Signs are the putative Republican “deficit hawks” are about to sign away whatever integrity they had. What are the implications for the deficit going forward, keeping in mind the fact we are near or at full employment.

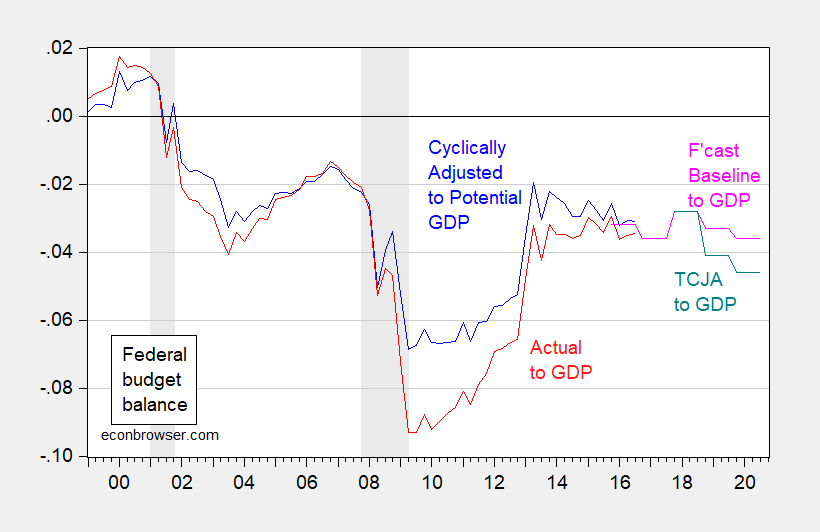

Figure 1: Federal budget balance without automatic stabilizers, as a share of potential GDP (blue), and Federal budget balance as share of actual GDP (red), and baseline forecast Federal budget balance from June CBO forecast (pink), and alternative under Senate budget bill (teal), both as share of projected GDP. NBER defined recession dates shaded gray. Source: CBO, Budget and Economic Outlook: An Update (June 2017), and CBO, Cost Estimate (November 2017), NBER, and author’s calculations.

The projections here do not incorporate dynamic effects. As we now know, mainstream analysis as incorporated in the JCT score, the deficit will still increase relative to baseline. The Tax Policy Center finds even less dynamic feedback effect, and hence larger deficit impacts than the JCT analysis. (Just for completeness, the JCT/CBO static score indicates a deficit over 6% of GDP by FY2027.)

What happens if we hit a recession along the way? Since the baseline forecast assumes the economy at near full employment, the teal line is the cyclically adjusted budget balance as ratio to potential GDP under implementation of TCJA and static score.

tax cuts for the wealthy, tax increases for the poor, increases in health care costs, rapidly growing debt and little economic growth. but the conservatives have to pass some legislation this year. all the chirping during the obama years, and now crickets coming from the conservative camp. and the return of voodoo economics and trick down theory.

https://www.nytimes.com/2017/12/01/us/politics/senate-tax-bill.html?_r=0

baffling, can you provide a link to the final version?

Bruce Hall So what you’re saying is that if Democrats want to know what’s in the bill, they’ll first have to vote for it. Have I got that right?

I agree that as of this moment we don’t know exactly what’s in the bill, but we do know that the bill seems to get worse with each “improvement” needed to bribe a red state senator. And we also know the core principle in the bill is to reduce the corporate tax rate. So far all of the ancillary provisions of the bill only serve to make the cut in the corporate tax rate (which could be a good idea if it were deficit neutral) into a kludge. Killing the health insurance mandate will not only throw low income folks off of Medicaid, but it will also increase premiums for those currently covered by individual or employer sponsored health insurance. That smells like a tax increase to me. And we should expect an appreciation of the dollar. That smells like a tariff to me. And eliminating the deductibility of state and local taxes sounds like a tax increase to me. In fact, it smells a lot like double taxation of the same income. Apparently rich Republicans only care about double taxation of dividends but don’t seem to care about earned income.

If you voted for Dimwit Donald, then you owe your fellow citizens an apology. But then again, I suspect you also voted for Nixon once or twice and never felt the need to apologize for that either.

Was i wrong Bruce? Hard to find a final copy, i think the republicans are still penciling in changes to the bill even today!

Funny how rick stryker complained about Obamacare, done in a partisan fashion, passed without knowing what was in it. The tax bill will impact a greater part of society, and yet what do we hear from rick stryker? Crickets. Not surprising, since he has a habit of promoting lying to achieve his goals. Guess he wasn’t so concerned about how Obamacare was passed after all.

There are only Republican deficit hawks when there is a democrat in the white house as both the Reagan and Bush Jnr years showed. They positively loved structural deficits back then as they do now.

I’d note that the numbers are potentially worse than you present here, Menzie.

The CBO assumes that personal income taxes go from 8.2% of GDP in 2017 to 9.2% in 2021 and on to 9.7% in 2027. And that’s baseline, before any tax changes.

Are you confident that under bau income receipts are going to go up like that? I am certainly not convinced.

I’d also bet the CBO is sandbagging on the outlay side, and picking a lowish estimate for the potential impact of the retirement of 25 million Americans between now and 2030.

