Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared on October 25th in Project Syndicate.

Populist politicians, among others, have claimed in recent years that monetary policy is too easy and that it is hurting ordinary workers. But raising interest rates is not the way to address income inequality.

It is a strange claim for anyone to make, but especially for populists. Low interest rates are good for debtors, of course, and bad for creditors. Throughout most of US history, populists have supported easy monetary policy and low interest rates, to help the little guy, against bankers, who had hard hearts and believed in hard money. That was the argument when William Jennings Bryan ran for president in 1896 on a platform of easier money, with the support of Midwestern farmers who were suffering from high interest rates and declining commodity prices. It was the argument when supply-siders opposed Paul Volcker’s high interest rates, leading Ronald Reagan in 1985 to appoint two Federal Reserve governors who would challenge the Chairman.

An interesting dimension concerns gold. In the 1890s, Bryan’s proposed reform for allowing easy money was to take the US off of the gold standard, most famously in his “cross of gold” speech. (He vowed to lead the people as they confronted “the idle holders of idle capital,” declaring “You shall not press down upon the brow of labor this crown of thorns; you shall not crucify mankind upon a cross of gold.”) In the 1980s, the supply siders’ proposal for easier money was to put the US back onto the gold standard. In this election year Donald Trump, following Ted Cruz and other Republican presidential candidates, has said he too would like to go back to the gold standard. But when Trump and other Republican politicians express admiration for the gold standard now, it is because they want tougher monetary policy. It is hard to find a consistent thread. Republicans seem to want monetary stimulus when they are in office, and to oppose it when they are not.

The truth is, monetary policy is not a very appropriate lever with which to address income inequality. That is not to say that inequality is not important. It is. Most of the increases in GDP have gone to those at the top since the 1970s. But the right tools to address the inequality problem are progressivity in taxes, universal health insurance, financial reform, and so on. To draw an analogy, global climate change is an important problem, but monetary policy is not the right tool for that job either.

The job of monetary policy is to promote growth in the overall economy while maintaining price stability and financial stability. This is not at odds with helping those in the lower rungs of the income ladder. To the contrary, a “high-pressure economy” (to invoke a phrase recently revived by Fed Chairman Janet Yellen), that is, an economy running hot enough to create jobs at a rapid rate, will eventually lead to higher real wages for workers and higher real incomes for the typical worker. This describes the results, for example, in the high-pressure economy of the late 1990s which eventually pushed the unemployment rate below 4%.

Some may then react: Why has that not happened in the current expansion? The answer is that it has.

The economy has added more than 15 million private sector jobs since early 2010. Employment growth has been running well in excess of the natural rate of increase in the labor force. The longest continuous series of monthly increases on record had brought the unemployment rate down to 5% by last year (from above 9% in 2009-10) and is now pulling previously-discouraged workers back into the labor force. The increased demand for labor has in turn led to rising real wages for workers (up 2 ½ % last year), at the fastest rate in this business cycle than any since the early 1970s.

