Voluntary Export Restraint (VER)

With Robert Lighthizer going to USTR, it’s useful to remember that he was “implementer” of many VER’s, or “Voluntary Export Restraints” on steel imports, during his last stint at USTR during the Reagan Administration.

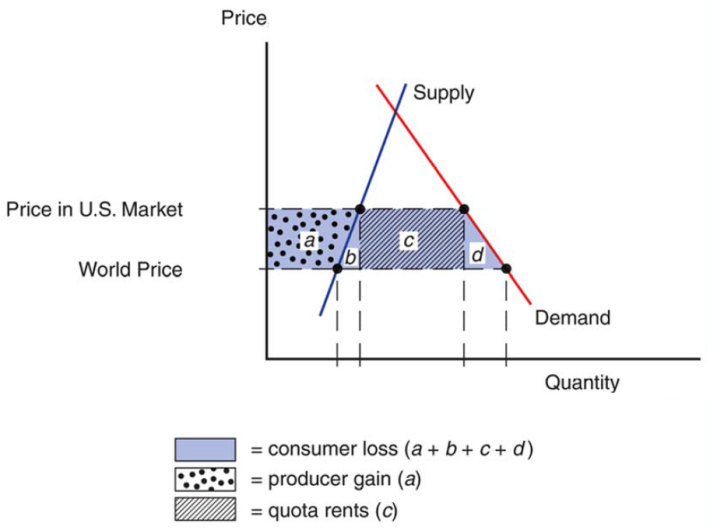

I’m about to teach a course in international trade policy (see last year’s course), and in just about any trade textbook, one will find VER’s as one of the pernicious policy tools in the pretty bad looking toolkit of trade policies. A VER acts like an import quota, but instead of the quota rents going to domestic agents entitled to import the restricted goods, the rents go to the foreign producers. So, if for example, we slap a VER on Chinese steel, Chinese steel producers get the rents. This is shown in Figure 1. Assume the US is a small country for this market. Then the VER restricts imports so the US market price rises from the world price.

For an import quota, consumer surplus is reduced by the blue area (a+b+c+d), producer surplus increases by dotted area (a), and so b and d are producer and consumer side dead weight loss. The cross-hatched area (c) are quota rents accruing to whoever has the right to import the restricted good. With a VER, the rents accrue to the foreign producer. Watch for this ostensibly “get tough” policy to re-appear. Like many seemingly tough policies, they are actually just plain stupid.

Ironically, one of my first research projects as an undergraduate research assistant was to study the effect of the Japan VER on the prices of imported Japanese cars. Some of the results made it into The Policy Game (written by Peter Navarro). One set of estimates (Feenstra, QJE, 1988) is $1100 quota-rent-induced price increase on a counterfactual free trade price of $5300 in 1985. (It happens my first research assistant project after graduating was also on VERs — so my preferred number is $2400 including both quota rents and quality upgrading — see Crandall (1987)).

For estimates of the costs of protection, like the ones the President Elect Trump’s trade team might be thinking of, see this “golden oldie” from the FTC (Tarr and Mokre, 1984); also general equilibrium estimates (de Melo and Tarr, 1988, published REStat, 1990).

Effective Rate of Protection (ERP)

Or, when 10% is not just 10%.

An effective rate of protection (ERP) calculation takes into account the fact that domestic value added might be less than total value added – i.e., there is substantial imported value added in the final good. Suppose a 10% tariff is applied to autos, so that a totally US made auto which originally sold for $50000 (under free trade) can now sell for $55000 because of the protection from foreign imports. In this calculation, effective protection equals nominal, i.e., 10%. However, suppose imported inputs used in cars were $30000. Then the effective rate of protection is 25% (=(25000/20000)-1).

Perhaps even more important, suppose instead a 10% tariff is applied to the imported inputs into automobiles. Then the effective rate of protection is -15% (=(17000/20000)-1). To redress this negative rate of protection, the protection on inputs would have to be coupled with a 6% nominal tariff. The more pervasive vertical specialization (i.e., more specifically, the greater the share of imported components), the more prominent this problem.

And that’s a final good tariff just to even out things domestically. If you want to export the autos, well, you’ll need an export subsidy. Under current WTO agreements, those are generally illegal.

Some things to consider as we go down the path of protection — and protection that is unlikely to reduce the trade deficit [1]

Nice portrait of John Fernald, in the WSJ

The Fed’s Point Man on Productivity

http://www.wsj.com/articles/the-feds-point-man-on-productivity-1483614002

Very nice reference Stephen.

Just a quibble, Menzie:

Wouldn’t the World Price also be the market clearing price? Thus, supply and demand would intersect at the world price, not well above it.

Otherwise, I think the interpretation is the same. A VER is, in effect, a lot like imposed cartel behavior on a producer who would rather operate under free market conditions. But perhaps that’s why they work: the foreign producer is rewarded for ‘voluntary’ restraint by a higher selling price.

Steven Kopits: Under perfect competition, there is a quota equivalent to a tariff. A tariff drives a wedge between world price (market clearing price outside of the country) and domestic price. If I drop the small country assumption, then the world price might decrease relative to pre-quota levels, but a wedge between world and domestic price would still exist.

OK, but I don’t think that’s what I was saying.

The supply and demand lines–the red and blue lines–cross well above both the world price and the domestic price. In theory, it seems to me, the supply and demand lines should cross at the world price, no? Put another way, the market clearing price appears to be well above the domestic US price in your example.