All part of their plan. “Starve the Beast” and all that. This will mean 2019 will be devoted to cutting Medicaid, Medicare and Social Security benefits. Just in time for us to increase spending on the military (Iran and NK).

What does recent history tell about Republican tax cuts, deficits, and the national debt?

From 2002 through FY 2006, Republican congresses and a Republican president borrowed $2.7 Trillion( to finance tax cuts enacted in 2001 and 2003 as well as to sustain the government).

Sandwiched in were invasions of Afghanistan and Iraq, with–if memory serves–140,000 American troops active on two war fronts in Asia. The bills for that are, of course, still coming in and will be for the foreseeable future.

So much for conservatives wailing about piling up debt for our children, their children and, well, let’s just say, for more than a few generations down the line. And that was prior to the Obama recession deficits that have caused conservatives so much more worry. and figurative hair pulling. Their desperate: cry doesn’t anyone realize we’re leaving debt for–one more time– our children, their children, their children.. it’s fiscal unborn child abuse unabated!

Well, not quite. Because here we go again, proving those who ignore history never really paid much attention to it in the first place.

P.S.

Almost forgot: remember that Republican/Bush plan to partially privatize Social Security? To refresh memory lapses and for those convinced debt problems date back to 1/20/09: the plan would have required BORROWING (there’s that detested–wink! wink!– word again) between $4 and $5 Trillion over a decade (or so) to facilitate the changeover.

Interesting fiscal conservatism, to say the least.

You left out the years after 1929 when Mellon pushed the idea that tax cuts to the wealthy would trickle down to the masses and that led to much of the wealth being concentrated at the top and austere budget. We all know about the result of the Great Depression. The Republicans still believe that tax cuts to the wealthy will produce economic growth despite the evidence to the contrary in 1981, 1986, 2001 and 2003 years resulted in red ink. The only time they complain and scream is when it is the other side is in power.

The only reason they are voting for it is to the say they accomplish something for next year’s election. Senator Graham said so himself.

Beeker: in Republican history books, the years after 1929 would be those where FDR messed up bigly. Their policies were working nicely until the New Dealers trashed the economy and began the Depression.

Both the House and Senate bills agree:

Eliminate the deduction for state and local income taxes.

Keep the deduction for state and local property taxes.

California and New York have some of the highest income taxes.

Texas has one of the highest property taxes.

You can’t say the Republicans don’t know where their votes come from.

What can be done? What can be done? Oh, dear! I wish there were someplace to start.

https://www.washingtonpost.com/business/capitalbusiness/federal-government-continues-to-lose-billions-to-waste-fraud-and-abuse/2013/03/08/a3fb7736-82b5-11e2-b99e-6baf4ebe42df_story.html?utm_term=.1b56913a998e

https://dupress.deloitte.com/dup-us-en/industry/public-sector/fraud-waste-and-abuse-in-entitlement-programs-benefits-fraud.html

https://www.washingtonpost.com/news/powerpost/wp/2016/04/15/report-says-federal-fragmentation-overlap-duplication-abound/?utm_term=.3edffbd48b30

I’ve got an idea… raise taxes!

Bruce Hall: So, let me get this straight — in your view, there is on the order $220 bn worth of waste per year that can be cut (remember the tax cuts have to be straightjacketed into $1.5 trn, but static tax revenue reductions before offsets are around $2.2 trn) that can be squeezed out?

There is probably $200+ bn in ‘waste’, in the sense of inefficiency, in the deck. McKinsey found $125 bn just at the Pentagon.

But that’s not really the point. The point is doing things in different ways, in changing the strategic mission. In McCardle’s piece, we can read that the Medicare expansion of $100 bn probably netted $5 bn in incremental benefits. That’s not necessarily waste, in the sense of input waste (ie, spending too much on a given medicine), but rather output waste, in the sense of getting relatively poor bang for the buck for tax dollars spent (because lifestyle choices are decisive for health outcomes in the under 65 cohort).

In this latter category–output waste–I wouldn’t be surprised if you could find $1 trillion in waste. Singapore is able to provide a similar level of services for about 60% the share of GDP. But if you look, policy there is much more intrusive in certain areas, eg, wrt to health savings accounts.

And the results show. Singapore’s per cap GDP in 1985 (ppp basis) was 0.8x US; now it’s 1.5x. The difference between pretty good and kind of bad policy over a period of thirty years makes a big, big difference.

No one knows the waste in the pentagon from ineptitude and failing to maintain auditable accounts.

Ineptitude: $125B annual is low ball and does not account for specifications that are not checked on weapons that do not work and cost too much to try and use.

If tests needed to be done (no worries about failure) before an airplane were bought there would be no F-22’s and no F-35’s outside a few at the incompetent test sites.

The audit issue is felonious!

Bruce Hall I think you’ll find that most of the waste, fraud and abuse comes from the GOP donor class. Notice how Big Ag, health insurance companies and defense contractors were identified as the problem children.