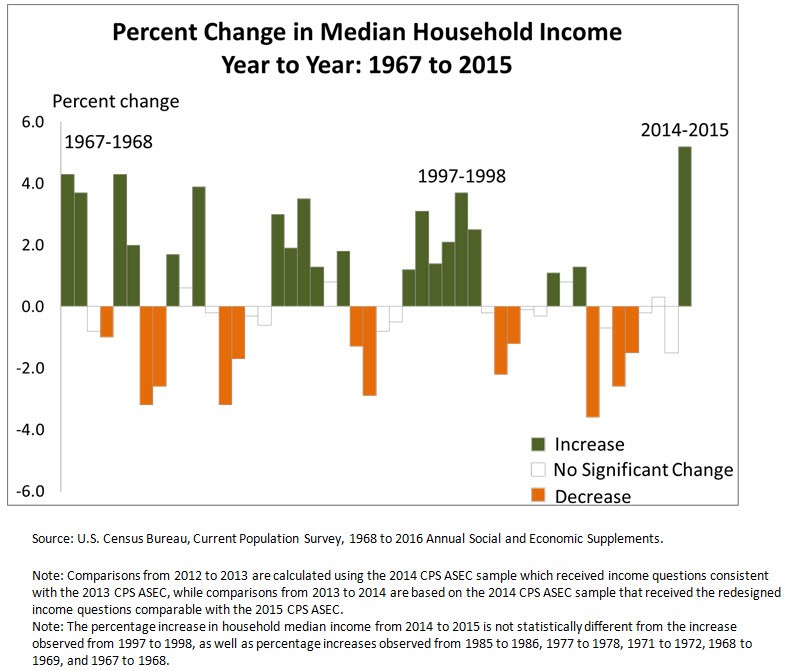

Until recently, the labor market gains puzzlingly did not seem to be show up in the reported real income of the typical American household. But last month, when the Census Bureau released its annual economic statistics, they showed that median household income had increased by 5.2 percent [$2,800] in 2015, the biggest rise on record (see chart). Furthermore, every part of the income distribution benefited, with the biggest percentage gains going to those in the bottom tier and the smallest gains going to those at the top. These are big changes and offer important confirmation that lower-income families are finally sharing in the economic recovery.

What about those who think that easy monetary policy is bad for income inequality? What are they thinking? Not all of them are fringe populists. For example, British Prime Minister Theresa May said earlier this month that low interest rates were hurting ordinary working class people while benefiting the rich.

A fall in interest rates contributes to a rise in securities prices, both stocks and bonds. Needless to say, the rich hold more stocks and bonds than the less fortunate. “People with assets have gotten richer. People without them have suffered,” aid PM May. And indeed, stock prices are high now, near all-time highs in the case of the United States.

The Fed reductions in the policy interest rate occurred quite a while ago, virtually to zero in 2008. That monetary stimulus together with the associated recovery of the economy no doubt contributed to the turnaround and strong rebound in the stock market that began in early 2009. But it is harder to use the low level of interest rate to explain the continued rise in the stock market from 2012 to 2015, a period when the Fed announced an end to quantitative easing and markets began to anticipate that it would soon start to raise interest rates.

One can think of other distributional implications of easy monetary policy as well. Inflation is good for debtors and bad for creditors. That is one reason why good populists have historically favored easy money.

The unconventional monetary policies of recent years [UMP] may have some new effects of their own. One is the effect on banks, whose profits have been severely squeezed of late. Low interest rates are a major reason for this compression of bank profits, especially in Europe where the interest rates that banks earn are actually negative but where it is hard for them to cut the rates they pay to their depositors below zero. Any self-respecting populist should like this squeeze on banks, especially if he or she is still angry about the global financial crisis.

The net effect of easy money is probably more to reduce inequality than to exacerbate it, according to econometric estimates. But the effect on income distribution is much less reliable than the effects of other policies targeted for that purpose. In any case, the Fed and other central banks are not balancing rapid growth against equality, but rather are balancing rapid growth against dangers of future overheating and financial instability. They view their jobs as managing the overall economy. They are right to do so.

This post written by Jeffrey Frankel.

The only problem with this post is that it confuses low interest rates with ‘easy money.’ Interest rates are not ‘the price of money,’ as Milton Friedman famously made a centerpiece of his monetary theories. As well, Ben Bernanke in his academic writings before he was named to the Fed Board.

Interest rates have no…NO…informational value about the stance of monetary policy. Relying on them to set monetary policy is worse than useless, it is often counter to what is needed. As in the 1930s here, in Japan beginning in the 1990s, in the USA in 2009-now, and in Europe lately.

What appears to be the best gauge of the stance of monetary policy is the deceptively simply Nominal GDP. Growth of which has been pathetically slow since 2008; ergo, monetary policy has been too tight.

This shouldn’t be controversial.

Patrick R. Sullivan: I am still waiting — now two years! — to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Grow up, Menzie. You were wrong to distort my claim two years ago, and your persistence in your foolish error just makes you look like the political hack your obviously are.

Now, are you capable of making a substantive comment on my comment. My money is on, ‘no.’

Patrick R. Sullivan: How does adding any surrounding text make true your assertion? It doesn’t. Your statement was factually wrong, and demonstrated with data. Hence, I continue to wait to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Each time you post, I will inquire again. If you wish to pursue this in depth, I am happy to write an entire post re-addressing this point.

Over a hundred years ago, no one was going to bail you out for making a bad loan. The country was much poorer compared to today. Risk takers with vision built the country and created jobs. They raised American living standards, and surpassed Great Britain and Imperial Germany, the two industrial giants at the time. There was no fiscal policy to stimulate demand and the Fed didn’t yet exist.

