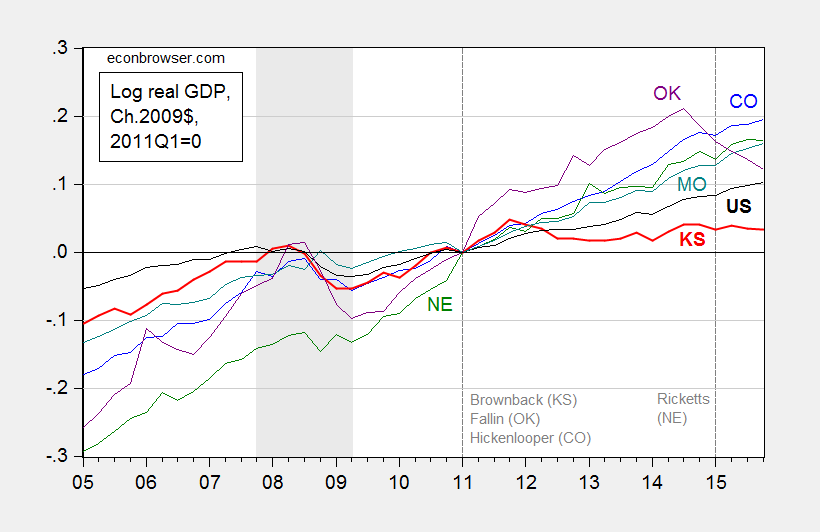

Some critics (e.g., [1]) have argued that employment and coincident indicators are too narrow of measures of economic activity to make relevant comparisons. Here I plot the real GDP — the broadest measure of economic activity — for Kansas and her neighbors.

Figure 1: Log real GDP for Colorado (blue), Kansas (bold red), Missouri (teal), Nebraska (green), Oklahoma (purple), and US (bold black), all 2011Q1=0. NBER defined recession dates shaded gray. Source: BEA quarterly state GDP release, and BEA GDP 2016Q1 2nd release, NBER, and author’s calculations.

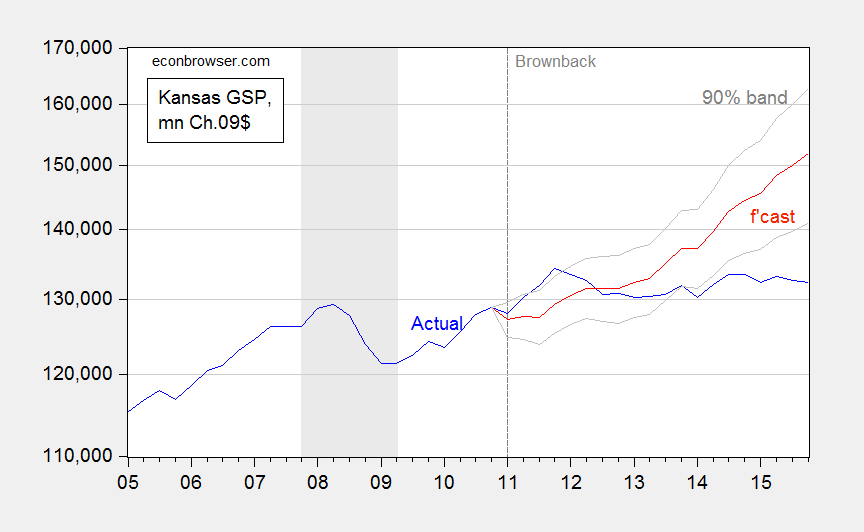

Now, it could be that Kansas has a flatter growth trend; however, as I noted in this post, based on pre-2010 correlations, Kansas should have done better (as shown in the red line), and done so by a statistically significant margin.

Figure 2: Kansas GDP, in millions Ch.2009$ SAAR (blue), ex post historical simulation (red), 90% prediction interval (gray lines). Forecast uses equation (1). NBER defined recession dates shaded gray. Log scale for vertical axis. Source: BEA, NBER, and author’s calculations.

The Kansas tax revenue shortfall has just forced the state government to borrow $900 million for the next fiscal year, and tap the highway fee and Medicaid fee funds. It’s already looking at a $45 million hole for the fiscal year about to end, despite previous fixes.[2]

In what respects would higher taxes have changed the basic situation in Kansas? What other specific policies would address the following?

– Demographic stagnation

– No real high tech presence

– Not much manufacturing

– Banking/finance not so much

– Full employment; increased labor participation rate http://www.bls.gov/regions/mountain-plains/kansas.htm#eag

Kansas is an agricultural state (7th nationally) but labor is not going to expand there and available land is not increasing. Maybe GMO products could increase yields and add to the state’s total economy, but that might be a hard sell.

The forecast lines on the graph are interesting, but what is the basis in any reality? Extrapolation of the past? That’s not a very sophisticated technique given the general conditions listed above.

Yes, political promises are cheap to make. All politicians know that and do that.

Good grief, has it come to this? Higher taxes would have led to higher government spending, with the corresponding multiplier impacts. Are you really still peddling expansionary austerity?

Did that really work for Greece? Come on, Howard. There are other factors besides government stimulus… forever. States, unlike the U.S. government, cannot print their own money. Take a stagnant, aging demographic and pump up taxes and you get… Texas/Florida (definitely not California) here I come.

Your one-dimensional thinking gets a little old. Well timed, stimulus can be effective. So can “rainy day” funds. But constantly increasing taxes and government spending is Venezuela. You run out of other people’s money.

“Did that really work for Greece?”

actually, during the financial crisis in greece, austerity was the defining economic policy. and it failed, miserably.

“Well timed, stimulus can be effective. ”

i certainly agree. and well timed stimulus, in the case of greece, would have been during its financial crisis. the same could be said for kansas. austerity economics during a downturn have been shown to be very poor economic policies. you have two case studies to illustrate this fact, and yet you still are in denial.

Finally you include Colorado, probably the most libertarian state in the US. The fact that a state that passed TABOR is outperforming the US is not surprising, given that taxes are very low here. Also note that CO depends on oil production like OK, but since we passed TABOR we have become very diversified and as Menzie’s chart shows CO is doing quite well despite sub$50 oil prices this year.