As I mentioned before, the quality of GAO’s analyses has really fallen off. For example, in the WaPo article the GAO claims that civilian agencies could save a lot of money by recycling property no longer needed by another government agency or department. The problem is that this has been standard procedure for decades: http://www.dla.mil/DispositionServices/About/Mission.aspx As is all too often the case, GAO gets the business process completely wrong. Another case of political hacks at GAO writing inaccurate or bad reports in order to draw attention to themselves. I learned a long time ago that when a GAO auditor comes along the best approach is to count the number of folks on the audit team and ask how many findings they have to find in order to justify the cost of the audit. Then I would always tell the auditors to come back later and I’d write up the deficiencies for them. It was the only way to generate meaningful audits. Left to their own devices the GAO would typically come up with bogus and ill-informed recommendations. The WaPo article provides us with yet another example of GAO not really understanding what they are supposed to be auditing. A bunch of 90 day wonders.

True story. Way back in the 1980s we developed a DOS program (yes…it was a long time ago) that estimated a production model that generated inputs to a larger economic model intended to identify when it there was a risk adjusted economic basis for directing the contracting officer to initiate a procurement cut back modification to an existing contract. The very first test case for the model happened to be a defense contractor in (then) Rep. Les Aspin’s district. Keep in mind that Les Aspin was always on the lookout for waste, fraud and abuse. It took less than half a day before the congressional liason office in the Pentagon directed that the model test be immediately terminated. Now this was only a test and there was no plan to execute any contract modification. The only purpose was to calibrate and test the production function used in the model. The point is that waste, fraud and abuse are part of the political process. And the biggest offenders tend to come from the very people who make the biggest stink about it. For example, you’d be hard pressed to find bigger pork barrel politicians than Rep. Darrel Issa (the guy quoted in the first WaPo article) and Sen. Richard Shelby (R-AL). Go to Alabama and you can’t avoid finding some road, airport, federal building or university hall that doesn’t have his name on it. Jerks like Issa and Shelby and Sen. Charles Grassely are some of the worst offenders. “Physician, heal thyself.”

2slug, I don’t doubt that there are waste and inefficiencies in the “GOP (and Dem) donor class” programs. So what?

There is opportunity for improvement, but that’s never discussed as part of any “reform” regardless of which party is re-forming government. Apparently, people are content to keep electing the same government cadre regardless of the real costs.

As I have said elsewhere, taxpayers who actually pay taxes would demand more judicious spending. That would include reduction/elimination of various subsidies that go to special interests (both parties). But as long as the government doles out bennies to those who don’t pay taxes (lots of demand there) and bennies to those that donate generously to their favorite congressman, there can never be enough taxation to stop debt from increasing.

Bruce Hall: And, after getting rid of deposit insurance, depositors will monitor bank managers and shareholders so as to minimize risk-taking so no bank failures occur. (!!!)

Did I say get rid of a specific program… or the waste/fraud in programs?

But yes, people should research and monitor their investments and those with whom those investments are entrusted. That’s why I use USAA, Pacific Life, and Dearborn Federal Credit Union for cash or cash equivalents. It’s called personal responsibility. But I can understand that some people are simply too busy for that or are not concerned about risk.

Bruce Hall: No, you didn’t. I meant that the idea that you can completely overcome asymmetric information problems with more monitoring is not supported by historical precedent.

Menzie, I agree that in the past the government has done a poor job of monitoring the output of its programs, but that doesn’t preclude improvement.

The American automotive industry was renown for it poor quality of product in the 70s and 80s. Then it adopted six-sigma manufacturing techniques and quality levels improved to virtually match the Japanese vehicles which were the output of their six-sigma controlled manufacturing.

The excuse that it hasn’t happened in the past is not an excuse at all. It is obfuscation. Would it be difficult? Certainly. The bureaucratic and program morass is stupefying. But if the GAO and other accounting firms such as Deloitte can identify the scope, then it is up to Congressional and Executive leadership to address those problems. You may not agree with Trump (well I know you don’t), but his “cut two regulations for every new one) is an attempt to force the self-examination needed. It may be a crude and simplistic attempt, but it is strategically and directionally correct. Eliminate overlapping programs, reduce bureaucratic drag… but then monitor, monitor, monitor and improve, improve, improve. That’s six-sigma.

Bruce Hall I think you’re changing your tune. In your previous posts and looking at your links you seemed to be suggesting that the problem is slothful and wasteful bureaucrats who are responsible for that budget category known as “waste, fraud and abuse.” Now you seem to be agreeing with me that the problem isn’t lazy and inattentive bureaucrats, but rather stupid voters. We don’t need smarter bureaucrats; we need smarter voters.

I would agree that both parties are guilty, but lately one party has been especially egregious. In my experience former Sen. Carl Levin (D-MI) was one of the worst pork barrel politicians in Congress…almost as bad as Shelby and Grassley. And way back when Newt Gingrich was in Congress bloviating about “waste, fraud and abuse” he was busy making sure that his district received the third highest federal dollars, third only to Arlington, VA and Cape Canaveral, FL.