Over the past hundred years, the Fed has increasingly done a better job smoothing-out business cycles. Boom-bust cycles are inefficient, both in the boom and bust phases, because of periods of strain and slack. However, the Fed has been unable to get us out of this depression, which is caused by other factors. The Fed believes it needs to do more to preempt inflation (and Reagan reappointed Volcker).

To PeakTrader.

That Republican Presidents Ronald Reagan and George H.W. Bush tried aggressively to push the Fed into easier monetary policy is documented in Bob Woodward’s 2000 book Maestro, among other places. It’s been a Republican tradition since Richard Nixon. [http://www.economonitor.com/blog/2010/11/the-pot-again-calls-the-kettle-red-republicans-democrats-the-fed-and-qe2/]

JF

JF, perhaps, Reagan in 1981 was for tax cuts and restrictive monetary policy and in 1985, he was for tax hikes and more accommodative monetary policy, given economic conditions. Bush 41 raised taxes and wanted more accommodative monetary policy, particularly before the 1992 election. Anyway, I believe, politicians don’t have enough information to second guess the Fed and monetary policy shouldn’t be set based on politics. I’m sure you agree the Fed should be independent.

Populist politicians, among others, have claimed in recent years that monetary policy is too easy and that it is hurting ordinary workers.

Yes, you do hear that a lot from politicians; especially GOP politicians who like to wear silly three cornered hats. The only thing I can figure out is that by “ordinary” they mean well-heeled and by “workers” they mean retirees with highly liquid assets. Strikes me as an abuse of the English language, but what do I know?

Those same politicians also talk about the Fed “printing” money, and they mean “printing” in a literal sense. Says a lot about how well informed our politicians are concerning monetary policy. Still, you can’t entirely blame the politicians. In the long run voters get what they deserve. As long as idiots have the franchise we’ll have idiot politicians. The solution isn’t to take away the franchise. The solution is to shut down Fox Noise as a public menace that makes people stupid. Maybe we need a new public service announcement: “This is your brain. This is your brain on Fox News.”

“The truth is, monetary policy is not a very appropriate lever with which to address income inequality.”

Piffle and nonsense. The Federal Reserve has consistently used over-tight monetary policy for the last three decades to ensure that the labor share of national income is repressed and that inflation is low to protect bankers. Don’t p**s on my leg and tell me it’s raining by claiming that the Fed doesn’t have an influence on inequality.

If the Fed really cared about inequality, they wouldn’t have spent the last eight years wringing their hands at every meeting looking for any excuse to raise interest rates. They would instead have declared that they would not enforce a limit of 2% inflation (from the lower side by the way) but would tolerate 3%, 4%, 5% inflation — whatever it takes — until labor’s share of income improved and made up for three decades of wage suppression. They wouldn’t declare that 5.5% is the floor for unemployment, thereby suppressing wage increases. They would have announced an easy money policy that won’t stop.

As horrible a Fed chairman as Alan Greenspan was, he did make one good move when he allowed unemployment to go below 5% in the late 90s — against the shrieking of Janet Yellen, by the way — the only period in the last three decades that wage earners actually had a real wage increase. There was no accelerating inflation, but there were real wage gains.

So no, your statement that the Fed doesn’t have to tools to influence inequality is false. The Fed has consistently used those tools to suppress wages and increase inequality.

And, it should be noted, while the Fed jawbones to keep inflation expectations low, it adopts a highly accommodated stance. Therefore, it maximizes easing the money supply. You’re blaming the wrong institution.

My comment above should be below my comment below.

It’s more accurate to say the Fed wants to contain inflation expectations and keep interest rates lower (rather than higher).

At the tail end of the height of the Information Revolution, in 1995-00, there was an investment boom – adding potential output – which allowed stronger growth without fueling inflation. Also, the Clinton Administration and the GOP Congress achieved some pro-growth policies. In the 2000s, the consumption boom accelerated. It wasn’t reflected in GDP growth, because it was on top of the 1982-00 economic boom, the mild 2001 recession, and increasing trade deficits – reaching 6% of GDP.

Joseph,

You are correct.

Directly, the Fed’s mandates are low inflation and full employment:

http://www.economist.com/news/finance-and-economics/21568426-fed-specifies-unemployment-threshold-raising-rates-other-mandate

http://www.demos.org/publication/federal-reserve-mandate-full-employment

Indirectly, I would take that to mean they have the tools to address inequality too.

