Among the many promises made by President Elect Trump, one was to declare China a currency manipulator on his first day in office. Besides the logistical difficulties of doing so without a Treasury Secretary in place, there are the minor difficulties of what the data indicate (I know, I know, facts seem of little import these days, but what the heck). In addition to the legally defined concerns Brad Setser has raised, I think it is useful to assess China’s currency using a commonly used measure of currency misalignment.

Recall, in recent work with Yin-Wong Cheung and Xin Nong, we found that that as of 2011, the yuan was not misaligned using the Penn effect allowing for nonlinearity. Now 2011 is a while ago, but we were constrained by the availability of internationally comparable price level data in the Penn World Tables (PWT).

Our findings using World Bank World Development Indicators (WDI) data up to 2014 indicated substantial overvaluation (in both 2011 and 2014); since the 2011 estimates of misalignment differ so much between the PWT and WDI datasets, that suggests an alternative check to determine misalignment. I use the the Big Mac index as of July 2016, and WDI PPP estimates of per capita income for 2016.

Using a sample of 55 countries (Data [XLSX]), I estimate the following regression:

r = 0.630y + 0.158y2

Adj-R2 = 0.12, SER = 0.273. bold face denotes significance at 5% msl, using Huber-White standard errors.

The use of the quadratic specification is justified in Cheung, Chinn and Nong (2016), following Subramanian (2014) and Hassan (2016, JIE).

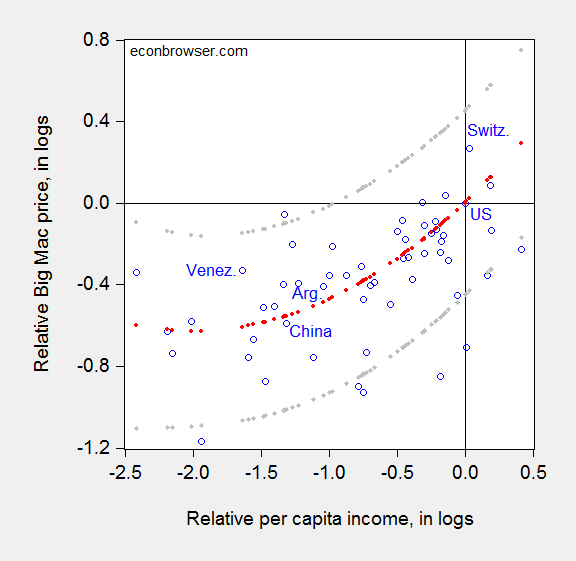

In Figure 1, I show the scatter plot for July 2016, and the curve fitted through the data, forcing the intercept to go through the origin, thereby forcing the US dollar to have no misalignment against itself.

Figure 1: Log relative dollar price of Big Mac against dollar price of US Big Mac (July 2016) versus log relative per capita income in PPP terms (2016 estimates); regression fit from quadratic specification (red dots), and 90% prediction interval (gray dots). Source: Economist, World Bank World Development Indicators, and author’s calculations. Data [XLSX]

The implied undervaluation of the Chinese yuan is 3.7% (log terms) as of July 2016. Of course, the estimate is surrounded by high degrees of uncertainty (as evidenced by the prediction interval) (see Cheung et al. (2007)).

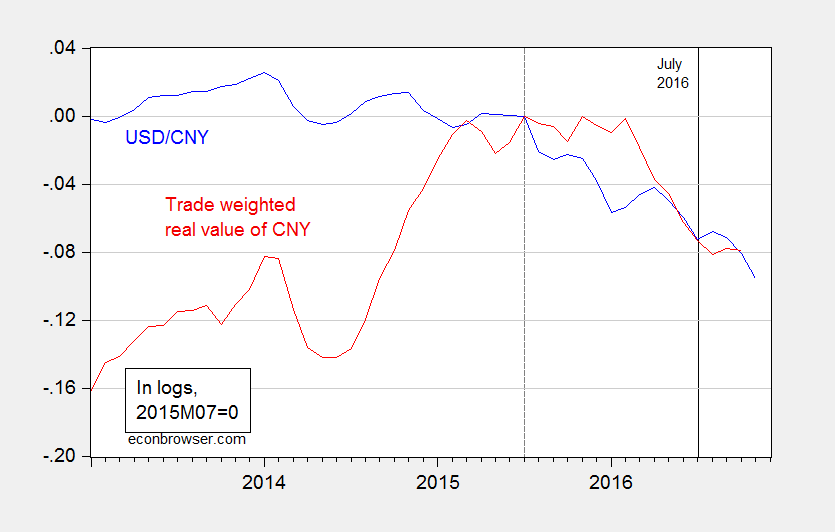

Since July 2016, the yuan has continued to drop against the US dollar, in nominal bilateral terms (see Figure 2):