Your last paragraph betrays a fundamental misunderstanding of political power in this country. It smacks of Reagan’s old Cadillac driving welfare queen and “young bucks” buying T-Bone steaks with food stamps. The poor have almost no political power and thanks to racist GOP controlled state legislature it’s getting much harder for the poor to even vote. There’s simply no comparison between the political power of poor folks versus K-Street lobbyists in expensive suits. For example, the ink is barely dry (literally!) on the Senate tax bill and already K-Street lobbyists and GOP senators are carving out all kinds of obscene special breaks. Murkowski gets special breaks for cruise ships that only go to Alaska. Car dealers in Kentucky get to deduct interest on showroom models. A senator whose son is a lobbyist for a large international brewery wants special tax benefits for imported beer. Sen. Isakson from Georgia thinks the Atlanta based airline Delta should get special protections from foreign owned airlines. Crazy widening of the carried interest loopholes…you know, that thing candidate Trump promised to close! And these are all lobbyist driven mark-ups since the Senate bill was passed…quite literally before the ink was even dry. If you really want to drain the swamp, then don’t vote for any politician with an “R”. Some day that might change to any politician with a “D”, but for right now the problem is with GOP politicians being too cozy and dependent on rich K-Street lobbyists.

2slug,

You are putting words in my mouth. Read my last reply to Menzie. The can be no mistaking my statement that, “The bureaucratic and program morass is stupefying.”

And, yes, voters should target those who simply want to expand that morass.

GAO reports each March on wreckage in major (90 or so ‘systems’, around $16T in sunk and future R&D and procurement) defense acquisition programs. They call it risk…… from “lack of knowledge” of how bad the decisions made on tests they do not have time to see how inept!

No one listens, the past 15 years they have been hawking!

Pentagon waste is bi-partisan since the democrats became shadow neocons (liberal imperialists) to appear hard on defense.

It may be the time to go long in equities, at least for the next 12-18 months. As money is repatriated back to the US the likelihood of share buybacks and increased M&A will positively impact equity prices. Of course CEOs want to do this as their compensation is tied into share price. This is about the only positive impact that I can see happening. Employment and salaries of the average worker will probably not increase at all leading to further discontent among the rank and file Trump voters.

The most interesting outcome however is what new tax dodges have been created by this legislation. The carried interest loophole was not fully closed and apparent increase in pass through income will advantage real estate developers and others.

Tax reform this wasn’t, job increase this wasn’t, increasing the wealth of the new gilded class this was.

“Blessed are the young for they shall inherit the national debt.”

Herbert Hoover

No one should be fooled by those who lament “deficits as far as the eye can see,” as their crocodile tears are just an attempt to stop much-needed tax reform. These scary charts make it appear as if this tax reform package has some kind of significant impact on the fiscal trajectory we’re on. But as conservatives have warned for years, we are already on an unsustainable fiscal trajectory and that won’t change if this bill is defeated. Let’s put this in context.

In the absence of any tax reform passed by Congress, the CBO has estimated that the debt-to-GDP ratio will rise to about 92% by 2027. How much will this tax reform bill worsen the problem? First, we have to understand that about $500 billion of the increase in the debt was realistically going to happen anyway, regardless of whether this tax bill passes. Congress makes many tax cuts temporary, the so-called tax extenders, but then always extends them before they expire. This bill changed some of those provisions and made them relatively permanent, so they have to be recognized when scoring the bill. But the cuts would have happened anyway. Moreover, the dynamic impact of the bill is likely about $500 billion. As a consequence, the true net increase in borrowing as a result of this bill is about $500 billion ($1.5 trillion – $500 bil – $500 bil.) That increase will raise the debt-to-GDP ratio from 92% to a little under 94% in 2027.

Thus, no one should think that failing to pass this bill somehow rescues the fiscal situation. It doesn’t. The question is whether the benefits of this bill outweigh the slight worsening of an already unsustainable fiscal trajectory. Of course no bill like this is perfect and there are provisions that I and others would disagree with. But overall, it’s worthy of support as the proposed tax reform will produce significant benefits for the economy, business, and the middle class.

Of course, despite any good effects from the tax reform, the problem of the unsustainability of our fiscal trajectory still looms. This problem won’t be solved by stopping much-needed tax reform. The solution requires a slowdown in the growth of entitlement spending. We will need to

repeal and replace Obamacare as well as put in fundamental reforms of Medicare and Social Security. If President Trump attempts to tackle the entitlement problem next, expect the very same voices that are currently screeching about “deficits as far as the eye can see” to mobilize to stop him, just as they did when Ryan raised the issue in 2012. (Recall they made commercials depicting Ryan pushing an elderly woman in a wheelchair off a cliff.)

If this bill passes as it appears it will, it will cap off a very impressive performance by President Trump in his first year in office: stellar judicial appointments that are remaking the judiciary, serious regulatory reform (e.g., a rollback of the Obama Administration’s attempt to regulate the internet under the guise of “net neutrality”, etc.), and significant tax reform. The unprecedented assault against Trump we are witnessing is a natural reaction to the President’s very year successful first year. Trump’s blood enemies, who revile his conservative agenda, hope to bring him down with a phony, politicized investigation and a tsunami of #FakeNews. Conservatives need to get on the right side of this struggle. Here’s what I say to my conservative friends who are still critical of Trump: if you doubt the President’s competence, look at the enemies he’s made and the lengths they go to to stop him; if you withheld your vote from Trump last November you should acknowledge the mistake you made and get on board; and if you are still a NeverTrumper you should be ashamed of yourself in light of Trump’s accomplishments to date. Conservatives need to band together to support the President as he fights–and indeed wins–for America.