Mike Whitney of Counterpunch always has a good article:

Is This Class Warfare?

http://www.counterpunch.org/2016/03/30/is-this-class-warfare/

We have to remember when Jeff writes an article like this, it always seems to be coming from an establishment point-of-view, which is protecting the status quo and business-as-usual.

Sometimes that is in direct contrast to what’s actually happening out there in the real world, which explains the disconnect between what he writes and what we see.

Jeff was a member of the Council of Economic Advisers under President Bill Clinton, and Harvard is as establishment as it gets.

If you look at his 51-page CV, you kind of get an idea of his career path.

https://www.hks.harvard.edu/fs/jfrankel/CVJeffFrankel.pdf

Joseph, sustainable growth through price stability is optimal growth. A higher level of inflation, beyond 2%, will not raise real growth. It just raises the inflation rate. And, if it raises inflation expectations, it can cause accelerating inflation, which would require even higher interest rates to slow inflation and cause suboptimal growth. So, price stability is the Fed’s best choice to optimize real growth.

Of course, the Fed has done whatever it takes to raise inflation when it’s too low, including the Greenspan Fed lowering the Fed Funds rate to 1% and the Bernanke Fed undertaking quantitative easings.

Peak Trader A higher level of inflation, beyond 2%, will not raise real growth.

This claim is very much in doubt. Quite a few economists have been arguing for a slightly higher target; e.g., something in the 3% to 4% range. The reason is that a slightly higher inflation target gives the Fed a little more room to lower nominal rates. The 2% target (which the Fed seems to be treating more as a ceiling than a target) is awfully close to the ZLB. Some of the early arguments for a 2% target understated the difficulty of breaking away from the ZLB. There really isn’t a lot of evidence that a slightly higher target would lead to accelerating inflationary expectations. Furthermore, the risks of accelerating inflation versus deflation are not symmetric. The Fed has plenty of tools and experience with fighting inflation. No one wants accelerating inflation, but as problems go it is a fairly manageable one. The risks of deflation are much more intractable and the Fed is ill-equipped to fight deflation. Fighting deflation requires a functioning and intelligent Congress. Good luck with that.

Joseph There have been times when you could fairly accuse some of the Fed regional presidents of being overly sensitive to the whines of bankers. But I don’t think that’s true with most of today’s influential Fed members. Yellen and Fischer are not yellow running dog lackeys of fat cat bankers. They might make mistakes, but I’m convinced that they take seriously their mandate to balance growth, employment and inflation. And that’s certainly true of the professional staff economists at the Fed. I only wish our idiot congress critters took their jobs half as seriously as members of the Fed.

I happily glean important data points and associated infrences from these posts. Thank you!

Can I spell? no.

Menzie,

When you publish an article like this, how do we reconcile it with articles like these:

There’s a story(s) like this every day:

http://www.desmoinesregister.com/story/life/2016/10/21/iowans-their-wages-m-not-stupid-lazy-s-just-not-there/90947714/

Milwaukee:

http://www.cbsnews.com/media/americas-11-poorest-cities/11/

94 million people outside the workforce:

http://blogs.wsj.com/economics/2016/10/06/over-94-million-americans-are-outside-the-labor-force-and-thats-almost-certain-to-rise/

Clinton thinks the middle class earns $250,000 / yr:

http://money.cnn.com/2016/02/18/news/economy/clinton-sanders-middle-class/index.html

Obama thinks people will be pleasantly surprised by the cost of their health insurance plans this year:

http://thehill.com/policy/healthcare/303166-obama-most-will-be-pleasantly-surprised-by-healthcare-plan-costs

Jeff writes about Obama creating 15 million jobs, but the National Center for Education Statistics says there are about 3 million graduates each year, so 8 yrs x 3m = 24 million; 24m – 15m = 9m jobs short so far.

The National Employment Law Project says that mid-wage jobs, paying between $13.83 and $21.13 per hour, made up about 60 percent of the jobs lost during the recession, and that low-wage jobs, paying $13.83 per hour or less, have dominated the recovery to date.

If I look at the BLS Birth-Death model, it says “the net contribution is relatively small and stable” and those raw numbers add up significantly (millions) from 2009-2015. Does that mean half of the 15 million jobs are fictitious?

