Is a current undervaluation of the Chinese yuan plausible?

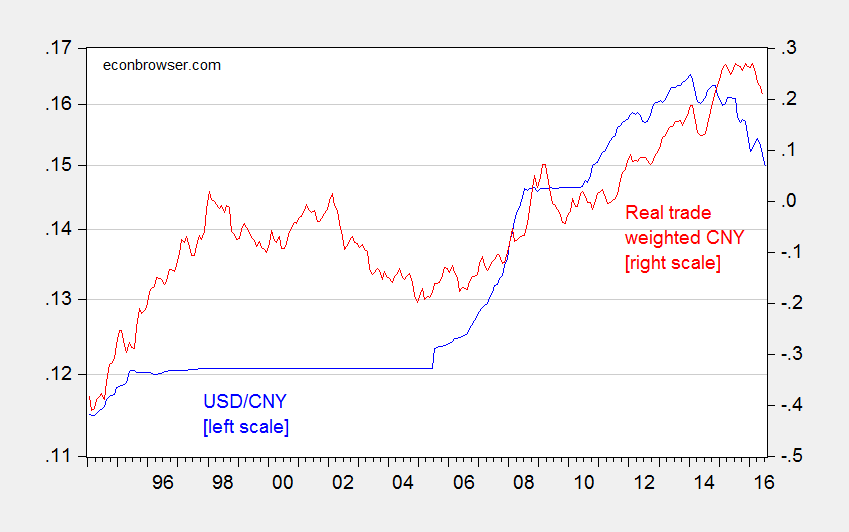

President candidate Donald Trump has argued for the imposition of tariffs on Chinese imports as a proper response to Chinese manipulation of the currency.[0] [1] Figure 1 depicts the nominal USD/CNY exchange rate in the blue line (where down is a depreciation of the Chinese currency).

Figure 1: USD/CNY exchange rate (blue, left log scale), and log real trade weighted value of the Chinese yuan (broad basket), 2010=0 (red, right scale). Down is a depreciation of the Chinese currency. Source: Federal Reserve via FRED, BIS, author’s calculation.

While the CNY has clearly depreciated against the US dollar, roughly 10% in log terms, the nominal bilateral exchange rate is pretty irrelevant in macro terms. The real, and effective, currency value is more important. And here, the depreciation is much less pronounced, roughly 6%.

Now, these are changes relative to some date; what we want to know is where the Chinese exchange rate is relative to where it should be. This is a much more involved question, taken up in many previous posts (see [2] [3] [4]). Rather than reviewing the material on currency misalignment, I’ll focus on the update to my previous work which views misalignment through the lens of the “Penn effect”, the phenomenon that the value of a currency in real terms varies with per capita income.

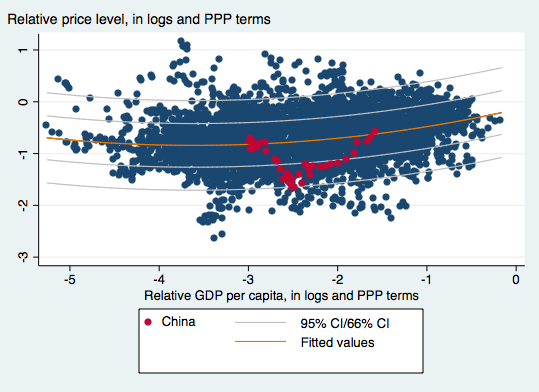

In a recent paper written by myself, Yin-Wong Cheung and Xin Nong, we find that by 2011, the Chinese currency was roughly at equilibrium. This is shown in Figure 2, which displays a quadratic fit of price level to per capita income (both in PPP terms).

Figure 2: OLS fit of price level on per capita income (red line), 66% and 95% prediction intervals; CNY in solid red circles. Sample is developing countries, using PWT8.1 data. Source: Cheung, Chinn and Nong, “Estimating Currency Misalignment Using the Penn Effect: It’s Not As Simple As It Looks,” mimeo (July 29, 2016).

Even after the recent depreciation, the CNY is still some 20% above where it was in 2011, suggesting that the CNY is not currently undervalued. If significant undervaluation is an important component of one’s definition of currency manipulation, then the case for imposing massive tariffs on the order of 45% is very weak.

Doesn’t the size of the trade deficit provide some evidence of currency undervaluation?

Recent Chinese economic data, notably capital flows from last month, suggest the creeping devaluation of the yuan may slowly be finding its right level.

It would be interesting, Menzie, to consider whether the 8% yuan devaluation since 2013 is consistent with an economy purportedly growing by 6-7% pa for that entire period. Thus, China’s economy should be about 21% bigger than it was three years ago, against a gain of around 6% for the US. And yet the yuan has devalued more or less for the entire period. Can we conclude anything about true Chinese GDP growth from this seeming mismatch between headline growth and observed exchange rates?

Steven Kopits: The Penn effect is a trend phenomenon, and allows for determining an equilibrium level. Short run macro developments can move the exchange rates in a direction opposite from the trend. Also note the elasticity (linear spec.) of price level with respect to per capita income is 0.124, so the 15% gain in relative per capita income has only a minimal impact on the equilibrium level.

Rescale so that one unit up or down is equal to a 5% change. Now that simplifies things a (very small) bit because a 5% decrease followed by a 5% increase doesn’t get you back to the same point, but it’s a good approximation, and makes internalizing / interpreting / discussing easier.

I did that back in November, here’s the blog post link. I’ll next teach my China course again from January 2016, and will update then. https://autosandeconomics.blogspot.com/2015/11/real-effective-exchange-rates-vs-market.html

BTW that will be the course’s 30th iteration, er, reinvention … initially it was a comparative economics course with a bit of economic history thrown in, and then more of an economic development course with a strong ag econ component, and recently a course focused about one-fourth on growth models and one-third on the microeconomics of migration and demographics. Now that migration is slowing, sometime in the next few years I’ll need to shift towards a Japan-like analysis of the tensions of slowing growth and an aging population, large swings in S-I, financial sector stress and so on, all for a strictly undergrad audience.