is the right version yet.

In the world according to JBH government workers are both easily dismissed if they won’t fake the numbers for the boss while at the same time being shiftless & lazy secure in the knowledge that they cannot be dismissed. I’m so confused.

There are two legitimate concerns over the accuracy of BLS data; viz., budget cuts at BLS and the (apparently arbitrary) requirement to release employment numbers on the first Friday of each month. The May 2016 numbers were reported on June 3rd at 8:30am EDT. There was also a government holiday (Memorial Day) earlier that week. Maybe some enterprising young grad student will compare the magnitude of revised employment numbers with the number of days the BLS has to develop the initial report.

Menzie Not that it makes all that much difference, but I thought BLS was using ARIMA X-13

2slugbaits: You are completely right — BLS uses X-13 ARIMA SEATS. I’m just behind the times…

If the facts don’t fit your ideology, and you believe your ideology is the only true one, then you have no alternative than to believe in a conspiracy. Otherwise, you would have to admit your ideology was not true. I use to think this was a phenomena found mainly on the right, but sadly it is true on the left too as witnessed by those who believe there are 2 million votes in the California democratic primary that are still uncounted

«I’m not taking issue with the assertion that the estimates of employment growth could be wrong; it’s the assertion that they are deliberately manipulated to go one way or the other which troubles me.»

That market and vote moving statistics get “massaged” and to significant amounts is something for which there is a lot of evidence; even if it does not happen every time in every way.

The evidence available shows that:

* There is significant “bipartisan” long term clever massaging of many market and vote moving indices by “plausible” but significant amounts. This is most clearly demonstrated by “methodological revisions” essentially always resulting in “better” values for the indices, be they stock market, GDP employment, inflation indices. Somehow nearly every past “mistake” that needs fixing resulted in “worse” values, and the fixing of those mistakes happens amazingly usually when it is most convenient.

* Sometimes evidence surfaces that specific indices get actively “LIBORized” in the short term by governments or private interests, but this is relatively less common. Sometimes this gets even prosecuted if done by private interests.

Blissex: Aren’t you the same person who wrote:

Kudos for consistency; but if you are saying Shadowstats is mostly right, then I think you have no credibility.

«ShadowStats are *mostly* right: their final numbers are «probably excessive», but their premises are quite agreeable as to the points they make on methodology changes»

As to ShadoStats on how biased the “methodology changes” have been there is little to dispute,and indeed there has been been little dispute, they have been mostly right. The “methodology changes” have indeed been nearly one-way (I say “nearly” only to prevent people finding one or two tiny ones that contradict the trend and claiming those invalidate it) for decades now, and there is still a cottage industry of loyal “sell-side” Economists publishing papers that try to find ways to “improve methodologies” so that reported inflation, GDP, unemployment, stock prices, etc., can be tweaked to “look better” than they did.

It is amazing looking at the stream of “methodology changes” since the late 1970s how the government and corporate statisticians of the 1950s and 1960s seemed to have erred almost always towards under-reporting the success of Real America; that is so suspiciously one sided that it looks as if they were part of a vast communist conspiracy, uncovered by the patriotic work of Boskin, Greenspan and many others. :-).

«“plausible” but significant amounts.»

This can be ass “innocent” as systematically biasing in a given direction the “methodologies” with which the data is collected and the index is computed, which can probably result in value more than one standard deviation away from a less biased value.

As to how significant the amount is, there have been arguments that if the statistics of the 1970s and 80s were “restated” using equally clever “more accurate” methodologies then those decades would turn out to have been periods of significantly more moderate inflation, low unemployment and GDP growth than it seemed at the time, and all that fuss of reaganism and monetarism was about nothing much. Probably the 1930s could be “restated” in much similar ways too :-).