I don’t know many establishment Republicans–conservatives–who are behind Trump.

Consider: With an economy growing at near 4%, the stock market at records, and unemployment near decadal lows, the President’s popularity is 10-15% below any of his predecessors at this time, and 40-50% below some of them. Not pretty.

https://projects.fivethirtyeight.com/trump-approval-ratings/

Steven,

By establishment Republican/conservatives, I think you mean Washington insiders and politicians, a portion of the conservative intelligentsia, and blue state Republicans. But if this election showed anything, it showed how out of touch this group is with the voters. Trump won 89% of the Republican vote, won 2 million more votes than establishment conservative Mitt Romney, and outperformed Romney in both African-American and Latino support. He beat Hillary Clinton despite the fact the Clinton matched Obama’s 2012 vote total. That’s the poll that counts. Trump’s approval polls might be bad today, but Hillary Clinton’s are actually worse.

My point is that this out-of-touch group of Republicans needs to acknowledge that despite all their warnings, Trump is doing a fantastic job, much better than the establishment Republican candidates that Trump defeated in the primaries would have done. The ferocity with which the Left is going after Trump testifies to that. The sham Mueller investigation has never been about collusion–there is no such thing legally. It has always been about building a case for impeachment. Why aren’t Washington Republicans fighting back? Trump is the leader of the party whether they like it or not and his defeat is their defeat. Why does Trump have to fight by himself to implement the agenda these so-called conservatives claim to want?

rick stryker does a bit of mental gymnastics in order to support a policy that increases the debt by $1 trillion dollars, reduces the number of medically insured, increases health care costs, increases taxes for the poor, and decreases taxes for the rich. in addition, he has managed to support policy makers who have racist tendencies, defend serial sexual harassers, and promoted class warfare against the poor. and those like rick will strike again by causing the deficit to dramatically expand, and use the self inflicted deficit as an excuse to further reduce social security and medicare. but again, they did the same thing with obamacare by sabotaging the funding mechanism and then claiming it is failing. integrity is not one of rick strykers strong suits.

Bruce Hall Eliminate overlapping programs, reduce bureaucratic drag… but then monitor, monitor, monitor and improve, improve, improve. That’s six-sigma.

Actually, that’s not six sigma; it’s value added lean processing. Six sigma was a Motorola initiative to improve reliability of its components to six standard deviations.

Why do you think that bureaucracies don’t use six sigma/lean processing techniques? Plenty of green belts and black belts in the federal government. Departments don’t just create bureaucratic red tape for the hell of it. All too often the lack of detailed regulations is Christmas in July for corporate lawyers. You need to learn how bureaucracies really work. The alternative to your “program morass” is the world of Charles Dickens’ “Bleak House”, also known as the “Leave No Lawyer Behind” program. Detailed regulations frustrate court challenges. Fuzzy regulations invite court challenges. That’s how the world works.

2slug,

I’ll grant you that the six-sigma statistical approach is for fine tuning a process to take out variability and unnecessary steps. The VALP approach is similar but a coarser methodology to pare down the processes to eliminate unnecessary (non-value added) elements. But when you have a process like Medicare payments that are fairly well established and yield billions of dollars in fraud, you may have a variability issue AND a process weakness. At Ford, we used six-sigma for both manufacturing and general operations improvement efforts.

Regardless, contradictory regulations, regulations that add significantly more expense than benefits, multiple programs targeting the same issue, and failure to use sound management principles exist and contribute mightily toward the waste and fraud… and are a drag on the economy. http://www.aei.org/publication/regulations-are-a-really-big-drag-on-us-growth/

Bruce Hall The AEI link is based on the same old and much discredited Mercatus “study.” I’ve read that study. If you pay close attention almost all of the regulations and laws cited in the Mercatus paper are state and local, not federal. Yet another reason why we need to trim the 50 states into 10 administrative districts.

I’ve been involved in plenty of lean/six sigma projects. Typically the project is headed by some black belt from the private sector. It doesn’t take a lot of effort to identify non-value added process points…and I’m talking “non-value added” in the lean/six sigma sense of the term. But it usually isn’t long before that private sector guru understands that there are usually good reasons for what superficially appears to be waste. Private sector agents attempting to defraud the government is one of the main reasons. This country has a lot of unscrupulous doctors and hospitals who attempt to defraud Medicare. The solution is not less regulation. The best way to prevent specific forms of fraud is to have a detailed law and regulation that is specifically targeted against that source of fraud. The worst solution is to rely upon vague and general regulations because those are easily challenged in court. And trust me, you’d probably be surprised just how many corrupt private sector agents are out there. People don’t get rich by being honest. We saw what lax regulation of the financial sector gave us in the early 00s.