Figure 2: Log USD/CNY exchange rate (blue), and log trade weighted real value of CNY against broad basket of currencies, both normalized to 2015M07=0 (dashed vertical line). Solid vertical line at July 2016 (Economist Big Mac date.) Up denotes increase in value of CNY for both series. Source: Federal Reserve Board, BIS, and author’s calculations.

However, the drop is small — 2.3% through November, and has actually appreciated in real trade weighted terms by 0.6% through October. (Figure 2 also highlights the fact that the Chinese yuan actually appreciated along with the dollar before the recent depreciation – so much so that the real trade weighted yuan remains above mid-2014 values.)

Hence, using a price metric (admittedly subject to large estimation error), it hardly seems easy to argue the Chinese currency is currently significantly undervalued.

For more on the various frameworks to assess currency misalignment, see this post. Brad Setser discusses “currency manipulation” in the context of American legislation regarding the determination of offending parties.

“Besides the logistical difficulties of doing so without a Treasury Secretary in place” seems like an odd statement.

https://www.google.com/#q=inauguration+2017

https://www.google.com/#q=trump+treasury+secretary

rtd: The point is that it is highly unlikely that the SecTreas would be confirmed by COB inauguration day. Current law requires SecTreas to make the determination, in my understanding. Please tell me if plans are in place to have SecTreas in place by COB 20 Jan 2017.

You think Mnuchin is eager to start a currency war with China? I have my doubts.

Mr. Mnuchin, 53, was the national finance chairman for Mr. Trump’s campaign, and his selection would elevate a wealthy loyalist to a pivotal economic post. He began his career at Goldman Sachs, where he became a partner, before creating his own hedge fund, moving to the West Coast and entering the first rank of movie financiers by bankrolling hits like the “X-Men” franchise and “Avatar.”

http://www.msn.com/en-us/news/politics/steven-mnuchin-is-donald-trump%E2%80%99s-expected-choice-for-treasury-secretary/ar-AAkW0a8?OCID=ansmsnnews11

Everything about Trump is BS so it is likely a mistake to take anything he says seriously but judge on actions rather than words, which in this case could be words without actions and irrelevant. I just hope Trump uses the next four years to work on his golf game.

China certainly was a currency manipulator in the past. And the present state of affairs may reasonably be blamed on past behavior, since it is doubtful that Chinese savings would be as high as they are without the huge stimulus generated by the past currency manipulation. Right now, though, a cessation of official intervention in currency markets would probably cause the yuan to fall. I think this is an example of the multiple equilibria that Prof. Chinn mentions in another post.

Too late to close the barn door now – the cows have all left.

Menzie, is the current capital ouflow from China completely market-determined? Is it possible that it is a substitute for official intervention in currency markets? Astute Chinese authorities might just have realized that U.S. and other sovereign debt is high priced and likely to yield low returns. They seemed to realize some time ago that the returns to long term sovereign debt could be subject to substantial erosion through inflation. Purchases of foreign equities might be reasonably viewed as an alternative to direct currency intervention.

From balance of payments constraints, China’s trade surplus is the other side of the coin of their capital outflows. Capital outflows in the form of official currency interventions seem to have stopped, or even been reversed. But can we say that the current purchases of foreign businesses are completely market-determined in China? Apparently, credit is often obtained from state-owned or controlled banks that fund much of the purchase price.

don: Because China is China, it’s hard to answer the question. Lots of the capital outflow is by state owned enterprises, and by state owned banks. Roughly speaking, “Official” in the BoP statistics refers to the central bank transactions only. Nonetheless, for the most part, I think it’s appropriate to think that the key motivation for flows from these entities is profit maximization/loss aversion (although there might have been some moral suasion to induce repayment of debt — that’s just speculation on my part). The capital flows due to households I think you could safely say is market (or fear) driven.