Steven Kopits: See slide 9 in this set of slides. In autarky, the clearing price is where the supply and demand curves cross; with free trade import supply curve is relevant. This is standard partial equilibrium analysis.

Yes, that’s the way I remember the presentation. Supply and demand cross at the no-trade equilibrium, that is, the domestic price in the absence of trade.

So what’s Navarro’s counter to this?

The first must be that there is some sort of structural unemployment, such that unemployed workers are making irrational choices, ie, they won’t move to where the jobs are.

Or,

Competing foreign labor has reduced the equilibrium price of labor such that there are fewer ‘good jobs’. In such a case, we’d expect to see unnaturally high levels of profits at the corporate level, at least for a while–which in fact we have. Over time, however, competition lowers the selling price of the product and that’s good for labor. But is it necessarily good for all labor?

Or do the gains accrue to the non-tradable or less competed sectors, for example, IT guys in California or investment bankers in NY?

If that were true, would that set you up for a red state-blue state conflict, where the blue states guys thought trade was great, and the red state guys thought it was bad. Wouldn’t the red state guys want to elect someone to reduce the effects of competition, ie, improve their particular situation even at the expense of the country as a whole?

Steven Kopits: To be fair, Navarro has not advocated VERs specifically. But he does think there has been an asymmetry in liberalization, so the US is more open than China. Basic trade theory indicates in the absence of distortions, and with transfers, the US in aggregate gains. I think he believes we should put greater weight on producer surplus than consumer (a nonstandard assumption); that *could* validate an argument for protection.

Very informative. It seems nothing in trade policy is as it seems at first glance. Who is going to explain it to Trump … or to journalists?

US places tariff on Chinese imports -> dollar appreciates -> maybe China sells more Treasury reserves to reduce capital outflow -> so Treasury yields rise (1.7%?).

EM’s that have dollar debt but few dollar reserves face debt payment crisis, exacerbated by falling commodity prices in their currency -> crisis leads to flight to Treasury investments … so do Treasury yields then fall and negate the +1.7%?

Given uncertainty and higher risk free rate, how can equity values can continue to rise?

If you want to export the autos, well, you’ll need an export subsidy. Under current WTO agreements, those are generally illegal.

I’m pretty sure that the Siberian Candidate’s response would be to ask how many divisions the WTO has.

The issue with free trade is not that there are gains in global output. It is almost axiomatic that any country will benefit in a strictly Pareto sense with a move to free trade. The problem is a distributional one. In a scenario where trade is largely driven by differences in factor abundance, it is very likely the price of the scarce factor will fall in real terms with a move from autarky.

In the case of the US, the scarce factor is labor. It follows that all wage earners may suffer a real loss when trade is opened to a world with an average wage still far below that of the typical US worker.

I work with numerical models of just these kinds of scenarios. I can tell you that the magnification effects that give rise to these real losses are so robust that it is impossible to construct sensible models showing gains for both the owners of capital and wage earners. Wage earners always lose.

It is interesting to reflect that the microeconomics of global integration easily explains all of the distributional effects we see in the developed economies. If we simply accept basic economics then we would expect slowed growth in output, wage stagnation and growing inequality as part of that process.

Floxo: I agree free trade is not necessarily optimal in the absence of compensating transfer and income distribution concerns. The question at hand is VER vs tariff or even quota. I’d prefer tariffs especially if there is monopoly power at home.

Menzie – you might enjoy today’s Reuters write-up of the Trump v. Toyota dust up:

http://www.reuters.com/article/us-japan-autos-nissan-idUSKBN14Q12O

In my view, it could have been a better discussion especially had Reuters read your Wednesday discussion of ERP and incorporated it.

The problem, as I see it, is improper “framing” of the problem and resolution.

All the talk about “unfair” trading practices and currency “manipulation” is based on framing the problem as China (or Mexico or some other place) intentionally trying to undermine the U.S. It would seem that the problem and resolution is obvious, although perhaps a bit difficult to achieve analytically.

What U.S. corporations (that are not producing overseas) and U.S. unions (that don’t have overseas chapters) really want is a “level playing field”… no economic disadvantages. So, have the new administration create a PPP … Price Parity Policy. This would be based on calculating the difference in labor wages, labor benefits, safety, and pollution regulations, plus government subsidies and tax differentials… an index if you will. So if, the cost difference based on those factors would be the basis of the PPP Index.

Then, if the U.S. index was 2.75 times China’s, the administration would declare an import duty of 2.75/2 times the wholesale price for Chinese imports (presumes the manufacturing cost to be approximately 1/2 the wholesale price). Of course, if France had an index of 1.35 times that of the U.S., we’d ignore that in our exports. It would be up to France to impose its own duty.

This would, in effect, level the playing field so that any natural or artificial advantage was negated for trade purposes with the U.S. It would also achieve the social scientists’ dreams of lifting up workers all over the world as those countries that did not pay or protect their workers sufficiently would be forced to do so in order to trade with the U.S. It would also achieve the environmentalists’ dream of pure environments as the countries that did not protect their environments against pollution would be forced to do so in order to trade with the U.S. It would also achieve the corporatists’ dream of lowering the value of U.S. currency so that other countries could no longer use currency manipulation to gain unfair advantage over the U.S. companies.

Don’t you just love indices? See, nothing to it. 😉

Explanations exist; they have existed for all time; there is always a well-known solution to every human problem — neat, plausible, and wrong. – H.L. Mencken