I agree that there are plenty of contradictory regulations. And rationalizing those regulations can be maddening. Been there, done that. It’s labor intensive work. But this is a case in which the man-on-the-street intuition generally ends up making the problem worse, not better.

BTW, some of us laugh at how primitive many of the standard management enterprise systems are. But I would agree that there are plenty of cases in which the government does not use sound management principles. For example, you’ve cited studies by GAO that found waste in the way the government reuses excess material. The GAO assigned a dollar value. But what you probably didn’t know is that GAO never evaluates inventory at market value, but at the last acquisition price plus an internal management cost. For example, if something cost $100 and there was a 10% management cost, the “standard” price used by GAO would be $110. But the GAO uses that same value regardless of an item’s condition. So even if the item is obsolete and complete junk with a zero market value, GAO would still evaluate it at $110. That’s a bad management principle.

2slug, no doubt there are hideous examples of the private sector gouging the government. UnitedHealth is a great example. That’s also a great example of a massive system, mature processes, and systemic weaknesses that enabled an unscrupulous entity to overbill. . How long would a private corporation last with those kind of billing controls?

And then there is the government bureaucracy itself… entrenched, isolated into chimneys, and “have to spend our budget this year so we get more next” mentality. It results in stuff like this in an ever-expanding arena: https://fcw.com/articles/2017/11/27/comment-tony-scott-gov-custom-code.aspx

Yes, there is sufficient blame and that is a good indicator that there is significant room to reduce costs through smarter, less wasteful management. My point still stands.

2slug, you might find this article from The Economist interesting. https://www.economist.com/news/united-states/21723862-donald-trump-repeating-promises-made-and-not-kept-barack-obama-and-george-w

It looks as if there have been some rudimentary attempts at AI to address some problems. More is required.

The comments from the leftists here show they’re politically motivated rather than driven by good policies. Even after being marginalized in the Obama years and Trump winning the election, they’re still playing the same wacko political games that shrunk their power. The Democrat party of JFK, Moynihan, Nunn, Koch, Lieberman, even Bill Clinton, and many others, have been reduced to the 2016 Presidential candidate of someone like Jim Webb, while the popularity of the party is represented by people like Hillary and Bernie.

And, it’s amazing the party of Lincoln is the party of racism when the Democrat party has a long history of racism, even through the voting of the 1964 Civil Rights Act and beyond. Obviously, the liberal media and history teachers had something to do with it. When a lie is told often enough, people believe it’s true. And, through systematic ignorance. For example, illegal immigration isn’t about law and order, it’s about racism.

And, people are resourceful. When government benefits are taken away, they’ll find a way to get what they need and want. Sure, it’ll be tough at the beginning, after being at the government trough, but they’ll find being more independent and taking some personal responsibility is good for them. We can afford to help the truly needy, not to pay for a nation of free riders.

PT: better stick with being a self-styled economics savant than exposing yourself as being extremely historically ignorant.

The Civil Rights Act passed the House with 292 votes, 138 coming from Republicans. That would mean some other party supplied the other 154 votes. Who could that possibly have been?

A larger percentage of Republicans did support the legislation, but Republican support was largely northern and midwestern. All ten House Republicans from the South were opposed as was presidential candidate Goldwater and his perhaps his best known supporter, GE spokesman Ronald Reagan. Strohm Thurmond couldn’t take it and became a Republican convert in opposition.

Anyone who claims knowledge of this history would not easily confuse the efforts of the Rockefeller wing in aiding passage opposed to the conservative wing which fought hard to prevent the Civil Rights Act from passing.

That you did speaks volumes of your own knowledge and lack thereof.

Without 80% of Republicans supporting the Civil Rights Act, it would’ve failed. How many Republicans voted against it, because they believed it was unconstitutional, like Goldwater.

“Senator Barry Goldwater of Arizona voted against the bill, remarking, “You can’t legislate morality.” Goldwater had supported previous attempts to pass civil rights legislation in 1957 and 1960 as well as the 24th Amendment outlawing the poll tax. He stated that the reason for his opposition to the 1964 bill was Title II, which in his opinion violated individual liberty and states’ rights. Democrats and Republicans from the Southern states opposed the bill and led an unsuccessful 83-day filibuster, including Senators Albert Gore, Sr. (D-TN) and J. William Fulbright (D-AR), as well as Senator Robert Byrd (D-WV), who personally filibustered for 14 hours straight.”

Only two Republicans in the South voted for the 1956 Southern Manifesto:

“The manifesto was signed by 101 politicians (99 Southern Democrats and two Republicans)…The Congressmen drafted the document to counter the landmark Supreme Court 1954 ruling Brown v. Board of Education, which determined that segregation of public schools was unconstitutional.”

You’re the one who injected racist Democrats into a discussion of budget deficits, repeating the nonsense history suggesting that Republicans were responsible for the Civil Rights act of 1964. They were part of a very successful co-operative effort between moderate and liberal Democrats, moderate and liberal Republicans (the party of Lincoln) and some conservative Republicans as well. That’s historical fact.