David Cay Johnston says wages have been flat since 1998:

http://america.aljazeera.com/opinions/2015/8/flat-wages-show-the-us-doesnt-have-a-labor-market.html

Labor Force Participation Rate (62.9%) is where it was in the 1970s during Carter’s term.

Something is not squaring up here and there seems to be a disconnect with what Jeff writes and reality.

Congratz MC.

Kansas is still bleeding, thanks to tea party economics

http://www.latimes.com/business/hiltzik/la-fi-hiltzik-kansas-economy-20161031-story.html

Alex: “Jeff writes about Obama creating 15 million jobs, but the National Center for Education Statistics says there are about 3 million graduates each year, so 8 yrs x 3m = 24 million; 24m – 15m = 9m jobs short so far.”

And about 4 million retire each year. Would you like to try again?

Then how did the labor participation rate drop from 66% to 63% over the past 8 years if we have created so many more jobs than eligible workers?

Dean,

Earlier this year I asked Mike Kimel, co-author of Presimetrics (a data-driven analysis of Democrat and Republican presidents and their policies and results) and contributor to angrybearblog.com, where Obama compares to the other presidents.

He said:

**

To be honest, I haven’t updated figures for Obama. In part it is because not enough people displayed an interest, and in part because there is a delay in getting data. Most of the figures needed to look at Obama’s performance won’t be available for years.

Here is what I can say. Obama has broken the patterns of behavior we noted in the book, at least when it comes to the economy. He has maintained GW’s tax policies, particularly early on. He dealt with the Great Recession the way GW was doing it rather than the way FDR did it, so the economy has grown GW-ish (i.e., lukewarm) rather than FDR-ish (i.e., an actual bounce back from a major downturn that included several years of the fastest peacetime real economic growth in this country’s history).

**

The other book I can recommend [aka : check out from the library or buy used : ) ] is Bulls Bears and the Ballot Box by Bob Deitrick & Lew Goldfarb; another data-driven analysis of presidents, policies, and results.

Thanks Joseph, but I’ll pass.

You missed all the context the first time around.

To JF, I agree with most of what you are saying but there is one critical aspect of this debate that you are missing: exactly how easy monetary policy could be hurting ‘ordinary workers’.

The resulting increase in asset prices makes home ownership in some markets prohibitive for ‘ordinary workers’. At the very least some of them are suffering sticker shock.

Workers are not just borrowers but also savers who eventually retire. They are not entirely dependent on transfers from the state.

If one assumes that ordinary workers are less financially sophisticated than the rich, the class of low-risk instruments that the less financially sophisticated often favour have been paying a much lower real rate of return in this era of super easy monetary policy.

Erik, there are some critical aspects you’re missing. Homeownership affordablility is also based on income and mortgage rates, not just home prices. Also, you can’t save without a job or decent income (e.g. a full-time job). So, it’s critical the Fed does its part when the economy is underperforming. The Fed isn’t hurting ordinary workers, particularly if they have 401(k)s and are homeowners.

Peaktrader,

Thanks but that said I do believe I understand all the factors affecting home ownership affordability including the infamous mortgage deduction from personal income tax. Including cognitive factors that I alluded to in the reference to perception and sticker shock.

As for the dual mandate that you implicitly refer to, I would argue that the employment mandate of the US central bank has really hurt ordinary US workers on more than one occasion.

Monetary policy should not target structural economic problems which is the omni-present temptation with the employment goal. Apparently, a few of the economists who work for the branches of the US central bank share that outlook, if you will pardon the lame authority argument.

Actually, it should be called a triple mandate monetary policy because there appears to be an implicit mandate to tend to the fiscal health of the federal government. Strikes me that there is great potential for moral hazard blow back though I suppose many actors that propose lower taxes and greater expenditures do seek to starve the beast and thus reduce the flexibility of the federal state to initiate new transfer programs.

Who knows what an optimal debt burden looks like? Those who support a strong fiscal situation so government has the flexibility to react effectively to all large negative shocks — be they natural disasters, armed invasion, ecological threats, negative economic growth — should worry about this implicit 3rd mandate.

Central banks are not the only the collective entity to manage risks on a broad scale. Government is critical to managing risk at the societal level.

The relatively fiscal tight stance of the Obama government has helped restore that flexibility in recent years and that means the US federal government can continue to effectively respond to various natural disasters and possibly one day a regional nuclear war. These disasters invariably impact the unemployed poor and working poor much harder than they do others.