Missing is your understanding of who those Republicans were. Today, most would no longer be in the party because they would have trouble with the knucklehead wing that detests RINO’s At the time, many were in the Rockefeller wing, and if you don’t remember (likely, never learned) how detested those Republicans were by Goldwater supporters, please return to school and study the history you so obviously missed.

While bashing those racist southern Democrats in 1964 (and excusing Goldwater for his position), you conveniently forgot to mention that Goldwater won five states heavily populated by those same racist Democrats. He got 87% of the vote in Mississippi. Apparently, while Goldwater, Thurmond, and Reagan were acting on principle, racists in those states were not? Or were they? You can’t have it both ways.

Ever heard the name Thomas Kuchel? He was a moderate senator from California who played a key role in passage of the act. For his diligence, he was defeated in the next Republican primary by radical right winger Max Rafferty whose nomination sealed the future political career of Alan Cranston. Remember him?

Lastly, the act passed with 72 senators voting for it. There were 33 Republicans in the Senate, 27 of whom voted in favor. You’re right. without those votes, no passage. With only those votes, however, there would have been no vote at all.

When discussing history, you’re better off sticking to your area of expertise: What that actually is, I’m not sure, but stick to it anyway.

Do you have a point to your rant, besides suggesting Goldwater Republicans supported Democrat racists by believing in State Rights, and there shouldn’t be conservative, moderate, and liberal Republicans?

peak, those democratic racists left the party in favor of the republican party.

Those racist Democrats didn’t like the social programs by other Democrats to make-up for their white guilt. So, they chose States Rights Republicans. Ironically, they ended up devastating the black population.

HOW THE WELFARE STATE HAS DEVASTATED AFRICAN AMERICANS

“The out-of-wedlock birth rate among African Americans today is 73%, three times higher than it was prior to the War on Poverty. Children raised in fatherless homes are far more likely to grow up poor and to eventually engage in criminal behavior, than their peers who are raised in two-parent homes. In 2010, blacks (approximately 13% of the U.S. population) accounted for 48.7% of all arrests for homicide, 31.8% of arrests for forcible rape, 33.5% of arrests for aggravated assault, and 55% of arrests for robbery. Also as of 2010, the black poverty rate was 27.4% (about 3 times higher than the white rate), meaning that 11.5 million blacks in the U.S. were living in poverty.”

“The best anti-poverty program for children is a stable, intact family,” according to former Clinton administration officials William Galston and Elaine Kamarck.

“Those racist Democrats didn’t like the social programs by other Democrats to make-up for their white guilt. ”

they were racist, period. and found a welcome home in the republican party. they became racist republicans. and we still see them in the republican party today. you seem to have an affinity for them peak. as does trump.

There is no “welcome home” for racists in the Republican Party. A bunch of racist Democrats did not become Republicans. You can thank Republican leadership for making the South less racist.

PeakTrader: Let me get this from you on (virtual) paper. Your position is either (1) Donald Trump is not a racist, but *is* a Republican, or (2) Donald Trump is a racist, but *is not* a Republican. (I guess there is (3), Donald Trump is neither a racist, nor is he a Republican, but I don’t think that’s your position).

Menzie Chinn, being politically incorrect doesn’t mean you’re a racist. Trump disrupts the comfortable political establishment, including the biased mainstream media, and they’re having a hard time reacting to it.

PeakTrader: When a given person’s categorization of “fine people” include white supremacists, neo-Nazis, etc., then I think a reasonable person can say that person is a racist, rather than just a disruptor.

PeakTrader: If you are carrying a lit torch quoting Nazi slogans (albeit in English rather than the original German) I’ll just venture to say statues are not really at the top of your agenda.

Menzie Chinn, not everyone, who believed the Confederate statue should stand were racists.

“Menzie Chinn, not everyone, who believed the Confederate statue should stand were racists.”

peak, what percentage of those protestors carrying torches were NOT racists?

Noneconomist, here’s a much better understanding of the Great Depression:

https://www.colorado.edu/ibs/es/alston/econ8534/SectionX/Fishback,_US_monetary_and_fiscal_policy_in_the_1930s.pdf

“It’s death to Democrats,” said conservative economist Stephen Moore, who advised Trump’s campaign on tax policy.

“They go after state and local taxes, which weakens public employee unions. They go after university endowments, and universities have become play pens of the left. And getting rid of the mandate is to eventually dismantle Obamacare,” Moore said in an interview, arguing that it would accelerate “a death spiral” in the health-care law’s marketplaces.

Well, you have to give him points for honesty (for perhaps his first time).

House Speaker Paul D. Ryan (R-Wis.) said Wednesday that congressional Republicans will aim next year to reduce spending on both federal health care and anti-poverty programs, citing the need to reduce America’s deficit.

“We’re going to have to get back next year at entitlement reform, which is how you tackle the debt and the deficit,” Ryan said during an appearance on Ross Kaminsky’s talk radio show. “… Frankly, it’s the health care entitlements that are the big drivers of our debt, so we spend more time on the health care entitlements — because that’s really where the problem lies, fiscally speaking.”

Well, at least they are being up front about it. Run up deficits with tax cuts for the rich and then use deficits as an excuse for screwing everyone else.

An unrelated comment I made elsewhere:

I think the difference between a recession and a depression is that the former is an income statement event and the latter is a balance sheet event. That is, in a recession, you can stimulate growth by reducing interest rates because the problem is costs misaligned to revenues. This can be solved in a relatively short period of time, say, 12-24 months.

In a depression, by contrast, it’s a balance sheet problem, that is, the value of liabilities is greater than the value of assets, either individually or in aggregate. In a depression, the interest rate mechanism is largely ineffective, and excluding TARP (which stabilized the banks), the QE’s were in fact ineffective in aggregate. In a depression, you have to pay down the debt, and that takes time, as much as 7-9 years. The Great Recession, by this line of thinking, was a crypto-depression.

If recessions and depressions are about income statements v balance sheet, real business cycles are about fixed and variable cost. In a boom, liquidity accumulates faster than fixed assets, thereby leading to price bubbles. Over time, however, the supply of assets increases. This causes asset related revenues to fall, which leads asset orders to collapse, leading to layoffs, etc. Put another way, you can get boom-and-bust with nothing more than a fixed/variable cost model, ie, a lag between the demand for fixed assets and the ability of the market to deliver them. It doesn’t really require a ‘shock’ as such, merely the inherent momentum of an economic expansion.

That’s not to discount the impact of shocks like oil prices spikes, but you can generate a boom and bust cycle with nothing more than a lag in the delivery of fixed assets.

It’s all about borrowing too much from the future. Households borrowed too much resulting in overconsumption, e.g. refinancing their homes at lower rates and taking out equity for home improvements or other consumption, getting a car loan, building-up credit card debt, etc.. The government should’ve refunded consumers with a large tax cut. So, they could catch-up on bills, pay off a car loan or a credit card, etc., to increase monthly discretionary income and strengthen the banking system. Unfortunately, the federal government borrowed too much from the future for inappropriate spending that didn’t compensate much for household debt, and imposed anti-growth policies, which the Fed couldn’t make up for. A recession can turn into a depression, including through regulations making it harder to borrow or raising the cost of health care.

It’s about borrowing too much in a loan-to-value sense. If my house increases to 150% of its value of five years earlier, I will feel richer and borrow against the higher value. Now, if the asset cycle catches up with me, then that house value can fall by the original gain, say, back to its original value. If I took a loan at 80%, then my loan value is 120 on a market value of 100. Now I can’t borrow any more until the asset has collateral value again. That is, I have to pay down more than 20% of the equity value to have collateral for a loan. Thus, lowering interest rates while the equity value remains negative will be ineffective. That’s depressionary dynamics, and it’s easy to understand why it would take a long time to return to a normally functioning economy.

When I was an investment banker in shipping back in 2007, lenders were giving out loans for ships at 70% of market value. Doesn’t seem so bad, except that the vessels were valued at three times the long term replacement cost, and that’s because day rates were historically high, due to the mismatch of supply and demand. And these vessels had nice fixed contracts at high day rates, but when the market collapsed, the contracts became largely worthless. Thus, the shipping companies collapsed and orders for dry bulk carriers collapsed, and ship yards collapsed, and the related lenders and investment banking houses collapsed and everyone was laid off.

But in some sense, no one was irrational at any point in the cycle.

peak, you are advocating that when households borrow too much, the government should bail them out.

More gratuitous comments:

I think the Taylor Rule is also quite enlightening here. During a depression, the ZLB is binding for an extended period of time, ie, real interest rates are too high and investment is being ‘crowded out’ by the ZLB, and the interest rate transmission mechanism is ineffective. You can see a nice analysis by Gavyn Davies at this link:

https://www.ft.com/content/0c6cfd54-b4c4-345b-a530-ae2b25967746

Importantly, once the Taylor Rule rate is above the ZLB, and it is now, I think the risk of more traditional crowding out by government borrowing becomes much bigger. You can’t just look back at the last ten years and see no govt crowding out and assume that’s going to be the case when the TR takes you above the ZLB.

By this line of thinking, the depression ends when the Taylor Rule interest rates exceeds the Fed Funds Rate or the Euro Target Rate. Thus, depression dating accordingly is different from recession dating. Rather than peak to trough as recessions are measured, for depressions, we would use the metric that from the point that the Taylor Rule interest rate falls below the FFR until the TR exceeds the FFR (during a prolonged downturn).

Finally, just to elaborate on the points above, to create a business cycle, all you need is for either operators or their financers (lenders, equity investors) to have either a historical or present-day bias, ie, all they have to be is conservative about predicting future demand based on recent prior or current market conditions. We see with oil rigs, for example, that they follow oil prices by about nine weeks. Thus, rig counts are driven principally by spot prices and they change with a lag — not with anticipation. Now, for US land rigs, the lag is not that great.

But if we’re talking offshore, the lag can be four years easily, and as much as seven, both on the upside and downside of the cycle. For example, the oil price crash of 2014 is expected to show up in offshore oil production declines in 2019–five years later. That’s how you get a business cycle–even absent a visible shock: lags in fixed asset responses.